Shannon is located in Carroll County. Connie Health gathered the Medicare Supplement plan costs and coverage information that matters most to you. Continue reading to discover the top five Medicare Supplement plans in Shannon, which plan may be right for your health and budget, and when and where to sign up.

10.44% of Medicare beneficiaries are enrolled in a Medigap (Medicare Supplement) plan in Illinois.

12 Medicare Supplement plan types exist in Shannon. These include Medicare Supplement Plan A, Plan B, Plan C, Plan D, Plan F, Plan F high-deductible, Plan G, Plan G high-deductible, Plan K, Plan L, Plan M, and Plan N.

The cost of a Medicare Supplement plan in Shannon ranges from $126 to $844 depending on the Plan you choose, your age, sex, whether you smoke, and when you enroll.

The five most popular Medicare Supplement plans in Shannon, by Medicare beneficiary enrollment, are Plan F, Plan G, Plan N, Plan D, and Plan C.

A Medigap and Medicare Supplement plan’s central role? To help cover some or all of the healthcare costs that Original Medicare Part A (hospital services) and Part B (preventive and medical services) don't fully cover. These supplement plans may be called Medigap or Medicare Supplement but refer to the same type of Medicare plan.

Original Medicare does a lot, but it doesn't cover everything. For instance, with Medicare Part B, 80% of the coinsurance costs are covered for Medicare-approved amounts, leaving enrollees to handle the remaining 20% of coinsurance. On top of that, there are deductibles and copayments to consider, and there's no cap on out-of-pocket spending. This is where a Medigap plan steps in.

Pairing a Medicare Supplement plan with Original Medicare Parts A and B provides robust coverage, enabling you to focus on enjoying life with less worry about healthcare costs. Here are the top 3 advantages of enrolling in a Medicare Supplement plan:

If you value having a clear picture of your healthcare expenses, a Medicare Supplement plan works with Original Medicare (Parts A and B) to cover some or all out-of-pocket costs, such as deductibles, coinsurance, and copayments.

This plan allows you to seek treatment from any hospital, doctor, or provider nationwide that accepts Medicare, offering unmatched flexibility.

Medigap becomes an attractive alternative if you prefer not to enroll in a Medicare Advantage plan in Illinois.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

The five top Medicare Supplement plans in Illinois are Plan F , Plan G , Plan N , Plan D , Plan C . This is based on the Medigap enrollment in Illinois. However, your chosen plan should be tailored to your health and budget needs. The chart below shows which Medigap plans Medicare beneficiaries enroll in most.

According to Medicare beneficiary enrollment in Shannon, Illinois, these five insurance companies enroll the most people in Medicare Supplement plans. Each insurance company offers varying levels of customer service and differing premium costs. These are insurance companies that you could consider when weighing your enrollment options.

| # | Insurance Company |

|---|---|

| 1 | BlueCross BlueShield of Illinois |

| 2 | AARP - UnitedHealthcare |

| 3 | Mutual of Omaha |

| 4 | Aetna Health Insurance Company |

| 5 | Cigna National Health Insurance Company |

Now that you know the most popular plans and insurance companies in Shannon, Illinois, see which insurance companies offer the plan you’re interested in.

| # | Insurance Company Name | Most Popular Plans Offered by Top Insurance Companies | ||||

|---|---|---|---|---|---|---|

| 1 | BlueCross BlueShield of Illinois | Plan F | Plan G | Plan N | ||

| 2 | AARP - UnitedHealthcare | Plan F | Plan G | Plan N | Plan C | |

| 3 | Mutual of Omaha | Plan F | Plan G | Plan N | ||

| 4 | Aetna Health Insurance Company | Plan F | Plan G | Plan N | ||

| 5 | Cigna National Health Insurance Company | Plan F | Plan G | Plan N | ||

| Benefits | Medigap Plan B | Medigap Plan C | Medigap Plan F | Medigap Plan G | Medigap Plan K | Medigap Plan N |

|---|---|---|---|---|---|---|

| Part A coinsurance and hospital stay costs |

|

|

|

|

|

|

| Part B copays and coinsurance |

|

|

|

|

50% |

(up to $20 office / $50 ER copayments) |

| Blood (first 3 pints) |

|

|

|

|

50% |

|

| Part A hospice care coinsurance or copayment |

|

|

|

|

50% |

|

| Skilled nursing facility care coinsurance |

|

|

|

|

50% |

|

| Part A deductible |

|

|

|

|

50% |

|

| Part B deductible |

|

|

|

|

|

|

| Part B excess charges |

|

|

|

|

|

|

| 80% of foreign travel healthcare emergencies |

|

80% |

|

|

|

|

| Out-of-pocket maximum in 2025 | N/A | N/A | N/A | N/A | $7,220 in 2025 | N/A |

Before learning about Medigap Plan F, remember that Medigap Plan F is no longer available to people who became Medicare-eligible on or after January 1, 2020. Medigap Plan F could still be possible if you became Medicare-eligible before January 1, 2020. If not, Plan G is the closest alternative to Plan F.

In Illinois, over 361,620 or 47.22% of Medigap enrollees have chosen Medicare Supplement Plan F for their healthcare coverage needs, making it a popular choice among the community. This preference is primarily attributed to the comprehensive coverage that Medigap Plan F offers.

With Medigap Plan F, you'll likely not have to worry about out-of-pocket costs for covered Medicare services. This level of coverage makes Plan F a favored option – it provides peace of mind and security against unforeseen medical bills, which can be particularly reassuring.

It's important to note that Plan F is considered one of the more premium options in terms of cost, with monthly premiums ranging between $126 - $844 per month. However, many find that the price is justified by the breadth of coverage it offers. Investing in Plan F can be seen as safeguarding against potential medical expenses that could significantly impact your finances, providing a safety net that many Medicare enrollees value.

In addition to Medigap Plan F covering 80% of foreign travel health emergencies, Plan F covers 100% of the following costs:

Part A coinsurance and hospital stay costs.

Part B copays and coinsurance.

Blood (first three pints).

Part A hospice care coinsurance or copayment.

Skilled nursing facility care coinsurance.

Part A deductible.

Part B deductible.

Part B excess charges.

80% foreign travel health emergencies. Deductible and limitations apply.

In Illinois, many Medicare enrollees are making a wise choice for their healthcare needs. Over 309,834 or 40.46% of Medigap enrollees in Illinois have turned to Medicare Plan G, making it a standout option in the community.

But what's the draw? Plan G shields enrollees from surprising and often substantial medical expenses. It achieves this by covering the costs that Original Medicare does not, except for the Medicare Part B deductible. Once you’ve met your Part B deductible, Medigap Plan G will cover copayments, coinsurance, and deductibles for Medicare Parts A and B. If you’re not eligible for Plan F, Plan G offers the second most comprehensive coverage and is often the most popular Plan F alternative.

Each coverage choice is made by considering the costs. Fortunately, Plan G is designed with affordability in mind. Medicare Supplement Plan G premiums range between $105 - $734 per month. While premiums can vary based on factors like your age, gender, smoking history, and more, many find Medigap Plan G a cost-effective solution. Shopping around and comparing plans from different insurance companies is essential to get the best rate.

In addition to Medigap Plan G covering 80% of foreign travel health emergencies, Plan G covers 100% of the following costs:

Part A coinsurance and hospital stay costs.

Part B copays and coinsurance.

Blood (first three pints).

Part A hospice care coinsurance or copayment.

Skilled nursing facility care coinsurance.

Part A deductible.

Part B excess charges.

80% foreign travel health emergencies. Deductible and limitations apply.

In Illinois, Medigap Plan N is a popular option among Medicare beneficiaries looking for supplementary Medicare insurance. With approximately 55,410, or 7.24% of Medigap enrollees choosing Plan N, it's clear that this plan has struck a chord with those seeking additional coverage. While it may not offer comprehensive coverage, like Plan F or Plan G, Medigap Plan N provides considerable protection at a cost that many find reasonable.

Plan N's appeal stems from its ability to protect against medical expenses without breaking the bank. Medicare Supplement Plan N premiums range from $79 - $542 per month. Plan N represents a middle ground for those who need more than what Original Medicare offers but are looking for a more affordable option. As you consider your insurance needs, remember the importance of weighing the benefits against the costs to find the right plan for you.

This is what Medigap Plan N covers at 100%:

Part A coinsurance and hospital stay costs.

Part B coinsurance (copayments are up to $20 per office visit and up to $50 per emergency room visit; waived if admitted).

Blood (first three pints).

Part A hospice care coinsurance or copayment.

Skilled nursing facility care coinsurance.

Part A deductible.

80% foreign travel health emergencies. Deductible and limitations apply.

In Illinois, Medigap Plan C is a highly regarded option among Medicare beneficiaries seeking additional coverage. Its comprehensive benefits and robust protection against out-of-pocket costs have become a favorite for those looking to enhance their Original Medicare coverage. While Medigap Plan C is not available to individuals newly eligible for Medicare after January 1, 2020, those already eligible before that date can still enroll and enjoy its extensive benefits. If not, Medigap Plan D and Plan G are your closest Medigap alternatives.

Medigap Plan C stands out for its ability to cover a wide range of medical expenses, offering peace of mind to policyholders. Medicare Supplement Plan C premiums generally range from $137 - $587 per month, depending on factors such as location and provider. Plan C balances comprehensive coverage and predictable costs for those who qualify, making it a solid choice for Medicare beneficiaries focused on reducing financial uncertainty. When evaluating your options, understanding a plan's benefits and costs is critical in determining the best fit for your healthcare needs.

This is what Medigap Plan C covers at 100%:

Part A deductible.

Part A coinsurance and hospital costs.

Part A hospice care coinsurance or copayment.

Part B deductible.

Part B coinsurance or copayment.

Skilled nursing facility care coinsurance.

First three pints of blood.

80% of foreign travel healthcare emergencies (deductible and limitations apply).

In Illinois, Medigap Plan K is a viable option for Medicare beneficiaries seeking supplementary Medicare insurance at a lower cost. With its focus on cost-sharing, Plan K appeals to individuals seeking affordable coverage while maintaining some financial responsibility for their care. Though it doesn't provide comprehensive coverage of options like Plan F or Plan G, it strikes a balance for those looking to save on premiums while still receiving essential medical support.

Medigap Plan K stands out due to its lower premium rates, which typically range from $65 - $216 per month, making it one of the more budget-friendly options. Covering a percentage of certain costs rather than the full amount, Plan K can reduce out-of-pocket expenses without committing to higher monthly premiums. Plan K is worth considering for those comfortable with some cost-sharing and seeking an affordable path to extra coverage.

Here’s what Medigap Plan K covers:

50% coverage for the Part A deductible.

100% coverage for Part A coinsurance and hospital stay costs.

50% coverage for Part A hospice care coinsurance or copayment.

50% coverage for Part B coinsurance or copayment.

50% coverage for skilled nursing facility care coinsurance.

50% coverage for blood (first three pints).

Additionally, Plan K includes an out-of-pocket annual limit, which provides a financial safety net. Once this limit is reached, Plan K will cover 100% of the services for the remainder of the year. This feature ensures peace of mind for beneficiaries facing higher medical costs within a year.

In Illinois, Medigap Plan B is a reliable choice for Medicare beneficiaries seeking supplementary Medicare insurance. With a smaller but significant number of enrollees opting for Plan B, this plan offers a straightforward and valuable option for additional coverage. While it doesn't provide as extensive coverage as Plans F or G, Medigap Plan B strikes the right balance for those looking for essential protection at a manageable cost.

Medigap Plan B appeals to beneficiaries who prefer simplicity and targeted coverage. The monthly premiums for Medigap Plan B typically range from $137 - $465 per month, offering an affordable option for those who seek more than what Original Medicare covers without taking on comprehensive supplemental insurance. Evaluating your healthcare needs against the benefits of each Medigap plan is critical to making the best choice for your circumstances.

Here’s what Medigap Plan B covers at 100%:

Part A deductible.

Part A coinsurance and hospital stay costs.

Part A hospice care coinsurance or copayment.

Blood (first three pints).

Skilled nursing facility care coinsurance.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

| Benefits | A | B | C | D | F2 | G2 | K | L | M | N |

|---|---|---|---|---|---|---|---|---|---|---|

| Part A coinsurance and hospital stay costs |

|

|

|

|

|

|

|

|

|

|

| Part B copays and coinsurance |

|

|

|

|

|

|

50% | 75% |

|

$20 office/$50 ER |

| Part A hospice care coinsurance or copayment1 |

|

|

|

|

|

|

50% | 75% |

|

|

| Skilled nursing facility care coinsurance |

|

|

|

|

|

|

50% | 75% |

|

|

| Part A deductible |

|

|

|

|

|

|

50% | 75% | 50% |

|

| Part B deductible |

|

|

|

|

|

|

|

|

|

|

| Part B excess charges |

|

|

|

|

|

|

|

|

|

|

| Blood (first 3 pints) |

|

|

|

|

|

|

50% | 75% |

|

|

| Foreign travel health emergencies (up to plan limits) |

|

|

80% | 80% | 80% | 80% |

|

|

80% | 80% |

| Out-of-pocket maximum in 20253 | N/A | N/A | N/A | N/A | N/A | N/A | $7,220 | $3,610 | N/A | N/A |

A notable feature of Medigap plans is their standardization by Medicare. This means that the basic benefits of a particular Medigap plan are the same across all insurance companies.

However, while coverage is standardized, costs are not. The monthly premium for a Medigap plan can vary based on factors such as your age, gender, the insurance company you choose, and your state of residence.

These are the top five Medicare Supplement plans in Shannon, by enrollment. Click on the links below to review more details about the plan.

| # | Medicare Supplement Plan Type | Percentage of Medicare Supplement Enrollees by Plan | Monthly Plan Premium Range (Not including Part B premium) | Part A Deductible (Hospital coverage) | Part B Deductible (Medical coverage) | Part B Copays/Coinsurance |

|---|---|---|---|---|---|---|

| 1 | Plan F | 47.22% | $126 - $844 | $0 | $0 | $0 |

| 2 | Plan G | 40.46% | $105 - $734 | $0 | $257 | $0 |

| 3 | Plan N | 7.24% | $79 - $542 | $0 | $257 | $0 |

| 4 | Plan D | 1.53% | $123 - $507 | $0 | $257 | $0 |

| 5 | Plan C | 1.32% | $137 - $587 | $0 | $0 | $0 |

| Plan Letter | Lowest Plan Premium | Highest Plan Premium |

|---|---|---|

| Medigap Plan A | $96 | $860 |

| Medigap Plan B | $137 | $465 |

| Medigap Plan C | $137 | $587 |

| Medigap Plan D | $123 | $507 |

| Medigap Plan F | $126 | $844 |

| Medigap Plan HDF - High Deductible | $34 | $206 |

| Medigap Plan G | $105 | $734 |

| Medigap Plan HDG - High Deductible | $37 | $262 |

| Medigap Plan K | $65 | $216 |

| Medigap Plan L | $105 | $330 |

| Medigap Plan M | $68 | $347 |

| Medigap Plan N | $79 | $542 |

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

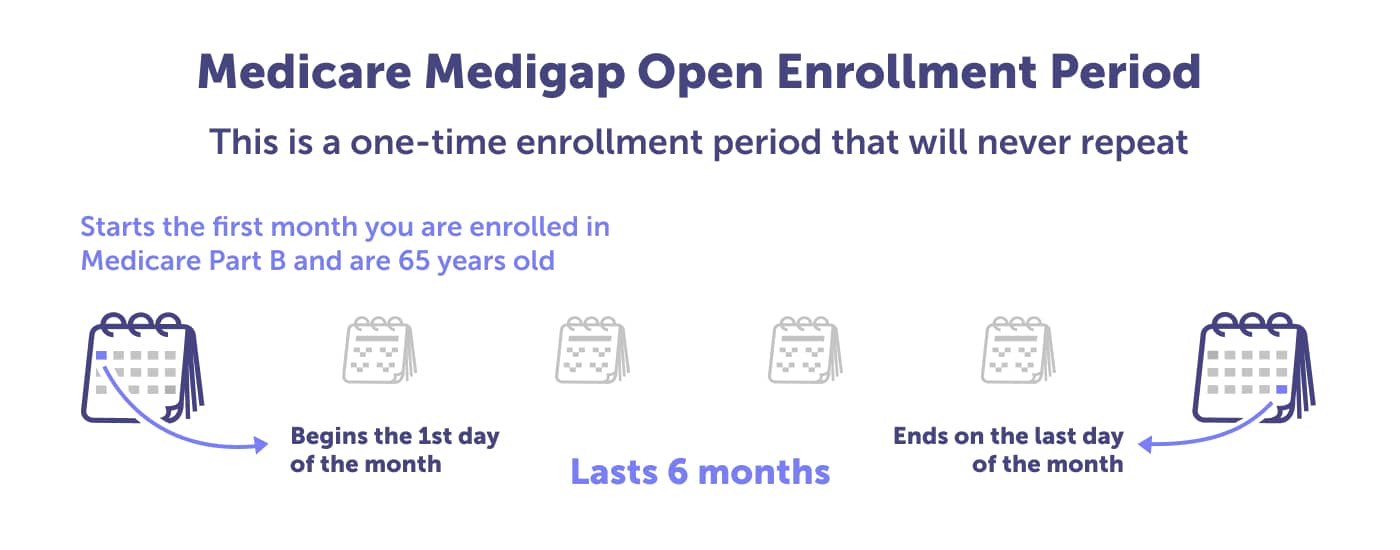

The Medigap Open Enrollment Period is the best time to enroll in a Medigap (Medicare Supplement) plan. This enrollment period only happens once, will never repeat, and is unique to you. It’s the 6-month window beginning when you turn 65 or older and are enrolled in Original Medicare Part B. However, you can apply 60 days before your 65th birthday.

The Medigap Open Enrollment Period is the best enrollment time because you have guaranteed issue rights. Guaranteed Issue Rights means you cannot be denied a policy due to current or past medical conditions. When your Medigap Open Enrollment Period ends, your options to purchase a Medigap policy could be limited, cost more, or be denied coverage due to medical underwriting.

You could sign up for a Medigap plan in several ways. You could choose your plan through Medicare’s website, speak with someone from a local SHIP, enroll directly with an insurance company, or enroll with an insurance broker or agent. We know you have options, and we hope that you’ll contact a local licensed Connie Health agent to speak about your Medicare healthcare needs.

With Connie Health, you can compare Medigap plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medigap plan options via phone, in person (a local place of your choosing), or via video chat, whichever you prefer. Call 1-888-814-11201-888-814-1120 to schedule an appointment or review your Medicare Supplement options online.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

Who is eligible for Medicare Supplement plans in Shannon?

You are eligible to enroll in a Medicare Supplement plan in Shannon once you are 65 years or older, are enrolled in Original Medicare Part A and Part B, and choose a plan available in your state.

What is the 6 month Medigap Open Enrollment Period?

The 6 month Medigap Open Enrollment Period is often called the Medicare Supplement Open Enrollment Period. Your enrollment period begins when you’re 65 or older and enrolled in Original Medicare Part B. The Medigap Open Enrollment Period provides the optimal plan options at the best cost.

What is the best time to enroll in a Medicare Supplement plan in Shannon?

The best time to enroll in a Medicare Supplement plan in Shannon is during the Medicare Supplement Open Enrollment Period (Medigap Open Enrollment Period). This 6-month window begins the month you turn 65 or older and are signed up for Original Medicare Part B. However, you can apply up to 60 days before your 65th birthday.

This is the best time to enroll because you have guaranteed issue rights. That means you must be sold a policy regardless of your current or past medical history. After your Medigap Open Enrollment Period, your options to buy a policy could be limited, cost more, or be denied due to underwriting.

When does Medicare Supplement Open Enrollment take place?

The Medicare Supplement Open Enrollment Period (Medigap Open Enrollment Period) is unique to you. It is a six-month window that begins once you’re enrolled in Original Medicare Part B and are 65 or older.

When is the Medigap Open Enrollment Period?

The Medigap Open Enrollment Period is the best time to enroll in a Medigap plan. It’s a six-month window that begins the month you’re 65 or older and enrolled in Original Medicare Part B.

Can I enroll in a Medicare Supplement plan if I have a pre-existing condition in Shannon?

You may be able to enroll in a Medicare Supplement plan if you have a pre-existing condition. The best time to enroll in a Medicare Supplement plan when you have a pre-existing condition is during the Medicare Supplement Open Enrollment Period (Medigap Open Enrollment Period). Regardless of your pre-existing medical condition, you can enroll in any Medigap plan during this period.

If you try enrolling in a Medigap plan outside the Medigap Open Enrollment Period, the insurance company may require underwriting approval. With underwriting, a Medigap plan may cost more, limit your options, or you may be denied coverage.

What is the best Medicare Supplement plan in Shannon?

There isn’t a best Medicare Supplement plan because your plan should be tailored to you. However, based on enrollment, it’s clear that in Shannon, there is a favorite Medicare Supplement plan. Many consider Medicare Supplement Plan F the best Medicare Supplement plan in Shannon, Illinois.

Can I switch from Medicare Advantage to Medigap?

Yes, you can switch from Medicare Advantage to Medigap, but there are specific rules and timeframes to remember. Generally, you can only make this switch during the Medicare Annual Enrollment Period, which runs from October 15 to December 7 each year. However, switching from a Medicare Advantage plan to Medigap can be more complex. Medigap policies may require medical underwriting unless you are in your Medigap Open Enrollment Period or qualify for a Special Enrollment Period.

Which is better? Medigap or Medicare Advantage?

The choice between Medigap

and Medicare

Advantage depends on your individual healthcare needs and preferences. Medigap, also known as Medicare

Supplement Insurance, helps cover costs not included in Original Medicare, such as copayments and

deductibles. It's ideal for those who want predictable out-of-pocket costs and the flexibility to see any

doctor who accepts Medicare.

On the other hand, Medicare Advantage (Medicare Part C) is an all-in-one

alternative to Original Medicare. These plans often include additional benefits like vision, dental, and

prescription drugs. However, they may have network restrictions, requiring you to use certain doctors and

hospitals. Consider factors such as your budget, healthcare needs, and preferred level of flexibility when

making your decision. Call 1-888-814-11201-888-814-1120, and a local licensed Connie Health agent

can help you

navigate

your Medicare plan choices.

What is the best supplemental insurance for Medicare?

There isn’t a best supplemental insurance for Medicare because your plan choice should be tailored to your health and budget needs. However, based on enrollment, in Shannon, there is a favorite supplemental insurance plan for Medicare. Many consider Medigap Supplement Plan F the best Medicare Supplement plan in Shannon, Illinois. Call 1-888-814-11201-888-814-1120, and a local licensed Connie Health agent can help you navigate your Medicare Suplement plan choices.

What is the best Medigap plan in Shannon, Illinois?

There isn’t a best Medigap plan because your plan should be tailored to you. However, based on enrollment, it’s clear that in that in Shannon, there is a favorite Medigap plan. Many consider Medigap Plan F the best Medigap plan in Shannon, Illinois. Call 1-888-814-11201-888-814-1120, and a local licensed Connie Health agent can help you navigate your Medigap plan choices.

What are the top 5 Medicare Supplement plans in Shannon, Illinois?

The top 5 Medicare Supplement plans in Shannon, based on enrollment numbers, are Plan F, Plan G, Plan N, Plan D, Plan C.

What Medicare Supplement plans are available in Shannon, Illinois?

In Shannon, you have 12 Medicare Supplement plans available to you. These options include the Medicare Supplement Plan A, Plan B, Plan C, Plan D, Plan F, Plan F high-deductible, Plan G, Plan G high-deductible, Plan K, Plan L, Plan M, and Plan N.

Can I buy a Medicare Supplemental plan in Shannon?

Yes, you may be able to buy a Medicare Supplement plan in Shannon. You must first be 65 or older and enrolled in Original Medicare B. The best time to enroll in a Medicare Supplement plan is during the Medicare Supplement Open Enrollment Period.

How much does a Medicare Supplement plan cost in Shannon, Illinois?

Medicare Supplement plans in Shannon can cost between $40 and $1,478. The most popular Medicare Supplement plan in Shannon is Plan F, and the premium for that plan ranges from $126 to $844.

Is Medicare Supplement Plan G available in Shannon?

Yes, Medicare Supplement Plan G is available in Shannon. The best time to enroll in Plan G is during the Medicare Supplement Open Enrollment Period. Otherwise, you may need to go through medical underwriting.

Are prescription drugs covered by Medicare Supplement plans in Shannon?

Medicare Supplement plans sold after 2005 do not cover prescription drugs in Shannon. So, if you’re enrolling in a Medigap plan for the first time, it will not include prescription drug coverage. To get prescription drug coverage through Medicare, you can enroll in a Medicare Part D prescription drug plan. These plans are sold separately. You can call 1-888-814-11201-888-814-1120 to speak with a local licensed Connie Health agent about prescription drug plans that fit your needs.

Can I switch Medicare Supplement plans in Shannon?

You may be able to switch your Medicare Supplement plan; however, underwriting may be required if it’s outside of your Medigap Open Enrollment Period (Medicare Supplement Open Enrollment Period). You should call 1-888-814-11201-888-814-1120 and speak with a local licensed agent. They can help you determine whether you can make a plan change.

Can you change Medicare Supplement plans in Shannon, Illinois without underwriting?

You may be able to change your Medicare Supplement plan in Shannon without underwriting. The best time to avoid medical underwriting is during your Medicare Supplement Open Enrollment Period.

Can I keep my Medicare Supplement Plan if I move to a different city in Illinois?

Medicare Supplement plans are state-wide, meaning you can move throughout the state and keep the same coverage. However, if you move out of state, consult your local licensed agent to discuss whether a plan change is needed. Call 1-888-814-11201-888-814-1120, and a local licensed Connie Health agent can help you navigate your Medicare journey.

How do I compare Medicare Supplement plans in Shannon, Illinois?

You can compare Medicare Supplement plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medicare Supplement options via phone, in person, or video chat, whichever you prefer. Call 1-888-814-11201-888-814-1120 to schedule an appointment or review your Medicare Supplement options online.

Where can I get more information about Medicare Supplement plans in Shannon, Illinois?

More information about Medicare Supplement plans in Shannon is available by calling 1-888-814-11201-888-814-1120 and speaking with a local licensed agent in your area. You can make an appointment to speak in person, over the phone, or by video chat. Or by reviewing Medicare Supplement plan options online.

Medicare Supplement plans may be available in the following zip codes in the Shannon, Illinois. 61078

“2023 Medicare Supplement Loss Ratios.” National Association of Insurance Commissioners.

“2024 The State of Medicare Supplement Coverage.” AHIP.

“2025 Compare Medigap Plan Benefits.” Medicare.gov.

“Find a Medigap policy that works for you.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

Last updated: October 24, 2025