Have questions about Medicare in Texas? Let us help you make the right decision. In this ultimate guide, discover local tips and answers to your frequently asked questions.

Speak with a local licensed insurance agent:

(623) 223-8884 (TTY: 711) M-F 9am - 5pmMedicare is a United States federal health insurance program designed to provide and reduce the cost of healthcare services for those who are Medicare-eligible.

Although you apply for Medicare in Texas, the system is regulated by the Centers for Medicare & Medicaid Services (CMS), a federal program. Even though you’re in Texas, you’ll find that Medicare functions the same across the United States.

As of January 2023, 4,547,406 (approximately 4.5 million) Texans are enrolled in Medicare. That’s nearly 15% of Texans (30.91 million).

Continue reading to check your eligibility and compare your Medicare plan options.

You are eligible for Medicare in Texas based on your age or eligible disabilities by the Social Security Administration.

In Texas, along with the rest of the country, you are eligible for Medicare if you meet one of the following criteria:

Nearly everyone eligible enrolls in Original Medicare Part A (hospital insurance) and Part B (medical insurance). However, Original Medicare doesn’t cover 100% of costs, and all beneficiaries must have prescription drug coverage. Most people expand their coverage beyond Original Medicare (Parts A and B).

Depending on health needs and budget, most people have Medicare Part C (Medicare Advantage plan or Medicare Advantage Prescription Drug plan), Medicare Part D (Prescription Drug Coverage), and Medicare Supplement (Medigap). These are private health insurance plans approved and regulated by the Centers for Medicare and Medicaid Services (CMS).

Of the nearly 4.5 million Texans enrolled in Medicare, 2.2 million (49%) are enrolled in Original Medicare Parts A (hospital insurance) and Part B (medical insurance). The remaining 2.3 million (51%) are enrolled in a Medicare Advantage plan (Medicare Part C). 2023 is the first year that Medicare Advantage enrollment has surpassed 50% of plan enrollments.

Texans enrolled in a Medicare Advantage plan have increased by 237%, up from 18% in 2010 to 51% in 2023.

You’re likely about to or have made a similar enrollment choice:

After you enroll in Original Medicare, you should review your options for expanding your Medicare coverage.

Continue reading to learn more about Medicare Parts A, B, C, D, and Medigap options to uncover what’s suitable for your health and budget needs.

Medicare Part A (hospital insurance) is part of Original Medicare. Part A is usually premium-free.

To be eligible for Original Medicare Part A in Texas, you must meet one of the following criteria:

Medicare Part A is hospital insurance. Part A covers medically necessary services delivered by a Medicare-assigned health provider in a Medicare-approved facility.

These services include:

Part A Medicare coverage is limited. To avoid high out-of-pocket costs, discover what is excluded. Read more about Medicare Part A.

You are eligible for premium-free Medicare Part A in Texas if you are age 65 or older and:

If you are under 65 years of age, you can get premium-free Part A if:

If you don’t qualify for premium-free Part A, you can purchase it. You may need to pay up to $518 per month in 2025. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $518. However, if you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $285.

If you choose to buy Part A, you must also have Medicare Part B (medical insurance) and pay monthly premiums for both Medicare Part A & B.

If you choose not to buy Medicare Part A, you can still purchase Medicare Part B.

Beyond the monthly premium, Medicare Part A hospital insurance also has a hospital inpatient deductible and coinsurance. These are additional out-of-pocket costs that you should budget for.

The 2025 Medicare Part A deductible is $1,676.

The amount of coinsurance you will owe for inpatient care depends on the duration of your stay. Medicare Part A coinsurance in 2025 is:

In addition to the deductible and coinsurance costs, Medicare Part A will only cover Medicare-approved expenses. This is why it’s important to know what is covered and what’s not. To avoid high out-of-pocket costs, read more about Medicare Part A.

The best time to enroll in Medicare Part A is during your Initial Enrollment Period. If you miss that, you can enroll during the General Enrollment Period, or during a Special Enrollment Period if you qualify.

Medicare Part B (medical insurance) is part of Original Medicare. Medicare Part B is NOT premium-free.

To be eligible for Original Medicare Part B in Texas, you must be eligible for Medicare Part A.

Medicare Part B covers medically necessary and preventative services.

Medicare Part B covers:

This is not an exhaustive list of what Medicare Part B covers. Read more about What Part B covers.

Medicare’s standard Part B premium for 2025 is $185.00. This is the amount that most people pay for their Part B; however, your premium is based on your income.

The Part B premium is based on your individual or joint modified adjusted gross income. If you made more than a certain amount, you could pay the standard premium of $185.00 plus an Income Related Monthly Adjustment Amount (IRMAA).

Your Part B premium is based on the modified adjusted gross income as reported to the IRS two years ago. In this case, your federal tax return from 2023.

View the table below to determine how much your Part B premium will be.

Preventative services are free from a health care provider that accepts your Medicare.

The 2025 Medicare Part B deductible is $257.

After you pay the $257 deductible for the calendar year, you typically pay 20% of Medicare-approved costs for most doctor services, including while you’re a hospital inpatient. You’ll also pay 20% for outpatient therapy and Durable Medical Equipment (DME).

Curious if a test, item, or service is covered? Medicare offers a helpful search tool to check coverage. To avoid surprise or costly out-of-pocket costs, ask about hospital orders if you’re admitted as an inpatient and negotiate the cost of services before they are provided.

Remember that Original Medicare Part B does not have an out-of-pocket maximum. You will pay 20% for Medicare-approved services or more unless you have a plan to expand your Medicare coverage (e.g., Medicare Supplement or Medicare Advantage) to cap or reduce your out-of-pocket costs.

The Initial Enrollment Period is the best time to enroll in Medicare Part B. This ensures that you avoid Part B late enrollment penalties. If you miss your Initial Enrollment Period, you should enroll during the General Enrollment Period or during a Special Enrollment Period if you qualify.

Should you delay enrollment in Medicare Part B, it should only be because you have creditable coverage from another source. Creditable coverage means that you have benefits at least as good as those provided by Medicare. Oftentimes, creditable Part B coverage comes from Veterans Affairs (VA) benefits, TRICARE for Life (TFL), Federal Employee Health Benefits (FEHB), or some job-based and retiree benefits.

You should check annually with your plan administrator to determine if your health benefits are equal to Medicare’s. If they are not, you could be subject to a lifetime penalty when you do enroll in Medicare Part B.

Medicare Advantage Plans (MA), also known as Medicare Part C, are one option for receiving your Original Medicare (Part A and B) coverage, with additional benefits. Also, Medicare Advantage plans cap your out-of-pocket costs, unlike Original Medicare. A Medicare Advantage Prescription Drug Plan (MAPD) is a Medicare Advantage plan that provides creditable prescription drug coverage.

These plans are offered by private insurance companies regulated and contracted by the Centers for Medicare and Medicaid Services (CMS).

To qualify for a Medicare Advantage plan in Texas, you must be enrolled in Medicare Part A and Part B. You must also live in the plan’s service area you wish to enroll in. Medicare Advantage plans are offered at the county level, and there are many options to choose from.

In 2025, there are 385 Medicare Advantage plans available in Texas. That is up from 337 plans in 2022, 289 plans in 2021, and 231 in 2020. Between 2022 and 2023, there are 15% more Medicare Advantage plans available in Texas.

With more plans coming out every year and with more competitive benefits, you have even more opportunities to shop around and find the one that’s suited to your needs.

While Medicare Advantage plans are growing in popularity and plan offerings. There are a few counties in Texas where the percentage of Medicare recipients enrolled in a Medicare Advantage plan is the highest.

In 2025, the 10 Texas counties with the highest Medicare Advantage enrollment are Starr County (71%), Hidalgo County (71%), El Paso County (70%), Willacy County (69%), Zavala County (66%), Cameron County (65%), Jim Wells County (65%), Maverick County (64%), San Patricio County (64%), and Kleberg County (63%).

Nearly all of these counties were in the top 10 for Medicare Advantage enrollment for 2022, except for one. Maverick County did not appear in the top 10 in 2022 and has replaced Nueces County, which was #10 in the top 10 last year.

The percentage enrolled also increased. 2022’s highest penetration percentage was 69%, with a low of 61%. While in 2021 highest penetration percentage was 69%, with a low of 56%. This year, the highest penetration is 71%, with a low of 63%.

Many people choose to enroll in a Medicare Advantage plan because of reduced costs and additional benefits. You could qualify for a low monthly premium, lower your out-of-pocket costs, and have additional benefits than what Original Medicare offers.

In every county across Texas, Medicare Advantage plans are available starting at $0 per month. If you enroll in a plan that does charge a premium, you’ll pay the Medicare Advantage plan premium plus the monthly Part B premium. The bonus of Medicare Advantage? Most plans include prescription drug coverage.

Did you know that Medicare Advantage plans limit out-of-pocket costs for services covered by Medicare Part A and B? Unlike Original Medicare, which doesn’t have a limit on out-of-pocket costs, Medicare Advantage plans set their copayments and coinsurance within limits established by the federal government. This could help you save a lot.

Once the out-of-pocket maximum is reached, including the deductible, the Medicare Advantage plan pays 100% of covered healthcare expenses for the remainder of the year.

Most Medicare Advantage plans in Texas offer benefits that Original Medicare doesn’t provide:

The two most common Medicare Advantage plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs and PPOs have networks of participating hospitals, doctors, specialists, and other healthcare professionals.

Three additional plan types are utilized less frequently but remain available within select locations in Texas. These include:

HMO and PPO Medicare Advantage plans have many similarities.

The primary difference between Medicare Advantage HMO and PPO plans are cost and flexibility.

Medicare Advantage HMO

Medicare Advantage PPO

In 2023, Medicare-eligible people have more HMO options (59%) than they do local PPO plan (40%) options. Only 1% of plans available are regional PPOs and private fee-for-service plans. Regional PPO plan enrollment is on the decline, down from 5% in 2020.

The Center for Medicare and Medicaid Services (CMS) requires that everyone on Medicare have creditable prescription drug coverage. Prescription drug coverage is offered with Medicare Advantage Plans. They are called Medicare Advantage Prescription Drug Plans (MAPD) when paired together.

These plans provide the convenience of having all Medicare hospital, medical, and prescription drug benefits through one plan. Bonus, there is no additional plan premium for prescription drug coverage with a Medicare Advantage Prescription Drug plan. In 2023, 89% of Medicare Advantage plans offer Medicare Advantage Prescription Drug Plans (prescription drug coverage).

A Medicare Advantage plan’s premium can cost as little as $0 per month. And 100% of people with Medicare have access to a Medicare Advantage plan with a $0 monthly premium. For those that do pay a premium, the monthly average premium for 2025 is $8.94 per month. That’s down from $10.68 in 2022 and $11.11 in 2021.

Medicare Advantage and Medicare Advantage Prescription Drug Plan premiums are paid directly to the plan provider. They are paid separately from any Medicare Part A or Part B premium paid to Medicare. Usually, payment is withdrawn from a monthly Social Security benefit, electronic withdrawal, or coupon book. At the time of enrollment, your payment method can be chosen.

While there isn’t a one-size-fits-all or “best” Medicare Advantage plan in Texas, there are tools to help you make the best decision for your health and budget.

The best way to discover the best Medicare Advantage plan for you is to gather your doctor, specialist, and medication information and use the Connie Health Medicare plan finder tool to search for plans that have the doctors and medications that you need.

The Centers for Medicare and Medicaid Services (CMS) has also created a Star Rating system to highlight top-performing plans based on a number of criteria. We don’t recommend that you choose a plan simply because it received a 5-star rating from CMS.

Remember, your Medicare plan should be unique to your needs. If you choose a plan for a high star rating, it should only be because it suits your health and budget needs first, and the high star rating is a bonus.

The Star Rating system measures the quality of health and prescription drug services received from Medicare enrollees. This rating system can help narrow your Medicare choices.

The plans are measured by five categories, on a scale of 1 to 5—with five being top-performing or “the best” in:

Based on the Star Rating system, there are 8 Medicare Advantage Plans and Medicare Advantage Prescription Drug Plans in Texas with a 5/5 rating for 2025. If you are not enrolled in one of these plans and are interested, you can use the 5-Star Special Enrollment Period to make a switch.

We recommend that you only use this special enrollment period if the plan suits your health and budget needs first, with the high star rating being a bonus.

The best time to enroll in a Medicare Advantage Plan in Texas is during your Initial Enrollment Period. If you miss that, you also have the opportunity to enroll during the General Enrollment Period or a Special Enrollment Period if you qualify.

If you’re enrolled in a Medicare Advantage plan, you can also use the Medicare Advantage Open Enrollment Period to switch to another plan.

Creditable prescription drug coverage is a requirement of Medicare. Are you choosing not to enroll in a Medicare Advantage or Medicare Advantage Prescription Drug Plan? And you don’t have creditable coverage from another source? If so, then you’ll likely need to enroll in a stand-alone prescription drug plan (Medicare Part D) along with your Original Medicare Parts A and B.

Medicare Part D pays for some of the costs of prescription drugs at participating pharmacies in your community. You usually pay a monthly premium, which varies by plan, and an annual deductible.

In 2025, there are 28 stand-alone Medicare Part D prescription drug plans available in Texas. There are 8 plans that will offer lower out-of-pocket costs through the Part D Senior Savings Model. And 28% of people with Medicare Part D get Extra Help.

All individuals with Original Medicare Part A and/or Part B have access to a standalone Medicare Part D prescription drug plan.

Every plan provides a unique list of covered prescription drugs called a “formulary.” All plans do NOT cover the same prescription drugs. Medicare Part D plans include brand-name and generic drug coverage and are required to have drugs in certain protected classes, such as drug treatments for HIV/AIDS and cancer.

Each plan’s formulary must consist of at least two drugs in the most commonly prescribed categories and classes. This helps people with varying medical conditions get the prescription drugs they rely on. If the formulary for your plan doesn’t include your specific drug, a similar drug should be available. In some cases, if there is no substitute, you can request an exception.

It’s important to review your Medicare Part D plan annually during the Annual Enrollment Period. That’s because Medicare Part D plans change their formularies annually. Also, therapies change, new prescription drugs are released, and new medical information becomes available. In some instances, plans may also increase the copayment or coinsurance for a particular drug or offer a generic form that can lower your out-of-pocket costs.

In Texas, the lowest monthly premium for a stand-alone Medicare Part D prescription drug plan is $6.90. But the average basic monthly premium for standard Medicare Part D coverage is $31.50 in 2025, a 1.8% decrease from $32.08 in 2022.

Along with the monthly premium, you’ll be responsible for out-of-pocket medication costs (copayments, coinsurance, deductible).

Most plans place drugs into different levels, called “tiers.” These tiers determine the out-of-pocket cost or copayment. The higher the tier, the higher the price. If you can get a generic version of the brand-name drug, that will save you money.

The Food and Drug Administration (FDA) says that generic drugs are copies of brand-name drugs and are the same as those brand-name drugs in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. You should speak to your doctor or prescriber about generic drug options.

If you take insulin, you may be able to get prescription drug coverage that offers savings on insulin.

Medicare Part D deductibles vary from plan to plan. However, no Medicare prescription drug plan can have a deductible higher than in 2025. Some Medicare Part D plans do not have a deductible.

If you are receiving Medicare, have limited financial resources and income, and live in Texas you may qualify for Extra Help.

Extra help assists with paying for your monthly premiums, annual deductibles, and co-payments related to Medicare prescription drug coverage. If you qualify, you won’t pay a late enrollment penalty when you join a Medicare drug plan.

The Centers for Medicare and Medicaid Services (CMS) provides Star Ratings for each Medicare plan. And while there isn’t a “best” or one-size-fits-all, you can use the CMS rating system to gauge customer services, preventative care, the management of chronic conditions, plan responsiveness, and member complaints. The ratings are on a scale of 1 to 5, with 5 being excellent.

Although zero Medicare Part D plans have a 5/5 rating, eight plans earned a 4 out of 5 rating in 2025.

The following companies offer stand-alone Prescription Drug (Medicare Part D) plans in Texas.

To enroll in a Medicare Part D prescription drug plan, you can sign-up during your Initial Enrollment Period. If you miss that, you still have the opportunity during the General Enrollment Period or a Special Enrollment Period if you qualify.

In order to avoid lifetime late enrollment penalties, it’s vital that you have creditable prescription drug coverage. Creditable drug coverage means that you have either as good or better than basic prescription drug coverage (Medicare Part D). There are several types of plans that offer creditable drug coverage if you are not enrolled in Medicare Part D.

These include:

You should check with your employer or plan to ensure that your prescription drug coverage is creditable. If you do not have creditable prescription drug coverage and miss your Initial Enrollment Period, you may incur a lifetime late enrollment penalty.

A Medicare Supplement plan, or Medigap plan, helps Original Medicare enrollees have predictable costs. In Texas, 931,380 Texans (40% of fee-for-service enrollees) enrolled in Medicare Supplement coverage in 2021. That’s up 2% since 2020 and 38% of fee-for-service enrollees, and in 2019 when 911,802 Texans (36%) were enrolled in a Medicare Supplement plan.

Medicare Part A covers some inpatient costs (hospital and nursing facility care), while Medicare Part B covers 80% of outpatient costs (doctor’s bills and other medical expenses). Some out-of-pocket expenses could include deductibles, copayments, and coinsurance. The coverage gap may cost you more than you expect. And Original Medicare has no maximum for out-of-pocket costs.

That’s why many people opt for enrolling in Original Medicare plus a Medicare Supplement plan. These plans help pay for some, if not all, of the out-of-pocket expenses that you would otherwise pay under Original Medicare. These plans only combine with Original Medicare and are not stand-alone plans.

Private insurance companies licensed by the Texas Department of Insurance are authorized to sell Medigap plans. And all plans are standardized.

Remember, if you choose to enroll in a Medicare Supplement plan, you must have creditable prescription drug coverage either through a stand-alone Medicare Part D plan or another source. Medicare Supplement plans do not provide creditable coverage.

There are ten types of Medicare Supplement plans available. The plans are lettered A – G and K – N. Every Medicare insurance company must offer at least Medicare Plan A.

The top 5 most popular Medicare Supplement plans in Texas are plans G, F, N, J, and C. In 2021, 416,173 of 931,380 (44.7%) Texan Medicare enrolled in Plan G. Followed by 387,814 (41.6%) in Plan F, 76,705 (8.2%) enrolled in Plan N, 16,469 (1.7%) enrolled in Plan J, and 9,265 (1%) enrolled in Plan C.

Most Popular Medigap Plans in Texas

As of January 1, 2020, plans that include the Part B deductible were phased out. That means that if you turned 65 on or before December 31, 1999, you can enroll in Plan C or Plan F. If you turned 65 on or after January 1, 2020, these plans are no longer available to you. Individuals already enrolled in those plans can keep their coverage.

Plan G is the closest to discontinued Plan F, which is likely why Plan G had the second-highest enrollment of supplement plans in Texas.

Remember, just because a plan is popular doesn’t mean it’s right for your health and budget needs. It’s important to weigh monthly premium costs with out-of-pocket expenses. Some plans with lower premiums may have higher out-of-pocket costs.

To qualify for a Medicare Supplement plan, you must be enrolled in Original Medicare Parts A and B. You must also live in the county where the plan is available.

The best time to enroll in a Medigap (Medicare Supplement) plan is when you are first eligible during your Medigap Open Enrollment Period. This period only happens once and cannot be changed or repeated.

If you miss your Medigap Open Enrollment Period, there is no guarantee that you can still enroll in a Medigap plan. If you can purchase a Medigap policy, it could cost more due to past or present health conditions.

Enrollment outside of your Medigap Open Enrollment Period may also require specific medical underwriting requirements or situations. Insurance companies generally use medical underwriting to decide whether to accept your application and how much to charge for the policy.

If you need help paying for Medicare, you can apply for one of four Medicare Savings Programs (MSP) available in Texas. They can assist in paying your Medicare premiums, including Medicare Part A and Part B deductibles, coinsurance, and copayments.

The Texas Health and Human Services Commission (HHSC) manages the four Texas Medicare Savings Programs. Each program has a different maximum income for eligibility, but the maximum accessible financial assets are nearly the same.

For three of the four programs, the financial limit requirement is the same. To qualify for the Qualified Medicare Beneficiary Program, Specified Low-Income Medicare Beneficiary Program, or the Qualifying Individual Program, limited financial resources are a requirement.

In 2025, when all financial resources are added up, they should equal no more than $9,430 for an individual and $14,130 if married. If the maximum countable resources exceed this, then you are ineligible for all Medicare Savings Programs because the Qualified Disabled and Working Individual Program’s financial requirement is even more strict.

In 2025, the maximum financial resources for the Qualified Disabled and Working Individual Program is $4,000 for an individual and $6,000 if married.

There are varying monthly income limitations for each of the Medicare Savings Programs. The maximum gross income you can have as an individual is $5,105 in 2025, and if married, $6,899. To receive the most help, you would need to have a maximum gross income of $1,275 (individual) or $1,724 (married) in 2025. Read what is counted towards monthly income and then review the table below to see if you qualify for any of the four Medicare Savings Programs.

The Qualified Medicare Beneficiary (QMB) Program could help pay for Part A and Part B premiums, deductibles, and coinsurance if you are eligible for Medicare Part A and meet income and financial resource limit requirements.

As a recipient, you would receive a Qualified Medicare Beneficiary Program identification card to show medical providers. This card would be provided by the Texas Health and Human Services Commission. Your eligibility would begin on the first day of the month after you are certified for benefits.

The Specified Low-Income Medicare Beneficiary Program (SLMB) could help you pay for your Medicare Part B premiums. If you receive Medicaid, you may also receive SLMB benefits. But if you are SLMB-eligible, you will not receive regular Medicaid benefits or a monthly medical identification card.

SLMB eligibility begins the month of application, and if you meet all the income and financial asset criteria, medical coverage is eligible for three months before application. Retroactively. Income eligibility is based on the Federal Poverty Level limits and is updated annually by the Census Bureau.

The Qualifying Individual Program (QI) will cover the cost of Medicare Part B premiums if you meet income and financial asset eligibility requirements. With this program, you cannot be eligible or receive regular Medicaid and the QI program coverage at the same time. Also, if you are QI-eligible, you will not get regular Medicaid benefits or a medical identification card.

Eligibility for the Qualified Individual Program is decided on a calendar year basis. Your eligibility may begin the month that you apply for coverage. You could also be eligible for coverage three months prior if you meet all the criteria, but the three-month period cannot extend into the previous calendar year.

The Qualified Disabled and Working Individual Program (QDWI) will pay for only the Medicare Part A premium if you meet eligibility requirements. You cannot qualify for regular Medicaid and the QDWI program at the same time.

To be eligible, you must be under 65 years of age, have a disabling impairment, continue to work, not be otherwise eligible for Medicaid, and meet the income and financial resource requirements.

Medicare Savings Programs are for those who are already enrolled in Medicare. Not yet enrolled? Enroll in Medicare Part A and/or Part B, and then you can apply for a Medicare Savings Program in Texas. If you’re not enrolled in Parts A or B yet, Connie Health can help. Call (623) 223-8884.

If you already have Part A and your income and financial resources are within the limits of the program you want to apply for, a Connie Health agent can help you complete an Application for Benefits with the Texas Health and Human Services Commission. Call now to speak with a local licensed agent: (623) 223-8884

Note: Even if your income and financial assets are higher than the amounts listed above, you may be eligible. You should speak to a local licensed agent to discuss your eligibility.

Do you know when to enroll in Medicare? There are six enrollment periods that you need to know. Two happen only once, three happen yearly, and one occurs only under special circumstances. Read below to learn about each of these enrollment periods.

Most people become eligible for Medicare enrollment during their Initial Enrollment Period (IEP). The Initial Enrollment Period begins three months before your 65th birthday, the month you turn 65, and ends three months after your 65th birthday. You have this seven-month window to enroll in Medicare for the first time.

Your Initial Enrollment Period is one of the most critical enrollment periods. If you miss it, you may have to wait until the General Enrollment Period to enroll in Medicare. This could result in late enrollment penalties for your lifetime.

Be sure you know when your Initial Enrollment Period is. Take our Medicare eligibility quiz to find out and receive enrollment reminders.

The Medigap Open Enrollment Period is the best time to buy a Medigap plan, also known as a Medicare Supplement plan. You’ll likely get better pricing and greater plan options during the Medigap Open Enrollment Period. It’s also when you can sign up for any Medigap plan regardless of preexisting health conditions.

This one-time enrollment period begins the first month that you are enrolled In Medicare Part B, and you’re age 65, and lasts for six months. After this enrollment period, you may not be able to enroll in a Medigap plan, or if you’re able, it may cost more due to previous or present health conditions.

The Medicare Annual Enrollment Period (AEP), also called the Medicare Open Enrollment Period, is every year between October 15 and December 7. This enrollment period is for people already enrolled in Medicare Parts A & B.

This is the time to have your Medicare plan reviewed by a local licensed agent. We recommend doing this annually to ensure that you’re on the best plan in your county—for your health needs and budget. Here are two primary reasons why.

Learn how to be prepared for the next Medicare Annual Enrollment Period by reading our AEP ultimate guide.

Once you’ve reviewed your plan with an agent, you have six possible coverage changes:

Did you miss your Initial Enrollment Period (IEP) and don’t qualify for a Special Enrollment Period? If you need to enroll in Original Medicare Part A or B, the General Enrollment Period is a date to circle on your calendar.

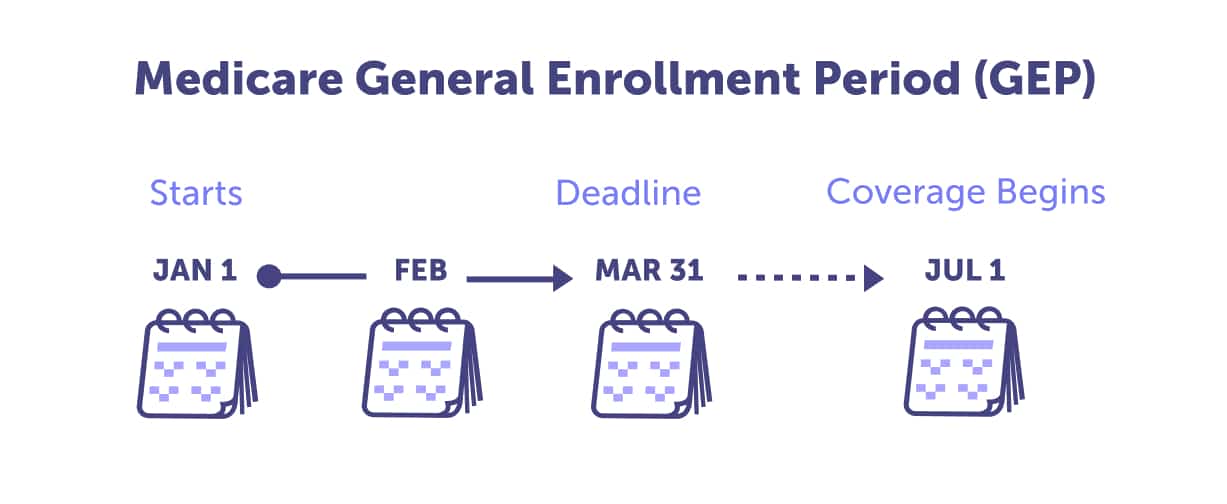

The General Enrollment Period (GEP) is January 1 – March 31 annually, with coverage beginning July 1. If you’re enrolling for Medicare Part A or B during the General Enrollment Period, you may have late-enrollment penalties because of delayed enrollment.

If you’ve already enrolled in a Medicare Advantage plan (Medicare Part C), you can review your plan and make one switch between January 1 and March 31 annually. This period is called the Medicare Advantage Open Enrollment Period.

If you don’t make a change during this enrollment period, you must wait until the Annual Enrollment Period (AEP) or a Special Enrollment Period (SEP) to make a switch if you qualify.

During the Medicare Advantage Open Enrollment Period, you can:

A Medicare Special Enrollment Period (SEP) enables you to make a Medicare plan switch or sign up for a Medicare plan outside the five standard enrollment periods listed above.

There are three primary reasons you would qualify for a Special Enrollment Period:

Did your primary residence change, did you lose your health insurance, did you get other health insurance or another special circumstance? Each Qualify Life Event Special Enrollment Period has unique timing. You should speak with a local licensed agent.

Medicare uses a rating system to share the performance of plans. A plan can be between 1 and 5 stars – with 5-stars being excellent. If a 5-star rated plan is available in your county, you can use the 5-Star Special Enrollment Period. You can switch from your current plan to a 5-Star Medicare Advantage Plan, Medicare Advantage Prescription Drug Plan (MAPD), or a stand-alone Prescription Drug Plan (Medicare Part D).

You can only use this Special Enrollment Period once between December 8 and November 30. Call to speak with a local licensed agent to see if a 5-star plan is available in your county. Or read about 5-Star Medicare Advantage plans in Texas.

Are you or your spouse working past the age of 65 and delaying Medicare? You can avoid accruing Medicare Part B and Part D penalties by ensuring your job-based healthcare coverage provides benefits at least as good as Medicare provides. This is known as creditable coverage. You should confirm that you have creditable coverage each year you consider delaying Medicare coverage.

Once you lose your employer-based health coverage, you have eight months to enroll in Medicare Parts A and B during this Special Enrollment Period. But you only have 63 days to enroll in a Medicare Advantage plan (Medicare Part C) or Medicare Part D. If you don’t enroll in the first two months, you may have late enrollment penalties. Important note: COBRA does not count as creditable coverage.

Texas Health and Human Services help seniors access services for independent living, federal and state benefits, caregiving resources, food access, and long-term care services. It can direct you to local area agencies on aging, which can help you find available resources in your local area.

Phone Number: 1-512-424-6500 (TTY 1-512-424-6597)

Website to apply for benefits in Texas

Texas Health and Human Services Social Service hotline

The Social Security Administration (SSA) administers retirement and disability income programs in the United States. They provide financial support for retirees. You can apply for retirement, disability, and Medicare benefits through SSA.

SSA Phone Number: 1-800-772-1213 (TTY 1-800-325-0778)

Social Security Administration FAQ

Social Security Administration local office locator

Email the Social Security Administration

The Texas Association of Regional Councils works with the Texas Health and Human Services Department to implement quality services at the local level. Programs include the Area Agencies on Aging and the Aging and Disability Resource Centers.

Area Agencies on Aging (AAA) Phone Number: 1-800-252-9240

Map of Area Agencies on Aging

Texas Association of Regional Councils contact page

The Texas Department of Insurance can provide information and resources about medical and long-term care insurance. The department can help you look for coverage, determine your policy, or file a complaint.

Texas Department of Insurance Consumer Helpline: 1-800-252-3439

Texas Department of Insurance Main Phone Number: 1-800-578-4677

Texas Department of Insurance website

The Medicare Savings Program can help you pay for some or all of your monthly Medicare payments, co-pays, and deductibles. The Medicare Savings Program is managed by the Texas State Health Insurance Assistance Program.

Texas Medicare Savings Program Phone Number: 1-800-252-9240

Directory of Services

The State Health Insurance Assistance Program provides unbiased counseling and assistance with making decisions about Medicare. The program offers Medicare education, help with Medicare eligibility and enrollment, information about long-term care insurance, and more.

Texas Health Information, Counseling, and Advocacy Program (HICAP) Phone Number: 1-800-252-9240

Directory of Services

Working with the Social Security Administration, the Railroad Retirement Board administers retirement benefits for railroad workers and their families in the United States.

Texas RRB Office Phone Number: 1-877-772-5772

RRB National Telephone Service: 1-877-772-5772

General TTY Number: 1-312-751-4701

Headquarters Personnel Directory: 1-312-751-4300

Railroad Retirement Board website

Fact sheet 2022 Medicare Advantage and Part D Advance Notice Part II.

Fact sheet 2023 Medicare Star Ratings.

Medicare Advantage 2023 spotlight: First look.

Medicare Open Enrollment in Texas, 2023.

Medicare Savings Programs Eligibility and Coverage.

News alert CMS releases 2023 projected Medicare basic part D average premium.

The State of Medicare Supplement Coverage.

Total number of Medicare beneficiaries by type of coverage.

Yearly deductible for Drug Plans.

Last updated: July 5, 2023

You can sign up for Medicare by contacting the Social Security Administration or the Railroad Retirement Board.

You can apply online at ssa.gov/benefits/medicare or call 1-800-772-1213 (TTY 1-800-325-0778) for the Social Security Administration.

You can call 1-877-772-5772 (TTY 1-312-751-4701) for the Railroad Retirement Board.

You can first get Medicare during the seven months around your 65th birthday. You are eligible to enroll three months before, the month of your birthday, and three months after.

Medicare does not cover nursing homes. If you are eligible for short-term coverage in a skilled nursing facility, Medicare Part A will cover 100% of the costs for the first 20 days. After the first 20 days, you could pay up to $200 a day through your coinsurance.

People who are 65 years of age or older, people younger than 65 with disabilities, and people with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS) can get Medicare in Texas.

A 1986 federal law required teachers to pay Medicare taxes.

Texas teachers qualify for Medicare when they turn 65.

Medicare may cover the medical costs for auto accident injuries depending on what type of injury.

Medicare Part A will cover your stay if you are admitted to the hospital and your surgery if it is performed as an inpatient.

The Medicare Part A deductible is $1,676 per benefit period in 2025. The first 60 days have free coinsurance for each benefit period in 2025. It is a $419 coinsurance for days 61-90. After the first 90 days, it is a $838 coinsurance in 2025.

Medicare Part B will cover ambulance transportation, emergency room treatment for evaluating your injuries, and surgery if performed as an outpatient. The Medicare Part B deductible is $257 per year in 2025. For the Medicare Part B coinsurance, you would pay 20% of the Medicare-approved amount after meeting the deductible.

Original Medicare (Parts A and B) does not cover dental care. Medicare Advantage plans typically provide dental coverage.

Original Medicare Part A and Part B do not cover dentures. Some Medicare Advantage plans cover dentures. Most DSNP plan cover dentures, and very limited non DSNP plans cover dentures in Texas.

You can have Medicare and Medicaid at the same time. Medicaid can provide benefits not covered by Medicare, such as nursing home care.

Texas Health and Human Services offer the Dual-Eligible Project for people who qualify for Medicare and Medicaid. The Dual Eligible Project could make it easier for people to receive care. You are eligible if you are age 21 or older, get Medicare Part A, Part B, Part D, receive full Medicaid benefits and are enrolled in the Medicaid STAR+PLUS program.

Medicare does not cover assisted living. If you are eligible for Medicaid, Texas offers Medicaid waivers to help pay for assisted living costs.

You can get a replacement Medicare card by logging into your Social Security account at ssa.gov/myaccount. You can also call 1-800-633-4227 (TTY 1-877-486-2048) to request a replacement card.

Medicare does not pay for assisted living services. You may have to pay out-of-pocket for these expenses or get long-term care insurance.

There are three Medicaid long-term care programs. Each program has different eligibility requirements and benefits. Also, some programs have entitlements, while others have limited enrollment.

To be eligible for a Medicaid long-term care program in Texas you must: Be a resident of Texas; Be a U.S. national, citizen, permanent resident, or legal alien; Need health care and insurance assistance; Be low or very low-income, according to Texas; and be 65 years of age or older, or have a disability.

Medicare Part F is a supplemental Medicare health plan (Medigap).

Part F covers Medicare Part A coinsurance and deductibles. It also covers Medicare Part B coinsurance, co-pays, and deductibles. Medicare Part F is not available for new enrollees as of January 2020. If you were eligible for Original Medicare before 2020, you could have enrolled or be enrolled in Medicare Part F.

No. Texas does not have free Medicare.

Medicare Part A covers hospital care. Medicare Part A is free for most Texans if you are enrolled in Social Security benefits.

The Medicare Part A deductible is $1,676 for 2025. The Medicare Part A coinsurance for 2025 is free for the first 60 days of your hospital stay. It is $419 per for the next 60 to 90 days and $838 per day after 90 days.

Medicare Part B covers doctor’s services and outpatient care. You will need to pay a minimum standard monthly premium for Medicare Part B ($185.00 for 2025). The Medicare Part B deductible is $257 for 2025. After paying the deductible, you would pay 20% of the Medicare-approved costs.

The monthly income limit to be eligible as a Qualified Medicare Beneficiary (QMB) is $1,275 for individuals and $1,724 for couples for 2025. The QMB program covers Medicare Part A and Part B.

To be eligible as a Specified Low-Income Medicare Beneficiary, the monthly income limit is $1,526 for individuals and $2,064 for couples for 2025.

Medicare is overseen by the Texas Health and Human Services Commission. The department offers Medicare Savings Programs, including the Qualified Medicare Beneficiary, Specified Low-Income Medicare Beneficiaries, the Qualifying Individuals Programs, and the Qualified Disabled and Working Individual (QDWI) Program.

Medicare Part A is typically free for most people. Medicare Part A may cost up to $518 a month in 2025. Medicare Part B’s minimum standard premium costs $185.00 a month for 2025.

If you are blind, have a disability or are 65 years old, you may be eligible for Medicaid.

Around the time of your 65 birthday, you have seven months to apply for Medicare as part of the Initial Enrollment Period. You can apply three months before, during your month of birth, and three months after.

You cannot use GoodRx in combination with Medicare Part D or a Medicare Advantage Prescription Drug Plan. GoodRx can be used to purchase prescriptions as an alternative to using your Medicare coverage.

You may want to use GoodRx instead of going through Medicare for your prescription if the medication isn’t covered by Medicare, the GoodRx prices are lower than the Medicare copay, when you won’t reach your annual deductible, or when you’re in the coverage gap phase (also known as the donut hole) of your plan or when you’re nearing the donut hole.

Medicare has discontinued Medigap Plan C and Plan F for new beneficiaries as of 2020. If you already had Medigap Plan C or Plan F before January 1, 2020, you can continue using the plan if it’s available in your county.

Adults, age 65 or older, younger people with disabilities, and people with End-Stage Renal Disease are eligible for Medicare.

Undocumented individuals do not qualify for the full Medicaid benefits. Medicaid has the Emergency Medicaid program that helps undocumented individuals pay for emergency medical care only.

Wondering what your plan options are for Medicare in Texas? Learn about Part A, B, C, D, and Medigap coverage, plus essential deadlines.

Learn how Medicare Advantage plans in Texas can reduce your healthcare costs. Plus, plans available, how much they cost, and when to enroll.

Find the Best Medicare Advantage plans in Texas here. Discover your plan options, their costs, and what to consider when choosing a plan.

Learn about the top Medicare Advantage PPO plans in Texas and discover if a local or regional PPO plan is right for you.

5-star Medicare Advantage plans in Texas: Discover if there are any available where you live and when you can enroll.

Learn about the basics of Medicare Supplement Plans in Texas, the 10 types of plans available to you, and the 6-month enrollment window.

Wondering how a Medicare Supplement Plan G in Texas compares? Learn about Medigap Plan G's coverage and costs.

Susan from San Antonio, Texas writes to ask Connie, "Are Texas teachers eligible for Medicare?" Read to discover the answer.

Nancy from San Antonio, Texas writes to ask Connie, "Does Texas MedClinic accept Medicare?" Read to discover the answer.