Questions about Medicare in Florida? We'll help you make an informed decision. In this ultimate guide, we share local tips and answer your frequently asked questions.

Speak with a local licensed insurance agent:

(623) 223-8884 (TTY: 711) M-F 9am - 5pmMedicare is a federal government health insurance program. It is designed to provide and reduce the cost of healthcare services for Medicare eligibles in the United States.

The Medicare system is regulated by the Centers for Medicare & Medicaid (CMS), a federal program. Although you apply for Medicare in Florida, Medicare functions the same way nationally.

There are nearly 5 million Floridians enrolled in Medicare. That’s nearly 22% of Floridians! As of 2020, 89% of Medicare enrollees were eligible due to age, while 11% were eligible for Medicare due to a Social Security Administration-approved disability.

Continue reading to learn if you’re eligible for Medicare in Florida.

What makes you eligible for Medicare in Florida? Either your age or a disability approved by the Social Security Administration.

You are eligible for Medicare in Florida, like in the rest of the country, if you meet one of three criteria:

If you meet one of the criteria above, you can apply for Medicare. Keep reading to learn more about the best times to enroll in Medicare.

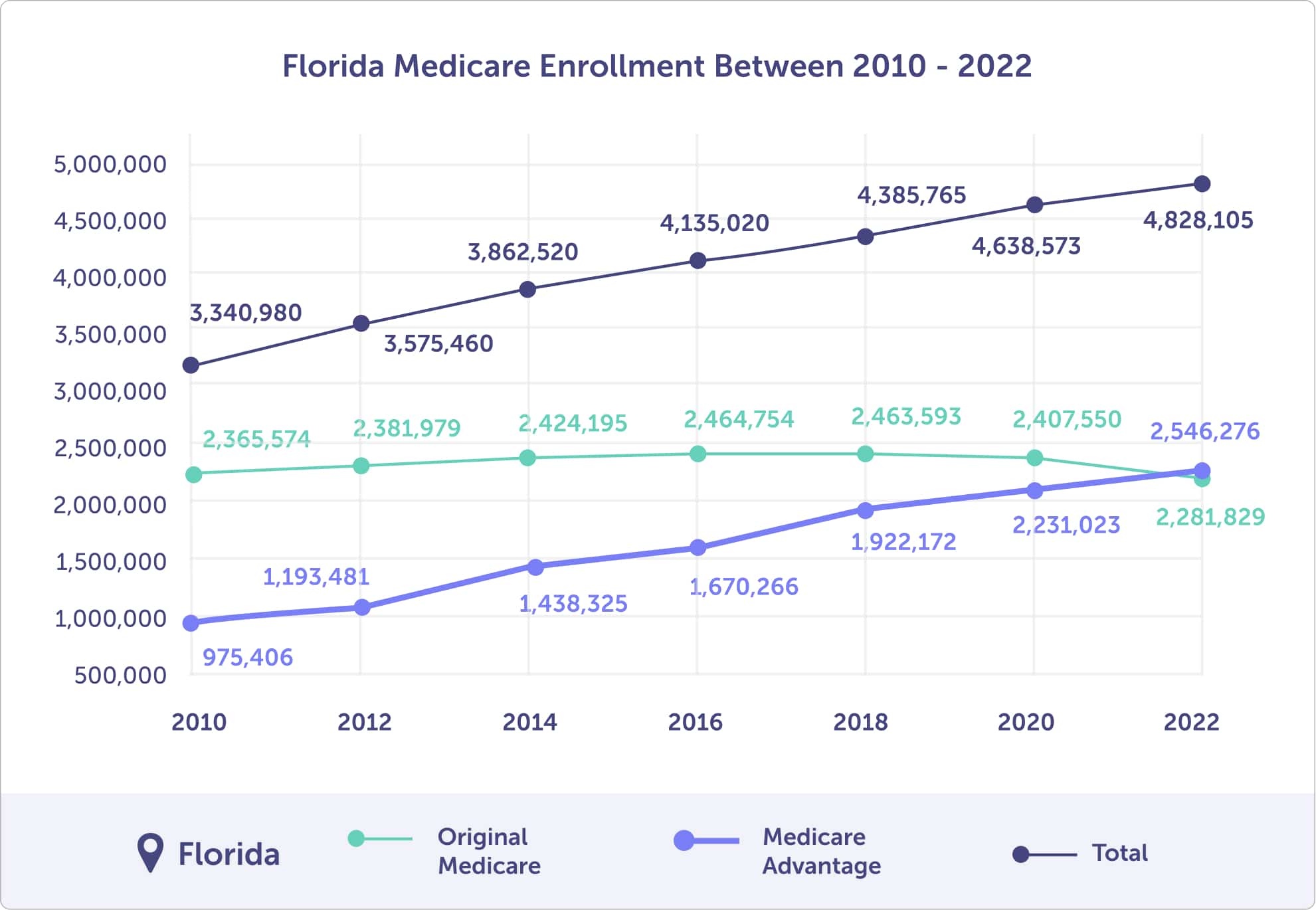

In 2023, there are nearly 5 million (4,955,887) Floridians enrolled in Medicare. Of those, 54.98% (2,724,506) are enrolled in a Medicare Advantage plan. That is up from 48% (2.2 million) in 2020.

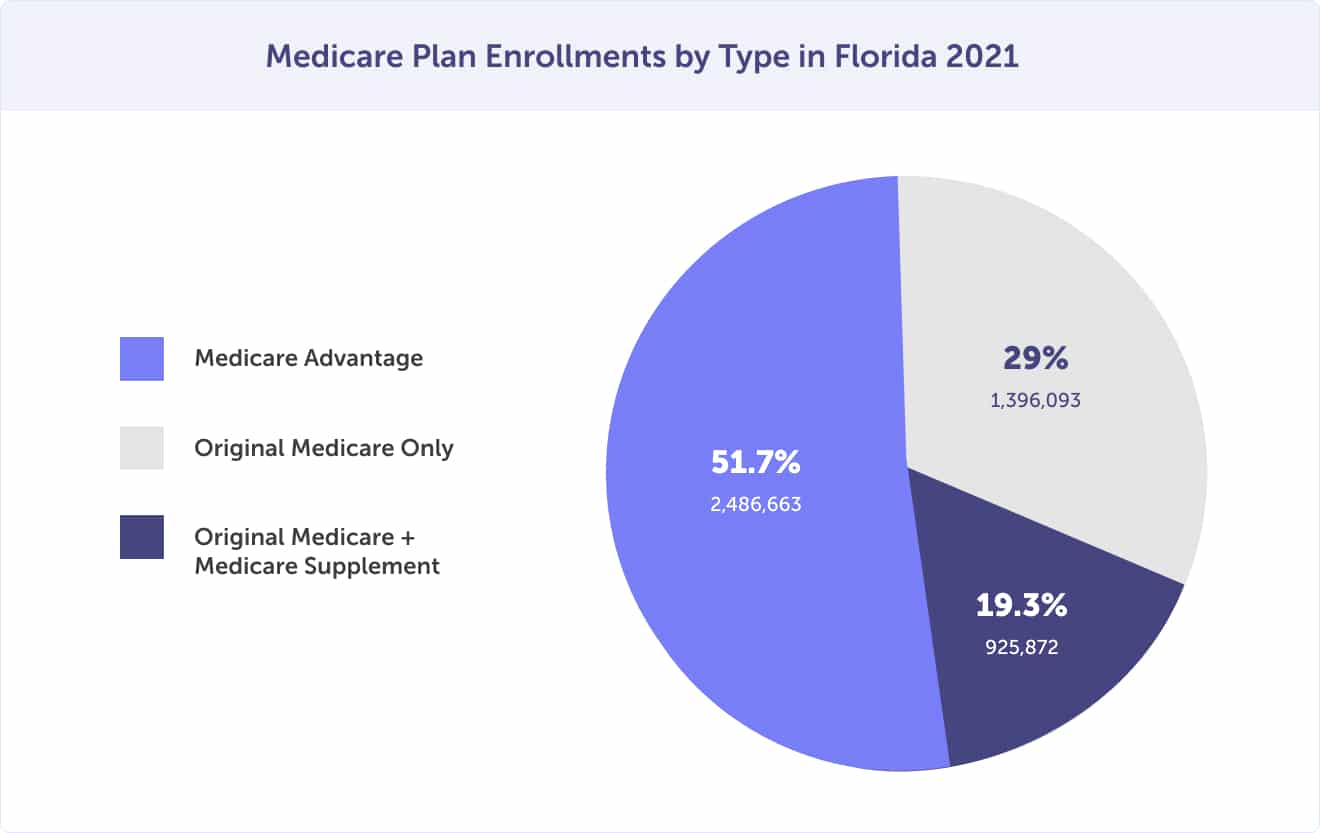

In 2021, of the 4.8 million Floridians enrolled in Medicare, 1.4 million (29%) are enrolled only in Original Medicare Part A and Part B. Of those enrolled in Original Medicare, 925,872(19.3%) are enrolled in a Medicare Supplement plan. The other 2.5 million (51.7%) Medicare beneficiaries are enrolled in a Medicare Advantage plan (Medicare Part C).

Floridian enrollment in a Medicare Advantage plan has increased by 161%, up from 29% in 2010 to 53% in 2022.

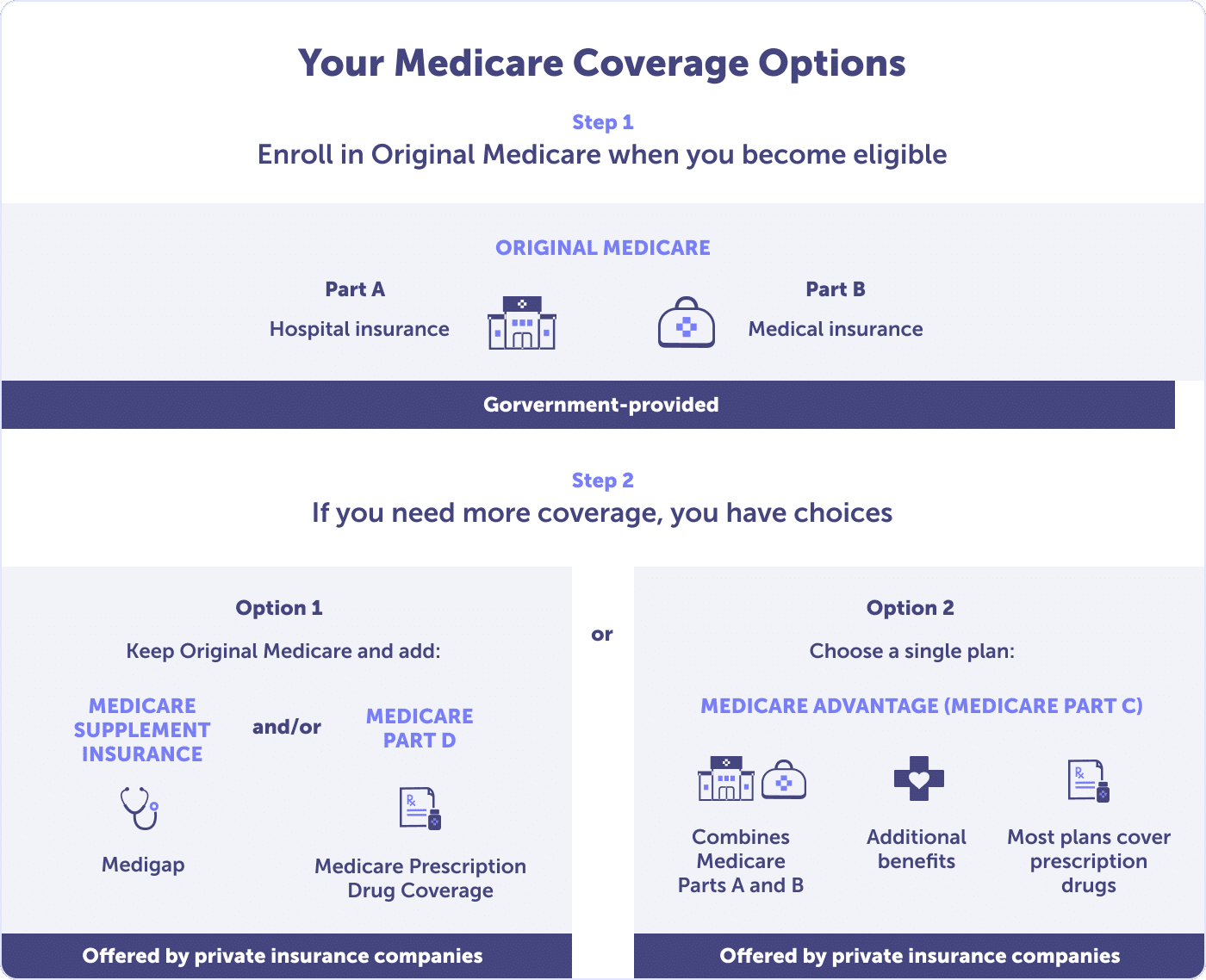

As you review your Medicare plan options, you’ll likely make one of two choices:

Everyone should enroll in Original Medicare Parts A & B. After enrolling, review how you’d like to protect yourself against out-of-pocket costs. A Medicare Advantage or Medicare Supplement plan can help – nearly 75% of Medicare beneficiaries in Florida have one of these plans.

Keep reading about your Medicare plan options: Medicare Parts A, B, C, D, and Medicare Supplement. We’ll help you uncover what mix is ideal for your health and budget needs.

Medicare Part A (hospital insurance) is part of Original Medicare. It is the public option provided by the federal government and is usually premium-free.

Private plans, like Medicare Advantage plans, contract with the Centers for Medicare & Medicaid (CMS). While they may have different rules, each plan must provide at least the same coverage as Original Medicare Part A.

You are eligible for Original Medicare Part A in Florida if you meet one of three criteria:

Medicare Part A is your hospital insurance. This plan would cover medically-necessary services delivered to you by a Medicare-assigned provider at a Medicare-approved facility.

These services include:

Medicare Part A coverage is limited. To help avoid high out-of-pocket and surprise costs, discover what is excluded. Read more about Medicare Part A.

Your Medicare Part A will likely be premium-free if you meet specific criteria.

In Florida, you must be at least 65 or older and:

Are you under 65 years of age? You may receive premium-free Part A if you:

If none of these circumstances apply to you or your spouse, you don’t qualify for premium-free Part A. However, you can purchase Part A. In 2025, you may need to pay up to $518 per month.

The premium amount is determined by the number of quarters you paid Medicare taxes. If you paid Medicare taxes for less than 30 quarters, your Part A premium is $518. But if you paid Medicare for 30 to 39 quarters, your Part A premium is $285 per month.

If you purchase Medicare Part A, you must also purchase Medicare Part B (medical insurance). Then, you would pay the monthly premiums for Medicare Part A & B. However, if you choose not to purchase Part A, you can still buy Medicare Part B.

Medicare Part A costs don’t stop at the premium. Whether you pay a premium or not, Medicare Part A also has deductible, coinsurance and/or copays. These costs should be accounted for in your healthcare budget.

In 2025, the Medicare Part A deductible is .

Should you have inpatient care, the amount of coinsurance owed will depend on the length of your stay. Coinsurance costs are based on the number of days; the longer the duration, the more costly coinsurance becomes.

In 2025, Medicare Part A coinsurance is:

Wondering what the coinsurance might cost you based on those stays? If you receive inpatient care for 151 days (roughly five months), you could owe approximately $62,850 in coinsurance. Review the table below to see the breakdown by the number of days and potential coinsurance costs.

If you maxed out your inpatient coinsurance costs and the deductible, you could owe at least $60,000. Also, remember that Medicare Part A covers only Medicare-approved expenses.

Should you have an inpatient stay beyond what coinsurance covers – or have a service that isn’t Medicare-approved? That’s out-of-pocket. This is why it’s critical to know what’s covered and what’s not. To prevent high out-of-pocket or surprise costs, read more about Medicare Part A.

The best time to enroll in Medicare Part A? During your Initial Enrollment Period. If you miss this enrollment period, you can enroll during the General Enrollment Period or a Special Enrollment Period if you qualify.

Medicare Part B is the second part of Original Medicare (Part A & B). It is your medical insurance provided by the federal government.

You are eligible for Original Medicare Part B in Florida if you are eligible for Medicare Part A.

Your Medicare Part B medical insurance covers medically necessary and preventative services.

Original Medicare Part B covers:

Medicare Part B covers many more services. To view the complete list, read What Part B covers.

Medicare Part B’s standard premium for 2025 is $185.00. This is the amount that most people pay; however, each person’s premium is based on income.

The Medicare Part B premium is based on your individual or joint modified adjusted gross income. While most people pay the standard premium, you could pay more if you made more than a specific threshold. In 2025, you could pay the standard $185.00 premium plus an Income Related Monthly Adjustment Amount (IRMAA).

The Centers for Medicare & Medicaid Services (CMS) bases your premium on the modified adjusted gross income reported to the IRS two years ago. For 2025, your Part B premium would be based on your federal tax return from 2023.

Review the table below to see if you’ll be paying an IRMAA for 2025.

The 2025 Medicare Part B deductible in Florida is $257.

After the $257 deductible is paid for the calendar year, you typically pay 20% coinsurance of Medicare-approved costs for most doctor services, including while a hospital inpatient. This includes a 20% coinsurance for outpatient therapy and Durable Medical Equipment (DME).

It’s important to note that Original Medicare Part A and B do not have an out-of-pocket maximum. You will pay 20% for Medicare-approved services – or more – unless you have a plan that expands your Original Medicare coverage. A Medicare Advantage or Medicare Supplement plan can help you cap or reduce out-of-pocket costs.

Note that all preventative services under Medicare Part B are free from a healthcare provider that accepts Medicare.

Are you wondering if a test, item, or service is covered by Original Medicare? You can check coverage with a helpful tool offered by the Centers for Medicare & Medicaid. Ask about hospital orders if you are admitted to avoid costly out-of-pocket or surprise costs. And negotiate the cost of services before they are provided.

The best time to enroll in Medicare Part B is during your Initial Enrollment Period. Should you miss your Initial Enrollment Period, the next best opportunity to enroll in the General Enrollment Period or a Special Enrollment Period if you qualify.

Timing is important because if you miss your Initial Enrollment Period, you could face lifetime late enrollment penalties. In most cases, you will incur a penalty if you enroll in Medicare Part B during the General Enrollment Period.

If you choose to delay Medicare Part B enrollment, you must have at least the same coverage Part B offers – from another source. This is called creditable coverage.

You should receive a Notice of Creditable Coverage if you have your health insurance through:

Maintaining creditable coverage until you enroll in Medicare Part B will help you avoid lifetime late enrollment penalties.

Medicare Advantage (MA) plans in Florida, also known as Medicare Part C, are an option for receiving your Original Medicare coverage with additional benefits. These plans are offered by private insurance companies regulated and contracted by the Centers for Medicare & Medicaid Services (CMS).

Unlike Original Medicare, Medicare Advantage plans cap your out-of-pocket costs. A Medicare Advantage plan that provides creditable prescription drug coverage is called a Medicare Advantage Prescription Drug Plan (MAPD).

To qualify for a Medicare Advantage plan in Florida, you must enroll in Medicare Part A and B. Plus, you need to live in the service area of the plan you’d like to enroll in. Medicare Advantage plans are offered at the county level, and many options are available.

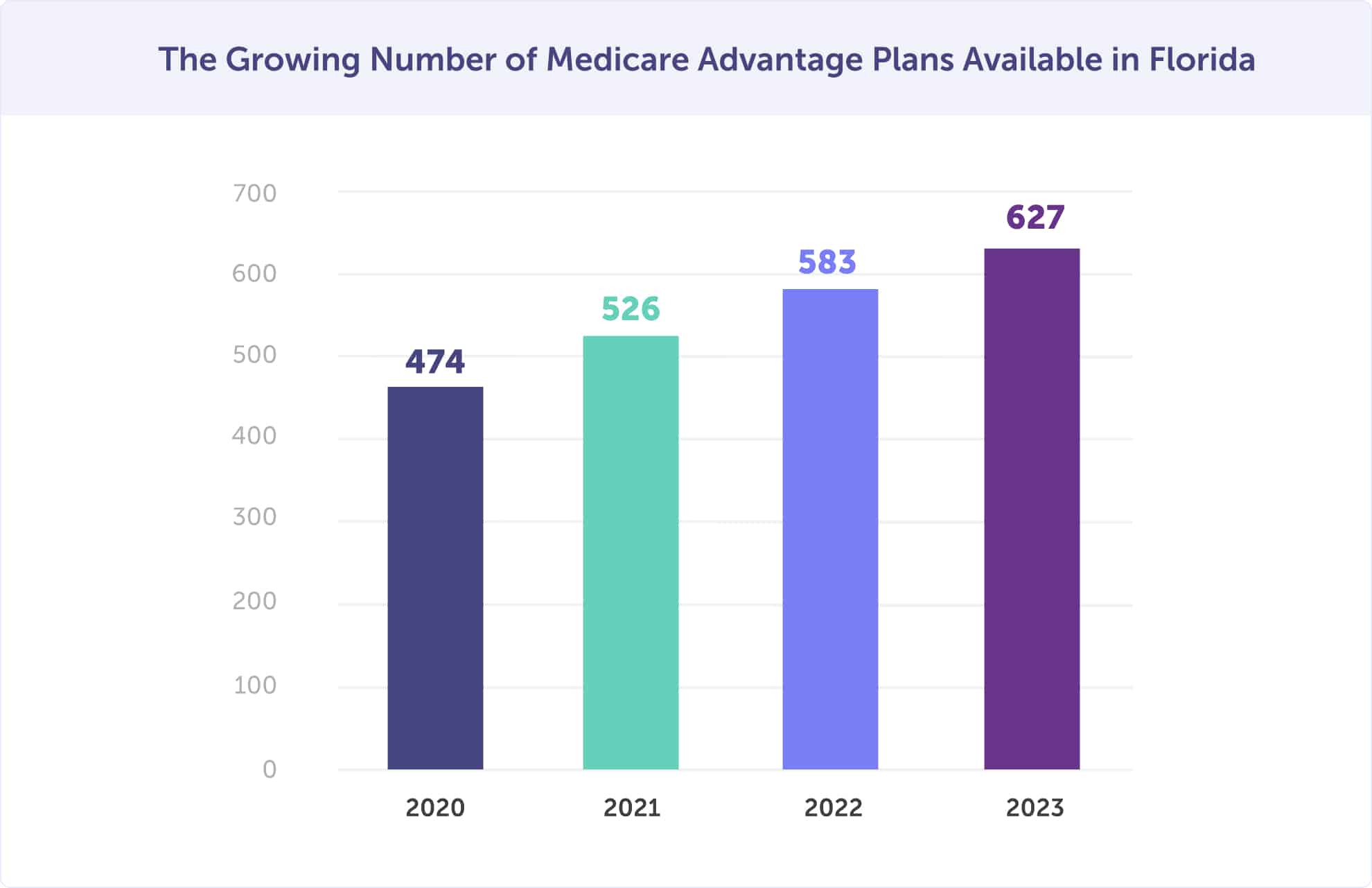

In 2025, there are 627 Medicare Advantage plans available in Florida. That’s up from 583 in 2022, 526 plans in 2021, and 474 plans in 2020. Between 2022 and 2023, there are 7.5% more Medicare Advantage plans available in Florida. Approximately 55% of Floridians were enrolled in a Medicare Advantage plan in 2025.

The increase in plan options is great news. Now, you have an even greater opportunity of finding a plan that’s suited to your health and budget needs.

Medicare Advantage plans are growing in popularity and plan options. That’s great news! But there are a few counties in Florida where the percentage of Medicare recipients enrolled in a Medicare Advantage plan is the highest.

In 2025, the 10 Florida counties with the highest Medicare Advantage plan enrollment are Miami-Dade County (75%), Osceola County (70%), Gadsden County (68%), Pasco County (66%), Polk County (65%), Hernando County (65%), Liberty County (64%), Broward County (64%), Wakulla County (62%), and Calhoun County (60%).

The counties that saw the largest percentage increase in enrollment between 2022 and 2023 are Gadsden County, Pasco County, Hernando County, and Liberty County. Each of these counties increased by 2% year-over-year.

A Medicare Advantage plan can offer low or no-cost premiums and lower out-of-pocket costs, with additional benefits that Original Medicare doesn’t provide. A Medicare Advantage plan offers equal coverage to Original Medicare Part A and B, but often at a lower cost. It’s clear why 55% of Floridians are enrolled in a Medicare Advantage plan in 2025.

All people enrolled in Medicare in Florida have access to a $0 monthly premium Medicare Advantage plan. If you don’t enroll in a $0 premium plan, the average monthly Medicare Advantage plan premium is $9.41.

When you enroll in a Medicare Advantage plan in Florida, you’ll pay any applicable Medicare Part A and B premiums in addition to the Medicare Advantage plan premium. Another upside of Medicare Advantage plans – the majority cover prescription drugs. Plus, unlike Original Medicare, there is an out-of-pocket maximum.

Did you know that Original Medicare Part A and B do not have a maximum for what you could spend on copayments and coinsurance? You could incur substantial out-of-pocket costs since the 20% coinsurance of Orignal Medicare has no cap. Medicare Advantage plans set their deductibles, coinsurance, and copayments within limits established by the federal government.

After you reach your Medicare Advantage plan’s out-of-pocket maximum, including the deductible, your plan pays 100% of covered healthcare expenses for the rest of the plan year.

Want dental, vision, or hearing coverage? Original Medicare doesn’t provide comprehensive coverage of these benefits. If any of these benefits are something you’re seeking, you can get them with a Medicare Advantage plan. These and more.

Most plans include reduced cost-sharing, over-the-counter and wellness products, transportation assistance, telemedicine, fitness programs, and other rewards and incentive programs.

Florida is unique because the Centers for Medicare & Medicaid Services (CMS) offer two special programs.

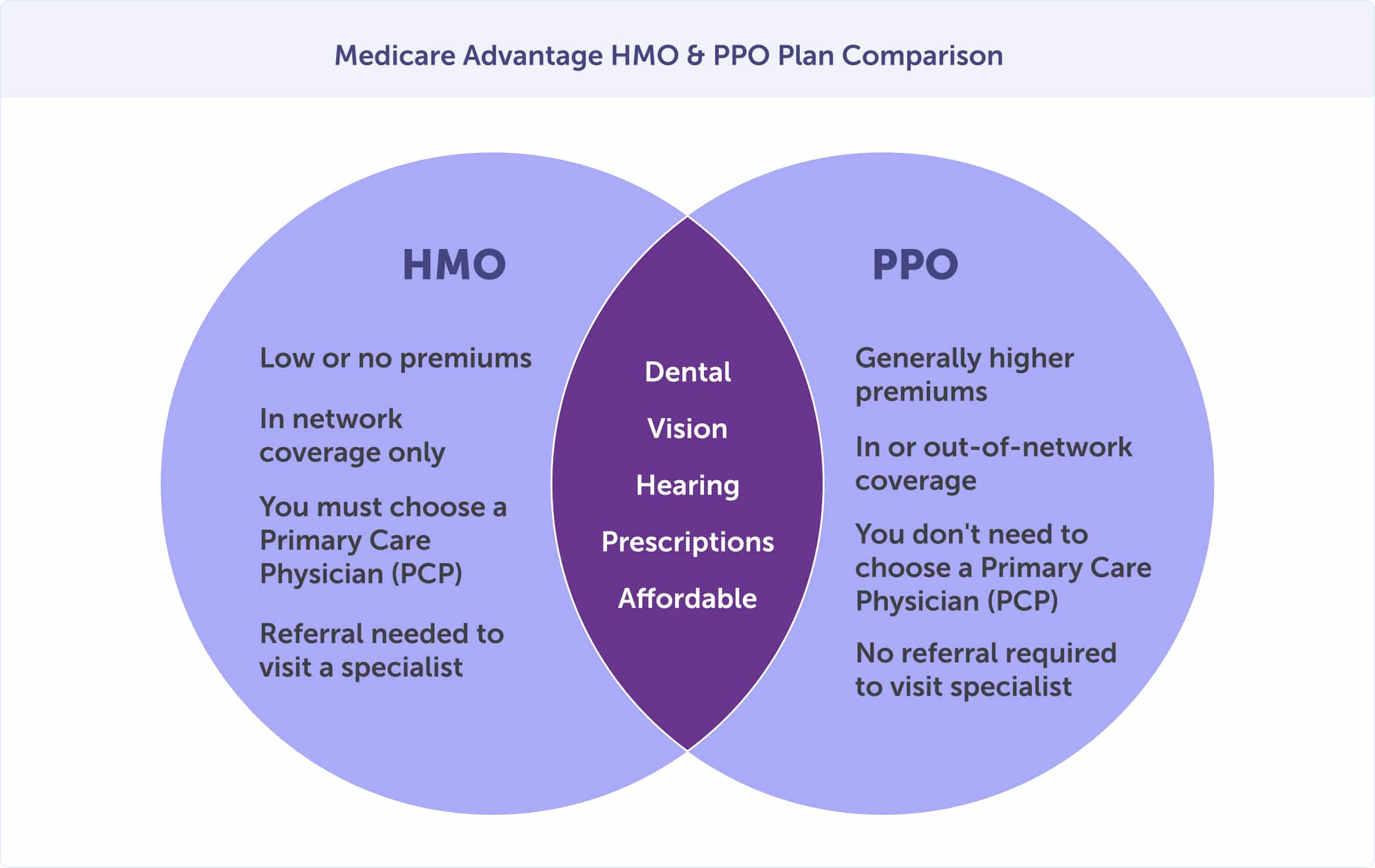

There are four Medicare Advantage plan types; however, the two most popular are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Special Needs Plans (SNPs) and Private Fee-for-Service (PFFS) plans are the lesser utilized plan types. You’ll likely choose between an HMO or PPO plan type since Private Fee-for-Service (PFFS) plans are usually available only somewhere especially rural.

Each of these plan types provides a different level of network flexibility and price.

What do all of these plans have in common?

Medicare Advantage HMO and PPO plans have many similarities.

The main difference between Medicare Advantage HMO and PPO plans are cost and flexibility.

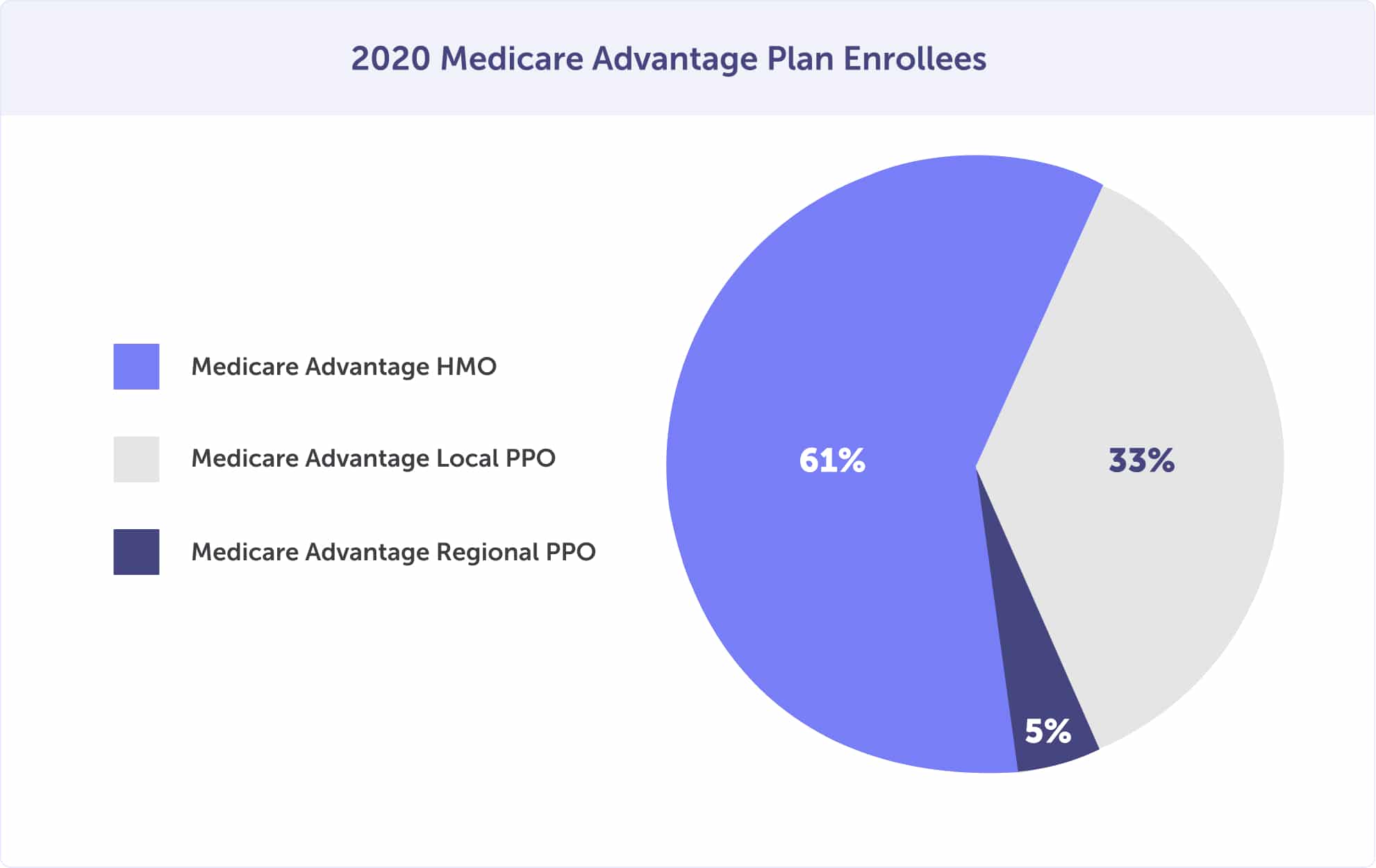

In 2020, most Medicare Advantage plan enrollees had an HMO (61%), while 33% enrolled in a local PPO. The least popular option was the regional PPO plan option – with 5%.

Everyone on Medicare must have creditable prescription drug coverage. This is a requirement set by the Centers for Medicare and Medicaid Services (CMS). You can receive prescription drug coverage through a Medicare Advantage Plan. These plans are called Medicare Advantage Prescription Drug plans (MAPD) when paired together.

If you’re looking for the convenience of having one plan and card that covers your Medicare hospital, medical, and prescription drug benefits through one plan – Medicare Advantage is the choice. Plus, there is no additional plan premium for prescription drug coverage with a Medicare Advantage Prescription Drug plan.

Most Medicare Advantage plans offer a Medicare Advantage Prescription Drug plan (prescription drug coverage). In fact, in 2020, 90% of plans offered MAPDs, and 89% of all Medicare Advantage enrollees were enrolled in an MAPD plan.

Medicare Advantage plans start at a $0 premium. One hundred percent of people enrolled in Medicare Part A and B have access to a Medicare Advantage plan in Florida with a $0 monthly premium. For those with a premium, the average monthly premium in 2025 is $9.41.

Once enrolled in a Medicare Advantage or Medicare Advantage Prescription Drug Plan (MAPD), plan premiums are paid directly to the plan provider. These are separate premiums from your Medicare Part A or Part B, which are paid directly to Medicare. Traditionally, these premiums are withdrawn from your Social Security benefit, electronic withdrawal, or coupon book. At the time of enrollment, you can choose your payment method.

In addition to the plan premium, you may incur out-of-pocket costs. These expenses include deductibles, copayments, and coinsurance. The costs will vary depending on the Medicare Advantage plan that you choose.

When choosing amongst your plan options, you’ll weigh the pros and cons of coverage and cost. And you’ll likely first be narrowing down whether you want an HMO or a PPO plan. Here are a few simple questions to ask yourself when shopping around for the right plan for your health and budget.

The ideal time to enroll in a Medicare Advantage plan in Florida is during your Initial Enrollment Period (IEP). If you miss your IEP, you can enroll during the General Enrollment Period or a Special Enrollment Period, should you qualify.

Once enrolled in a Medicare Advantage plan, you can use the Medicare Advantage Open Enrollment Period to switch to another plan.

Medicare Part D is a federal government program that offers Medicare eligibles prescription drug coverage. Part D is provided by private insurance companies regulated by the Centers for Medicare & Medicaid Services (CMS) – similar to Medicare Advantage plans. Most enrollees have Medicare Part D if they are enrolled in Medicare Part A and B but not a Medicare Advantage plan.

If you have a Medicare Advantage plan, you would likely get your prescription drug coverage through a Medicare Advantage Prescription Drug plan (MAPD). You must choose an MAPD plan or Medicare Part D, but you’ll be unable to have both.

Medicare Part D pays for some of the costs of prescription drugs at participating pharmacies in your community. The cost and availability of Medicare Part D plans will vary by county. Typically, you would pay a monthly premium, depending on your plan choice, plus an annual deductible and copayment or coinsurance.

In 2025, 22 stand-alone Medicare Part D prescription drug plans are available in Florida. Eight plans offer lower out-of-pocket insulin costs through the Part D Senior Savings Model. And 27% of Floridians with Medicare Part D get Extra Help (the low-income subsidy).

The Centers for Medicare & Medicaid Services (CMS) require creditable prescription drug coverage. If you don’t have creditable coverage, you could face penalties. These penalties are for as long as you have Medicare coverage.

To have creditable coverage, you’ll likely need to enroll in a Medicare Advantage Prescription Drug plan or a standalone prescription drug plan (Medicare Part D), along with your Orignal Medicare Parts A and B. You can also have creditable coverage from another source, such as an employer, but they must provide proof that their prescription drug coverage is equal to the coverage of Medicare Part D.

There are several types of plans that offer creditable coverage if you are not enrolled in Medicare Part D or a Medicare Advantage Prescription Drug Plan.

These include:

Avoid late enrollment penalties by enrolling in prescription drug coverage during your Initial Enrollment Period. And, if you have creditable group health insurance coverage and lose it, enroll in Medicare Part D or a Medicare Advantage Prescription Drug plan within 63 days of losing coverage.

Everyone enrolled in Medicare Part A and/or Medicare Part B has access to a standalone Medicare Part D prescription drug plan in Florida.

Each plan has a unique list of covered prescription medications called a “formulary.” All plans are different and do NOT cover the same prescription medications. Medicare Part D plans include brand-name and generic drugs and must make prescriptions in certain protected classes available. These include drug treatments for HIV/AIDS and cancer, for example.

Each Medicare Part D plan’s formulary must have at least two drugs in the most commonly prescribed categories and classes. This ensures people with varying medical conditions get the prescription medications they depend on. If the formulary for your plan doesn’t include your specific drug, a brand name, for example, a similar medication, should be available. If there is no substitute, you can request an exception.

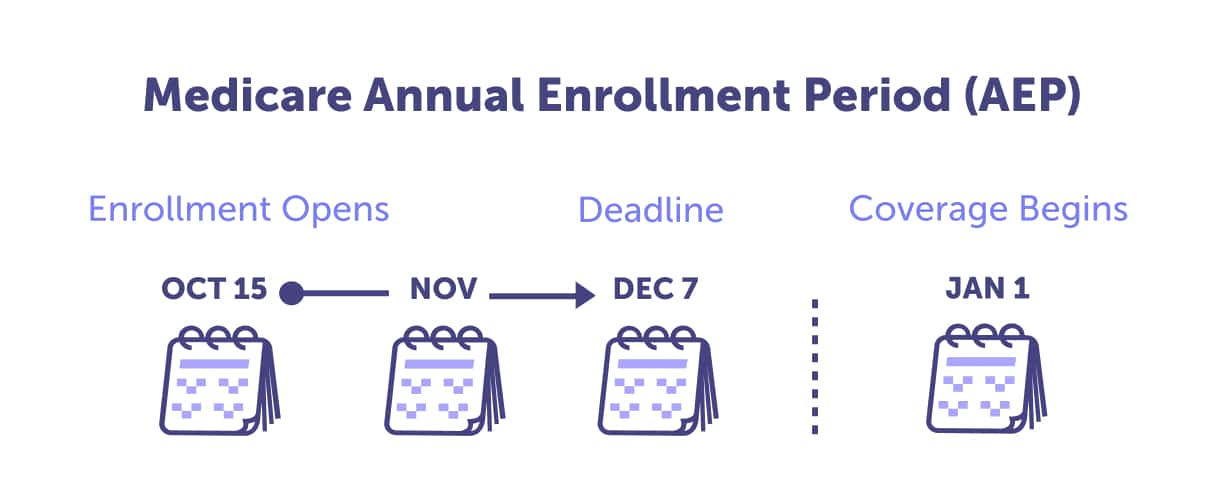

Because Medicare Part D plan formularies change annually, reviewing your plan at least once a year is essential. We recommend doing this during the Annual Enrollment Period, October 15 through December 7. A plan review is essential because therapies change, new prescription medications are released, and further medical information becomes available. In some cases, your plan may also increase the copayment or coinsurance for your drugs or offer a generic form that can lower out-of-pocket expenses.

In Florida, the lowest monthly premium for a stand-alone Medicare Part D prescription drug plan is $8.40. In 2025, the national average monthly premium for standard Medicare Part D coverage is $31.50.

The Medicare Part D premium is not the only cost for prescription drug coverage. You’ll also be responsible for out-of-pocket medication costs. These can include the annual deductible and copayments and/or coinsurance.

Plan formularies have levels of coverage called “tiers.” The tiers determine how costly your out-of-pocket costs – or copayment – will be. The higher the tier, the higher the price.

For example, it will usually be less expensive to choose a generic version of medication versus a brand-name version. If you can get a generic version, that will save you money.

Don’t think that by choosing a generic, you’re choosing a lesser quality. The Food and Drug Administration (FDA) says that generic drugs are copies of brand-name drugs and are the same in dosage, safety, strength, route of administration, quality, performance characteristics, and intended use. To save money, you should speak with your doctor or prescriber about generic drug options.

Eight plans offer lower out-of-pocket insulin costs through the Part D Senior Savings Model if you are on insulin. You should ask if one of these plans is available in your county.

Depending on the Medicare Part D plan you choose, your deductible will vary. Some Medicare Part D plans do not have a deductible. Those Medicare prescription drug plans with a deductible can be no higher than in 2025.

Do you have limited financial resources and income? If so, and you’re enrolled in Medicare in Florida, you could qualify for Extra Help.

Extra Help supports you with paying monthly premiums, annual deductibles, and co-payments related to Medicare prescription drug coverage. If you are eligible for Extra Help, you won’t pay a late enrollment penalty when joining a Medicare drug plan.

The following carriers offer stand-alone Prescription Drug (Medicare Part D) plans in Florida:

| AARP MedicareRx | Humana Rx |

| BlueMedicare Rx | Humana Walmart Value |

| Cigna Rx | Mutual of Omaha Rx |

| Clear Spring Health | SilverScript |

| Elixir Rx | WellCare Rx |

| Humana |

You can sign up for a Medicare Part D prescription drug plan during your Initial Enrollment Period. If you miss that, you can still enroll during the General Enrollment Period, but you may have late enrollment penalties. If you qualify, you can also enroll during a Special Enrollment Period.

A Medicare Supplement plan, or Medigap plan, helps those enrolled in Original Medicare have more predictable out-of-pocket costs. These plans work with Original Medicare and are not stand-alone plans. Private insurance companies licensed by the Florida Office of Insurance Regulation are authorized to sell Medigap plans – and all plans are standardized.

You will also need creditable coverage if you choose to enroll in Original Medicare Part A and B with a Medicare Supplement plan. You can get this through a stand-alone Medicare Part D plan or another source. Medicare Supplement plans do not provide creditable coverage.

According to The State of Medicare Supplement Coverage, there were 925,872 Florida Medicare enrollees (19.3%) with Medicare Supplement coverage in 2021. This is down from 913,759 Florida Medicare enrollees (19.5%) in 2020 and 922,604 (20.2% of enrolled) in 2019. In Florida, enrollment is down for the third year.

Original Medicare Parts A and B do not have a maximum for out-of-pocket costs. Medicare Part A covers some inpatient costs, while Medicare Part B covers 80% of outpatient costs. That leaves you with out-of-pocket costs for deductibles, copayment, and 20% coinsurance for doctor bills and other medical expenses.

The coverage gap may cost more than you expect, especially if you have a hospital stay over 60 days or receive care in a skilled nursing facility over 20 days. Remember, Original Medicare has no maximum for out-of-pocket costs. That’s where a Medicare Supplement plan can help.

Medicare Supplement plan coverage varies but can include the following:

There are 10 types of Medicare Supplement plans (Medigap) available in Florida. Medicare Supplement plans are labeled A-G and K-N. Every Medicare insurance company must offer at least Medicare Supplement A but can also offer other plans.

Although 10 types of Medicare Supplement plans exist, only a portion of those plans are available to you. As of January 1, 2020, the Part B deductible plans were phased out. If you turned 65 on or before December 31, 1999, you can enroll in Plan C or Plan F. However, if you turned 65 on or after January 1, 2020, these plans are unavailable.

The top five most popular Medicare Supplement plans in Florida are Plan F (57.1%), Plan G (14.5%), Plan N (9.7%), Plan J (5.6%), and Plan C (4.1%). For those who turned 65 after January 1, 2020, Plan G has become a popular second choice to Plan F.

You should not base your enrollment decisions on the popularity of a plan. Just because a plan is popular doesn’t mean it’s the right option for your unique health and budget needs. It’s important to consider monthly premium costs and out-of-pocket expenses. Some plans with lower premiums may have higher out-of-pocket costs.

Medicare Plan F has the highest percentage of Medicare Supplement plan enrollment. However, as of January 1, 2020, plans that include the Part B deductible were phased out. This includes Plan F. This means that if you turned 65 or enrolled in Plan F before December 31, 1999, you are grandfathered in. But if you turned 65 on or after January 1, 2020, you cannot enroll in this plan.

Plan G is the closest to discontinued Plan F, which is likely why it has the second-highest enrollment of Medicare Supplement plans in Florida.

To be eligible for a Medicare Supplement plan, you must first be enrolled in Original Medicare Part A and Medicare Part B. You must also live in the county where the plan is available.

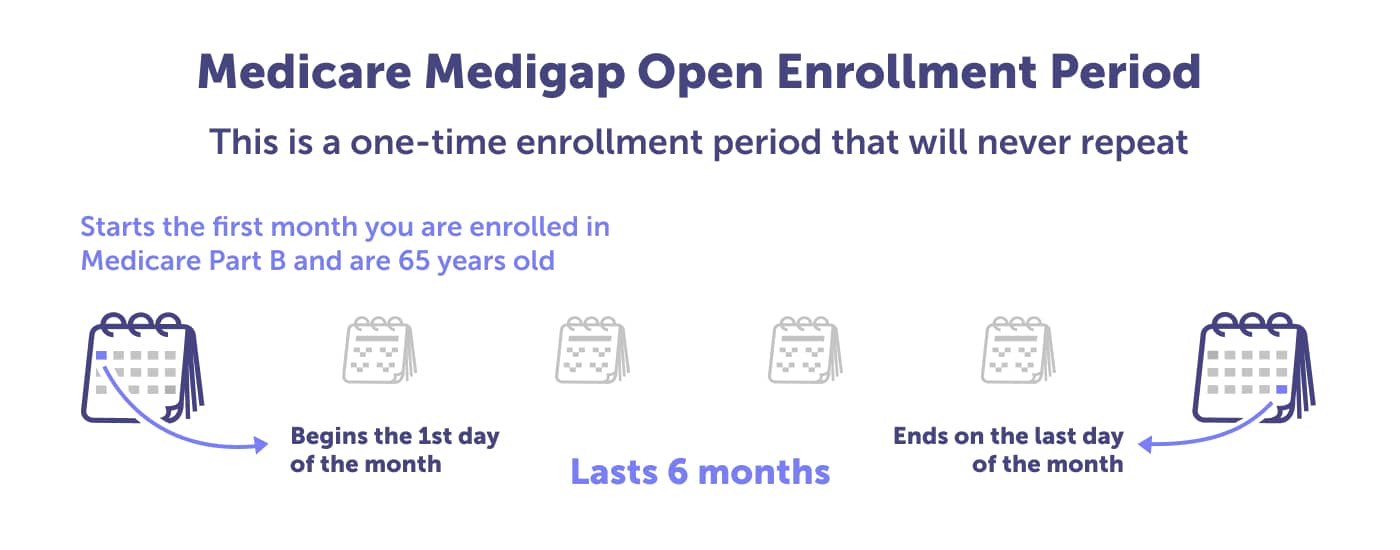

The ideal time to enroll in a Medigap (Medicare Supplement) plan is when you first become eligible during your Medigap Open Enrollment Period. This one-time enrollment period cannot be changed or repeated, so you must know when it occurs.

If you miss your Medigap Open Enrollment Period, you may be unable to enroll in a Medigap plan. Enrollment outside of your Medigap Open Enrollment Period may require medical underwriting. Insurance companies generally use medical underwriting to decide whether to accept your application and how much to charge for a policy.

If you are accepted to a plan outside your Medigap Open Enrollment Period, it could cost more because of past or present medical conditions.

If you’re applying for Medicare for the first time, three enrollment periods are critical to you. These are your Initial Enrollment Period, the General Enrollment Period, and the Medigap Open Enrollment Period. If you miss any of these, you may be able to enroll during a Special Enrollment Period – if you qualify.

The Medicare Initial Enrollment Period (IEP) is when Floridians become Medicare-eligible for the first time and enroll. It starts three months before your 65th birthday, includes the month of your birthday, and ends three months after you turn 65. Your Initial Enrollment Period lasts a total of seven months.

This enrollment period is critical because you may incur late enrollment penalties if you miss it. Should you miss your Initial Enrollment Period, the next time you could enroll would be the General Enrollment Period.

Ensure that you know when your Initial Enrollment Period is. Take our Medicare eligibility quiz to discover your Initial Enrollment Period and receive enrollment reminders.

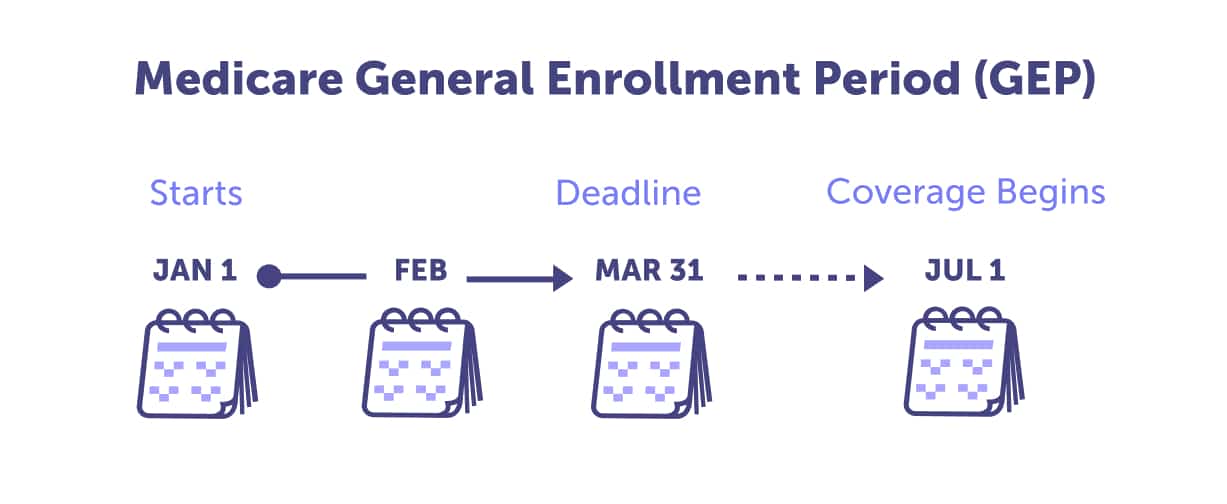

If you miss your Initial Enrollment Period, the General Enrollment Period is your next opportunity to enroll in Medicare for the first time. The General Enrollment Period occurs from January 1 through March 31 annually. If you enroll during this time, your Medicare coverage will begin on July 1.

Note: If you enroll in Medicare during the General Enrollment Period, you may incur late enrollment penalties.

The Medigap Open Enrollment Period is the best time to enroll in a Medigap plan, also called a Medicare Supplement plan. If you’re considering enrolling in a Medicare Supplement plan, mark your calendar for the first month you’re enrolled in Medicare Part B and are age 65. This one-time enrollment period lasts only six months, happens once, and can not be extended or changed.

This enrollment period is the best time to enroll in a Medicare Supplement plan in Florida because you’ll get the best pricing and greater plan options. This is also when you can enroll in a Medigap plan regardless of your preexisting medical condition. If you try to enroll in a Medicare Supplement plan outside of this enrollment period, you may find it more costly, it may require underwriting, and you may be denied coverage.

Suppose you want to have your Medicare plan reviewed (which you should do yearly) or need to make a plan change. In that case, you should know three enrollment periods: the Annual Enrollment Period, the Medicare Advantage Open Enrollment Period, and the Special Enrollment Period.

Marking these enrollment periods on your calendar could save you money or get you better benefits. By shopping around, you ensure that you have the best plan for your health and budget.

The Medicare Annual Enrollment Period (AEP), also known as the Medicare Open Enrollment Period, is for individuals already enrolled in Medicare. This enrollment period happens every year between October 15 and December 7.

For those enrolled in Medicare, this is a critical time to review your Medicare plan with a local licensed agent. We recommend reviewing annually to ensure you’re on the best plan for your health needs and budget. Why?

Discover how to be prepared for the next Medicare Annual Enrollment Period by reading our ultimate guide.

After reviewing your plan with a local licensed agent, there are six possible changes to make:

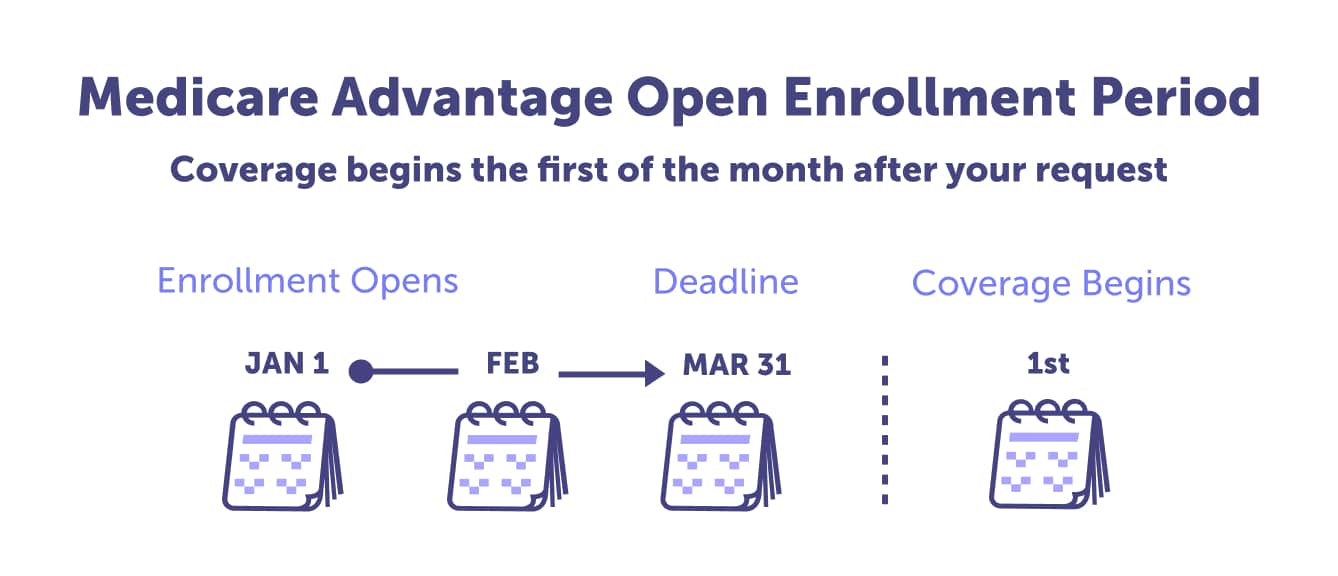

Are you already enrolled in a Medicare Advantage plan (Medicare Part C) and want to make a change? You can do that during the Medicare Advantage Open Enrollment Period. This enrollment period runs from January 1 through March 31 annually.

If you choose not to make a plan change during the Medicare Advantage Open Enrollment Period, you’ll need to wait until the Annual Enrollment Period. If you qualify, you could also make a change during a Special Enrollment Period.

You can make the following changes during the Medicare Advantage Open Enrollment Period:

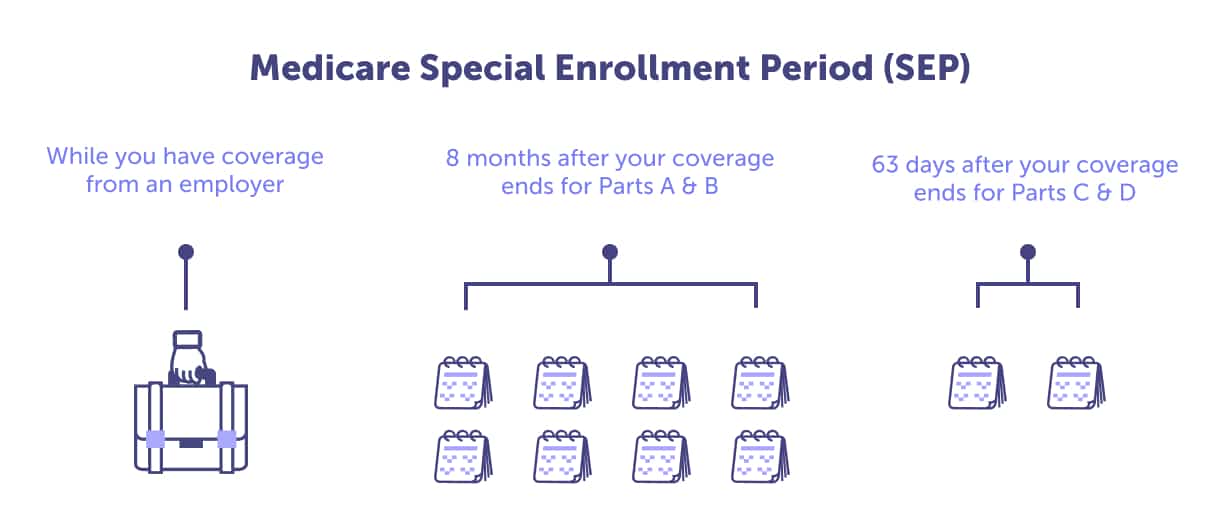

Particular circumstances allow you to make a plan change outside the five enrollment periods mentioned above. A Special Enrollment Period (SEP) is dependent on life circumstances or new plan availability.

Continue reading to discover the three primary reasons you would qualify for a Special Enrollment Period.

If your primary residence changes (you move), you lose your health insurance, or you get an opportunity to get other health insurance, you may have a qualifying life event. You should speak with a local licensed agent if you want to change your plan outside one of the standard enrollment periods. An agent can help determine if you’ve experienced a qualifying life event and the unique timing for the Special Enrollment Period.

Have you heard of 5-Star Medicare plans? The Centers for Medicare & Medicaid Services (CMS) evaluates Medicare plans and rates their performance. They use a star rating system, 1 through 5 stars – with 5 stars being the highest.

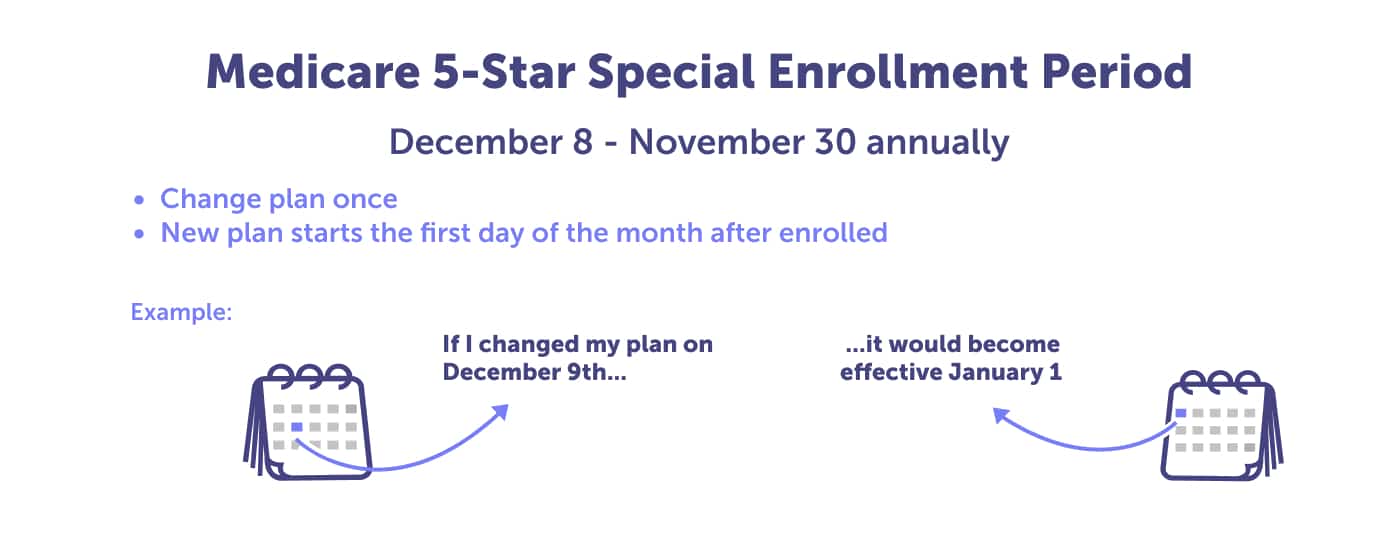

You can use the 5-Star Special Enrollment Period to enroll in a 5-Star plan that is available in your county. This allows you to change from your current plan to a 5-Star rated Medicare Advantage plan in Florida, Medicare Advantage Prescription Drug plan (MAPD), or a standalone Medicare Part D prescription drug plan.

The 5-Star Special Enrollment Period can be used once between December 8th and November 30th. If you’d like to make a plan change and you’re unsure if a 5-Star plan is available in your county, you should call to speak with a licensed local agent.

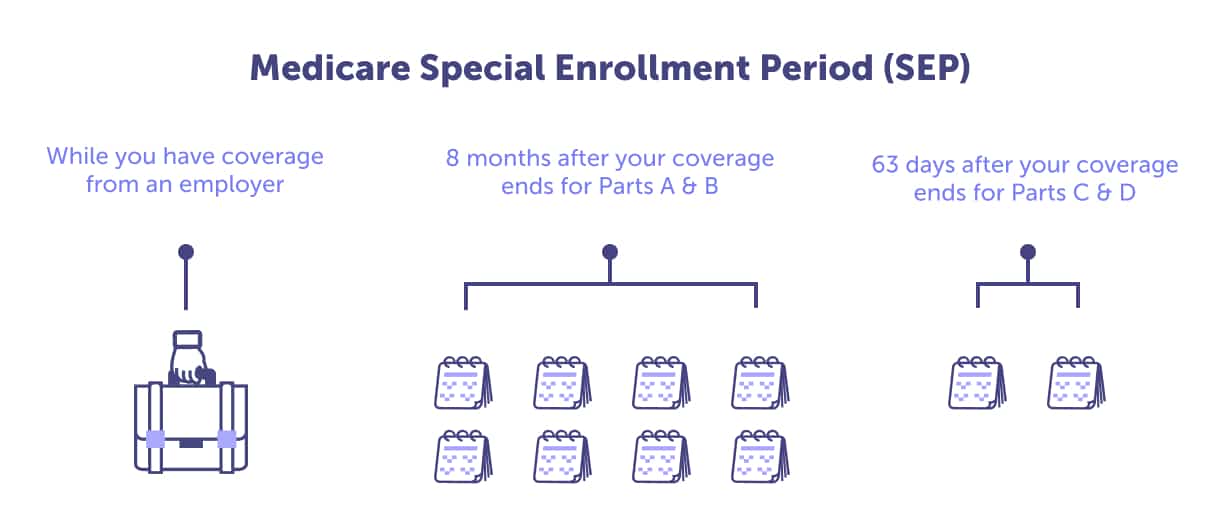

Do you or your spouse plan on delaying Medicare because you will be working after the age of 65? Your job-based healthcare coverage must provide benefits as good as Medicare offers. This is called creditable coverage.

You should confirm annually that you have creditable Medicare Part B and prescription drug coverage (Medicare Part D) through your employer. If you don’t, you, your spouse – or both of you – could incur lifetime late-enrollment penalties when you enroll in Medicare Part B and prescription drug coverage. If you’re delaying Medicare coverage, ensure you have creditable coverage from another source.

You have eight months, during a Special Enrollment Period, to enroll in Medicare Part A and B if you lose your employer-sponsored health coverage. If you want to enroll in a Medicare Advantage plan (Medicare Part C) or Medicare Part D, you only have 63 days to enroll. If you don’t enroll, you could face late enrollment penalties. Important note: COBRA does not count as creditable coverage.

The Social Security Administration (SSA) administers retirement and disability income programs for the United States. They provide financial support for retirees. You can apply for retirement, disability, and Medicare benefits through the Social Security Administration.

SSA Phone Number: 1-800-772-1213 (TTY 1-800-325-0778)

Social Security Administration FAQ

Social Security Administration local office locator

Email the Social Security Administration

Working with the Social Security Administration, the Railroad Retirement Board administers the retirement benefits for railroad workers and their families in the United States.

Texas RRB Office Phone Number: 1-877-772-5772

RRB National Telephone Service: 1-877-772-5772

General TTY Number: 1-312-751-4701

Headquarters Personnel Directory: 1-312-751-4300

Railroad Retirement Board website

The Florida Office of Insurance Regulation can provide information and resources about medical and long-term care insurance. The department can help you look for coverage, determine your policy, or file a complaint.

Florida Office of Insurance Regulation Phone Number: 1-850-413-3140

DFS Consumer Services (Questions/Complaints): 1-877-693-5236 (Toll-Free Helpline in FL)

Contact the Florida Office of Insurance Regulation by Email

The SHINE (Serving Health Insurance Needs of Elders) Program, Department of Elder Affairs, provides health insurance information and free, unbiased, and confidential counseling assistance to Medicare beneficiaries, their families, and caregivers.

SHINE Program Phone Number: 1-800-96-ELDER / 1-800-963-5337

SHINE Program Resources

SHINE Program Contact Page

The Senior Resource Alliance (SRA) serves the Brevard, Orange, Osceola, and Seminole Counties in Florida. They are a local resource for accessing the many services and programs offered by the state and federal government for senior citizens, their caregivers, and family members.

Senior Resource Alliance Phone Number: 1-800-963-5337

Programs and Services

The Area Agency on Aging in Southwest Florida serves Charlotte, Collier, DeSoto, Glades, Hendry, Lee, and Sarasota counties. They provide information and local resources like elder care, adult day care, housing assistance, home care, housekeeping, legal assistance, and personal care.

Area Agency on Aging for Southwest Florida Phone Number: 1-866-413-5337

Local Resources from Area Agency on Aging in Southwest Florida

The State of Florida’s Department of Elder Affairs provides home and community-based services to seniors at risk of being placed into a long-term care facility due to their degree of frailty. They also coordinate the state’s 11 Area Agencies on Aging and local service providers to deliver essential services to the community.

Department of Elder Affairs Phone Number: 1-850-414-2000

Department of Elder Affairs Elder Helpline: 1-800-96-ELDER (1-800-963-5337)

Department of Elder Affairs Programs and Resources

CMS Releases 2023 Projected Medicare Basic Part D Average Premium.

Florida population, 2023.

MA State/County Penetration, February 2023.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

Medicare Costs.

Medicare Open Enrollment in Florida, 2023.

State Health Facts: Custom State Report, 2020.

Supplement Insurance (Medigap) plans in Florida.

The State of Medicare Supplement Coverage, 2022.

Total Number of Medicare Beneficiaries by Type of Coverage.

What Medicare Part D drug plans cover.

Yearly deductible for drug plans.

Last updated: May 1, 2023

Florida Blue Medicare Supplement plans do not cover hearing aids. The average cost of digital hearing aids is $1,500, and high-end devices can cost $5,000.

If you need hearing aid coverage and want a Florida Blue plan, you may want to look into the Florida Blue Medicare Advantage PPO or HMO plans. Generally, Medicare Advantage plans (Medicare Part C) cover hearing aids.

Speak with a local licensed agent if you would like help finding a plan that provides hearing aid benefits. Call (623) 223-8884 or review your Medicare plan options online.

Yes, Florida has a Medicare Savings Program. These programs help Florida Medicare beneficiaries who struggle to afford the cost of Medicare coverage. With a Medicare Savings Program (MSP), you could get help paying for Medicare Part B premiums, Medicare Part A and B cost-sharing, and in some cases, help with Medicare Part A premiums.

If you have limited income and limited resources, and you have or are eligible for Medicare Part A, you may apply for one of the four Medicare Savings Programs available in Florida.

The four kinds of Medicare Savings Programs include the Qualified Medicare Beneficiary (QMB) Program, Specified Low-Income Medicare Beneficiary (SLMB) Program, Qualify Individual (QI) Program, and Qualified Disabled & Working Individuals (QDWI) Program.

There are instances when you may be automatically enrolled in Original Medicare. These include if you’re already receiving Social Security benefits, are younger than 65 with an eligible disability, or have Amyotrophic Lateral Sclerosis or End-Stage Renal Disease.

If you’re not automatically enrolled, you should enroll when you’re first Medicare-eligible – during your Initial Enrollment Period. Take our Medicare Eligibility quiz to know when to apply and receive reminders.

There are four ways to apply for Medicare through the Social Security Administration: Online, in-person, calling the Social Security Administration, or calling the Railroad Retirement Board.

To have a local licensed agent assist you with enrollment, call (623) 223-8884.

Florida Blue is health coverage offered by Blue Cross and Blue Shield of Florida. Medicare Advantage HMO coverage is offered by Florida Blue Medicare. Blue Cross and Blue Shield of Florida are private insurance carriers regulated by the Centers for Medicare & Medicaid Services (CMS). Florida Blue must offer the same coverage as Original Medicare Part A and B.

No, Medicare does not pay for assisted living in Florida. Florida provides assisted living and nursing facility care through Florida’s Medicaid Long-Term Care Managed Care (LTCMC) plans. To qualify for an LTCMC, you must need nursing home level care and financial eligibility.

Medicare may cover the medicare costs for auto accident injuries in Florida, depending on the type of injury.

Medicare Part A will cover the costs associated with being admitted to the hospital or any surgery performed as an inpatient. Medicare Part B will cover ambulatory transportation, emergency room treatment related to your injuries, and outpatient surgery.

You would still need to pay any applicable deductibles pertaining to your care. This could include the Medicare Part A deductible and $257 Part B deductible for 2025. You may also need to pay coinsurance for any inpatient stay and 20% of Medicare-approved costs after meeting the Part B deductible.

Florida Blue has Medicare Advantage plans (Medicare Part C) available. You can choose from their HMO and PPO plan options.

Do you want to know if a Florida Blue Medicare Advantage plan is available in your area? Call (623) 223-8884 to speak with a local licensed agent or review your plan options online.

Original Medicare Part A and B costs could include premiums, deductibles, coinsurance, and/or copays.

Medicare Part A is usually premium-free in Florida, but it could cost up to $518 if you need to pay. In 2025, the deductible is , plus there are coinsurance and copays that you need to factor in. Medicare Part A basic annual costs could range from – $7,544, excluding coinsurance and copays.

The Medicare Part B standard premium is $185.00 in 2025, but you may need to pay an Income Related Monthly Adjustment Amount (IRMAA) if your income exceeded $91,000 in 2023. The Part B deductible in 2025 is $257, plus you would need to pay 20% of Medicare-approved doctor services, outpatient therapy, and Durable Medicare Equipment (DME). Medicare Part B’s basic annual costs could range from $2,274.20 – $7,172.60, excluding coinsurance and copays.

If you choose a Medicare Advantage, Medicare Supplement, or Medicare Part D standalone plan, those would have additional costs to account for.

Yes, if you qualify for Medicare and Medicaid in Florida, then that’s called dual-eligible. You can enroll in a dual-eligible Special Needs Plan (D-SNP) that covers both Medicare and Medicaid benefits in Florida. With these plans, you may receive over-the-counter items, hearing aids, and vision or dental at little to no cost.

Speak with a local licensed agent to discover your plan options if you qualify for Medicare and Medicaid in Florida. Call (623) 223-8884.

Original Medicare Part A and Part B do not cover dentures in Florida. There are Medicare Advantage plans that cover dentures. Depending on the plan you choose, the plan could also cover everything from teeth cleanings to root canals.

We can help you find a plan that includes denture coverage. Call (623) 223-8884 to speak with a local licensed agent or review your Medicare Advantage plan options online.

The average cost of digital hearing aids is about $1,500, with high-end devices costing as much as $5,000.

Original Medicare Part A and B do not cover hearing aids in Florida, but they cover hearing exams when a doctor orders. Medicare Supplement plans generally do not provide hearing-aid coverage.

A Medicare Advantage plan (Medicare Part C) may provide coverage for hearing aids. If this is an essential benefit to you, speak with one of our local licensed agents. We can help you find a plan that fits your needs. Call (623) 223-8884 to speak with a local licensed agent or review your Medicare Advantage plan options online.

Under certain circumstances, Medicare pays for home health care in Florida. A doctor must order the services, and a certified home health agency must provide the care. If you follow these guidelines, Medicare can pay the total cost of home health care for up to 60 days in Florida.

You can get a replacement Medicare card in Florida by logging into your Medicare to print an official copy of your Medicare card. You can also call 1-800-MEDICARE (1-800-633-4227) to order a replacement card. TTY users can call 1-877-486-2048.

Traditional Original Medicare Parts A and B do not provide routine dental care, like cleanings, X-rays, or dentures. Original Medicare will only offer non-routine dental care. For example, if you need surgery on your jaw or facial bones, teeth extractions related to other hospital treatments, or other dental services that would be provided by a medical doctor – not a dentist.

Many Medicare Advantage plans cover some dental services. Depending on your chosen plan, it could cover everything from cleanings to root canals. To find a plan that includes the dental coverage you need, speak with a local licensed agent. Call (623) 223-8884 or review your Medicare plan option online.

Discover your Florida Medicare plan options & don't-miss enrollment deadlines. Learn about Part A, B, C, D, and Medigap coverage.

A Medicare Advantage plan in Florida could help lower your costs - with additional benefits. Discover your Medicare Advantage plan options.

Learn about the basics of Medicare Supplement Plans in Florida, the 10 types of plans available to you, and the 6-month enrollment window.

There are several 5-Star Medicare Advantage plans in Florida. Discover if one is available in your area and when to enroll.

Curious which are the best Medicare Advantage plans in Florida? Discover the top 5 insurance providers and plans.

Ron from Orange, Florida, writes to ask Connie, "Is Florida Blue Medicare?" Read to discover the answer.