Medicare in Illinois includes Parts A, B, C, D, and Medicare Supplement coverage. Uncover the basics of each plan type and the essential enrollment deadlines.

Medicare is a federal health insurance program in the United States. It is designed to provide and reduce the cost of healthcare services in Illinois and the rest of the country.

To be eligible for Medicare in Illinois, you must be:

If you live in Illinois and meet any of the above criteria, you can apply for Medicare. Keep reading to learn about your Medicare plan options in Illinois, enrollment periods, plus how to find the coverage you need for your health and budget.

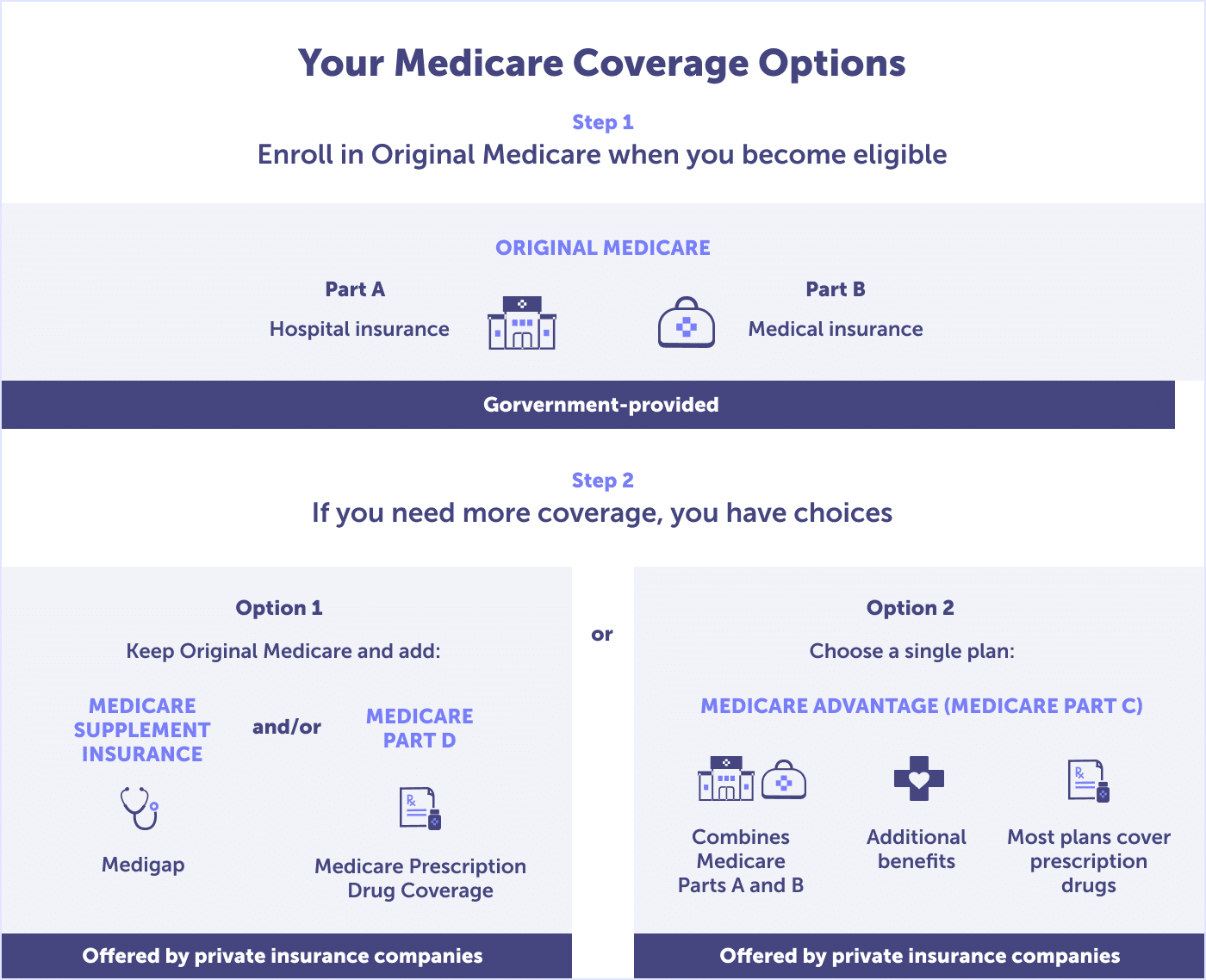

You have both public and private Medicare plan options in Illinois. Original Medicare is the public option that includes Medicare Part A (hospital insurance) and Medicare Part B (outpatient and medical insurance).

The Centers for Medicare and Medicaid Services approved private Medicare options, including Medicare Part C (Medicare Advantage), Medicare Part D (Prescription Drug Coverage), and Medicare Supplement (Medigap).

The federal government provides a public option called Original Medicare. This includes Medicare Part A (hospital insurance) and Medicare Part B (outpatient and medical insurance).

Original Medicare includes Medicare Part A hospital insurance. This part of Medicare is usually premium-free.

Medicare Plan A covers a variety of hospital-type care, including inpatient care in a hospital, skilled nursing facility, or short-term nursing home. It also includes hospice and home health care. Although private Medicare plans (Medicare Advantage and Medicare Supplement) may have different rules, your plan must give you at least the same coverage as Part A Original Medicare.

Read more about what Medicare Part A is and what it covers.

The other part of Original Medicare is outpatient and medical insurance, Medicare Part B. If you are eligible for Medicare Part A, you can also enroll in Medicare Part B. Part B, however, is not premium-free.

Agent tip:

“If you don’t sign up for Medicare Part B when it’s required, you could face a lifetime late enrollment penalty.“

There are also requirements for signing up for Medicare Part B—if you don’t sign up when required, you could face a lifetime late enrollment penalty fee. That amount gets added to your monthly Part B premium. The longer you wait to sign-up for Medicare Part B, the higher the monthly penalty becomes.

Not sure when you should sign-up for Medicare Part B to avoid the lifetime late enrollment penalty? Have a local Medicare agent guide you through the process. Call (623) 223-8884 to determine your enrollment period.

Wondering what Medicare Part B premiums might cost you and what’s covered? The Part B premium in Illinois is comparable to the rest of the country because it is based on you or your spouse’s income history, not on your zip code or the fact that you’re in Illinois. If your income fluctuates or you make above a certain threshold, your monthly premium might be higher than average. In addition to the monthly or quarterly premium costs, Part B also has an annual deductible.

Medicare Part B will cover your basic medical needs at 80% of costs, with the remaining 20% being an out-of-pocket cost to you. Basic medical includes doctor visits and lab tests, and medical equipment.

Almost all specialist visits are included in Medicare Part B, including orthopedic, cardiology, and radiology, among others. You can also receive screenings for common medical conditions, obtain second options about a medical issue, and get a complete annual wellness check. Routine shots (e.g., flu, pneumococcal, and Hepatitis B) are covered with no copay.

Read more about Medicare Part B and what it covers. You can also read about Medicare Part B costs, including premiums, deductibles, and more.

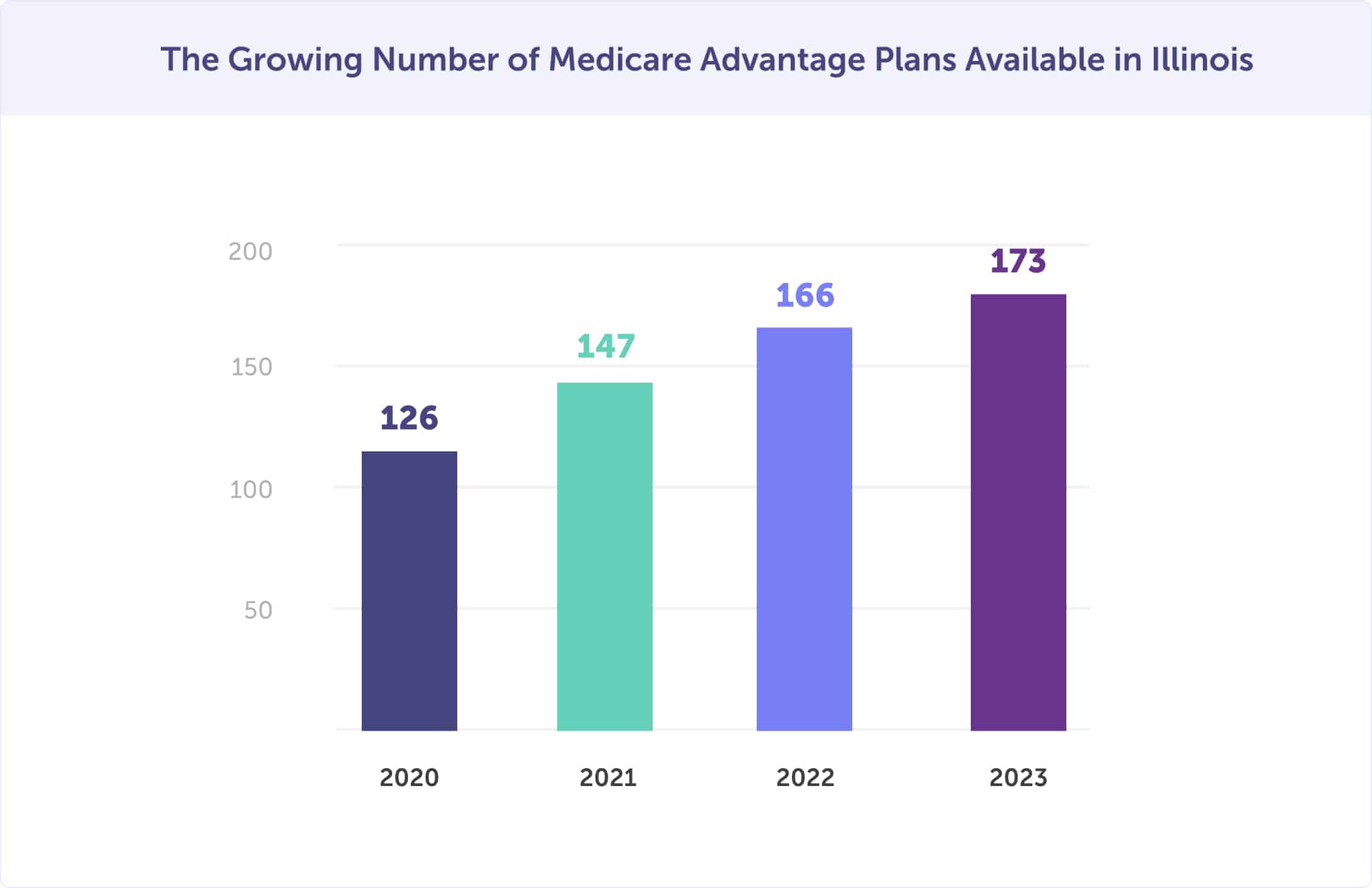

In 2025, 40% of enrollees are on a Medicare Advantage plan in Illinois, also referred to as Medicare Part C. That’s up from 38% in 2022 and 30% in 2021. Medicare Advantage (MA) plans are an alternative to Original Medicare (Parts A & B). The Centers for Medicare and Medicaid Services (CMS) contracts with private insurance companies that offer these plans.

To qualify for a Medicare Advantage plan, you must enroll in Medicare Part A & B and live in the service area of the plan you wish to enroll in. Medicare Advantage plans are local—down to the county level—and many options exist in Illinois.

In 2025, 173 Medicare Advantage plans are available, compared to 166 in 2022, 147 in 2021, and 126 in 2020. That’s a 4.2% increase in plan options—and many more options for you to choose from.

Many of these plans offer Medicare Advantage enrollees innovative benefits such as wellness and healthcare planning, reduced cost-sharing, and rewards and incentives programs.

Did you know that Original Medicare doesn’t have a maximum spending limit to cap your annual out-of-pocket costs?

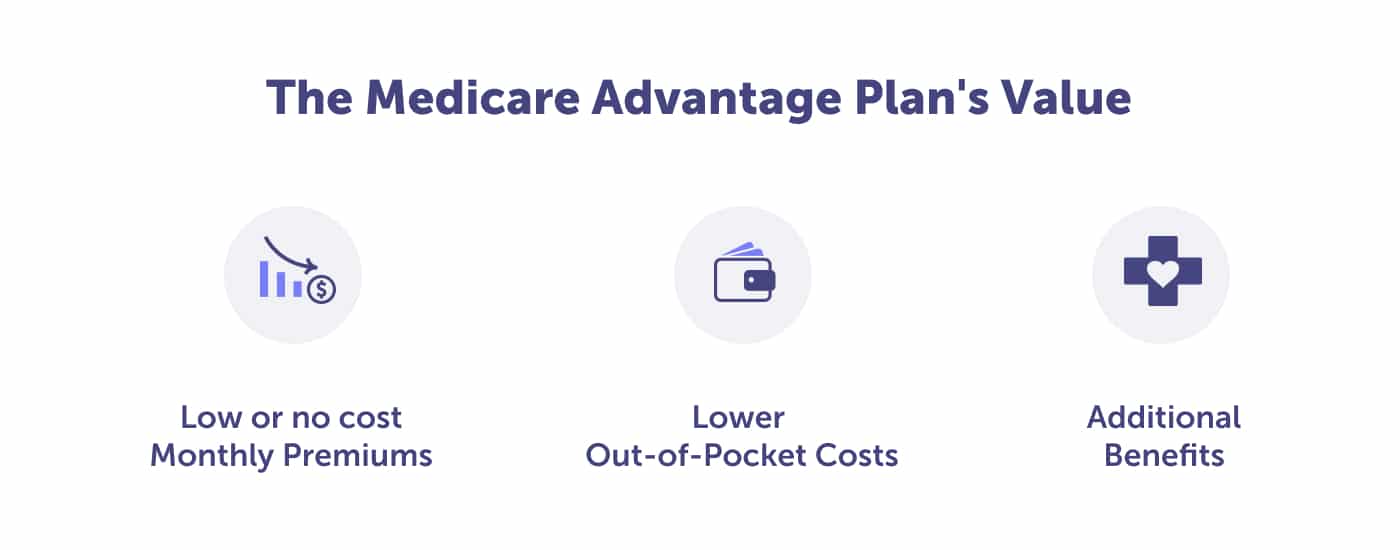

Medicare Advantage (MA) plans limit your out-of-pocket spending with all of the benefits of Original Medicare. Medicare Advantage plans have different cost-sharing, and they set their deductibles, coinsurance, and copays within limits established by the federal government. Many Medicare Advantage plans in Illinois also have additional coverage benefits for prescription drugs, wellness programs, and routine dental & vision.

Worried about out-of-pocket spending for healthcare services covered by Medicare Part A and Part B? Medicare Advantage plans pay 100% of covered healthcare expenses for the remainder of the year once your out-of-pocket limit and deductible are met.

Do you need prescription drug coverage as well? Medicare Advantage plans that include this coverage are Medicare Advantage Prescription Drug (MAPD) plans. These plans bundle the convenience of having your Medicare medical and prescription drug benefits through a single plan. In 2020, 90% of Medicare Advantage plans offered prescription drug coverage (MA-PD), and 89% of Medicare Advantage enrollees were in MA-PD plans.

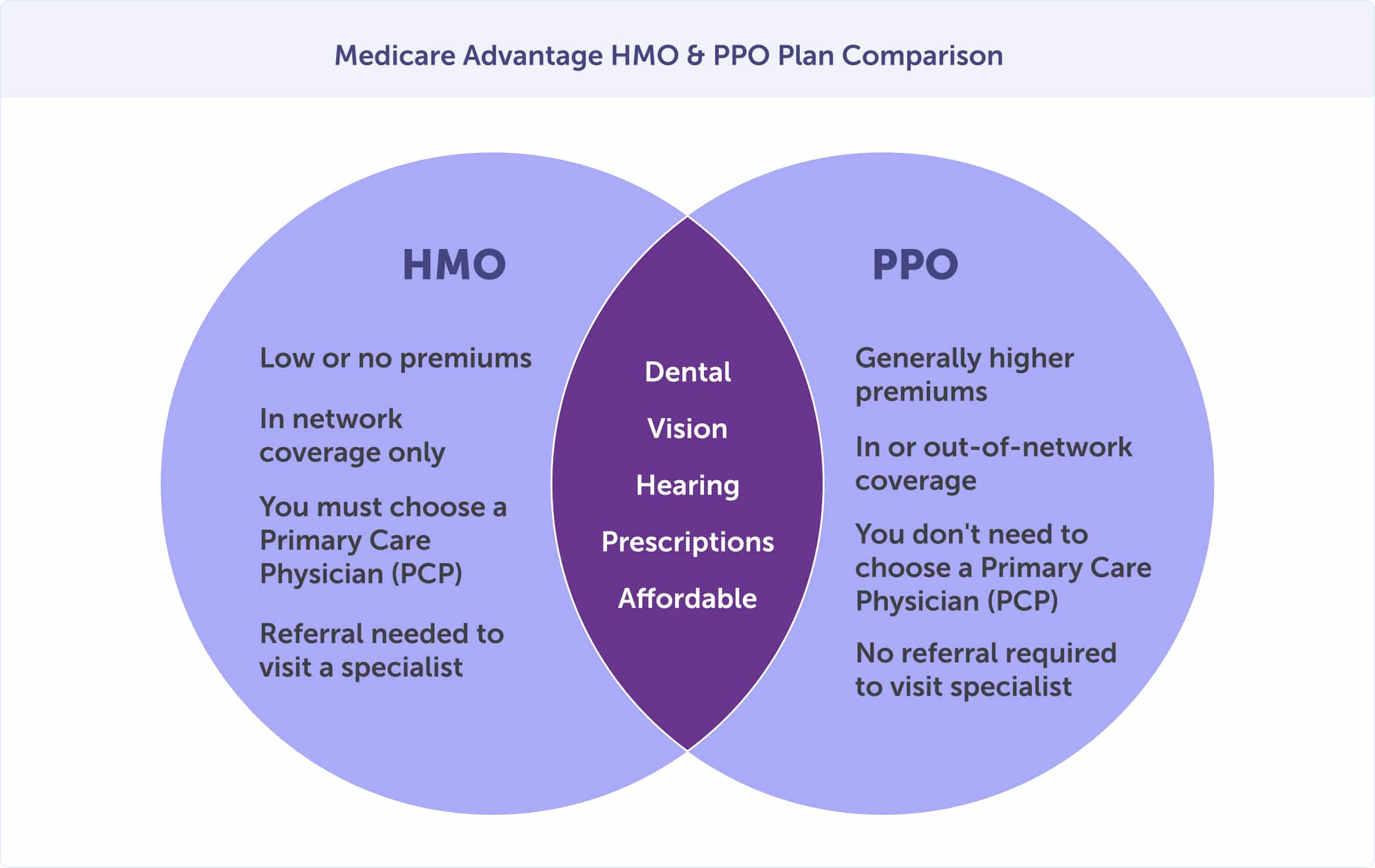

There are two primary types of Medicare Advantage plans: Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs and PPOs have networks of participating hospitals, doctors, and other healthcare professionals. You’ll need to use the health care providers participating in the plan network and service area.

With a Medicare Advantage HMO, you’ll choose a primary care physician who provides or coordinates your care through referrals to other participating providers. Aside from emergencies, out-of-network services are not covered by an HMO unless approved in advance.

A Medicare Advantage PPO plan has more flexibility, but premiums may cost more. Ultimately, your out-of-pocket costs should be lower when you use hospitals, doctors, and other healthcare professionals in the PPO’s network versus non-participating healthcare providers.

If maintaining relationships with your current doctors is essential, you should check if your preferred healthcare providers participate in the plan’s network.

Need help picking a plan that has the doctors you value and the prescriptions you need? Call (623) 223-8884 to speak with a local Medicare agent—and choose a Medicare plan that maintains the doctors and medications you rely on. Or review your Medicare Advantage plan options online.

When signing up for Original Medicare (Part A & B), you won’t receive prescription drug benefits automatically. And if you don’t have creditable prescription drug coverage from another source, you could face penalties. Medicare Part D (Medicare Prescription Drug Coverage) can help you avoid that.

Medicare Part D is a federal program that offers Medicare beneficiaries prescription drug coverage. This is available to Illinois residents but also across the United States. Medicare Part D plans are provided by private insurance companies contracted with the Centers for Medicare and Medicaid Services (CMS).

Medicare Part A and B work with Medicare Part D, but if you have a Medicare Advantage plan, you won’t need Part D coverage. You’ll likely get your prescription drug coverage through an MA-PD (Medicare Advantage Prescription Drug) plan. You must choose one or the other—you cannot have Medicare coverage from a Medicare Prescription Drug Plan and a stand-alone Medicare Part D Prescription Drug Plan.

As a Medicare beneficiary in the State of Illinois, you can enroll in a stand-alone Medicare Part D Prescription Drug Plan. The cost and availability of Part D plans vary by county.

Most plans require a monthly premium, annual deductible, and copayment or coinsurance. If it’s difficult for you to afford creditable prescription drug coverage, you may qualify for financial assistance from the Social Security Administration’s Extra Help (Low-Income Subsidy). In 2025, 26% of Illinoisans with a stand-alone Medicare prescription drug plan receive Extra Help.

Part D is an optional Medicare program. However, if you don’t have an alternative source of prescription drug coverage, you may incur a permanent late penalty. This would begin when you decide to buy Medicare Part D and for the length of your coverage. If you’re enrolled in Medicare Part A & B, don’t forget to enroll in Part D during your Initial Enrollment Period—or your General Enrollment Period if you miss the initial one. This way, you’ll avoid the lifetime late penalty fee.

If you have creditable coverage ending through your group health plan, you must enroll in Medicare Part D within 63 days of losing coverage.

Ensure that your Medicare plan includes creditable coverage through Medicare Part D or another source. One of our agents can provide information about Medicare and see if you qualify for Extra Help. Call (623) 223-8884 to speak with a local licensed agent. You can also review your plan options now.

Original Medicare (Parts A & B) do not have a cap on out-of-pocket expenses. This can leave you vulnerable to fluctuating and high costs. Because of this, most enrollees with Original Medicare have some form of Medicare Supplemental insurance.

Medicare Supplement plans, also known as Medigap plans, help pay for some out-of-pocket costs from Original Medicare. A Medigap plan helps with the cost-sharing expenses of copays, deductibles, and coinsurance. Some plans may also cover emergencies during international travel. Medigap plans can not be used with a Medicare Advantage plan.

Illinois Medicare Supplement plans include plans A, B, C, D, F, F High-Deductible, G, G High-Deductible, K, L, M, and N. Each plan provides a different level of coverage, and the plan’s cost is determined by the carrier. Some Medigap plans may offer additional benefits like a gym membership, hearing, and dental discounts.

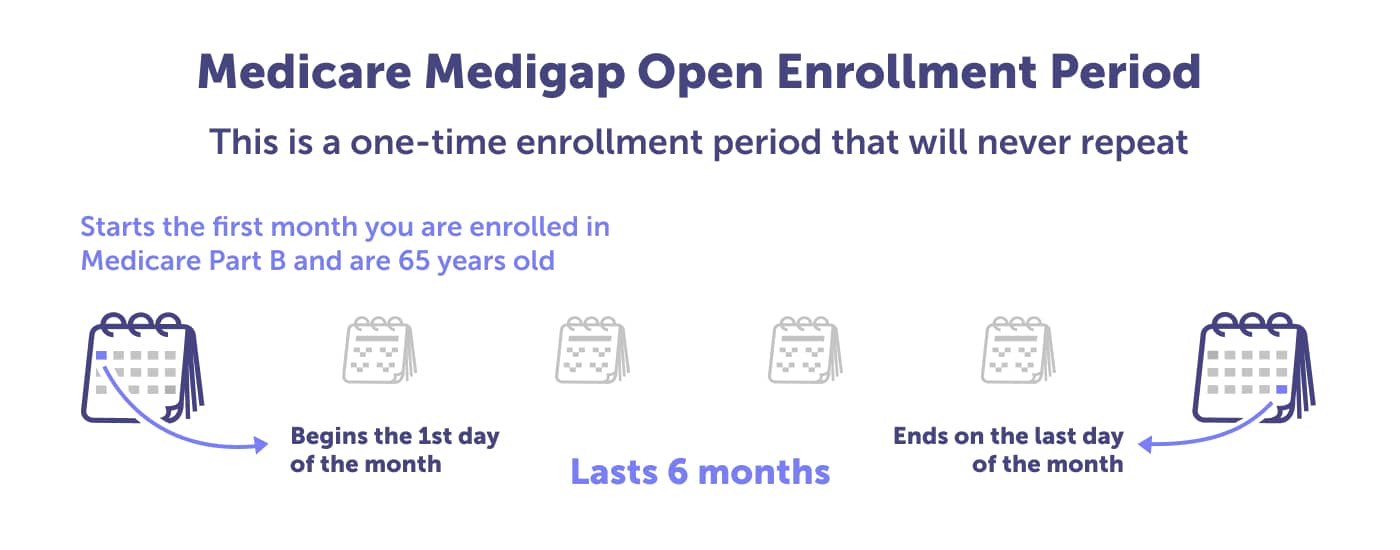

Illinois Medicare Supplement plans are provided by private insurance companies licensed by the Illinois Department of Insurance. This makes them authorized to sell Medigap plans. You can purchase a Medigap plan during your Medigap Open Enrollment period. If you miss this open enrollment period, you may not be able to enroll in a Medigap policy at the same initial rate—or at all.

Review your Medicare Supplement plan options with a local licensed Medicare agent. Call (623) 223-8884 to speak with a Connie Health agent. Or review your plan options online.

There are several periods when you can enroll, switch, or unenroll in Medicare. Knowing when to enroll and when you can make changes will ultimately save you money.

Want to know the best time to enroll in a Medicare health or drug plan? When you first become eligible for Medicare. Keep reading to learn about essential enrollment periods.

Your Initial Enrollment Period is three months before you turn 65, the month you turn 65, and ends three months after you turn 65. There is a seven-month window. That’s when most Illinoisans enroll in Medicare Parts A & B. If you’re not collecting Social Security before your Initial Enrollment Period begins, you’ll need to sign-up for Medicare online or contact the Social Security Administration.

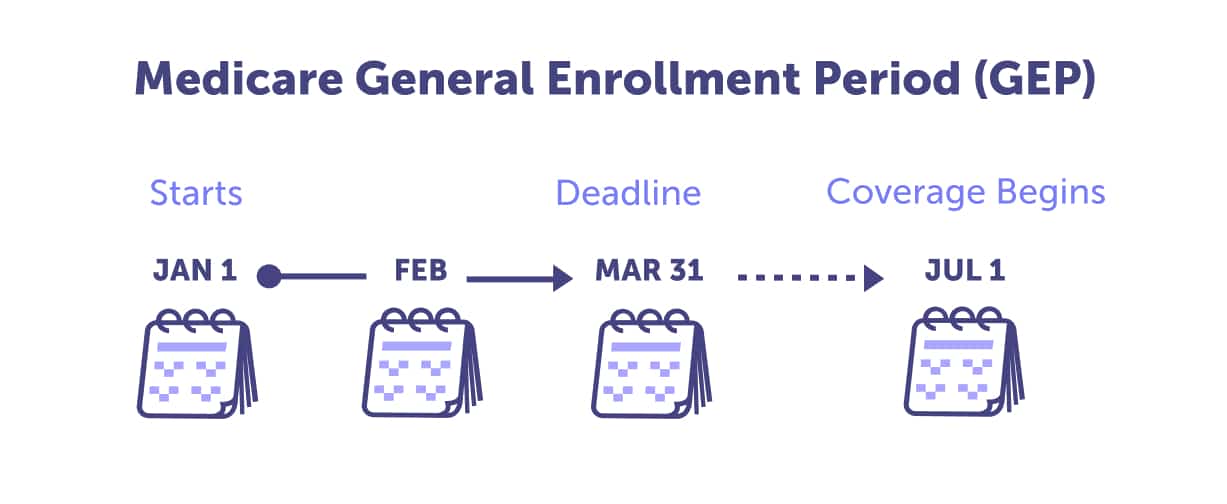

Didn’t sign up for Medicare during your Initial Enrollment Period? This is your second chance. The Medicare General Enrollment Period is annually between January 1st and March 31st. During this time, you can sign-up for Original Medicare Part A and/or Part B. If you sign up during this period, you may have a late enrollment penalty.

Your Medicare Supplement (Medigap) Open Enrollment Period starts the first month you’re enrolled in Medicare Part B and older than 65. The enrollment period lasts six months and only happens once. It cannot be changed or repeated. If you miss your Medigap Open Enrollment Period, you might be able to purchase a Medigap policy, but it will likely cost more due to past or present health conditions.

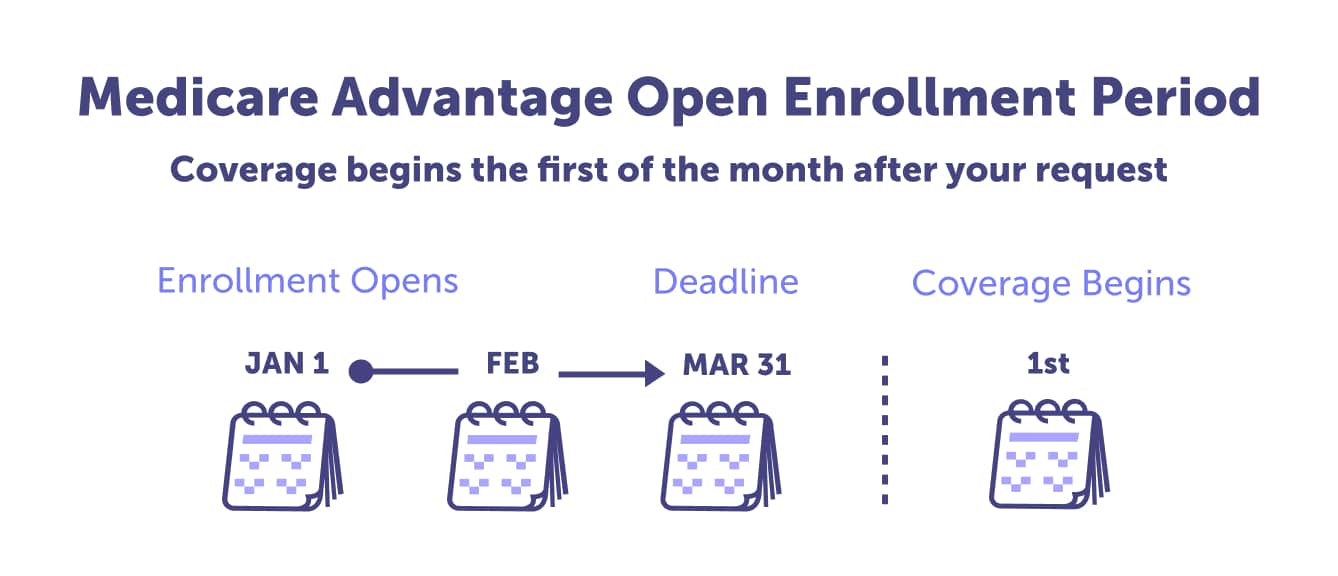

The dates for the Medicare Advantage Open Enrollment Period mirror the General Enrollment Period; January 1st through March 31st. During this time, you can unenroll from a Medicare Advantage plan and go back to Original Medicare. You can also switch from one MA plan to another. Or, unenroll from an MA plan and join a Medicare Prescription Drug Plan (Part D) to go along with your Original Medicare plans (Parts A & B).

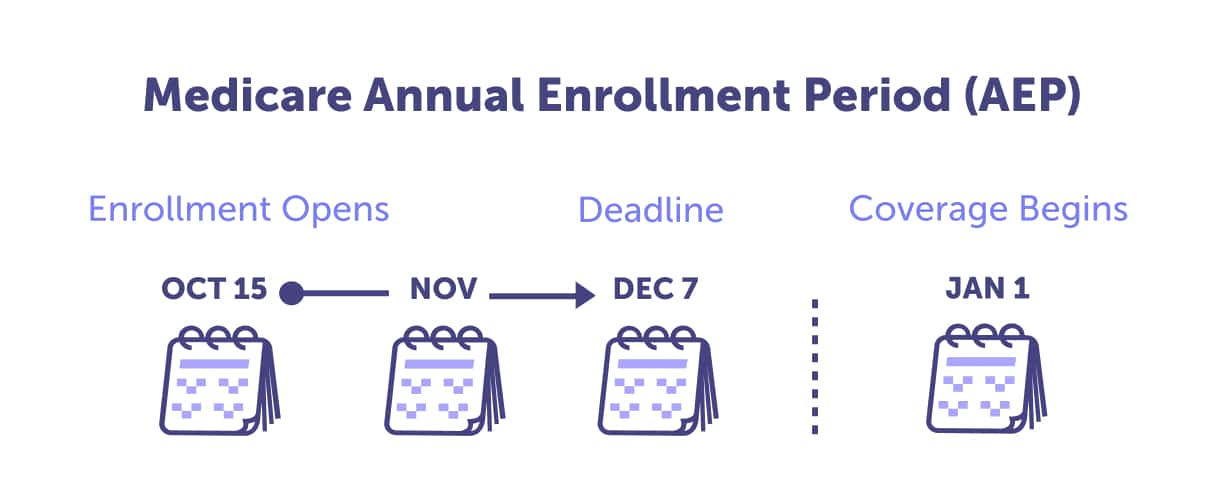

The Medicare Annual Enrollment Period (AEP) is sometimes called the Open Enrollment Period. It occurs annually between October 15th and December 7th. During this time, you can sign up for a plan, switch plans, or leave a plan. This enrollment period is for people who are already enrolled in Medicare Part A and B.

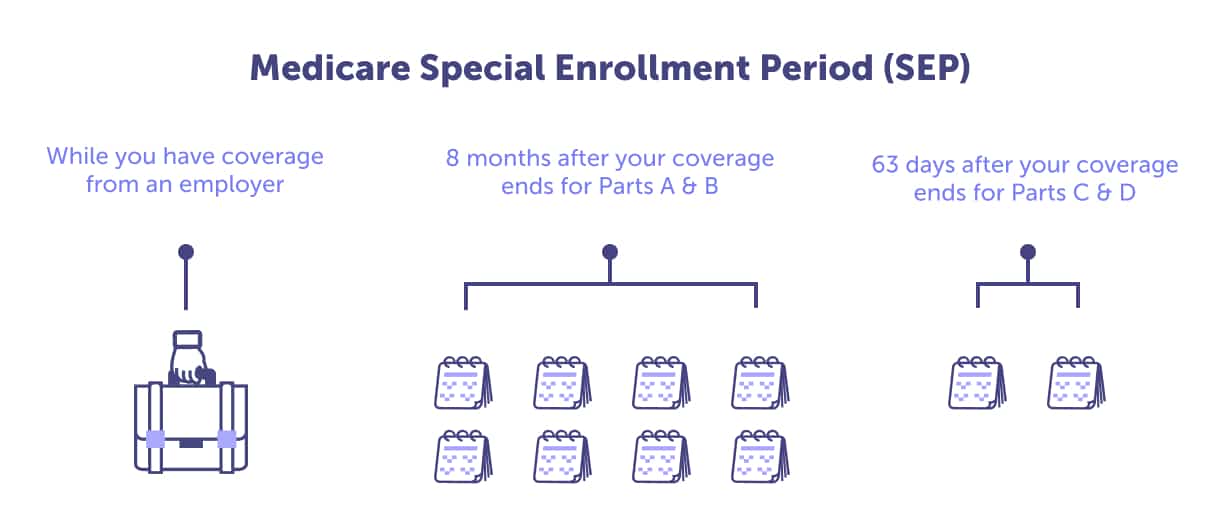

If you recently moved or there was a loss or change to your health insurance coverage, you could be eligible for a Special Enrollment Period (SEP). You could also qualify if your Medicare plan changes its contract with Medicare or other special circumstances. During a Special Enrollment Period, you might have the opportunity to sign up for Medicare or make changes to your plan; it depends on your circumstances.

Not sure which Medicare period applies to you? Or want guidance walking you through the Medicare process? Have a local agent ensure you enroll on time and in the plan(s) that are right for your health and budget.

Call (623) 223-8884 to speak with a local licensed agent. Or review your Medicare plan options online now.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

MA State/County Penetration 2023 02.

Medicare Open Enrollment in Illinois, 2023

Last updated: February 15, 2023

Read more by Renee van Staveren

Since 2009, I've been writing about complicated, technical issues, with the goal of making topics like Medicare and healthcare easier to understand. I've been writing about Medicare since 2021 and healthcare since 2019. I am an AmeriCorps alumni. I enjoy gardening, reading, and DIYing.