Understanding the details of Medicare prescription drug plans is crucial for those nearing 65 or currently on Medicare, as it can help you avoid unnecessary costs and anxiety. Connie Health gathered the Medicare Part D prescription drug plan costs and coverage information that matters most to you.

Continue reading to discover eligibility requirements, coverage, costs, the best Medicare Part D plan options in Newton, how to enroll in a Medicare prescription drug plan, and the Extra Help program.

In Newton, you can select from 17 different Medicare Part D prescription drug plans.

of Medicare beneficiaries have access to prescription drug coverage at a lower cost than in 2024. This is why it’s critical that you have your prescription drug plan reviewed by a licensed agent.

The monthly premiums for Medicare prescription drug plans in Newton vary, ranging from $0.00 to $125.80, based on whether you opt for a basic or enhanced benefit plan and your specific prescription drug needs.

The typical monthly premium for stand-alone Part D in Newton is approximately .

The average annual deductible for a stand-alone Part D plan in Newton is .

There are plans in Newton that have earned a Medicare rating of three stars or more.

of those eligible for Medicare with a stand-alone Part D plan receive Extra Help in Illinois.

Medicare Part D is a voluntary health insurance program the federal government runs to assist Medicare recipients with covering the costs of their prescription drugs. Although private insurers offer these plans, they are overseen by the Centers for Medicare and Medicaid Services (CMS).

Part D mainly covers outpatient prescription drugs, while Original Medicare Parts A and B handle most inpatient medication needs.

Through Medicare Part D, people with Medicare can access various prescription drugs, ensuring they receive the necessary medications without the total financial burden falling on their shoulders.

You have two main pathways to choose a Medicare drug plan depending on your existing Medicare health care coverage: Medicare Part D drug plans and Medicare Advantage plans.

If you've already signed up for Original Medicare Parts A and B, you can join a separate Medicare Part D plan specifically for prescription drugs. Often, people enhance this setup with a Medicare Supplement plan for additional coverage. In Newton, of Medicare beneficiaries are enrolled in a standalone Medicare Part D plan.

Learn more about Medicare Supplement plans in Newton, Illinois.

For those enrolled in Medicare Parts A and B, there's an option to enroll in a Medicare Part C plan, commonly known as Medicare Advantage. These plans are required to offer the same level of coverage as Original Medicare and might include extra features like dental, vision, and hearing services.

Most Medicare Advantage plans come bundled with a Part D prescription drug plan, a Medicare Advantage Prescription Drug (MAPD) plan. In Newton, 50.00% of beneficiaries are enrolled in a Medicare Advantage Prescription Drug plan. When considering a Medicare Part C plan, review its formulary to verify that your medications are covered at an affordable price.

It's crucial to understand that once you choose a Medicare Advantage plan, you typically can't enroll in a separate stand-alone Medicare Part D plan—except in specific situations. Some Medicare Advantage plans do not include drug coverage, so choose a plan that meets your needs.

Learn more about Medicare Advantage plans in Newton, Illinois.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

Medicare Part D plans offer varied coverage but must include a comprehensive range of prescription drugs that most beneficiaries might need. Each Part D plan must offer at least a couple of medications from most drug categories and cover all medications within certain protected classes. These protected classes include:

Medicare Part D plans typically cover most vaccines that Original Medicare Part B does not.

Each Medicare Part D plan has its list of covered medications known as a “formulary." Reviewing this list to ensure your prescriptions are covered before enrolling is crucial. If you are enrolled and your specific drug is missing from the formulary, you have several options, including requesting an exception, paying out-of-pocket, or filing an appeal.

Remember that Medicare drug plans can update their formularies; changes might occur due to Medicare directives, advancements in drug therapies, the introduction of new medications, or new medical insights. Consequently, reviewing your Part D plan’s coverage annually is prudent. The best time to review your plan is during the Medicare Annual Enrollment Period that runs from October 15th through December 7th annually.

Within a plan’s formulary are different coverage levels known as "tiers," each with varying costs. Drugs in lower tiers usually have lower copayments than those in higher tiers.

Here's a typical example of Medicare Part D plan tiers, though they can differ between plans:

When evaluating your medication choices, consider opting for generic drugs. The FDA (Food and Drug Administration) assures that generics are equivalent to brand-name drugs in dosage, safety, strength, administration route, quality, performance characteristics, and intended use. Thus, choosing generics can lead to significant cost savings without compromising effectiveness.

When you sign up for Medicare Part D prescription drug coverage, you can encounter various costs such as premiums, annual deductibles, copayments, and coinsurance. These expenses can vary based on your chosen plan and the medications you require.

Most Medicare Part D plans have a monthly premium fee, although some offer a $0 premium option. The cost can change annually, making it crucial to review your plan each year to ensure the coverage and costs meet your budget needs. Premiums are established with the approval of the Centers for Medicare and Medicaid Services (CMS), and they can differ depending on your selected plan.

For 2025, CMS has set the national average premium for stand-alone Medicare Part D plans at . The average monthly Medicare Part D premium in Newton is . That’s a difference of between the national average and Newton average premium.

However, your monthly payment will depend on your specific plan selection. Medicare Part D premiums in Newton, Illinois range from $0.00 to $125.80.

If you choose a Medicare Advantage plan (Part C) that includes drug coverage (or Medicare Advantage Prescription Drug plan), your prescription drug premium will be bundled with your Medicare Advantage premium. You can have this premium deducted from your Social Security or Railroad Retirement Board payments or receive a direct bill. Ensure you communicate your billing preferences with your plan, as it may take a few months to start.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

High-income earners may face an additional premium known as the Medicare Part D Income-Related Monthly Adjustment Amount (IRMAA). This extra amount is based on your tax return from two years prior. You might be eligible to appeal this adjustment if you’ve experienced a significant life change affecting your income.

Review the table below to determine if you’ll pay a Medicare Part D IRMAA.

If your filing status and yearly income in 2023 was:

| File individual tax return | File joint tax return | File married & separate tax return | You pay each month (2025) |

|---|---|---|---|

| $106,000 or less | $212,000 or less | $106,000 or less | Your plan premium |

| Above $106,000 up to $133,000 | Above $212,000 up to $266,000 | Not applicable | $13.70 + your plan premium |

| Above $133,000 up to $167,000 | Above $266,000 up to $334,000 | Not applicable | $35.30 + your plan premium |

| Above $167,000 up to $200,000 | Above $334,000 up to $400,000 | Not applicable | $57.00 + your plan premium |

| Above $200,000 and less than $500,000 | Above $400,000 and less than $750,000 | Above $106,000 and less than $394,000 | $78.60 + your plan premium |

| $500,000 or above | $750,000 or above | $394,000 or above | $85.80 + your plan premium |

Most Medicare Part D plans include an annual deductible, which you must pay out-of-pocket before your plan starts covering your prescriptions. For 2025, the maximum deductible is , as determined by CMS (Centers for Medicare and Medicaid Services).

Some plans offer a $0 deductible, and others might cover specific medications before reaching the deductible threshold. The Annual Drug Deductible in Newton can range from . The average Medicare Part D deductible in Newton is annually.

After meeting your deductible, your plan will begin sharing costs. Copayments or coinsurance are your share of the prescription cost, with the plan covering the rest. These costs can fluctuate due to changes in drug prices or newly available generic options. Opting for generics at preferred pharmacies can significantly reduce your expenses.

In 2025, Medicare introduced a $2,000 cap on out-of-pocket drug costs. You'll qualify for catastrophic coverage once you and your prescription drug plan collectively spend $2,000 on Medicare-approved medications. After that, you won’t pay out-of-pocket for Part D covered medications for the rest of the year.

This marks a significant change compared to previous years. Before, Part D enrollees faced an out-of-pocket threshold, entered a coverage gap (commonly called the "donut hole"), and transitioned to catastrophic coverage once they hit the limit. The catastrophic coverage maximum in 2024 was $8,000, so this new $2,000 cap could save individuals who depend on high-cost prescriptions up to $6,000 annually in out-of-pocket expenses.

However, these savings may come with trade-offs. Premiums for some Medicare Part D plans are increasing, and some Medicare Advantage Prescription Drug plans may scale back benefits or even discontinue availability altogether. Given these adjustments, evaluating your Medicare plan every year is more important than ever.

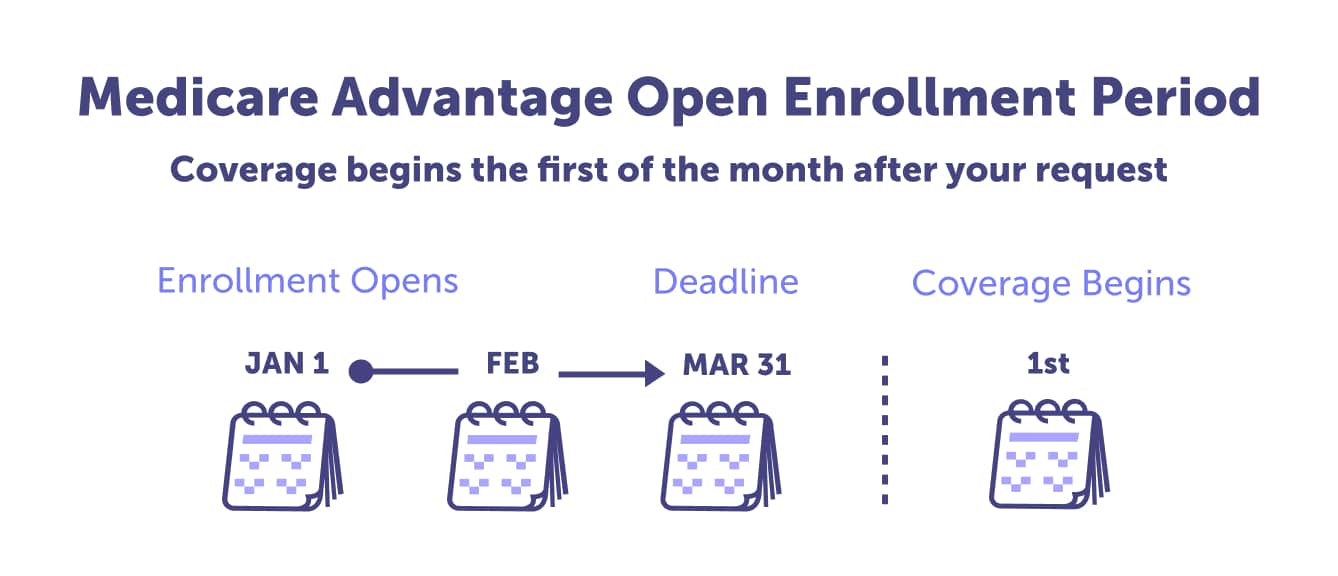

During the Annual Enrollment Period—or the Medicare Advantage Open Enrollment Period, if you have a Medicare Advantage plan—you can review your current plan. This ensures your coverage aligns with both your budget and healthcare needs. Take the time to explore updated plan options for 2025 and beyond to ensure you’re prepared for these changes.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

The Medicare Extra Help program is designed to assist those with limited income and assets by significantly lowering their Part D prescription drug plan costs. If you qualify, you’ll avoid the Part D late enrollment penalty and benefit from reduced premiums and deductibles.

Should you be eligible for Medicare Part D Extra Help in 2025, you'll enjoy $0 costs for plan premiums and deductibles. Generic prescriptions will cost at most for a month's supply. At the same time, brand-name drugs will be capped at for the same period.

Individuals automatically receive Medicare Part D Extra Help if they have full Medicaid, receive state assistance for Part B premiums (Medicare Savings Programs), or obtain Supplemental Security Income (SSI) benefits from Social Security. If you are automatically enrolled, you'll receive a notification letter regarding your Extra Help benefits.

To qualify for Part D Extra Help, most people must be within specified income and resource limits. These limits can vary by year, so staying informed is essential.

2025 Medicare Part D Extra Help Income and Resource Limits

| Your situation: | Income limit: | Resource limit: |

|---|---|---|

| Individual | $22,590 | $17,600 |

| Married couple | $30,660 | $35,130 |

If you fit the income and resource criteria, you'll need the following documents for yourself and your spouse:

Once these documents are ready, contact a local licensed Connie Health agent to assess your Part D Extra Help eligibility and guide you through the application process.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

Starting in 2025, Medicare beneficiaries will have access to a new Medicare Prescription Payment Plan designed to spread out the cost of prescription medications over the calendar year. This program can make managing your monthly medication expenses much more manageable, regardless of whether you’re enrolled in a standalone Medicare Part D plan or a Medicare Advantage Prescription Drug plan.

If you’re enrolled in a prescription drug plan, you can contact your insurance provider to sign up for the Medicare Prescription Payment Plan. Enrollment is simple, free of charge, and available at any time. Instead of paying for prescriptions at the pharmacy, your insurance provider will bill you directly. The total cost of your prescriptions will then be evenly distributed over the remaining months of the year, helping reduce your monthly payments.

If you’re new to Medicare prescription drug coverage, a local licensed agent at Connie Health can guide you. Once enrolled, all prescription payments will be made directly to your insurance provider. While this plan doesn’t lower the overall cost of your medications, it helps make your monthly expenses more manageable.

The ideal Medicare Part D prescription drug plan varies based on individual circumstances, such as the medications you take, your preferred pharmacy, and your financial situation. It's important to review each plan's drug list (formulary) and how they price their prescriptions. A local licensed agent from Connie Health can guide you through the available options in your area, ensuring you select a plan that aligns with your healthcare needs and budget.

Managing your Medicare Part D enrollment can be straightforward. You can sign up during your Initial Enrollment Period or a Special Enrollment Period. Enrolling within these timeframes is vital to avoid lifetime late enrollment penalties, emphasizing the importance of timing.

Relax, though—if you need to tweak your prescription drug plan, you can do so during the Annual Enrollment Period or, for those with a Medicare Advantage plan, the Medicare Advantage Open Enrollment Period. Keep reading to familiarize yourself with these pivotal times.

Your golden opportunity to join Medicare Part D or a Medicare Advantage Prescription Drug plan unfolds during your seven-month Initial Enrollment Period. This period begins three months before your 65th birthday, includes your birth month, and extends three months beyond. This is when you first qualify for Medicare.

Special Enrollment Periods grant an alternative path to enrolling in Medicare Part D beyond your Initial Enrollment Period. If you retire, lose employer drug coverage, or relocate outside your plan's service area, you may be eligible for a Special Enrollment Period.

Typically lasting 60 days, a Special Enrollment Period might begin the month after you retire or lose creditable employer insurance, whichever occurs first. Avoid late enrollment penalties by signing up during this window if you lose creditable coverage. Call and speak with a local licensed Connie Health agent if you’re unsure whether you qualify for a Special Enrollment Period.

Should you postpone enrolling in Medicare Part D, it's crucial to have creditable prescription drug coverage through sources like your or your spouse's employer or union. You could incur a late enrollment penalty for Medicare drug coverage without it.

Enrolling in Medicare Part D or a Medicare Advantage Prescription Drug plan outside your Initial or Special Enrollment Period could trigger a Part D late enrollment penalty. This penalty can elevate your monthly premium for the duration of your Medicare drug coverage unless you qualify for Part D Extra Help.

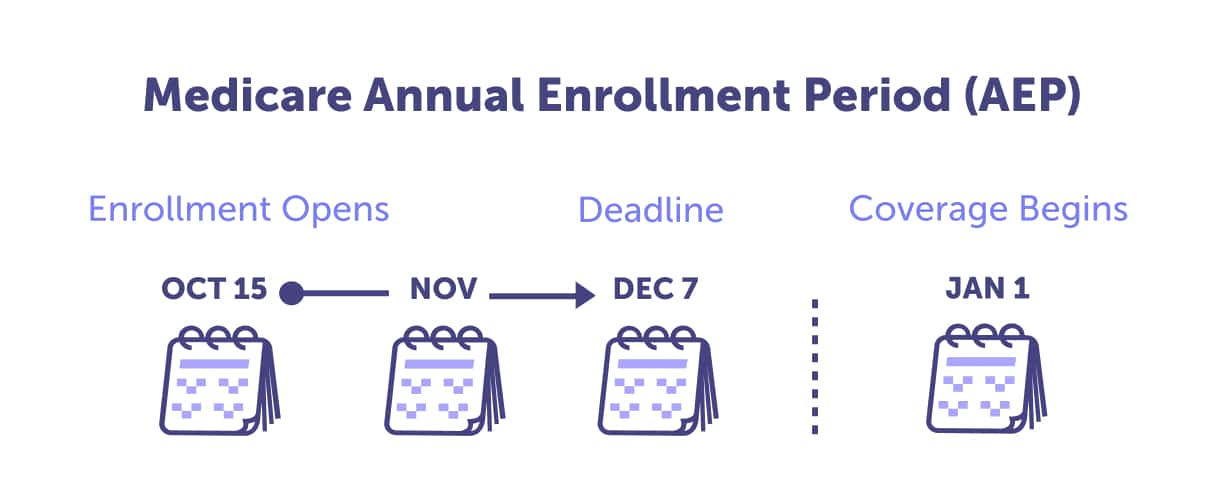

Adjusting your Part D plan is possible during the Annual Enrollment Period, also known as the Medicare Open Enrollment Period, which runs from October 15 to December 7 each year. During this window, you can join, drop, or switch Part D or Medicare Advantage Prescription Drug plans.

The Medicare Advantage Open Enrollment Period occurs annually from January 1 to March 31. Note this timeframe if you're currently in a Medicare Advantage plan. If enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage Prescription Drug plan or move to Original Medicare. If you move back to Original Medicare with a stand-alone Medicare Part D plan, you may want to explore enrolling in a Medicare Supplement plan (Medigap).

Choosing a Medicare Part D plan or a Medicare Advantage Prescription Drug plan that aligns with your budget and covers your medications is crucial. There are several ways to enroll for Medicare prescription drug coverage.

You can select a plan via Medicare's website, consult with a representative from a local SHIP, enroll directly with an insurance provider, or use the services of an insurance broker or agent. With various options available, we encourage you to contact a local licensed Connie Health agent to discuss your Medicare prescription requirements.

With Connie Health, you can compare prescription drug plans online or by meeting with a licensed Connie Health agent in your area. A local licensed agent can review your Part D plan options with you over the phone, face-to-face at a location of your choice, or through a video call, based on your preference. When reviewing plans with Connie Health, we ensure your medications are included in the formulary and assist you in estimating your prescription drug costs.

To set up an appointment or explore your Medicare Part D plan options online, call 1-888-282-98831-888-282-9883.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

What is Medicare Part D?

Medicare Part D is a prescription drug coverage plan offered through private insurance companies approved by Medicare (Centers for Medicare and Medicaid Services). It's designed to help cover the cost of prescription medications. It can be added to your Original Medicare (Part A and Part B) or bundled with a Medicare Advantage Plan (Medicare Part C).

How does Medicare Part D work?

You'll pay a monthly premium once you enroll in a Medicare Part D plan. Your specific costs may include an annual deductible, copayments, or coinsurance for each prescription. Coverage is divided into two phases—deductible and catastrophic coverage—that determine your out-of-pocket costs throughout the year.

What is the best Medicare Part D for all 50 states?

While there isn't a one-size-fits-all plan that works best for everyone in all states, comparing plans based on your medication needs, costs, and pharmacy network is essential. Call a local licensed Connie Health agent at 1-888-282-98831-888-282-9883 for help comparing plans in your area.

Best Medicare Part D plans?

The "best" Medicare Part D plan varies depending on individual needs. Consider monthly premiums, deductible amounts, drug coverage, and pharmacy networks when selecting a plan. Call a local licensed Connie Health agent 1-888-282-98831-888-282-9883 for help comparing plans in your area.

How do I know if I have Medicare Part D?

To verify if you have Medicare Part D, check your insurance documents, look for the plan name on your Medicare card, or contact your insurance provider. You can also log into your Medicare account online to view your coverage details or call and speak with your local licensed Connie Health agent at 1-888-282-98831-888-282-9883.

How much is Medicare Part D?

The cost of Medicare Part D varies based on the plan you select, your income, and any late enrollment penalties. You will typically pay a monthly premium, deductible, copayments, or coinsurance. The average monthly premium is , and the average annual deductible is in Newton, Illinois. Costs can vary significantly, so it's essential to compare plans.

What does Medicare Part D cover?

Medicare Part D covers a wide range of outpatient prescription drugs, including both generic and brand-name medications. Each plan has its own formulary or list of covered drugs, which can change annually. Be sure to review the formulary to ensure your medications are covered. Inpatient medications not covered by Medicare Part D may be covered under Medicare Part B.

What drugs are covered by Medicare Part D?

Part D plan coverage varies by plan, but each must cover specific categories of drugs, including antidepressants, antipsychotics, anticonvulsants, immunosuppressants, cancer drugs, and HIV/AIDS treatments. Check your plan’s formulary for specific details.

Who is eligible for Medicare Part D?

You're eligible for Medicare Part D if enrolled in Orginal Medicare Part A and B. You must also reside in the plan's service area. Enrollment periods include your Initial Enrollment Period, the Annual Enrollment Period, and Special Enrollment Periods for qualifying events.

How to apply for Medicare Part D?

If eligible, you can apply for Medicare Part D during your Initial Enrollment Period, the Annual Enrollment Period (October 15 - December 7), or a Special Enrollment Period. You can enroll through the Medicare website or by calling them, directly with a private insurance company, or with Connie Health either by phone, video chat, or in person. Ensure you have your Medicare number and a list of your current medications, and call 1-888-282-98831-888-282-9883.

How do I apply for Medicare Part D?

Applying for Medicare Part D is simple. Visit the Medicare website and use the Plan Finder tool, contact the plan provider directly, or call a local licensed Connie Health agent. Ensure you have your Medicare number and a list of your current medications, and call 1-888-282-98831-888-282-9883.

How to sign up for Medicare Part D?

To sign up for Medicare Part D, visit Medicare.gov, contact a plan provider, or call a local licensed Connie Health agent. Have your Medicare number and a list of current medications, and call 1-888-282-98831-888-282-9883 to compare Medicare plan options.

How long does the Medicare Part D penalty last?

The Medicare Part D penalty is a lifetime penalty that you will pay as long as you have Medicare Part D coverage. The penalty is imposed if you go without creditable prescription drug coverage for 63 consecutive days or more after your Initial Enrollment Period.

Does Medicare Part D cover weight loss drugs?

Medicare Part D generally does not cover weight loss medications. Coverage can vary by plan, so it’s essential to review the specific formulary of your Part D plan to see if any weight loss drugs are covered.

Does Medicare Part D cover Wegovy?

Wegovy, a medication used for weight management, is typically not covered under Medicare Part D. Beneficiaries should check with their specific plan provider to confirm the availability and coverage details.

How much does Eliquis cost with Medicare Part D?

The cost of Eliquis with Medicare Part D can vary based on the specific plan, pharmacy, and location. Many plans include Eliquis in their formularies, but the out-of-pocket cost may depend on factors like your plan’s tier structure.

Does Medicare Part D cover Eliquis?

Yes, most Medicare Part D plans cover Eliquis, but coverage may vary by plan. You should check your plan's formulary for specific details regarding coverage and cost.

Does Medicare Part D cover the RSV vaccine?

Traditionally, Medicare Part D does not cover vaccines like the RSV vaccine. Vaccine coverage often falls under Medicare Part B or your Medicare Advantage Plan. Check with your plan to determine what vaccines are covered.

Does Medicare Advantage include Part D?

Many Medicare Advantage Plans, or Medicare Advantage Prescription Drug plans (MAPDs), include Medicare Part D coverage. However, not all do, so verifying whether your Medicare Advantage Plan includes prescription drug coverage is essential.

Does Medicare Part D cover Mounjaro?

Medicare Part D plans do not typically cover Mounjaro. Coverage options can vary, so it’s advisable to consult your plan's formulary or contact your insurance provider directly.

Does Medicare Part D cover the shingles vaccine?

Yes, Medicare Part D typically covers the shingles vaccine, including Shingrix. However, coverage details and cost-sharing responsibilities can vary, so checking your specific plan's formulary is essential.

How much does Medicare Part D cost per month?

The monthly premium for Medicare Part D in Newton, Illinois varies based on your chosen plan. Premiums can range from $0.00 to $125.80 per month, and the average premium is per month. In addition, there may be late enrollment penalties, deductibles, and copayments.

Does Amazon Pharmacy take Medicare Part D?

Amazon Pharmacy accepts Medicare Part D. However, you should confirm that your specific Part D plan is accepted by checking with Amazon Pharmacy directly. If you have further questions about Medicare Part D coverage or need personalized assistance, consider contacting a local licensed Connie Health agent at 1-888-282-98831-888-282-9883.

How do I compare Medicare Part D plans in Newton, Illinois?

You can compare Medicare Part D plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medicare prescription drug plan options via phone, in person, or video chat, whichever you prefer. Call 1-888-282-98831-888-282-9883 to schedule an appointment or review your Medicare Part D options online.

Where can I get more information about Medicare Part D plans in Newton, Illinois?

More information about Medicare prescription drug plans in Newton is available by calling 1-888-282-98831-888-282-9883 and speaking with a licensed agent in your area. You can also make an appointment to talk in person, over the phone, via video chat, or by reviewing Medicare Part D options online.

Medicare Part D plans may be available in the following zip codes in the Newton, Illinois.

“Apply for Medicare Part D Extra Help program.” SSA.gov.

“Catastrophic coverage.” Medicare.gov.

“Copayment/coinsurance in drug plans.” Medicare.gov.

“Costs for Medicare drug coverage.” Medicare.gov.

“Costs in the coverage gap.” Medicare.gov.

“Fact sheet - 2025 Medicare costs.” Medicare.gov.

“Help with drug costs.” Medicare.gov.

“Medicare Enrollment Dashboard: Prescription Drug enrollment counts.” CMS.gov.

“Monthly premium for drug plans.” Medicare.gov.

“What Is Medicare Part D?” NCOA.org.

“Yearly deductible for drug plans.” Medicare.gov.

Last updated: October 24, 2025