Medicare in Waterloo, Nebraska 2024

Save money and get better coverage from your Medicare plan.

Find the right Medicare plan for you

- 2024 Medicare Facts for Waterloo

- What is Medicare?

- Medicare Plans in Waterloo

- When to Enroll in a Medicare Plan in Waterloo

- Doctors Near Me Accepting Medicare: Waterloo, Nebraska

- Frequently Asked Questions

Want to discover how to sign up for Medicare in Waterloo, Nebraska or what plans are available? You’ve come to the right place. Connie Health gathered the vital details you need to sign up for Medicare, your plan options in Waterloo, Douglas County, and Medicare providers in your area.

2024 Medicare Facts for Waterloo

Original Medicare (Parts A & B)

- There are 97,548 Medicare-eligible people living in Waterloo, Nebraska.

- Most Medicare beneficiaries pay $0 for their Medicare Part A premium. For those that pay a premium, it's $0 or $505 each month, depending on how long you or your spouse worked and paid Medicare taxes.

- The Medicare Part A deductible is $1,632 before Original Medicare starts to pay for inpatient hospital stays, plus copayments.

- The majority of Medicare beneficiaries pay for their Medicare Part B coverage. The standard Part B premium is $174.70 per month. Your Part B premium could be higher because of your income (IRMAA).

- The Medicare Part B deductible is $240 annually before Original Medicare starts to pay, plus 20% coinsurance for all Medicare-approved services.

Medicare Part C (Medicare Advantage)

- Of the 97,548 Medicare beneficiaries, there are 43,782 enrolled in a Medicare Advantage plan in Waterloo. That’s 44.88% of those enrolled in Medicare in Waterloo.

- All Medicare eligibles have access to a $0 premium Medicare Advantage plan, and there are 20 $0 premium plans in Waterloo.

- If you pay a premium for a Medicare Advantage plan, the average cost is $44.53 per month. And the average out-of-pocket max is $4,677.78 per year.

Read more about Medicare Advantage plans in Waterloo.

Speak with a local licensed insurance agent

M-F 9am - 5pm

No obligation to enroll

(TTY: 711)

Medicare Part D (Prescription drug coverage)

- You have 22 Medicare Part D prescription drug plans to choose from in Waterloo.

- Medicare Part D premiums range from $0.50 to $123.50 per month in Waterloo. The price depends on whether you enroll in a basic or enhanced benefit plan, and your prescription drug needs.

- The average monthly stand-alone Part D premium in Waterloo is $53.77.

- There are 15 plans available in Waterloo that Medicare rated three stars or higher.

- 18.42% of Medicare eligibles with a stand-alone Part D plan get Extra Help.

Read more about Medicare Part D plans in Waterloo.

Medicare Supplement (Medigap)

- There are 12 Medicare Supplement plan types to choose from in Waterloo. These include Medicare Supplement Plan A, Plan B, Plan C, Plan D, Plan F, Plan F high-deductible, Plan G, Plan G high-deductible, Plan K, Plan L, Plan M, and Plan N.

- The cost of a Medicare Supplement plan in Waterloo ranges from $40 to $1,478 depending on the Plan Type you choose, your age, sex, whether you smoke, and when you enroll.

- The annual prescription drug deductible ranges between $0 - $545 in Waterloo, Nebraska.

Read more about Medicare Supplement plans in Waterloo.

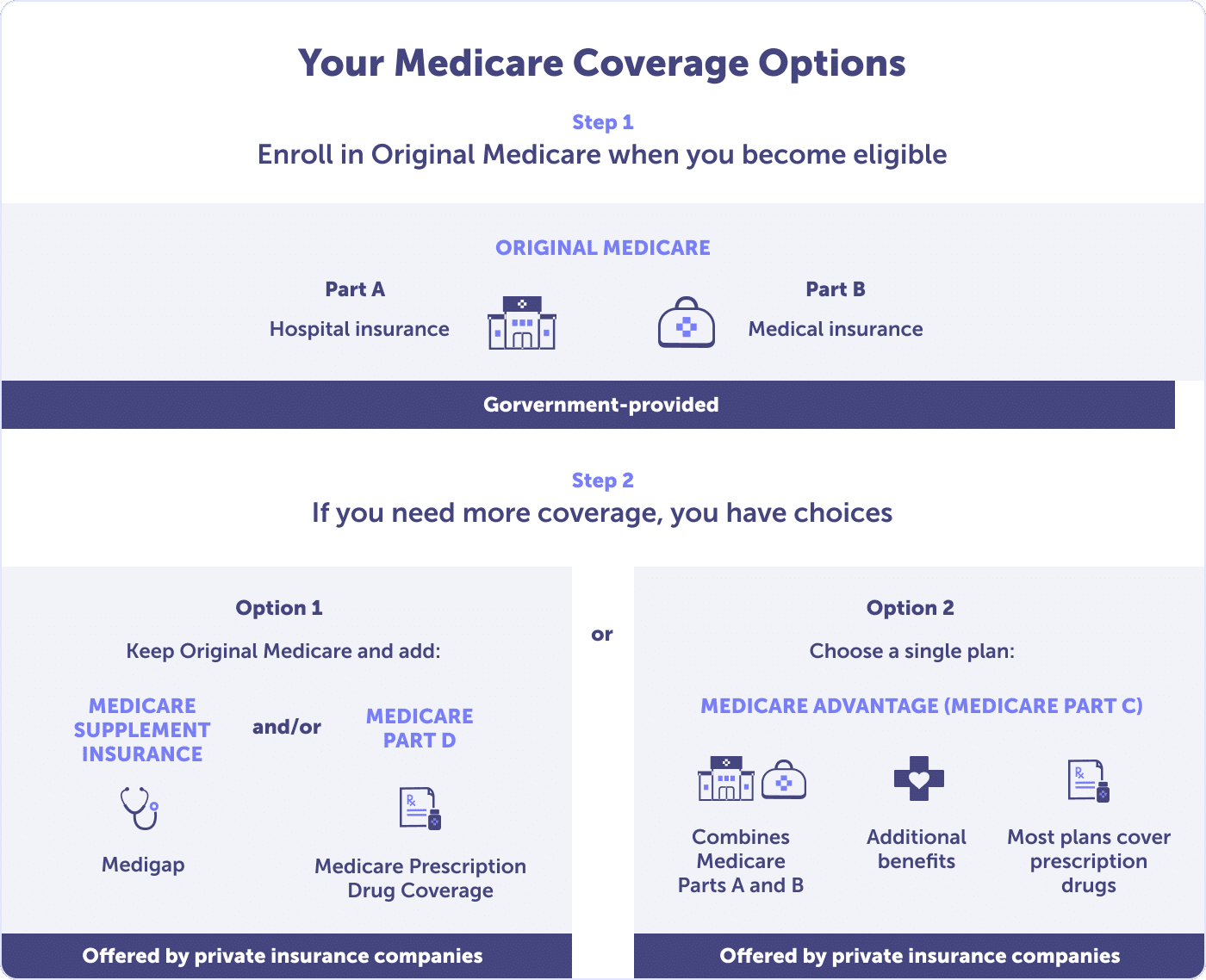

What is Medicare?

Medicare is a health insurance program created by the government. There are 27.9 million people who have Medicare in the United States. And there are 97,548 Medicare-eligible people in Waterloo. If you're eligible for Medicare, this means that you're in good company.

People who are 65 years old or older, certain younger people with disabilities, and individuals with End-Stage Renal Disease (ESRD) or other qualified illnesses can get help from Medicare to pay for medical costs like doctor visits, hospital stays, and other treatments.

Medicare Plans in Waterloo

Original Medicare (Part A and B) is the most basic coverage offered by the government for people who are eligible for Medicare. You enroll in Medicare Part A and Medicare Part B when you first become eligible for Medicare.

There are also plan options that expand Original Medicare coverage. These options include Medicare Advantage (Part C), stand-alone Medicare Prescription Drug Coverage (Part D), and Medicare Supplement (Medigap) plans.

Most people enrolled in Medicare expand their coverage because Original Medicare doesn’t have an out-of-pocket maximum. Without expanded coverage, you could expose yourself to high out-of-pocket costs, a financial risk.

By enrolling in a Medicare Supplement and/or a Medicare Part D stand-alone prescription drug plan, you get help with some or all of your Medicare out-of-pocket costs, plus prescription drug coverage.

With a Medicare Advantage plan, you receive your coverage in a single plan: Medicare Parts A and B, and comprehensive dental, vision, and hearing coverage. Plus, most plans include prescription drug coverage. 44.88% of Medicare beneficiaries in Waterloo are enrolled in a Medicare Advantage plan.

When to Enroll in a Medicare Plan in Waterloo

Knowing when to enroll or make plan changes can help you save money.

Enrolling in Medicare for the first time, or are you interested in making a plan change? Skip to the section that applies to you - and mark the dates in your calendar.

Enroll for the First Time

If you’re new to Medicare, the best time to enroll in Medicare is during your Initial Enrollment Period. If you miss that, you can still enroll during the General Enrollment Period (January 1 - March 31) or Special Enrollment Period, but likely with penalties.

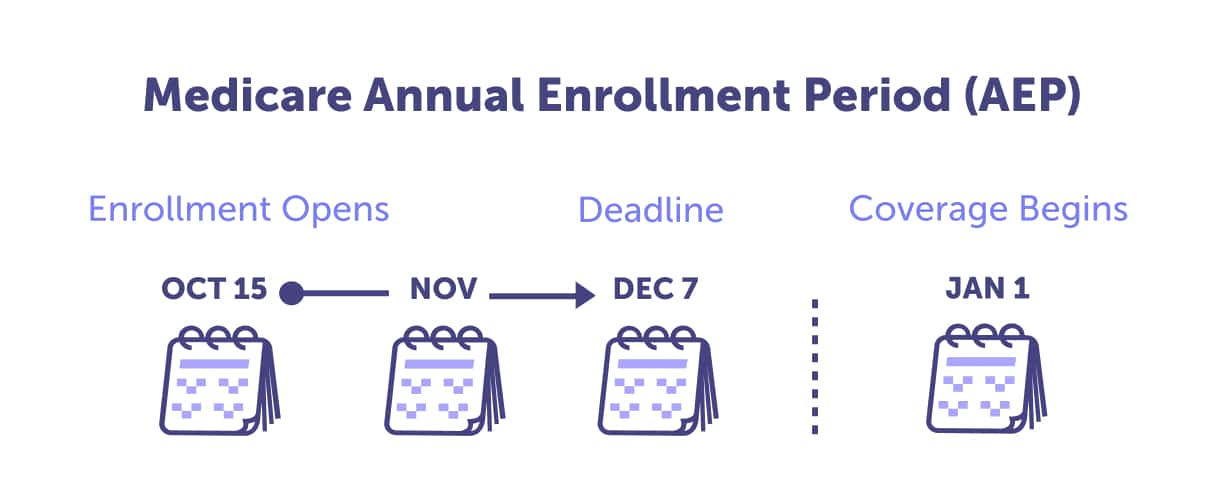

Make A Plan Change

The best time to make a plan change is during the Medicare Annual Enrollment Period (October 15 - December 7). During this time, anyone enrolled in Medicare can review their plan options for the coming year and ensure that their plan choice meets their health and budget needs.

If you need to make a plan change because you moved to a new service area or lost coverage, among other reasons, you could qualify for a Special Enrollment Period.

Whether you’re enrolling for the first time or making a plan change, Medicare in Nebraska can be confusing. You don’t have to sift through your options alone. A local licensed agent can help.

Medicare Doctors Near Me in Waterloo, Nebraska

Having trouble finding doctors that accept your plan? The search for a trustworthy physician can feel overwhelming, but no need to worry. Say goodbye to endless phone calls and time-consuming online searches.

We’ve modernized the process with our convenient online platform. Enter your address and plan information, and let Connie Health do the heavy lifting. We'll locate Medicare doctors near you.

Why Connie Health

Local licensed insurance agents:

Independent agents, who live and work in your community, can help you access the best care for you in your area.

Compare all major insurance:

Our technology will help you find the plan that best fits your budget and health needs.

Our service is free:

You receive unbiased advice since our agents receive the same commission regardless of the insurance plan selected.

Ongoing support:

Once you have selected an insurance plan, your dedicated team will help you use your benefits and answer your questions.

Speak with a local licensed insurance agent

M-F 9am - 5pm

No obligation to enroll

(TTY: 711)

Frequently Asked Questions

Medicare has national offices in Maryland and Washington, D.C., and ten regional offices in the United States. Medicare does not operate in local offices, but you can apply for Medicare at any local Social Security office or through Connie Health. Also, most questions can be answered through the Social Security Administration’s toll-free phone number 1-800-772-1213 or by speaking with a Connie Health local licensed Medicare agent at 1-888-369-1211.

Don’t stress about finding a doctor or specialist who accepts Medicare. Find your Medicare doctor today.

Medicare plans may be available in the following zip codes in Waterloo, Nebraska: 68069.

Sources

“2021 Medicare Supplement Loss Ratios.” National Association of Insurance Commissioners.

“Fact sheet - Medicare Open Enrollment, 2024” CMS.gov.

“Find a Medigap policy that works for you.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

“Monthly PDP Enrollment by State/County/Contract.” Medicare.gov.

“Prescription Drug Coverage - General Information.” CMS.gov.

“Social Security Office Locator.” The Official Website of the U.S. Social Security Administration.

“The State of Medicare Supplement Coverage.” AHIP.

Last updated: December 9, 2024