You've come to the right place if you want to learn how to sign up for Medicare in Fort Worth, Texas, or what plans are available. Connie Health gathered the vital details you need to sign up for Medicare, including your plan options in Fort Worth, Tarrant County, and Medicare providers in your area.

315,429 Medicare-eligible people are living in Fort Worth, Texas.

Most Medicare beneficiaries pay $0 for their Medicare Part A premium. For those that pay a premium, it's $0.00 or $518.00 each month, depending on how long you or your spouse worked and paid Medicare taxes.

The Medicare Part A deductible is $1,676.00 before Original Medicare starts to pay for inpatient hospital stays, plus copayments.

The majority of Medicare beneficiaries pay for their Medicare Part B coverage. The standard Part B premium per month is $185.00. Your Part B premium could be higher because of your income (IRMAA).

The Medicare Part B deductible is $257.00 annually before Original Medicare starts to pay, plus 20% coinsurance for all Medicare-approved services.

Of the 315,429 Medicare beneficiaries, 176,118 are enrolled in a Medicare Advantage plan in Fort Worth, which is 55.83% of those enrolled in Medicare in Fort Worth.

All Medicare eligibles have access to a $0 premium Medicare Advantage plan, and there are 0 $0 premium plans in Fort Worth.

If you pay a premium for a Medicare Advantage plan, the average cost is $17.90 per month. And the average out-of-pocket max is $6,110.09 per year.

Read more about Medicare Advantage plans in Fort Worth.

You have 17 Medicare Part D prescription drug plans to choose from in Fort Worth.

Medicare Part D premiums range from $0.00 to $124.60 per month in Fort Worth. The price depends on whether you enroll in a basic or enhanced benefit plan, and your prescription drug needs.

The average monthly stand-alone Part D premium in Fort Worth is $66.72.

There are 9 plans in Fort Worth that Medicare rated three stars or higher.

25.84% of Medicare eligibles with a stand-alone Part D plan get Extra Help.

The annual prescription drug deductible ranges between $0 - $590 in Fort Worth, Texas.

Read more about Medicare Part D plans in Fort Worth.

There are 12 Medicare Supplement plan types to choose from in Fort Worth. These include Plan A, Plan B, Plan C, Plan D, Plan F, Plan F high-deductible, Plan G, Plan G high-deductible, Plan K, Plan L, Plan M, and Plan N.

The cost of a Medicare Supplement plan in Fort Worth ranges from $29 to $2,129 depending on the Plan Type you choose, your age, sex, whether you smoke, and when you enroll.

Read more about Medicare Supplement plans in Fort Worth.

Medicare is a health insurance program created by the government. There are 5,462,901 million people in the United States who have Medicare. And there are 315,429 Medicare-eligible people in Fort Worth. If you're eligible for Medicare, you're in good company.

People who are 65 years old or older, certain younger people with disabilities, and individuals with End-Stage Renal Disease (ESRD) or other qualified illnesses can get help from Medicare to pay for medical costs like doctor visits, hospital stays, and other treatments.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

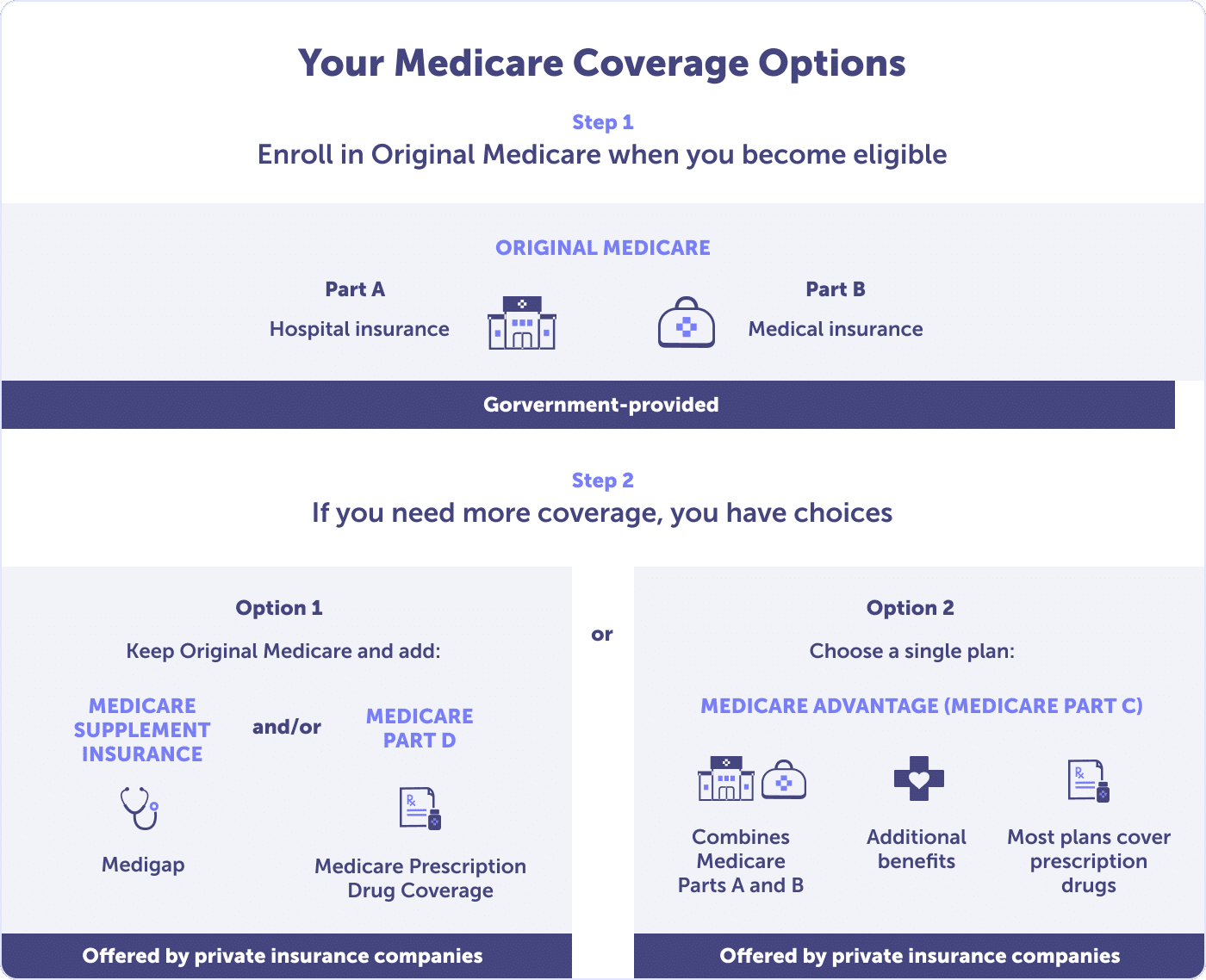

Original Medicare (Part A and B) is the most basic coverage offered by the government for people who are eligible for Medicare. You enroll in Medicare Part A and Medicare Part B when you first become eligible for Medicare.

There are also plan options that expand Original Medicare coverage. These options include Medicare Advantage (Part C), stand-alone Medicare Prescription Drug Coverage (Part D), and Medicare Supplement (Medigap) plans.

Most Medicare beneficiaries expand their coverage because Original Medicare doesn’t have an out-of-pocket maximum. Without expanded coverage, you could expose yourself to high out-of-pocket costs, a financial risk.

By enrolling in a Medicare Supplement and/or a Medicare Part D stand-alone prescription drug plan, you get help with some or all of your Medicare out-of-pocket costs, plus prescription drug coverage.

With a Medicare Advantage plan, you receive your coverage in a single plan: Medicare Parts A and B, as well as comprehensive dental, vision, and hearing coverage. Plus, most plans include prescription drug coverage. 55.83% of Medicare beneficiaries in Fort Worth are enrolled in a Medicare Advantage plan.

Connie Health can help you compare your plan options and find the one that suits your unique health and budget needs. Call 1-888-369-12111-888-369-1211 to speak with a licensed local agent.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

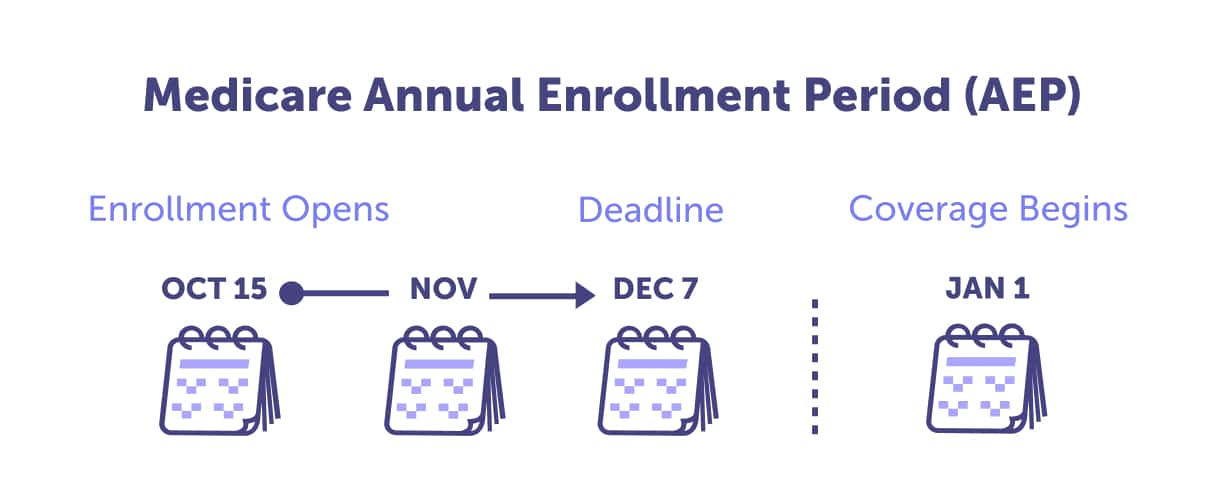

Knowing when to enroll or make plan changes can help you save money.

Are you enrolling in Medicare for the first time, or are you interested in changing your plan? Skip to the section that applies to you - and mark the dates in your calendar.

If you’re new to Medicare, the best time to enroll is during your Initial Enrollment Period. If you miss that, you can still enroll during the General Enrollment Period (January 1 - March 31) or Special Enrollment Period, but likely with penalties.

The best time to change a plan is during the Medicare Annual Enrollment Period (October 15 - December 7). During this period, Medicare beneficiaries can review their plan options for the coming year and ensure that their plan choice meets their health and budget needs.

If you need to make a plan change because you moved to a new service area or lost coverage, among other reasons, you could qualify for a Special Enrollment Period.

Whether enrolling for the first time or changing plans, Medicare in Texas can be confusing. However, you don’t have to sift through your options alone. A local licensed agent can help. Call 1-888-369-12111-888-369-1211 to speak with an agent today.

There are several ways to enroll in Medicare. You can enroll in Original Medicare or select a plan via Medicare's website, consult with a representative from a local SHIP, enroll directly with an insurance provider, or use the services of an insurance broker or agent. Given the various options available, we encourage you to contact a licensed Connie Health agent to discuss your Medicare enrollment.

With Connie Health, you can compare Medicare plans online or by meeting with a licensed Connie Health agent in your area. A local licensed agent can review your Medicare plan options with you over the phone, face-to-face at a location of your choice, or through a video call, based on your preference

To set up an appointment or explore your Medicare plan options, call 1-888-369-12111-888-369-1211.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

Are you having trouble finding doctors who accept your plan? The search for a trustworthy physician can feel overwhelming, but there is no need to worry. Say goodbye to endless phone calls and time-consuming online searches.

Our convenient online platform modernizes the process. Enter your address and plan information, and let Connie Health do the heavy lifting. We'll locate Medicare doctors near you.

Where is a Medicare office near me in Fort Worth, Texas?

The local Medicare office for Fort Worth, Texas is 819 Taylor St, Fort Worth, TX 76102. Phone: 1-866-704-4858.

Medicare has national offices in Maryland and Washington, D.C., and ten regional offices in the United States. Medicare does not operate in local offices, but you can apply for Medicare at any local Social Security office or through Connie Health. Also, most questions can be answered through the Social Security Administration’s toll-free phone number 1-800-772-1213 or by speaking with a Connie Health local licensed Medicare agent at 1-888-369-1211.

Where are Medicare brokers near me in Fort Worth, Texas?

Connie Health has local licensed Medicare brokers in Fort Worth, Texas. Call 1-888-369-12111-888-369-1211 to schedule a time to meet with an agent in your home or other preferred location, by video call, or by phone. You can also review your Medicare plan options online with the Connie Health Medicare plan finder tool.

Where is a Medicare agent near me in Fort Worth, Texas?

A licensed Connie Health Medicare agent can meet with you in your home or other preferred location, by video call or phone. Call 1-888-369-12111-888-369-1211 to speak with a Medicare agent in Fort Worth, Texas. You can also review your Medicare plan options online.

Where is a Medicare doctor near me in Fort Worth, Texas?

When searching for a Medicare doctor near you in Fort Worth, Texas, use the Connie Health Medicare provider tool. Connie Health has made it easy to find a trustworthy Primary Care Physician who accepts Medicare near you. Enter your address and plan information if you have it, and the tool will provide a list of doctors near you. Find your Medicare doctor today.

What is Medicare?

Medicare is a federal health insurance program in the United States designed primarily for individuals 65 and older, though it also covers certain younger individuals with disabilities or specific diseases. Medicare consists of several parts (Medicare Part A, Medicare Part B, Medicare Part C, Medicare Part D, and Medigap), each covering different aspects of healthcare services.

Does Medicare cover dental in Fort Worth, Texas?

Standard Medicare plans, Part A and Part B, do not cover most dental services, including cleanings, fillings, tooth extractions, or dentures. However, some Medicare Advantage plans (Part C) may offer dental coverage as part of their additional benefits.

What is Medicare Part B?

Medicare Part B is a component of Original Medicare, often called hospital insurance. It covers outpatient care, preventive services, ambulance services, and durable medical equipment. It generally requires a monthly premium and helps pay for medically necessary services and supplies.

How to sign up for Medicare in Fort Worth, Texas?

If you're not automatically enrolled in Medicare, you can sign up during your Initial Enrollment Period, which begins three months before you turn 65, includes your birth month, and ends three months after you turn 65. You can sign up online via the Social Security website, by phone, in person, or by speaking with a Connie Health agent at 1-888-369-12111-888-369-1211. Once enrolled in Medicare Parts A and B, you can explore your Medicare Advantage, Medicare Part D, and Medicare Supplement plan options with your local licensed Connie Heath agent.

What does Medicare Part A cover?

Medicare Part A, also known as hospital insurance, covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home healthcare services. Most people qualify for Part A without paying a premium if they or their spouse have paid Medicare taxes for a certain amount of time while working.

Who is eligible for Medicare?

Individuals who are U.S. citizens or permanent residents are eligible for Medicare at age 65. Under certain conditions, younger individuals with disabilities or those with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis (ALS) may also qualify for Medicare coverage.

How much is Medicare Part B?

The cost of Medicare Part B varies depending on your income. In 2025, the standard Part B premium is $185.00 per month, but it can be higher for individuals with annual incomes above a certain threshold. These thresholds are called Income Related Monthly Adjustment Amounts (IRMAA) and are in addition to the standard Part B premium.

How old do you have to be to get Medicare?

You typically become eligible for Medicare when you turn 65. However, individuals under 65 may qualify if they have specific disabilities or conditions like End-Stage Renal Disease, Amyotrophic Lateral Sclerosis (ALS), or chronic heart failure.

When can I apply for Medicare?

The ideal time to apply for Medicare is during your Initial Enrollment Period, which starts three months before you turn 65 and ends three months after your birth month. Applying during this period helps avoid late enrollment penalties and ensures coverage begins as soon as possible.

Do all doctors accept Medicare in Fort Worth, Texas?

No, not all doctors accept Medicare in Fort Worth. When you choose your Medicare plan, you must also choose a Primary Care Physician (PCP) that accepts Medicare. Connie Health has made it easy to find a trustworthy doctor near you. Don’t spend your time on calls or searches. Instead, enter your address and plan information, if you have it, into Connie Health’s tool. Then, we’ll provide a list of Medicare doctors near you. Don’t stress about finding a doctor or specialist who accepts Medicare. Find your Medicare doctor today.

How to apply for Medicare in Fort Worth, Texas?

You can apply for Medicare in Fort Worth by calling Connie Health at 1-888-369-12111-888-369-1211. A local licensed agent will help you navigate signing up for Original Medicare Parts A and B. They’ll also review your options for expanding your Medicare coverage.

What is the best Medicare Supplement plan in Fort Worth, Texas?

The best Medicare Supplement plan is the one that best suits your health and budget needs. In Fort Worth, Texas, the two most popular Medicare Supplement plans are Plan G or Plan F offered by these popular insurance companies: AARP - UnitedHealthcare, BlueCross BlueShield of Texas. You may want to explore these plan types and companies to see if they suit your unique Medicare needs.

What is the best Medicare Advantage plan in Fort Worth, Texas?

There isn’t an overall best Medicare Advantage plan because your health choices are unique to your health and budget. There is no “best plan” because what serves your neighbor likely won’t serve you best. Medicare isn’t one-size-fits-all.

How do I compare Medicare plans in Fort Worth, Texas?

You can compare Medicare plans online or with a licensed Connie Health agent in Fort Worth, Texas. A local licensed agent can discuss your Medicare plan options via phone, in person, or video chat, whichever you prefer. Call 1-888-369-12111-888-369-1211 to schedule an appointment or review your Medicare plan options online.

Where can I get more information about Medicare plans in Fort Worth, Texas?

More information about Medicare plans in Fort Worth is available by calling 1-888-369-12111-888-369-1211 and speaking with a local licensed agent in your area. You can make an appointment to talk in person, over the phone, or by video chat. Or by reviewing Medicare plan options online.

Medicare plans may be available in the following zip codes in the Fort Worth, Texas. 76101, 76102, 76103, 76104, 76105, 76106, 76107, 76109, 76110, 76111, 76112, 76113, 76114, 76115, 76116, 76118, 76119, 76120, 76121, 76122, 76123, 76124, 76129, 76130, 76131, 76132, 76133, 76134, 76135, 76136, 76137, 76140, 76147, 76148, 76150, 76155, 76161, 76162, 76163, 76164, 76166, 76179, 76181, 76185, 76190, 76191, 76192, 76193, 76195, 76196, 76197, 76198, 76199

“2023 Medicare Supplement Loss Ratios.” National Association of Insurance Commissioners.

“Fact sheet - Medicare Open Enrollment, 2025,” CMS.gov.

“Find a Medigap policy that works for you.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

“Monthly PDP Enrollment by State/County/Contract.” Medicare.gov.

“Prescription Drug Coverage - General Information.” CMS.gov.

“Social Security Office Locator.” The Official Website of the U.S. Social Security Administration.

“The State of Medicare Supplement Coverage.” AHIP.

Last updated: October 21, 2025