While there are 80 Medicare Advantage plans in Michigan, there are 52 plans available to you in Dorr, Michigan. Dorr is located in Allegan County. Connie Health gathered the plan cost and coverage information that matters most to you. Continue reading to discover the Medicare Advantage plan right for your health & budget and when to enroll.

72.32% of Medicare beneficiaries are enrolled in a Medicare Advantage plan in Dorr.

All Medicare beneficiaries in Dorr have access to a $0 premium plan.

23 $0 premium Medicare Advantage plans are available in Dorr.

For those paying a premium, the average is $29.26 monthly.

The average out-of-pocket maximum is $6,040.38 per year.

The average prescription drug plan deductible (for plans that include Part D) is $277.67 per year.

There are 32 plans available in Dorr that Medicare rated four stars or higher.

You can choose from 5 Medicare Advantage plan types, including PPO, HMO-POS, HMO, PFFS, Regional PPO.

There are three primary reasons you may choose to enroll in a Medicare Advantage plan:

Low or no-cost monthly premiums.

Lower out-of-pocket costs.

Additional benefits such as comprehensive dental, vision, hearing, and more.

You can access to a Medicare Advantage plan as low as $0 monthly. If you don't qualify for a $0 premium plan, the average is $29.26 monthly. This premium is low, especially compared to a Medicare Supplement plan or your Part B premiums.

Original Medicare doesn't cap their out-of-pocket costs, so you could end up with unexpectedly high medical bills. With Original Medicare Part B, you must pay the premium, deductible, and 20% coinsurance for Medicare-approved services and procedures. The 20% can add up.

Want routine dental coverage? Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) don't offer comprehensive dental, vision, or hearing coverage. These services would be entirely out-of-pocket for you.

The good news? Medicare Advantage plans have low or no-cost premiums, an out-of-pocket maximum, offer additional benefits, and are regulated by the Centers for Medicare & Medicaid Services (CMS). With a Medicare Advantage plan, you could receive prescription drug coverage, routine dental, vision, hearing, transportation, reduced cost-sharing, a gym membership, and more.

No-cost, unbiased service

Compare all major plans and carriers

Local, licensed insurance agents with 25+ years of combined experience

9 insurance companies offer Medicare Advantage plans in Dorr.

| Medicare Advantage Insurance Companies in Dorr |

|---|

| Blue Care Network |

| Blue Cross Blue Shield |

| HAP Senior Plus |

| HAP Senior Plus (PPO) |

| Humana |

| McLaren Medicare |

| Priority Health Medicare |

| UnitedHealthcare |

| Wellcare |

These 5 Medicare Advantage insurance companies enroll the largest amount of Medicare beneficiaries in Dorr. They offer the most popular plans.

| # | Medicare Advantage Insurance Companies in Dorr |

|---|---|

| 1 | Priority Health |

| 2 | Bcbs Of Michigan Mutual Insurance Company |

| 3 | Humana Insurance Company |

| 4 | Blue Care Network Of Michigan |

| 5 | Unitedhealthcare Community Plan, Inc. |

There are 52 Medicare Advantage plans to choose from in Dorr. Below are the many available options. Click on any of the links to review additional plan details.

| Medicare Advantage Plan Name | Plan Type | Monthly Plan Premium | Maximum Out-of-Pocket | Rx Deductible | Medicare Star Rating |

|---|---|---|---|---|---|

| PriorityMedicare Key (HMO-POS) | HMO-POS | $0.00 | $5,800.00 | $200.00 | 4.5 |

| PriorityMedicare (HMO-POS) | HMO-POS | $81.00 | $4,500.00 | $0.00 | 4.5 |

| PriorityMedicare Value (HMO-POS) | HMO-POS | $32.00 | $5,100.00 | $100.00 | 4.5 |

| PriorityMedicare Vintage (HMO-POS) | HMO-POS | $8.80 | $5,600.00 | $615.00 | 4.5 |

| PriorityMedicare Smart Savings (HMO-POS) | HMO-POS | $0.00 | $9,250.00 | $500.00 | 4.5 |

| BCN Advantage Elements (HMO-POS) | HMO-POS | Not Applicable | $4,500.00 | Not Applicable | 4.5 |

| BCN Advantage Classic (HMO-POS) | HMO-POS | $93.00 | $4,400.00 | $0.00 | 4.5 |

| BCN Advantage Prestige (HMO-POS) | HMO-POS | $178.00 | $4,000.00 | $0.00 | 4.5 |

| BCN Advantage Prime Value (HMO-POS) | HMO-POS | $35.00 | $5,000.00 | $150.00 | 4.5 |

| Humana Full Access H7617-052 (PPO) | PPO | $0.00 | $5,650.00 | $350.00 | 4.5 |

| Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,550.00 | Not Applicable | 4.5 |

| Humana Full Access Giveback H7617-058 (PPO) | PPO | $0.00 | $9,150.00 | $0.00 | 4.5 |

| Humana USAA Honor Giveback with Rx (PPO) | PPO | $0.00 | $8,650.00 | $90.00 | 4.5 |

| Medicare Plus Blue Signature (PPO) | PPO | $106.60 | $4,300.00 | $0.00 | 4.5 |

| Medicare Plus Blue Vitality (PPO) | PPO | $38.50 | $5,000.00 | $0.00 | 4.5 |

| Medicare Plus Blue Assure (PPO) | PPO | $191.60 | $4,000.00 | $0.00 | 4.5 |

| Medicare Plus Blue Essential (PPO) | PPO | $25.00 | $6,250.00 | $150.00 | 4.5 |

| Medicare Plus Blue + Meijer (PPO) | PPO | $35.00 | $6,750.00 | $150.00 | 4.5 |

| Medicare Plus Blue Giveback (PPO) | PPO | $0.00 | $9,250.00 | $150.00 | 4.5 |

| Medicare Plus Blue Secure (PPO) | PPO | $0.00 | $6,750.00 | $150.00 | 4.5 |

| HAP Senior Plus (PPO) | PPO | $165.00 | $4,150.00 | $0.00 | 4.0 |

| HAP Medicare Explore (PPO) | PPO | $0.00 | $5,400.00 | $200.00 | 4.0 |

| HAP Medicare Prime (PPO) | PPO | $0.00 | $5,650.00 | $200.00 | 4.0 |

| HAP Member Assist (PPO) | PPO | $8.80 | $5,200.00 | $615.00 | 4.0 |

| HAP Medicare Connect (HMO) | HMO | $0.00 | $5,000.00 | $150.00 | 4.0 |

| HAP Medicare MedicalAccess (HMO) | HMO | Not Applicable | $4,500.00 | Not Applicable | 4.0 |

| HAP Medicare Superior (HMO) | HMO | $0.00 | $5,100.00 | $150.00 | 4.0 |

| PriorityMedicare Merit (PPO) | PPO | $70.00 | $4,200.00 | $0.00 | 4.0 |

| PriorityMedicare Thrive Plus (PPO) | PPO | $49.00 | $5,600.00 | $100.00 | 4.0 |

| PriorityMedicare Edge (PPO) | PPO | $0.00 | $6,000.00 | $200.00 | 4.0 |

| PriorityMedicare Vital (PPO) | PPO | $0.00 | $6,300.00 | $450.00 | 4.0 |

| PriorityMedicare Thrive (PPO) | PPO | $0.00 | $6,200.00 | $250.00 | 4.0 |

| AARP Medicare Advantage from UHC MI-0001 (PPO) | PPO | $0.00 | $6,700.00 | $600.00 | 3.5 |

| AARP Medicare Advantage from UHC MI-0002 (PPO) | PPO | $64.00 | $5,400.00 | $600.00 | 3.5 |

| AARP Medicare Advantage Patriot No Rx MI-MA01 (PPO) | PPO | Not Applicable | $6,700.00 | Not Applicable | 3.5 |

| Humana Full Access H5216-011 (PPO) | PPO | $18.00 | $5,700.00 | $300.00 | 3.5 |

| Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,550.00 | Not Applicable | 3.5 |

| Humana USAA Honor Giveback with Rx (PPO) | PPO | $0.00 | $8,650.00 | $90.00 | 3.5 |

| Humana Full Access Giveback H5216-306 (PPO) | PPO | $0.00 | $9,150.00 | $0.00 | 3.5 |

| Humana Value Plus H5216-382 (PPO) | PPO | $8.80 | $9,250.00 | $250.00 | 3.5 |

| Humana Full Access H5216-384 (PPO) | PPO | $0.00 | $5,650.00 | $350.00 | 3.5 |

| Humana Gold Choice H8145-006 (PFFS) | PFFS | $37.00 | $6,800.00 | $615.00 | 3.5 |

| HumanaChoice R0110-013 (Regional PPO) | Regional PPO | Not Applicable | $6,550.00 | Not Applicable | 3.5 |

| Humana Full Access R0110-014 (Regional PPO) | Regional PPO | $54.00 | $6,550.00 | $615.00 | 3.5 |

| Wellcare Simple Open (PPO) | PPO | $0.00 | $5,200.00 | $615.00 | 3.0 |

| Wellcare Patriot Giveback Open (PPO) | PPO | Not Applicable | $5,000.00 | Not Applicable | 3.0 |

| Wellcare Simple (HMO-POS) | HMO-POS | $0.00 | $5,000.00 | $615.00 | 3.0 |

| Wellcare Giveback (HMO-POS) | HMO-POS | $0.00 | $7,550.00 | $615.00 | 3.0 |

| Wellcare Assist (HMO-POS) | HMO-POS | $8.80 | $5,000.00 | $580.00 | 3.0 |

| McLaren Medicare Inspire (HMO) | HMO | $0.00 | $6,300.00 | $615.00 | 3.0 |

| McLaren Medicare Inspire Plus (HMO) | HMO | $8.80 | $5,900.00 | $500.00 | 3.0 |

| McLaren Medicare Inspire Select (HMO) | HMO | $0.00 | $6,750.00 | $615.00 | 3.0 |

The Centers for Medicare and Medicaid Services (CMS) rates all Medicare Advantage plans on a scale of 1 to 5 stars. Plans with one star are considered “poor,” while those with five stars are considered “excellent.” Any plan that is four stars and higher is a “top-rated” plan. These are the plans with the highest star ratings in Dorr.

| # | Plan Name | Plan Type | Monthly Plan Premium | Maximum Out-of-Pocket | Rx Deductible | Medicare Star Rating |

|---|---|---|---|---|---|---|

| 1 | PriorityMedicare Key (HMO-POS) | HMO-POS | $0.00 | $5,800.00 | $200.00 | 4.5 |

| 2 | PriorityMedicare (HMO-POS) | HMO-POS | $81.00 | $4,500.00 | $0.00 | 4.5 |

| 3 | PriorityMedicare Value (HMO-POS) | HMO-POS | $32.00 | $5,100.00 | $100.00 | 4.5 |

| 4 | PriorityMedicare Vintage (HMO-POS) | HMO-POS | $8.80 | $5,600.00 | $615.00 | 4.5 |

| 5 | PriorityMedicare Smart Savings (HMO-POS) | HMO-POS | $0.00 | $9,250.00 | $500.00 | 4.5 |

| 6 | BCN Advantage Elements (HMO-POS) | HMO-POS | Not Applicable | $4,500.00 | Not Applicable | 4.5 |

| 7 | BCN Advantage Classic (HMO-POS) | HMO-POS | $93.00 | $4,400.00 | $0.00 | 4.5 |

| 8 | BCN Advantage Prestige (HMO-POS) | HMO-POS | $178.00 | $4,000.00 | $0.00 | 4.5 |

| 9 | BCN Advantage Prime Value (HMO-POS) | HMO-POS | $35.00 | $5,000.00 | $150.00 | 4.5 |

| 10 | Humana Full Access H7617-052 (PPO) | PPO | $0.00 | $5,650.00 | $350.00 | 4.5 |

| 11 | Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,550.00 | Not Applicable | 4.5 |

| 12 | Humana Full Access Giveback H7617-058 (PPO) | PPO | $0.00 | $9,150.00 | $0.00 | 4.5 |

| 13 | Humana USAA Honor Giveback with Rx (PPO) | PPO | $0.00 | $8,650.00 | $90.00 | 4.5 |

| 14 | Medicare Plus Blue Signature (PPO) | PPO | $106.60 | $4,300.00 | $0.00 | 4.5 |

| 15 | Medicare Plus Blue Vitality (PPO) | PPO | $38.50 | $5,000.00 | $0.00 | 4.5 |

| 16 | Medicare Plus Blue Assure (PPO) | PPO | $191.60 | $4,000.00 | $0.00 | 4.5 |

| 17 | Medicare Plus Blue Essential (PPO) | PPO | $25.00 | $6,250.00 | $150.00 | 4.5 |

| 18 | Medicare Plus Blue + Meijer (PPO) | PPO | $35.00 | $6,750.00 | $150.00 | 4.5 |

| 19 | Medicare Plus Blue Giveback (PPO) | PPO | $0.00 | $9,250.00 | $150.00 | 4.5 |

| 20 | Medicare Plus Blue Secure (PPO) | PPO | $0.00 | $6,750.00 | $150.00 | 4.5 |

| 21 | HAP Senior Plus (PPO) | PPO | $165.00 | $4,150.00 | $0.00 | 4.0 |

| 22 | HAP Medicare Explore (PPO) | PPO | $0.00 | $5,400.00 | $200.00 | 4.0 |

| 23 | HAP Medicare Prime (PPO) | PPO | $0.00 | $5,650.00 | $200.00 | 4.0 |

| 24 | HAP Member Assist (PPO) | PPO | $8.80 | $5,200.00 | $615.00 | 4.0 |

| 25 | HAP Medicare Connect (HMO) | HMO | $0.00 | $5,000.00 | $150.00 | 4.0 |

| 26 | HAP Medicare MedicalAccess (HMO) | HMO | Not Applicable | $4,500.00 | Not Applicable | 4.0 |

| 27 | HAP Medicare Superior (HMO) | HMO | $0.00 | $5,100.00 | $150.00 | 4.0 |

| 28 | PriorityMedicare Merit (PPO) | PPO | $70.00 | $4,200.00 | $0.00 | 4.0 |

| 29 | PriorityMedicare Thrive Plus (PPO) | PPO | $49.00 | $5,600.00 | $100.00 | 4.0 |

| 30 | PriorityMedicare Edge (PPO) | PPO | $0.00 | $6,000.00 | $200.00 | 4.0 |

| 31 | PriorityMedicare Vital (PPO) | PPO | $0.00 | $6,300.00 | $450.00 | 4.0 |

| 32 | PriorityMedicare Thrive (PPO) | PPO | $0.00 | $6,200.00 | $250.00 | 4.0 |

No-cost, unbiased service

Compare all major plans and carriers

Local, licensed insurance agents with 25+ years of combined experience

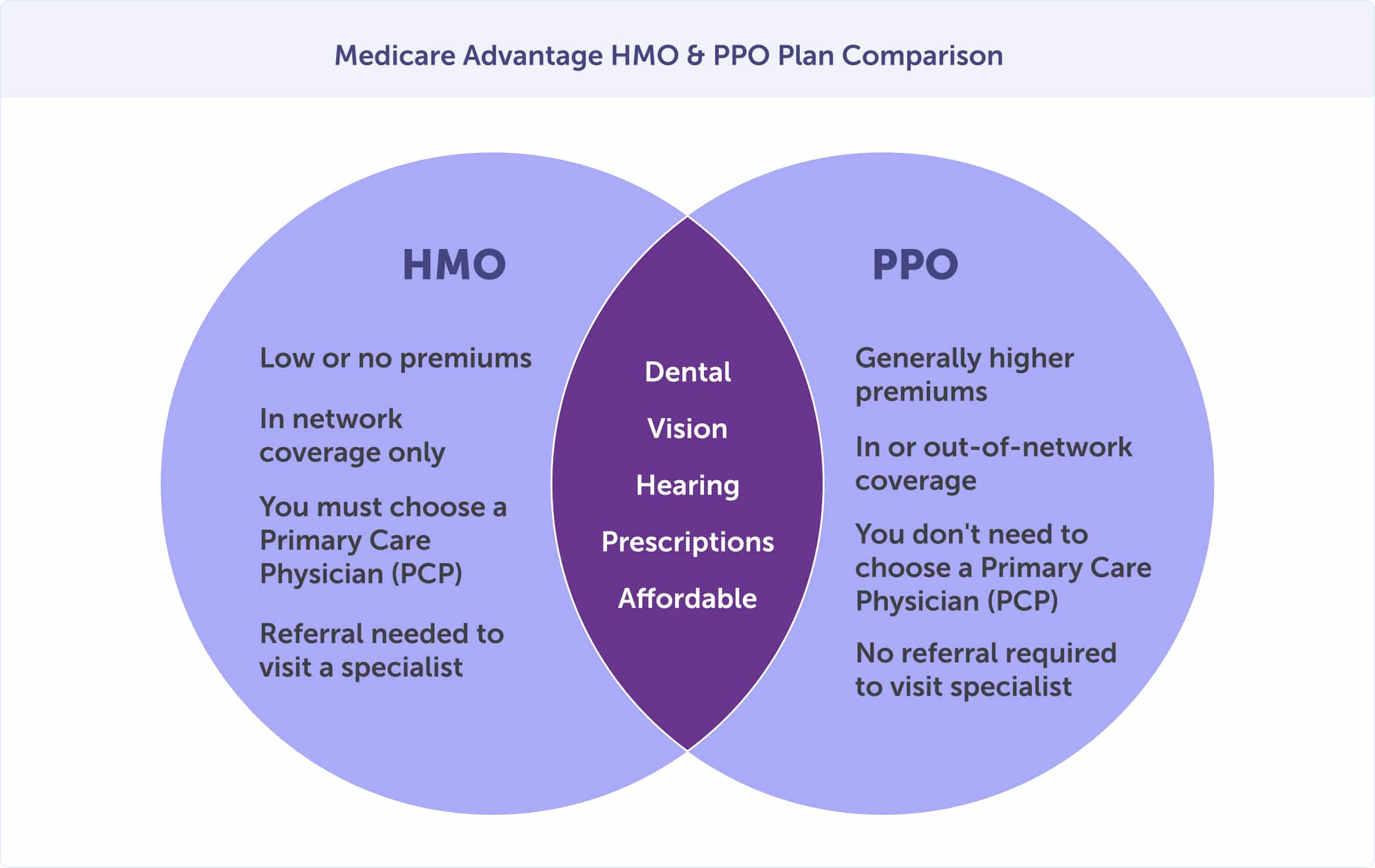

You can choose from 5 Medicare Advantage plan types in Dorr. These include: PPO, HMO-POS, HMO, PFFS, Regional PPO. Which is the best plan for your health needs and budget? We'll walk you through the most popular plan types: PPO, HMO-POS, HMO, PFFS, Regional PPO. At the end of this section, you'll understand the difference between these popular plan types.

You have 18 Medicare Advantage HMO plans to choose from in Dorr. An HMO, or Health Maintenance Organization, is a type of health plan that limits coverage to in-network care from doctors who work for or contract with the HMO. Typically, HMO plans won't cover out-of-network care except in an emergency.

There are 33 Medicare Advantage PPO plans in Dorr. A PPO, or Preferred Provider Organization, is a type of health plan where you pay less to use doctors in the plan's network. Unlike an HMO, you can see doctors and specialists and use a hospital outside the network without a referral for an additional cost.

No-cost, unbiased service

Compare all major plans and carriers

Local, licensed insurance agents with 25+ years of combined experience

Special Needs Plans, or SNPs, are a type of Medicare Advantage plan. There are two types of Special Needs Plans that may be available to you: Chronic Special Needs Plans (C-SNP) and Dual Special Needs Plans (D-SNP).

Chronic Special Needs Plans (C-SNP) are limited to people with specific illnesses or characteristics. For example, you may qualify for a C-SNP if you have diabetes, End-Stage Renal Disease (ESRD), HIV/AIDS, dementia, chronic heart failure, or other qualifying illnesses. Medicare C-SNPs tailor benefits, provider choices, and drug formularies to meet the needs of the special needs groups they serve.

You may qualify for a Dual Special Needs Plan (D-SNP) if you are eligible for Medicare and Medicaid. With a D-SNP, the State of Michigan may cover your Medicare costs, depending on your eligibility.

If you or your spouse are veterans, you likely have VA benefits. However, the U.S. Department of Veteran Affairs encourages you to sign up for Medicare as soon as you are eligible. Here are three reasons you should speak to a local licensed agent about how VA benefits and Medicare work together:

Having Medicare means you're covered when you need care from a non-VA hospital or doctor, offering you greater health options.

VA benefits and health care could change in the future, so you should enroll in every health care benefit that you are eligible for.

If you lose VA benefits and aren't enrolled in Medicare, you could face Medicare Part B and Part D lifetime late enrollment penalties.

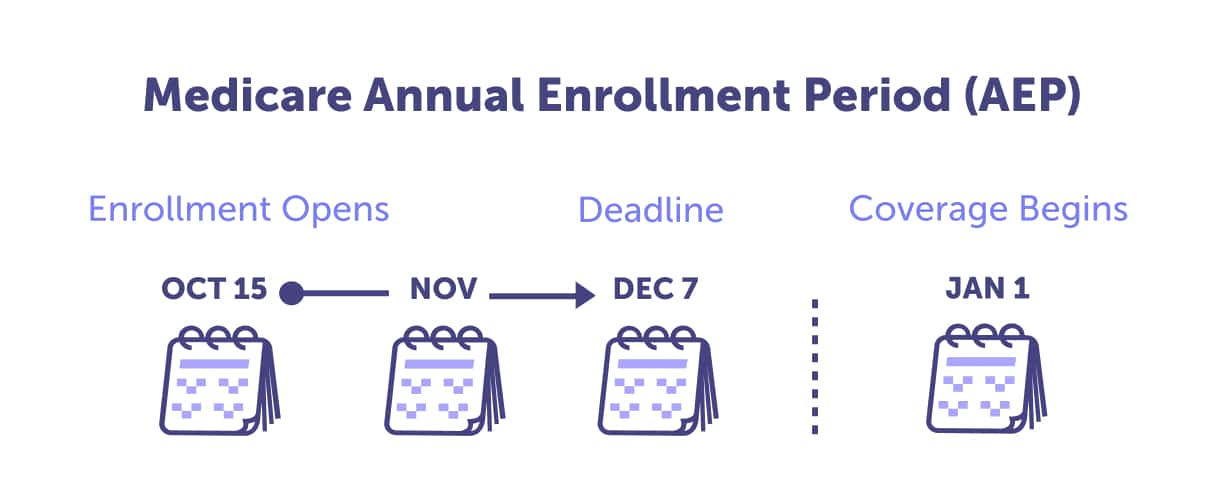

Knowing when to enroll or make plan changes can help you save money.

Are you enrolling in a Medicare Advantage plan for the first time, or are you interested in making a plan change? Skip to the section that applies to you - and mark the dates in your calendar.

If you're new to Medicare, the best time to enroll in a Medicare Advantage plan is during your Initial Enrollment Period. If you miss that, you can still enroll during the General Enrollment Period (January 1 - March 31) or Special Enrollment Period, but likely with penalties.

The best time to change a plan is during the Medicare Annual Enrollment Period (October 15 - December 7). During this time, anyone enrolled in Medicare can review their plan options for the coming year and ensure that their plan choice meets their health and budget needs.

If you need to make a plan change because you moved to a new service area or lost coverage, among other reasons, you could qualify for a Special Enrollment Period.

Whether enrolling for the first time or making a plan change, a Medicare Advantage plan could fit your health and budget needs. Medicare in Michigan can be confusing; you, don't have to sift through your options alone. Call 1-888-813-89111-888-813-8911 to speak with an agent today and review your frequently asked questions below.

You could sign up for a Medicare Advantage plan in several ways. You could choose your plan through Medicare’s website, speak with someone from a local SHIP, enroll directly with an insurance company, or enroll with an insurance broker or agent. We know you have options, and we hope that you’ll contact a local licensed Connie Health agent to speak about your Medicare healthcare needs.

With Connie Health, you can compare Medicare Advantage plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medicare Advantage plan options via phone, in person (a local place of your choosing), or via video chat, whichever you prefer. Call 1-888-813-89111-888-813-8911 to schedule an appointment or review your Medicare Advantage options online.

No-cost, unbiased service

Compare all major plans and carriers

Local, licensed insurance agents with 25+ years of combined experience

Struggling to find a trustworthy doctor who accepts your Medicare plan? It can be a daunting task but don't worry. With Connie Health, you can easily locate Medicare doctors near you.

No more endless phone calls or web searches. Our platform lets you enter your address and plan information (if you have it), and we'll do the rest. Let us help you eliminate the stress of finding a physician who accepts Medicare.

Which doctors near me accept Medicare in Dorr?

It’s easy to find a trustworthy doctor that

accepts Medicare in Dorr. Don’t spend your

time on endless phone calls and searches. Instead,

the Connie Health tool allows you to enter your

address and plan information if you have it. Then,

our tool will provide Medicare doctors near

you.

Let us help you eliminate the

stress of finding a physician who accepts

Medicare.

Find

your Medicare doctor today.

How many people are enrolled in a Medicare Advantage plan in Dorr?

19,734 of 27,286 eligible Medicare beneficiaries are enrolled in Medicare Advantage plan in Dorr. That's of the city's Medicare population. These people have chosen to protect themselves from the potentially high out-of-pocket costs of Original Medicare while receiving extra benefits like comprehensive dental, vision, hearing, and more.

Who is eligible for Medicare Advantage plans in Dorr?

To be eligible for a Medicare Advantage plan in Dorr, you must be enrolled in both Original Medicare Part A and Part B, and live in the service area of the Medicare Advantage plan that you’re considering enrolling.

Can I buy a Medicare Advantage plan in Dorr?

Yes, if you meet the Medicare Advantage eligibility criteria you can enroll in an available Medicare Advantage plan in Dorr. To be eligible to enroll in a Medicare Advantage plan, you must already be enrolled in Original Medicare Parts A and B.

What is the best time to enroll in a Medicare Advantage plan in Dorr?

The best time to enroll in a Medicare Advantage plan in Dorr for the first time is during your unique Initial Enrollment Period. This is when you first become eligible for Medicare.

Can I enroll in a Medicare Advantage plan anytime?

No, you cannot enroll in a Medicare Advantage plan in Dorr at anytime. There are specific enrollment periods when you can enroll in a Medicare Advantage plan for the first time, or change your plan. You can enroll for the first time during your Initial Enrollment Period, the General Enrollment Period, or a Special Enrollment Period. You can make a Medicare Advantage plan change during the Annual Enrollment Period, Medicare Advantage Open Enrollment Period, or a Special Enrollment Period.

What is the best Medicare Advantage plan in Dorr?

The best Medicare Advantage plan in Dorr is the plan that best serves your health and budget needs. There is no “best plan” because what serves your neighbor likely won't serve you best. Medicare isn't one-size-fits-all.

How much does a Medicare Advantage plan cost in Dorr?

Every Medicare beneficiary in Dorr has access to a $0 monthly premium Medicare Advantage plan. That is the lowest-cost premium, and there are 23 plans with a $0 premium in Dorr. For those who pay a premium, the average monthly cost is $29.26.

How much does Medicare cost in Dorr?

Medicare costs include premiums and deductibles, but also copays and coinsurance. These amounts will depend on the plan or plans that you choose. A Medicare Advantage plan in Dorr will cost an average of $29.26 per month for the premium, in addition to the Medicare Part B premium and Medicare Part A, if that applies. Out-of-pocket costs will vary depending on the Medicare-approved services or procedures you need and medications. However, the average Medicare Advantage out-of-pocket maximum is $6,040.38 per year, and the average prescription drug plan deductible is $277.67.

What is the difference between a Medicare Advantage and Medicare Supplement?

A Medicare Advantage plan includes Medicare Part A and B, oftentimes prescription drug coverage, and extra benefits like dental, vision, and hearing. These plans are also called Medicare Part C plans. Medicare Supplement plans, also called Medicare Advantage, supplements your Original Medicare benefits and pays for out-of-pocket medical expenses not covered by Part A and Medicare Part B. A Medicare Supplement plan only works with Original Medicare and doesn’t include extra benefits.

Can I switch Medicare Advantage plans in Dorr?

Yes, you can switch Medicare Advantage plans during the Annual Enrollment Period from October 15th to December 7th annually or during the Medicare Advantage Open Enrollment Period between January 1st and March 31st each year.

Can I keep my Medicare Advantage plan if I move to a different city in Michigan?

Maybe. Medicare Advantage plan service areas are by county, so if you stay within the same county you may not need to make a plan change. However, you should inform your Connie Health agent if you move to a different city. Your agent can review your address and determine if it's within your plan's service area and you can keep your plan. If not, you will need to choose a new Medicare Advantage plan that's available in your new location.

Is Humana Gold Plus a Medicare Advantage plan?

Yes, Humana Gold Plus is a type of Medicare Advantage plan, specifically a Health Maintenance Organixation (HMO) plan.

Does Medicare Advantage cover dental in Dorr?

Yes, some Medicare Advantage plans cover dental as an additional benefit. Coverage availability and specifics vary by plan and location, so it is best to check with your plan provider for details. If you're looking for a Medicare Advantage plan that offers routine dental, a local licensed Connie Health agent can help review your plan options.

How to choose a Medicare Advantage plan in Dorr?

Is Humana Choice PPO a Medicare Advantage plan?

Yes, Humana Choice PPO is a type of Medicare Advantage plan, specifically a Preferred Provider Organization (PPO) plan.

Does Medicare Advantage cover hearing aids in Dorr?

Some Medicare Advantage plans offer hearing aid coverage as an additional benefit. Coverage specifics can vary, so it is essential to review the details of each plan.

How to compare Medicare Advantage plans in Dorr?

Is Medicare Part C the same as Medicare Advantage?

Yes, Medicare Part C is the same as Medicare Advantage. It is an alternative way to receive your Medicare benefits through private insurance companies approved by Medicare.

What doctors near me accept Medicare in Dorr?

It's easy to find a trustworthy doctor who accepts Medicare in Dorr. Don't spend your time on endless phone calls and searches. Instead, the Connie Health tool allows you to enter your address and plan information if you have it. Then, our tool will provide Medicare doctors near you. Let us help you eliminate the stress of finding a physician who accepts Medicare. Find your Medicare doctor today.

How do I compare Medicare Advantage plans in Dorr, Michigan?

You can compare Medicare Advantage plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medicare Advantage options via phone, in person, or video chat, whichever you prefer. Call 1-888-813-89111-888-813-8911 to schedule an appointment or review your Medicare Advantage options online.

Where can I get more information about Medicare Advantage plans in Dorr, Michigan?

More information about Medicare Advantage plans in Dorr is available by calling 1-888-813-89111-888-813-8911 and speaking with a local licensed agent in your area. You can make an appointment to speak in person, over the phone, or by video chat. Or by reviewing Medicare Advantage plan options online.

Medicare Advantage plans may be available in the following zip codes in the Dorr, Michigan. 49323

Renée is the Director of Content at Connie Health. She has a passion for helping people understand their Medicare options and make informed decisions.

David is a licensed Medicare insurance agent with a passion for helping people understand their Medicare options and make informed decisions.

“Explore your Medicare coverage options.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

“Monthly MA Enrollment by State/County/Contract.” CMS.gov.

“Prescription Drug Coverage - General Information.” CMS.gov.

“VA healthcare and other insurance.” U.S. Department of Veterans Affairs (VA.gov).

Last updated: February 1, 2026