Want extra benefits? A Medicare Advantage plan can offer extra benefits like dental, vision, & hearing—more affordably and with prescription drug coverage. If you’re enrolled in Medicare in Illinois, these are plans you’ll want to consider.

Private insurance companies with a contract with the Centers for Medicare & Medicaid Services (CMS) can offer Medicare Advantage plans, also known as Medicare Part C. In 2025, more than 40% of Medicare-eligibles in Illinois are enrolled in a Medicare Advantage plan.

To qualify for a Medicare Advantage (MA) plan, you must be eligible for Medicare Part A and enrolled in Medicare Part B, plus live in the plan’s service area you wish to enroll. Medicare Advantage plans are local—down to the county level—and numerous options are available.

Curious about where people enroll in Medicare Advantage plans the most?

In 2025, the 10 Illinois counties with the largest Medicare Advantage enrollment are Stephenson County (57%), Champaign County (56%), Jo Daviess County (56%), Piatt County (54%), Sangamon County (53%), Rock Island County (53%), Monroe County (53%), Winnebago County (53%), St. Clair County (52%), and Madison County (51%).

Between 2022 and 2023, the amount of people enrolling in these counties has increased. In 2022, the lowest percentage in the top 10 was 49%; this year, it’s 51%. This means that there are a greater number of individuals enrolling in Medicare Advantage plans in these counties.

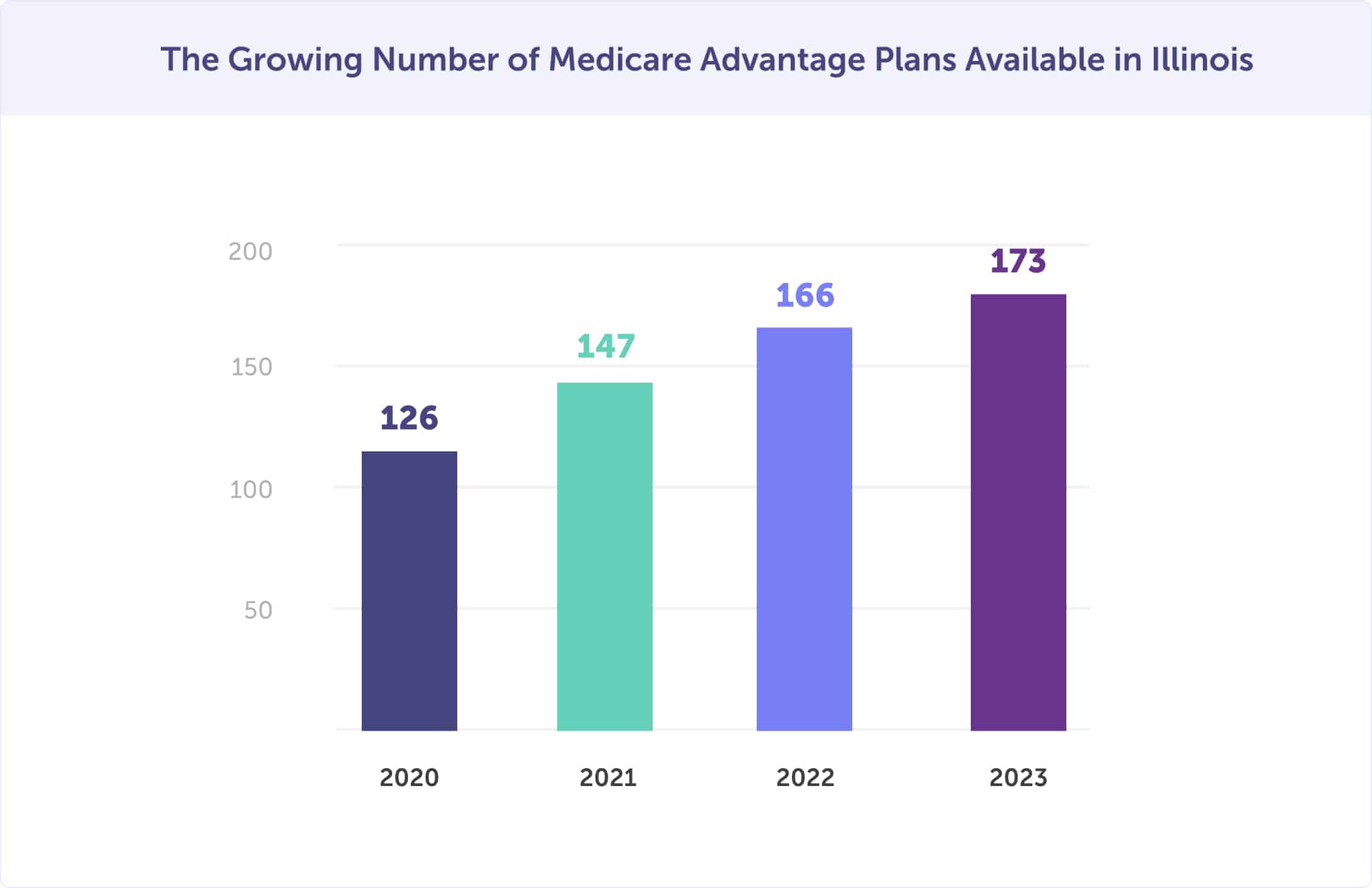

In Illinois, in 2025, 173 Medicare Advantage plans are available compared to 166 in 2022, 147 in 2021, and 126 plans in 2020. That’s a 4.2% percent increase year-over-year in Medicare Advantage plan options—many more options for you to choose from. And because insurance companies compete for your business, it empowers you to find the best plan for your health and budget.

Many of those plans offer innovative benefits to Medicare Advantage enrollees. These benefits often include dental, vision, & hearing aids; wellness & health care planning; reduced cost-sharing; plus rewards and incentives programs. These benefits are not provided by Original Medicare Parts A & B.

Are you looking for extra benefits, like dental, and a way to reduce your Medicare costs? A Medicare Advantage plan could provide more affordable premiums, doctor visits, and prescription drugs.

A Medicare Advantage plan provides all your benefits from Original Medicare in Illinois, often at a lower cost. If you have Medicare Part A and B, you can access a Medicare Advantage plan.

Are you looking for a $0 monthly premium? Many Medicare Advantage (MA) plans offer that. For Medicare Advantage plans that charge a premium, you’ll pay the Medicare Advantage plan premium plus the monthly Medicare Part B premium.

Did you know that Original Medicare doesn’t have a maximum spending limit and that there’s no cap on annual out-of-pocket expenses? A Medicare Advantage plan can limit your out-of-pocket costs for covered services by Medicare Part A and B. That’s because Medicare Advantage plans set their deductibles, coinsurance, and copays—within the maximum out-of-pocket limits set by the federal government.

Agent tip:

“Original Medicare doesn’t have a maximum spending limit, but a Medicare Advantage plan can limit your out-of-pocket costs.“

When you’ve reached your out-of-pocket maximum, including your deductible, your Medicare Advantage plan pays 100% of covered healthcare expenses for the remainder of the year. Suppose you’d like to keep your Original Medicare (Parts A & B) but are searching for more predictable monthly premiums. In that case, a Medicare Supplement (Medigap) plan is an alternative to Medicare Advantage.

Do you want comprehensive and routine benefits such as dental, vision, or hearing (hearing aids)? That’s not something you’ll get with Original Medicare Parts A and B.

Many Medicare Advantage plans offer these additional benefits, plus prescription drug coverage. With a Medicare Advantage plan, you can expect the same level of coverage as Original Medicare, plus extra benefits you won’t receive with Original Medicare.

Unsure whether a Medicare Advantage or Medicare Supplement plan is best for you? Let a local licensed agent guide you to your optimal plan for your health and budget. Call (623) 223-8884 or review your plan options online.

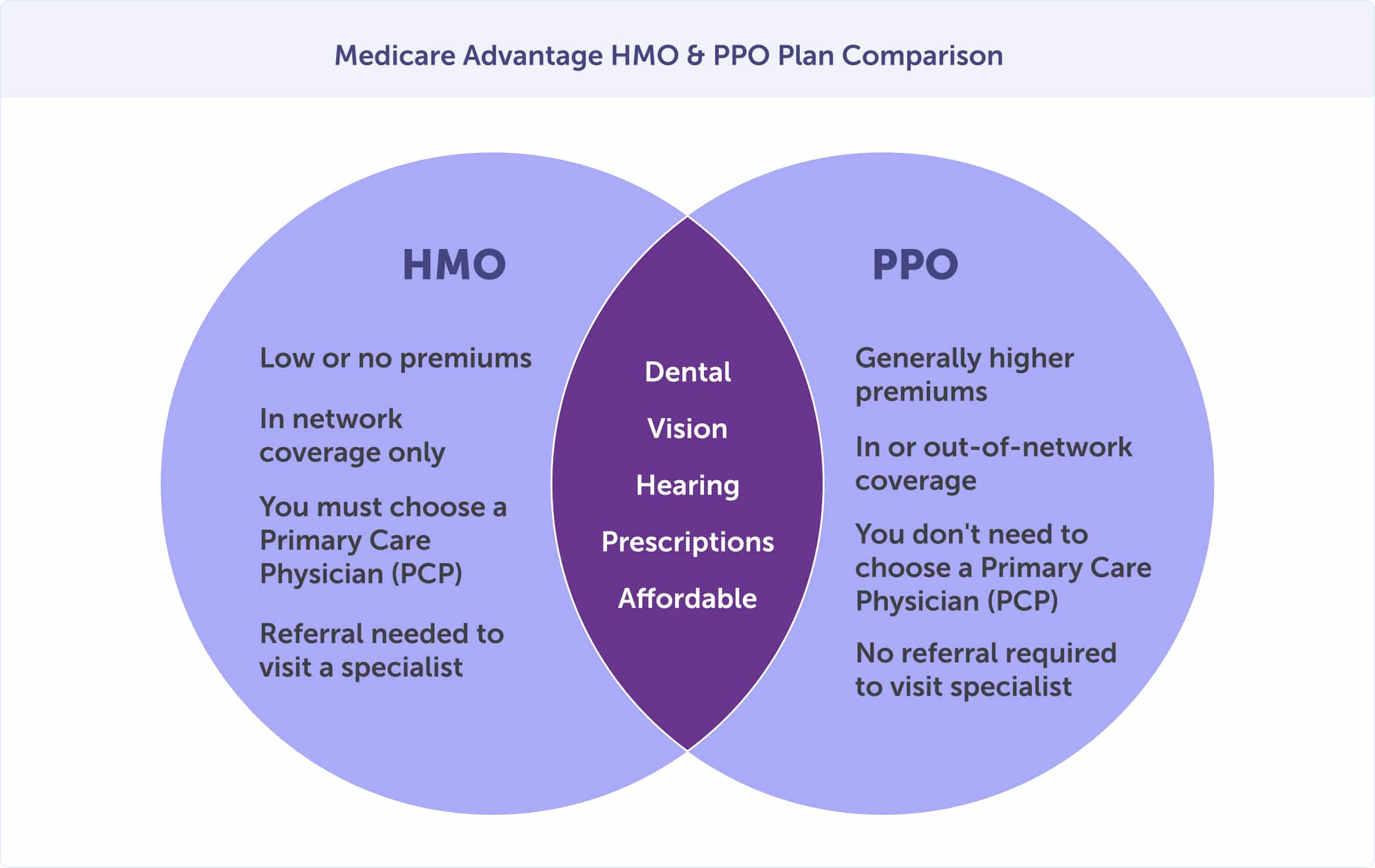

Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are the two most common types of Medicare Advantage plans. HMOs and PPOs have hospitals, doctors, and other healthcare professionals participating in their networks.

Yes. There are several ways that they are similar:

If you’re enrolled in a Medicare Advantage HMO, your costs will traditionally be lower than a Medicare Advantage PPO plan. Once you enroll in the HMO, you’ll choose a primary care physician who will coordinate your care through referrals to participating in-network providers. If you need to see a specialist, your primary care physician will provide a referral. Outside of emergencies, an out-of-network provider’s services are not covered unless approved in advance by the Medicare Advantage HMO plan.

A Medicare Advantage PPO provides more flexibility than an HMO but usually at a slightly higher cost. Monthly premiums will generally be higher than an HMO, but you can see doctors outside the PPO plan network. If you see a provider outside the plan network, you’ll likely pay more for that care.

With an HMO, the network will thoroughly record all your care. With a PPO, you’ll need to play a more active role in coordinating your care, including record keeping of your medical care and prescription drugs. If you’d prefer not to share records between providers, an HMO might be a better option.

If maintaining existing relationships with doctors, hospitals, and other care providers is vital to you, check the HMOs’ or PPOs’ plan network before making a plan change. You’ll need to ensure that your preferred healthcare providers participate in the Medicare Advantage plan’s network.

Aside from HMOs and PPOs, you may come across the following plan types: Point of Service (POS) plans, Private Fee-for-Service (PFFS) plans, and Special Needs (SNPs) plans.

Need help to pick a plan that includes the doctors and prescriptions you need? Call Connie Health to find a Medicare Advantage plan that maintains your current care. Call (623) 223-8884 or review plans online.

Want prescription drug benefits with your Medicare Advantage plan? Those Medicare Advantage plans are Medicare Advantage Prescription Drug (MAPD) plans. MAPD plans provide the convenience of having Medicare medical and prescription drug benefits all through one plan. In 2020, 90% of Medicare Advantage plans in the United States offered MAPDs, and 89% of all Medicare Advantage plan enrollees were in MAPD plans.

The lowest monthly premium for a Medicare Advantage plan is $0. If you are enrolled in Medicare Part A and B, you have access to a Medicare Advantage plan with a $0 monthly premium. The average monthly Medicare Advantage plan premium in Illinois, for those with a premium, is $11.39 in 2025. That’s a 20% decrease between 2022 and 2023, down from $14.25 in 2022 and $14.05 in 2021.

Medicare Advantage Prescription Drug (MAPD) plan costs vary by county, and the premiums vary by plan type (e.g., HMO vs. PPO). According to the Kaiser Family Foundation, in 2020, premiums ranged from $20 to $47 per month throughout the US.

Premiums were on average $20 per month for HMOs, $32 per month for local PPOs, and $47 per month for regional PPOs. The majority of Medicare Advantage beneficiaries enrolled in an HMO (61%), followed by local PPOs (33%) and regional PPO plans (5%).

Because MA and MAPD plans are through private insurance companies contracted with CMS, these premiums are paid directly to the plan provider. They are paid separately from the Medicare Part B premium paid to Medicare, which is traditionally paid by a monthly withdrawal from your Social Security benefit.

Are you wondering if you qualify for a $0 premium Medicare Advantage plan in your county? Call (623) 223-8884to speak with a local Connie Health agent. Or review your Medicare Advantage plan options online.

The number of Medicare Advantage plans available to you will depend on the county you reside. You may have a few or numerous options available to you—and their networks and benefits will vary.

Your Medicare Advantage plan choice will come down to a combination of coverage and cost. From extra benefits, prescription drug coverage, and plan network, to premium and out-of-pocket costs—there’s a lot to consider.

Have a local licensed agent guide you through your Medicare journey to ensure you get the health care coverage you need at a price that you can afford. Call (623) 223-8884 or review plan options online.

It’s vital that you know when you can switch, enroll, or unenroll from a Medicare Advantage plan—in fact, knowing when could save you a lot of money. The best time to join a Medicare health plan or drug plan is during your Initial Enrollment Period. Continue reading to learn about that, and the other three times, you can make a Medicare Advantage plan change.

Three months before you turn 65, the month you turn 65, and three months after you turn 65 is your Initial Enrollment Period. In total, it’s a seven-month period. That’s when most Illinoisans enroll in Medicare Part A & Medicare Part B. If you reach your Initial Enrollment Period and you’re not yet collecting Social Security benefits; you’ll need to sign up for Medicare online or contact the Social Security Administration.

Important to note: If you don’t enroll in Medicare Part B during your seven-month Initial Enrollment Period, you could face a late enrollment penalty. The penalty would be added to your monthly Medicare Part B premium for your lifetime. The longer you wait to sign-up for Part B after your Initial Enrollment Period, the larger the monthly premium penalty becomes.

If you don’t enroll in a Medicare Advantage plan during your Initial Enrollment Period, you might be eligible to make a change during the General Enrollment Period or Annual Enrollment Period (AEP). If an election was made during the Annual Enrollment Period, you could make changes during the Medicare Advantage Open Enrollment Period. Continue reading to learn more.

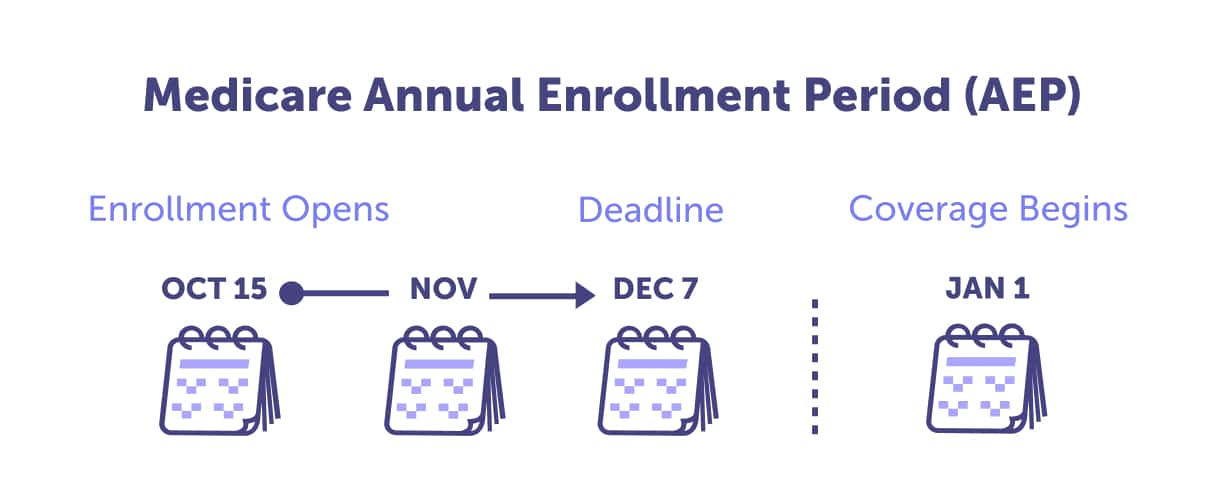

The Medicare Annual Enrollment Period (AEP) is annually between October 15 and December 7. This enrollment period is for people who are already enrolled in Medicare Part A and B. It’s also a time to join a Medicare Advantage plan, plus the following:

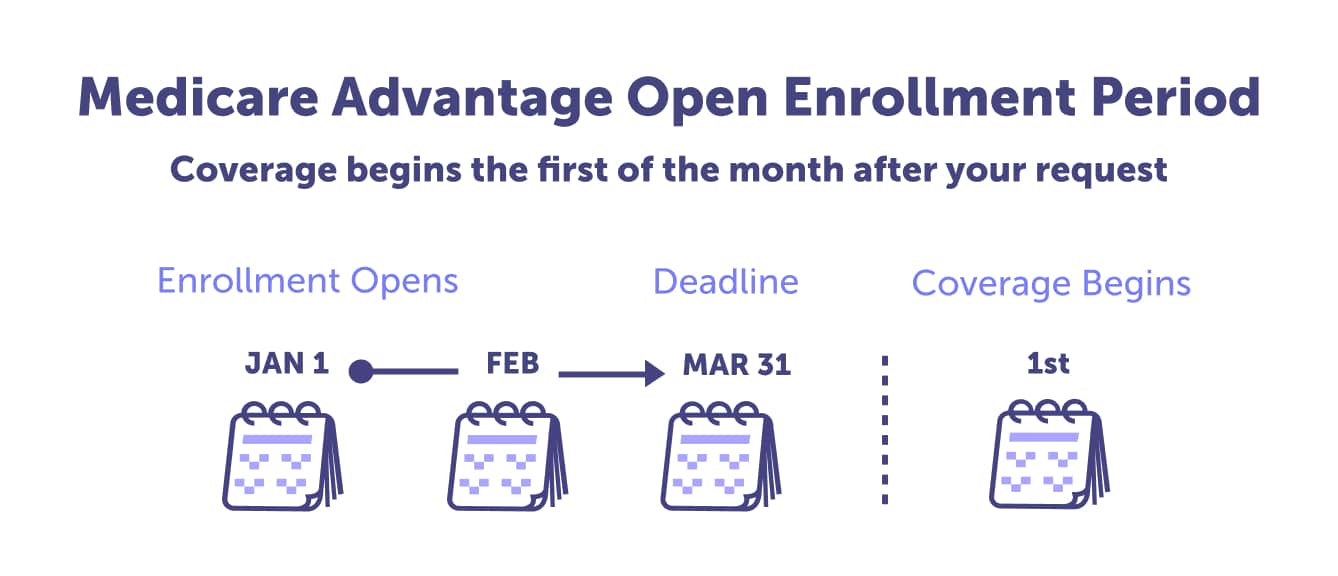

During the Medicare Advantage Open Enrollment Period, January 1 and March 31, annually, you can change your Medicare Advantage plan.

Some changes you can make include:

You cannot switch from Original Medicare to a MA plan during the Medicare Advantage Open Enrollment Period. Neither can you join a standalone Medicare prescription drug plan if you’re in Original Medicare or switch your Medicare Prescription drug plan to another if you’re enrolled in Original Medicare.

There are times when you qualify for a Special Enrollment Period. These include if you move, lose your coverage, have the opportunity to get other coverage, your plan changes its contract with Medicare, or other special circumstances. During a Special Enrollment Period, you can sign up for or make Medicare Advantage (MA) or Medicare Advantage Prescription Drug (MAPD) plan changes.

Not sure when you should enroll or change your Medicare Advantage plan? Call (623) 223-8884 to speak with a local licensed agent. We’re here to guide you through your Medicare journey.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

MA State/County Penetration 2023 02.

Medicare Open Enrollment in Illinois, 2023

Last updated: February 15, 2023

Read more by Renee van Staveren

Since 2009, I've been writing about complicated, technical issues, with the goal of making topics like Medicare and healthcare easier to understand. I've been writing about Medicare since 2021 and healthcare since 2019. I am an AmeriCorps alumni. I enjoy gardening, reading, and DIYing.