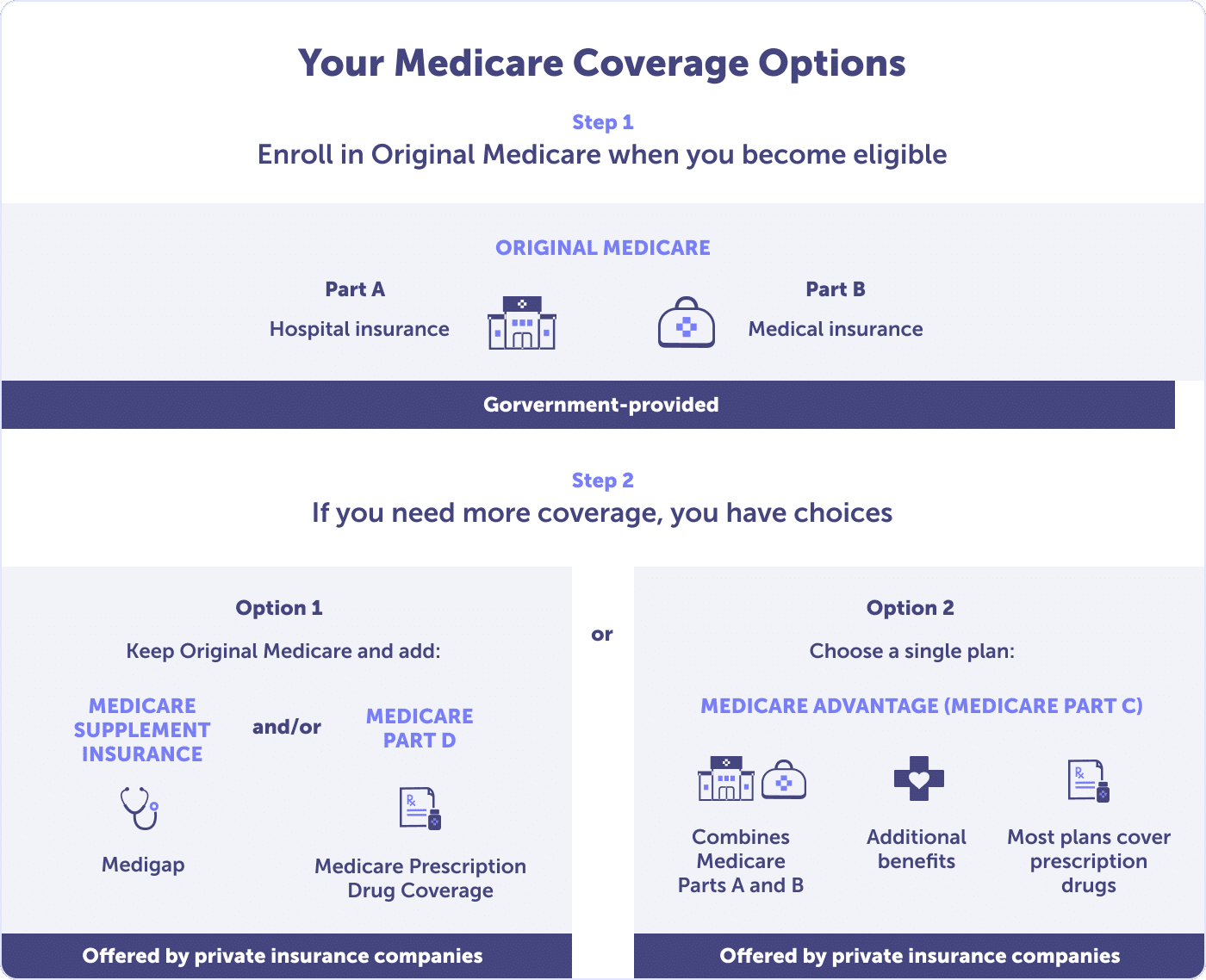

When you’re Medicare eligible, you enroll in Original Medicare. This provides the most basic coverage offered by the government.

Original Medicare includes:

Plan options that expand Original Medicare coverage include Medicare Part C, Medicare Part D, and Medigap plans.

Plan options that expand your Original Medicare coverage:

Continue reading to learn more about each of your Medicare plan options.

Medicare Part A (hospital insurance) is part of Original Medicare. Most people don’t pay a monthly or quarterly premium for Medicare Part A because they’ve worked and had Federal Insurance Contributions Act (FICA) taxes taken out of their paychecks.

If you or your spouse haven’t earned 40 credits of work and paid taxes for at least ten years, you could be required to pay a Part A premium.

Contact a local licensed agent at (623) 223-8884 for detailed information on your Medicare Part A premium-free eligibility.

Part A covers but is not limited to:

Most people won’t need to pay a Part A premium.

Part A doesn’t cover all your medical expenses, and there’s a deductible that you’re responsible for paying. This year, you must pay out-of-pocket before Medicare Part A coverage begins. Plus, Part A coverage will cover only 80% of your care during a benefit period. You are responsible for the 20% coinsurance of Medicare-covered services.

Medicare Part B (medical insurance) is part of Original Medicare. Suppose you are eligible for Medicare Part A. In that case, you can also enroll in Medicare Part B.

Part B covers but is not limited to:

Many tests, items, and services are not covered by Medicare Part B. These include routine dental, vision, and hearing care, such as check-ups, eyeglasses or contact lenses, hearing aids, dental extractions, and dentures. To see if a test, item, or service is covered, visit Medicare.org.

For Medicare Part B, most people pay a premium. There is a standard monthly premium set annually by the Internal Revenue Service (IRS). The Part B standard premium is $185.00 per month in 2025.

Agent tip:

“The standard Medicare Part B premium is $185.00 per month. Higher-income recipients pay more based on their tax returns.“

If your Modified Adjusted Gross Income (MAGI), as reported on your IRS tax return from two years ago, is higher than a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your standard premium.

To discover how much your Medicare Part B premium will be – contact a Connie Health local licensed agent at (623) 223-8884.

The Part B premium will be automatically deducted from your benefit payment if you receive a Social Security, Railroad Retirement Board, or Office of Personnel Management benefit. If you don’t receive these benefits, you’ll receive a monthly or quarterly premium invoice.

Your Medicare Part B costs also include an annual deductible. The Part B deductible is $257 in 2025. After your deductible is met, you pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment.

Medicare Part C, also known as Medicare Advantage (MA), expands Original Medicare (Parts A & B) coverage. Medicare Advantage plans are offered by private companies that contract with the Centers for Medicare & Medicaid Services (CMS), the government entity that regulates Medicare.

To qualify for a Medicare Advantage plan, you must enroll in Medicare Parts A & B and live in the plan’s service area. Medicare Advantage plans are local—to the county level—and many options exist.

Most Medicare Advantage plans offer extra benefits that Original Medicare doesn’t cover:

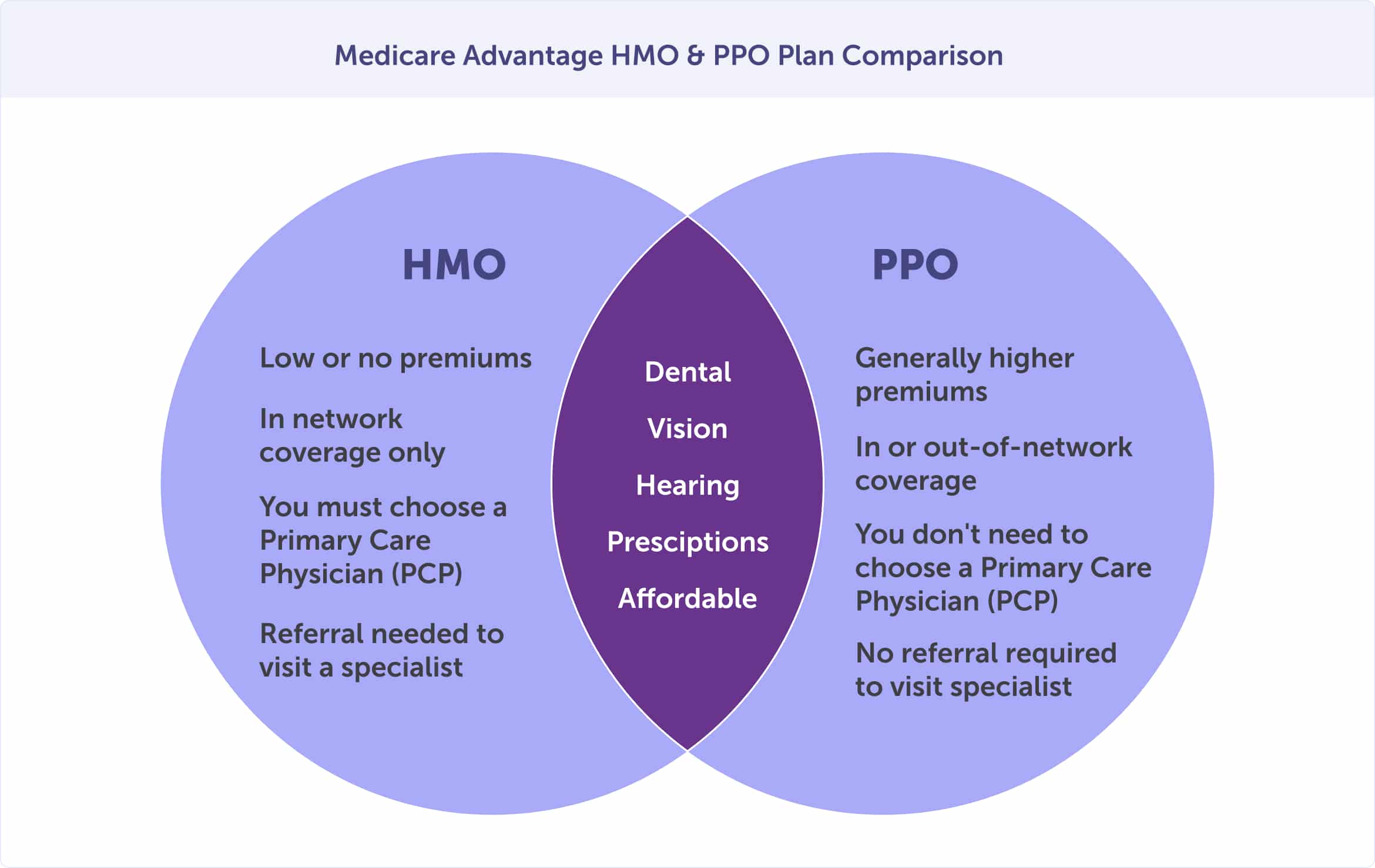

The most common Medicare Advantage plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs and PPOs have networks of participating hospitals, doctors, and other healthcare professionals.

With a Medicare Advantage HMO, your costs are generally lower than a PPO. You’ll need to choose a primary care physician who provides or coordinates your care through referrals to other participating in-network providers.

If you want to see a specialist with an HMO, you’ll need to receive a referral from your primary care physician. Outside of emergencies, out-of-network providers’ services are not covered unless approved in advance by the Medicare Advantage HMO plan.

With a Medicare Advantage PPO, you’ll have more flexibility. While you can see doctors outside the Medicare Advantage PPO plan network, you’ll also likely pay higher coinsurance or copayments for that care. And you’ll need to provide information about the medical care and prescription drugs you’ve received. This means you’ll need to keep excellent records and take a more active role in coordinating your care.

If the lowest cost plan possible is your primary concern, then a Medicare Advantage HMO plan might be the best health insurance choice for you. Your costs are generally lower than a PPO. However, if having maximum flexibility is most important, you may choose a Medicare Advantage PPO with slightly higher fees.

A Medicare Advantage plan provides all of the benefits of Original Medicare but with different set costs. These plans may have set deductibles, coinsurance, and copayments within limits established by the federal government.

Worried about your out-of-pocket expenses? Original Medicare doesn’t have a limit on out-of-pocket costs. But Medicare Advantage plans do. Once you reach your annual out-of-pocket limit, a Medicare Advantage plan pays 100% of covered medical expenses.

Medicare Advantage plans start as low as a $0 premium. But some plans charge a premium. Like Original Medicare, you are responsible for premiums, copayments, and coinsurance. If you have a premium, it could be withdrawn from your Social Security check, or depending on the plan, you could pay from your checking or savings account.

Medicare Advantage plans may offer prescription drug coverage. These are known as Medicare Advantage Prescription Drug (MAPD) plans. These plans provide the convenience of having all your Medicare medical and prescription drug benefits through one plan. In 2024, 90% of Medicare Advantage enrollees were in MAPD plans.

Medicare Part D is a federal program designed to offer prescription drug coverage. The plan is provided by private insurance companies that contract with the Centers for Medicare & Medicaid Services (CMS)—similar to Medicare Advantage plans.

Original Medicare Parts A and B work with Medicare drug coverage Part D. If you have a Medicare Advantage plan, you’ll get this coverage through a MAPD (Medicare Advantage Prescription Drug) plan. You cannot have a Medicare Advantage Prescription Drug Plan and a stand-alone Medicare Part D Prescription Drug Plan, except for specific circumstances.

You can choose a stand-alone Medicare Part D Prescription Drug Plan as a Medicare enrollee. The cost and availability will vary by county, and most plans require you to pay a monthly premium, annual deductible, and copayment or coinsurance. You may qualify for financial assistance for prescription drug costs through a program called Extra Help.

If you are receiving Medicare, have limited financial resources and income, and live in one of the 50 states or the District of Columbia, you may qualify for Extra Help.

Extra help assists with paying for your monthly premiums, annual deductibles, and co-payments related to Medicare prescription drug coverage. If you qualify, you won’t pay a late enrollment penalty when you join a Medicare drug plan.

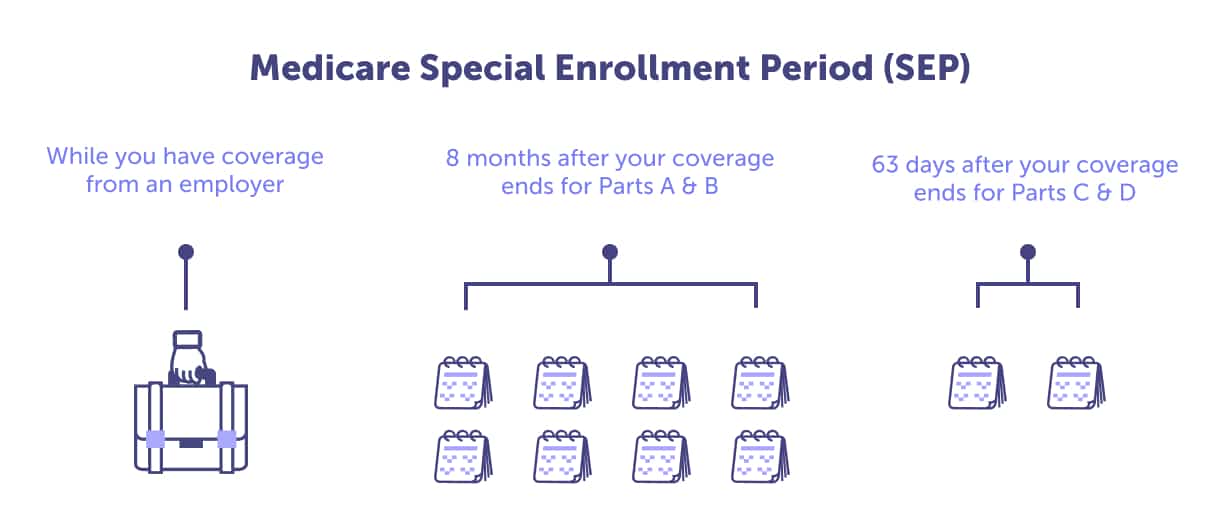

While Medicare Part D is an optional part of Medicare, if you don’t have another source of prescription drug coverage, you may incur a permanent late enrollment penalty when you do decide to buy Medicare Part D. If you have creditable coverage through an employer group health coverage that is ending, you must enroll in Medicare Part D within 63 days of losing your coverage.

If you fail to have creditable prescription drug coverage, this penalty will be in place for the entire length of your Medicare coverage. If you’re enrolled in Original Medicare Parts A & B, be sure to enroll in Part D during your Initial Enrollment Period or General Enrollment Period—if you miss your Initial Enrollment Period. This way, you can avoid those lifetime penalties.

Agent tip:

“You must have creditable prescription drug coverage, or you may incur a permanent late enrollment penalty.“

Medigap, also known as Medicare Supplement plans, assists in paying for some out-of-pocket costs under Original Medicare, including cost-sharing expenses (copayments, deductibles, and coinsurance). Some include emergencies during international travel.

Because Original Medicare (Parts A & B) does not include a cap on out-of-pocket costs, most enrollees have supplemental coverage if they don’t enroll in a Medicare Advantage plan. Medigap plans can not be used with a Medicare Advantage plan.

Medicare Supplement plans do not often include extra benefits that Medicare Advantage plans do, such as benefits for vision, hearing and dental services.

Usually, you’ll need to decide whether you want Original Medicare with a Medicare Supplement and a prescription drug plan (Medicare Part D) or a Medicare Advantage Prescription Drug plan. For most people, Original Medicare—alone—will not serve their needs or help control their out-of-pocket costs.

Need help deciding which Medicare plan combination is right for your health and budget? Contact a local licensed Connie Health agent at (623) 223-8884. We’ll be happy to help you navigate the beginning of your Medicare journey.

Read more by David Luna

I am a Spanish-speaking Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2005. I am a Marine Corps Veteran & former police officer. I enjoy watching football and basketball but hold family time in the highest regard.