The Best Medicare Supplement Plans in New River, Arizona 2024

Find My Medicare Plan- 2024 Medigap Facts for New River

- What is Medicare Supplement?

- What are the Top 5 Medicare Supplement Plans in Arizona

- Top 5 Medicare Supplement Plans in Arizona

- Comparing Popular Medigap Plan Coverage: Plan F, Plan G & Plan N

- 2024 Costs of the Top 5 Most Popular Medigap Plans in New River, Arizona

- 2024 Coverage of All Medigap Plans in New River, Arizona

- 2024 Costs of Medicare Supplement in New River, Arizona

- When to Enroll in Medicare Supplement in New River, Arizona

- Where to Sign Up for Medicare Supplement (Medigap) in New River, Arizona

- Frequently Asked Questions

Connie Health gathered the Medicare Supplement plan costs and coverage information that matters most to you. Continue reading to discover top five Medicare Supplement plans in New River, which plan may be right for your health and budget, and when and where to sign up.

2024 Medigap Facts for New River

- 24.60% of Medicare beneficiaries are enrolled in a Medigap (Medicare Supplement) plan in Arizona.

- There are 12 Medicare Supplement plan types in New River. These include Medicare Supplement Plan A, Plan B, Plan C, Plan D, Plan F, Plan F high-deductible, Plan G, Plan G high-deductible, Plan K, Plan L, Plan M, and Plan N.

- The cost of a Medicare Supplement plan in New River ranges from $40 to $796 depending on the Plan you choose, your age, sex, whether you smoke, and when you enroll.

- The five most popular plans in New River, by Medicare beneficiary enrollment, are Plan G,Plan F,Plan C,Plan K.

What is Medicare Supplement?

A Medigap and Medicare Supplement plan’s central role? To help cover some or all of the healthcare costs that Original Medicare Part A (hospital services) and Part B (preventive and medical services) don't fully cover. These plans may be called Medigap or Medicare Supplement but refer to the same type of Medicare plan.

Original Medicare does a lot, but it doesn't cover everything. For instance, with Medicare Part B, 80% of the coinsurance costs are covered, leaving enrollees to handle the remaining 20% coinsurance. On top of that, there are deductibles and copayments to consider, and there's no cap on out-of-pocket spending. This is where a Medigap plan steps in.

3 Advantages of Enrolling in a Medicare Supplement Plan

1. Predictability in Costs:

If you value having a clear picture of your healthcare expenses, a Medicare Supplement plan works with Original Medicare (Parts A and B) to cover some or all out-of-pocket costs, such as deductibles and copayments.

2. Freedom of Choice:

This plan allows you to seek treatment from any hospital, doctor, or provider nationwide that accepts Medicare, offering unmatched flexibility.

3. Preference:

Medigap becomes an attractive alternative if you prefer not to enroll in a Medicare Advantage plan in Arizona.

What are the Top 5 Medicare Supplement Plans in Arizona?

1. Medigap Plan F

Before learning about Medigap Plan F, remember that Medigap Plan F is no longer available to people who became Medicare-eligible on or after January 1, 2020. Medigap Plan F could still be possible if you became Medicare-eligible before January 1, 2020. If not, Plan G is the closest alternative to Plan F.

In Arizona, over NaN or 42.96% of Medigap enrollees have chosen Medicare Supplement Plan F for their healthcare coverage needs, making it a popular choice among the community. This preference is largely attributed to the comprehensive coverage that Medigap Plan F offers.

With Medigap Plan F, you'll likely not have to worry about out-of-pocket costs for covered Medicare services. This level of coverage makes Plan F a favored option – it provides peace of mind and security against unforeseen medical bills, which can be particularly reassuring.

In addition to Medigap Plan F covering 80% of foreign travel health emergencies, Plan F covers 100% of the following costs:

It's important to note that Plan F is considered one of the more premium options in terms of cost, with monthly premiums ranging between $143 - $770 per month. However, many find that the price is justified by the breadth of coverage it offers. Investing in Plan F can be seen as safeguarding against potential medical expenses that could significantly impact your finances, providing a safety net that many Medicare enrollees value.

- Part A coinsurance and hospital stay costs.

- Part B copays and coinsurance.

- Blood (first three pints).

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B deductible.

- Part B excess charges.

- 80% foreign travel health emergencies. Deductible and limitations apply.

2. Medigap Plan G

In the state of Arizona, many Medicare enrollees are making a wise choice for their healthcare needs. Over NaN or 43.74% of Medigap enrollees in Arizona have turned to Medicare Plan G, making it a standout option in the community.

But what's the draw? Plan G shields enrollees from surprising and often substantial medical expenses. It achieves this by covering the costs that Original Medicare does not, except for the Medicare Part B deductible. Once you’ve met your Part B deductible, Medigap Plan G will cover copayments, coinsurance, and deductibles for Medicare Parts A and B.

No coverage choice is made without considering the costs. Fortunately, Plan G is designed with affordability in mind. Medicare Supplement Plan G premiums range between $100 - $715 per month. While premiums can vary based on factors like your age, gender, smoking history, and more, many find Medigap Plan G a cost-effective solution. Shopping around and comparing plans from different insurance companies is important to ensure you get the best rate.

In addition to Medigap Plan G covering 80% of foreign travel health emergencies, Plan G covers 100% of the following costs:

- Part A coinsurance and hospital stay costs.

- Part B copays and coinsurance.

- Blood (first three pints).

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B excess charges.

- 80% foreign travel health emergencies. Deductible and limitations apply.

Find the right Medigap Plan for you

3. Medigap Plan N

In Arizona, Medigap Plan N stands out as the third most chosen option among Medicare beneficiaries looking for supplementary Medicare insurance. With approximately NaN, or 7.97% of Medigap enrollees choosing Plan N, it's clear that this plan has struck a chord with those seeking additional coverage. While it may not offer comprehensive coverage, like Plan F or Plan G, Medigap Plan N provides considerable protection at a cost that many find reasonable.

Plan N's appeal stems from its ability to protect against medical expenses without breaking the bank. Medicare Supplement Plan N premiums range from $88 - $532 per month. Plan N represents a middle ground for those who need more than what Original Medicare offers but are looking for a more affordable option. As you consider your insurance needs, remember the importance of weighing the benefits against the costs to find the right plan for you.

This is what Medigap Plan N covers at 100%:

- Part A coinsurance and hospital stay costs.

- Part B coinsurance (copayments are up to $20 per office visit and up to $50 per emergency room visit; waived if admitted).

- Blood (first three pints).

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- 80% foreign travel health emergencies. Deductible and limitations apply.

Comparing Popular Medigap Plan Coverage: Plan F, Plan G & Plan N

| Benefits | Medigap Plan F | Medigap Plan G | Medigap Plan N |

|---|---|---|---|

| Part A coinsurance and hospital stay costs |

|

|

|

| Part B copays and coinsurance |

|

|

($20

office / $50 ER copayments)

($20

office / $50 ER copayments) |

| Blood (first 3 pints) |

|

|

|

| Part A hospice care coinsurance or copayment |

|

|

|

| Skilled nursing facility care coinsurance |

|

|

|

| Part A deductible |

|

|

|

| Part B deductible |

|

|

|

| Part B excess charges |

|

|

|

| 80% of foreign travel healthcare emergencies |

|

|

|

Find the right Medigap Plan for you

Costs of the top 5 Most Popular Medicare Supplement Plans in New River, Arizona

A notable feature of Medigap plans is their standardization by Medicare. This means that the basic benefits of a particular Medigap plan are the same across all insurance companies.

However, while coverage is standardized, costs are not. The monthly premium for a Medigap plan can vary based onfactors such as your age, gender, the insurance company you choose, and your state of residence.

These are the top five Medicare Supplement plans in New River, by enrollment. Click on the links below to review more plan details.

| # | Medicare Supplement Plan Type | Percentage of Medicare Supplement Enrollees by Plan | Monthly Plan Premium Range (Not including Part B premium) | Part A Deductible (Hospital coverage) | Part B Deductible (Medical coverage) | Part B Copays/Coinsurance |

|---|---|---|---|---|---|---|

| 1 | Plan G | 43.74% | $100 - $715 | $0 | $240 | $0 |

| 2 | Plan F | 42.96% | $143 - $770 | $0 | $0 | $0 |

| 3 | Plan C | 1.72% | $147 - $645 | $0 | $0 | $0 |

| 4 | Plan K | 0.49% | $49 - $276 | $816 | $240 | 10% Generally your cost for approved Part B services up to $7,060. Then, you'll pay $0 for the rest of the year. |

2024 Coverage of All Medigap Plans in New River, Arizona

| Benefits | A | B | C | D | F2 | G2 | K | L | M | N |

|---|---|---|---|---|---|---|---|---|---|---|

| Part A coinsurance and hospital stay costs |

|

|

|

|

|

|

|

|

|

|

| Part B copays and coinsurance |

|

|

|

|

|

|

50% | 75% |

|

$20 office/$50 ER |

| Part A hospice care coinsurance or copayment1 |

|

|

|

|

|

|

50% | 75% |

|

|

| Skilled nursing facility care coinsurance |

|

|

|

|

|

|

50% | 75% |

|

|

| Part A deductible |

|

|

|

|

|

|

50% | 75% | 50% |

|

| Part B deductible |

|

|

|

|

|

|

|

|

|

|

| Part B excess charges |

|

|

|

|

|

|

|

|

|

|

| Blood (first 3 pints) |

|

|

|

|

|

|

50% | 75% |

|

|

| Foreign travel health emergencies (up to plan limits) |

|

|

80% | 80% | 80% | 80% |

|

|

80% | 80% |

| Out-of-pocket maximum in 20243 | N/A | N/A | N/A | N/A | N/A | N/A | $7,060 | $3,530 | N/A | N/A |

2 Plans F & G offer a high deductible plan in some states.

3 Plans K & L show how much they'll pay for approved services before you meet out-of-pocket yearly limits and deductibles. After you meet them, the plan will pay for 100% of approved services.

2024 Costs All of Medicare Supplement in New River, Arizona

When to Enroll in Medicare Supplement in New River, Arizona

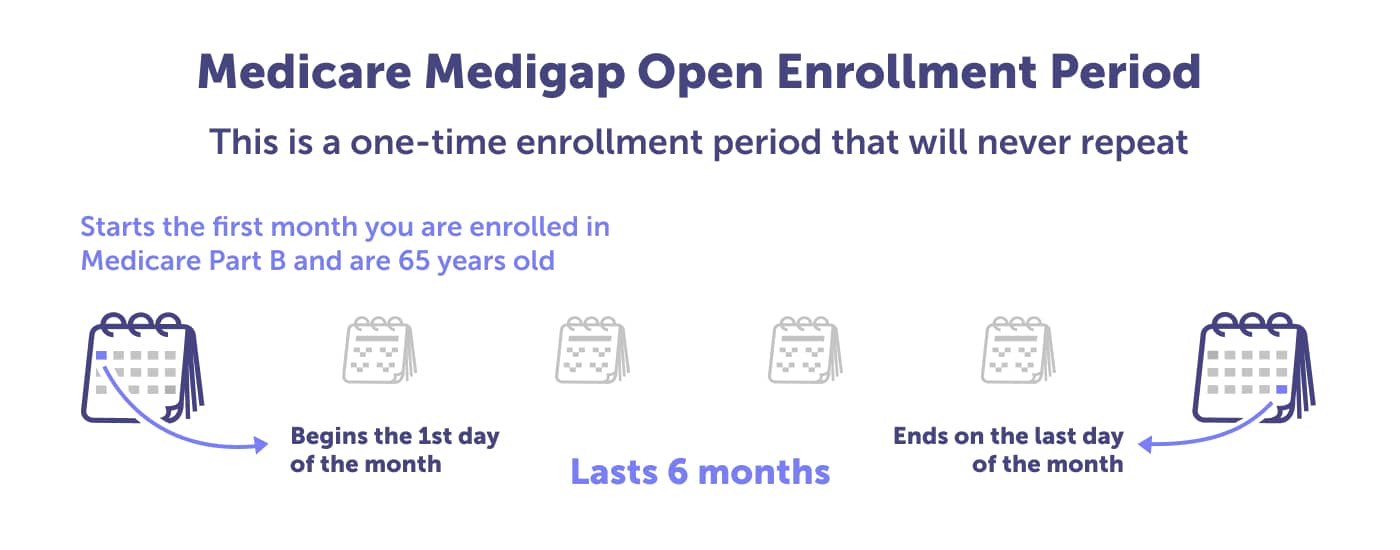

The Medigap Open Enrollment Period is the best time to enroll in a Medigap (Medicare Supplement) plan. This enrollment period only happens once, will never repeat, and is unique to you. It’s the 6-month window beginning when you turn 65 or older and are enrolled in Original Medicare Part B. However, you can submit an application 60 days before your 65th birthday.

The Medigap Open Enrollment Period is the best enrollment time because you have guaranteed issue rights. Guaranteed Issue Rights means you cannot be denied a policy due to current or past medical conditions. When your Medigap Open Enrollment Period ends, your options to purchase a Medigap policy could be limited, cost more, or be denied coverage due to medical underwriting.

Where to Sign Up for Medicare Supplement (Medigap) in New River, Arizona

You could sign up for a Medigap plan in several ways. You could choose your plan through Medicare’s website, speak with someone from a local SHIP, enroll directly with an insurance company, or enroll with an insurance broker or agent. We know you have options, and we hope that you’ll contact a local licensed Connie Health agent to speak about your Medicare healthcare needs.

With Connie Health, you can compare Medigap plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medigap plan options via phone, in person (a local place of your choosing), or via video chat, whichever you prefer. Call 1-888-814-1120 to schedule an appointment or review your Medicare Supplement options online.

Why Connie Health

Local licensed insurance agents:

Independent agents, who live and work in your community, can help you access the best care for you in your area.

Compare all major insurance:

Our technology will help you find the plan that best fits your budget and health needs.

Our service is free:

You receive unbiased advice since our agents receive the same commission regardless of the insurance plan selected.

Ongoing support:

Once you have selected an insurance plan, your dedicated team will help you use your benefits and answer your questions.

Frequently Asked Questions

This is the best time to enroll because you have guaranteed issue rights. That means you must be sold a policy regardless of your current or past medical history. After your Medigap Open Enrollment Period, your options to buy a policy could be limited, cost more, or be denied due to underwriting.

If you try enrolling in a Medigap plan outside the Medigap Open Enrollment Period, the insurance company may require underwriting approval. With underwriting, a Medigap plan may cost more, limit your options, or you may be denied coverage.

Medicare Supplement plans may be available in the following zip codes in New River, Arizona: 85087.

Sources

“2022 Medicare Supplement Loss Ratios.” National Association of Insurance Commissioners.

“2024 Compare Medigap Plan Benefits.” Medicare.gov.

“Find a Medigap policy that works for you.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

“The State of Medicare Supplement Coverage.” AHIP.

Last updated: December 1, 2024