While there are 99 Medicare Advantage plans in Illinois, there are 29 plans available to you in Perry, Illinois. Perry is located in Pike County. Connie Health gathered the plan cost and coverage information that matters most to you. Continue reading to discover the Medicare Advantage plan right for your health & budget and when to enroll.

30.31% of Medicare beneficiaries are enrolled in a Medicare Advantage plan in Perry.

All Medicare beneficiaries in Perry have access to a $0 premium plan.

15 $0 premium Medicare Advantage plans are available in Perry.

For those paying a premium, the average is $14.00 monthly.

The average out-of-pocket maximum is $6,160.34 per year.

The average prescription drug plan deductible (for plans that include Part D) is $548.00 per year.

There are 8 plans available in Perry that Medicare rated four stars or higher.

You can choose from 5 Medicare Advantage plan types, including PPO, HMO, HMO-POS, PFFS, Regional PPO.

There are three primary reasons you may choose to enroll in a Medicare Advantage plan:

Low or no-cost monthly premiums.

Lower out-of-pocket costs.

Additional benefits such as comprehensive dental, vision, hearing, and more.

You can access to a Medicare Advantage plan as low as $0 monthly. If you don't qualify for a $0 premium plan, the average is $14.00 monthly. This premium is low, especially compared to a Medicare Supplement plan or your Part B premiums.

Original Medicare doesn't cap their out-of-pocket costs, so you could end up with unexpectedly high medical bills. With Original Medicare Part B, you must pay the premium, deductible, and 20% coinsurance for Medicare-approved services and procedures. The 20% can add up.

Want routine dental coverage? Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) don't offer comprehensive dental, vision, or hearing coverage. These services would be entirely out-of-pocket for you.

The good news? Medicare Advantage plans have low or no-cost premiums, an out-of-pocket maximum, offer additional benefits, and are regulated by the Centers for Medicare & Medicaid Services (CMS). With a Medicare Advantage plan, you could receive prescription drug coverage, routine dental, vision, hearing, transportation, reduced cost-sharing, a gym membership, and more.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

6 insurance companies offer Medicare Advantage plans in Perry.

| Medicare Advantage Insurance Companies in Perry |

|---|

| Aetna Medicare |

| Blue Cross and Blue Shield |

| Humana |

| Molina Healthcare |

| UnitedHealthcare |

| Wellcare |

These 5 Medicare Advantage insurance companies enroll the largest amount of Medicare beneficiaries in Perry. They offer the most popular plans.

| # | Medicare Advantage Insurance Companies in Perry |

|---|---|

| 1 | Unitedhealthcare Of The Midlands, Inc. |

| 2 | Sierra Health And Life Insurance Company, Inc. |

| 3 | Humana Insurance Company |

| 4 | Molina Healthcare Of Illinois, Inc. |

| 5 | Aetna Better Health Premier Plan Mmai Inc. |

There are 29 Medicare Advantage plans to choose from in Perry. Below are the many available options. Click on any of the links to review additional plan details.

| Medicare Advantage Plan Name | Plan Type | Monthly Plan Premium | Maximum Out-of-Pocket | Rx Deductible | Medicare Star Rating |

|---|---|---|---|---|---|

| HumanaChoice Giveback H7617-013 (PPO) | PPO | $0.00 | $4,500.00 | $615.00 | 4.5 |

| Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,000.00 | Not Applicable | 4.5 |

| AARP Medicare Advantage from UHC ST-0001 (PPO) | PPO | $53.00 | $4,500.00 | $520.00 | 4.0 |

| AARP Medicare Advantage from UHC ST-2 (PPO) | PPO | $0.00 | $6,700.00 | $600.00 | 4.0 |

| AARP Medicare Advantage Essentials from UHC ST-3 (HMO-POS) | HMO-POS | $0.00 | $3,200.00 | $440.00 | 4.0 |

| AARP Medicare Advantage Patriot No Rx MO-MA01 (HMO-POS) | HMO-POS | Not Applicable | $4,900.00 | Not Applicable | 4.0 |

| AARP Medicare Advantage Extras from UHC ST-4 (HMO-POS) | HMO-POS | $0.00 | $3,900.00 | $520.00 | 4.0 |

| AARP Medicare Advantage CareFlex from UHC ST-6 (HMO-POS) | HMO-POS | $0.00 | $6,700.00 | $600.00 | 4.0 |

| Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,000.00 | Not Applicable | 3.5 |

| Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,000.00 | Not Applicable | 3.5 |

| HumanaChoice H5216-399 (PPO) | PPO | $18.00 | $6,000.00 | $615.00 | 3.5 |

| HumanaChoice Giveback H5216-403 (PPO) | PPO | $0.00 | $4,500.00 | $615.00 | 3.5 |

| Aetna Medicare Eagle (PPO) | PPO | Not Applicable | $4,500.00 | Not Applicable | 3.5 |

| Aetna Medicare Signature (PPO) | PPO | $0.00 | $9,250.00 | $615.00 | 3.5 |

| Aetna Medicare Enhanced (PPO) | PPO | $69.00 | $8,750.00 | $615.00 | 3.5 |

| Humana Gold Choice H8145-006 (PFFS) | PFFS | $37.00 | $6,800.00 | $615.00 | 3.5 |

| Humana Gold Choice H8145-126 (PFFS) | PFFS | Not Applicable | $6,700.00 | Not Applicable | 3.5 |

| Blue Cross Medicare Advantage Basic (HMO) | HMO | $0.00 | $5,500.00 | $450.00 | 3.0 |

| Wellcare Simple Essential (HMO) | HMO | $0.00 | $4,200.00 | $615.00 | 3.0 |

| Wellcare Simple Essential Value (HMO) | HMO | $0.00 | $3,900.00 | $615.00 | 3.0 |

| Wellcare Giveback (HMO) | HMO | $0.00 | $7,500.00 | $615.00 | 3.0 |

| Wellcare Patriot Giveback (HMO) | HMO | Not Applicable | $5,500.00 | Not Applicable | 3.0 |

| Blue Cross Medicare Advantage Essential (PPO) | PPO | $0.00 | $6,700.00 | $450.00 | 3.0 |

| Blue Cross Medicare Advantage Health Choice (PPO) | PPO | $0.00 | $9,000.00 | $615.00 | 3.0 |

| Blue Cross Medicare Advantage Protect (PPO) | PPO | Not Applicable | $6,750.00 | Not Applicable | 3.0 |

| Blue Cross Medicare Advantage Dental Premier (PPO) | PPO | $0.00 | $7,500.00 | $615.00 | 3.0 |

| Humana USAA Honor Giveback (Regional PPO) | Regional PPO | Not Applicable | $6,750.00 | Not Applicable | 3.0 |

| HumanaChoice R5361-002 (Regional PPO) | Regional PPO | $103.00 | $7,200.00 | $615.00 | 3.0 |

The Centers for Medicare and Medicaid Services (CMS) rates all Medicare Advantage plans on a scale of 1 to 5 stars. Plans with one star are considered “poor,” while those with five stars are considered “excellent.” Any plan that is four stars and higher is a “top-rated” plan. These are the plans with the highest star ratings in Perry.

| # | Plan Name | Plan Type | Monthly Plan Premium | Maximum Out-of-Pocket | Rx Deductible | Medicare Star Rating |

|---|---|---|---|---|---|---|

| 1 | HumanaChoice Giveback H7617-013 (PPO) | PPO | $0.00 | $4,500.00 | $615.00 | 4.5 |

| 2 | Humana USAA Honor Giveback (PPO) | PPO | Not Applicable | $6,000.00 | Not Applicable | 4.5 |

| 3 | AARP Medicare Advantage from UHC ST-0001 (PPO) | PPO | $53.00 | $4,500.00 | $520.00 | 4.0 |

| 4 | AARP Medicare Advantage from UHC ST-2 (PPO) | PPO | $0.00 | $6,700.00 | $600.00 | 4.0 |

| 5 | AARP Medicare Advantage Essentials from UHC ST-3 (HMO-POS) | HMO-POS | $0.00 | $3,200.00 | $440.00 | 4.0 |

| 6 | AARP Medicare Advantage Patriot No Rx MO-MA01 (HMO-POS) | HMO-POS | Not Applicable | $4,900.00 | Not Applicable | 4.0 |

| 7 | AARP Medicare Advantage Extras from UHC ST-4 (HMO-POS) | HMO-POS | $0.00 | $3,900.00 | $520.00 | 4.0 |

| 8 | AARP Medicare Advantage CareFlex from UHC ST-6 (HMO-POS) | HMO-POS | $0.00 | $6,700.00 | $600.00 | 4.0 |

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

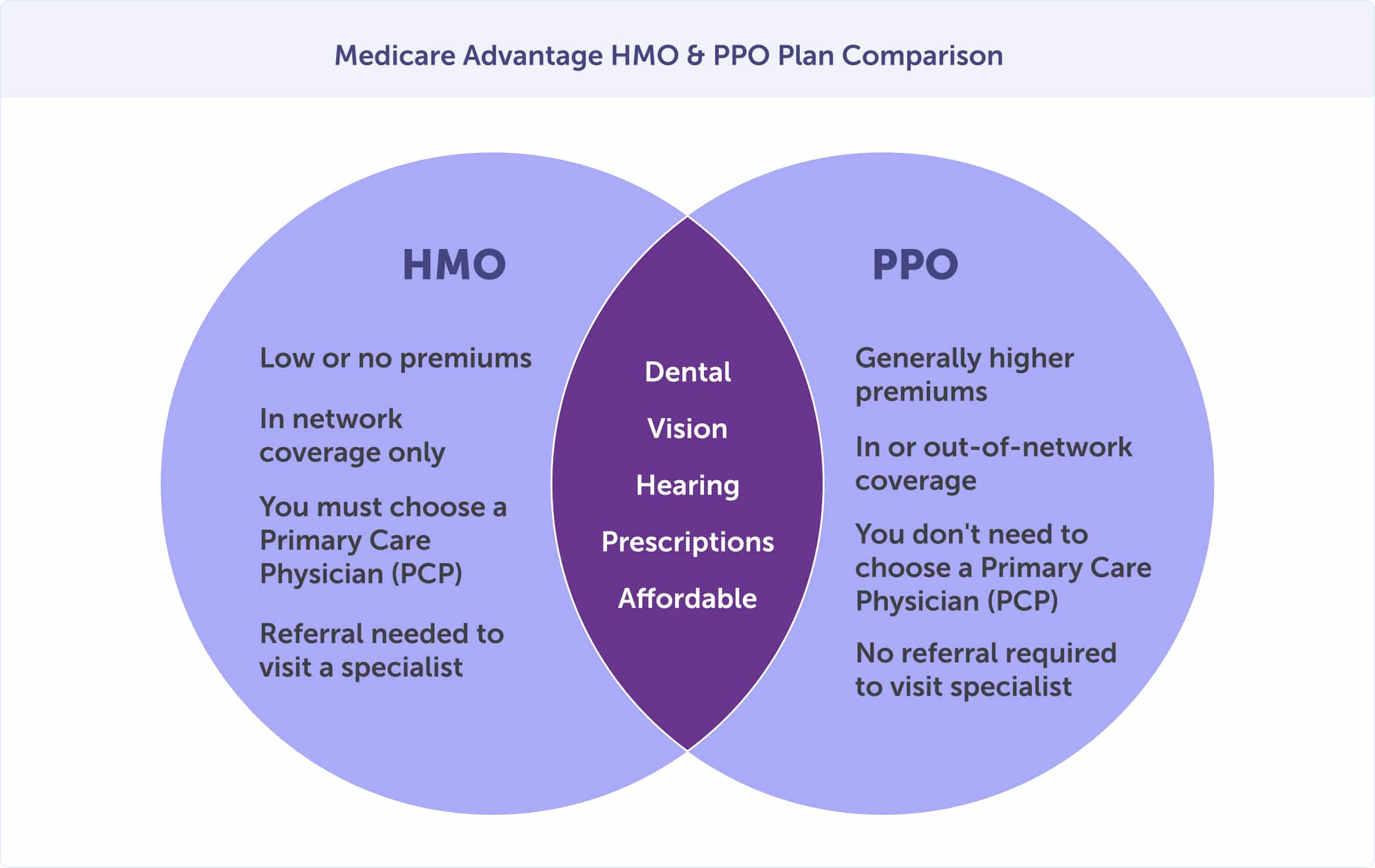

You can choose from 5 Medicare Advantage plan types in Perry. These include: PPO, HMO, HMO-POS, PFFS, Regional PPO. Which is the best plan for your health needs and budget? We'll walk you through the most popular plan types: PPO, HMO, HMO-POS, PFFS, Regional PPO. At the end of this section, you'll understand the difference between these popular plan types.

You have 10 Medicare Advantage HMO plans to choose from in Perry. An HMO, or Health Maintenance Organization, is a type of health plan that limits coverage to in-network care from doctors who work for or contract with the HMO. Typically, HMO plans won't cover out-of-network care except in an emergency.

There are 17 Medicare Advantage PPO plans in Perry. A PPO, or Preferred Provider Organization, is a type of health plan where you pay less to use doctors in the plan's network. Unlike an HMO, you can see doctors and specialists and use a hospital outside the network without a referral for an additional cost.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

Special Needs Plans, or SNPs, are a type of Medicare Advantage plan. There are two types of Special Needs Plans that may be available to you: Chronic Special Needs Plans (C-SNP) and Dual Special Needs Plans (D-SNP).

Chronic Special Needs Plans (C-SNP) are limited to people with specific illnesses or characteristics. For example, you may qualify for a C-SNP if you have diabetes, End-Stage Renal Disease (ESRD), HIV/AIDS, dementia, chronic heart failure, or other qualifying illnesses. Medicare C-SNPs tailor benefits, provider choices, and drug formularies to meet the needs of the special needs groups they serve.

You may qualify for a Dual Special Needs Plan (D-SNP) if you are eligible for Medicare and Medicaid. With a D-SNP, the State of Illinois may cover your Medicare costs, depending on your eligibility.

If you or your spouse are veterans, you likely have VA benefits. However, the U.S. Department of Veteran Affairs encourages you to sign up for Medicare as soon as you are eligible. Here are three reasons you should speak to a local licensed agent about how VA benefits and Medicare work together:

Having Medicare means you're covered when you need care from a non-VA hospital or doctor, offering you greater health options.

VA benefits and health care could change in the future, so you should enroll in every health care benefit that you are eligible for.

If you lose VA benefits and aren't enrolled in Medicare, you could face Medicare Part B and Part D lifetime late enrollment penalties.

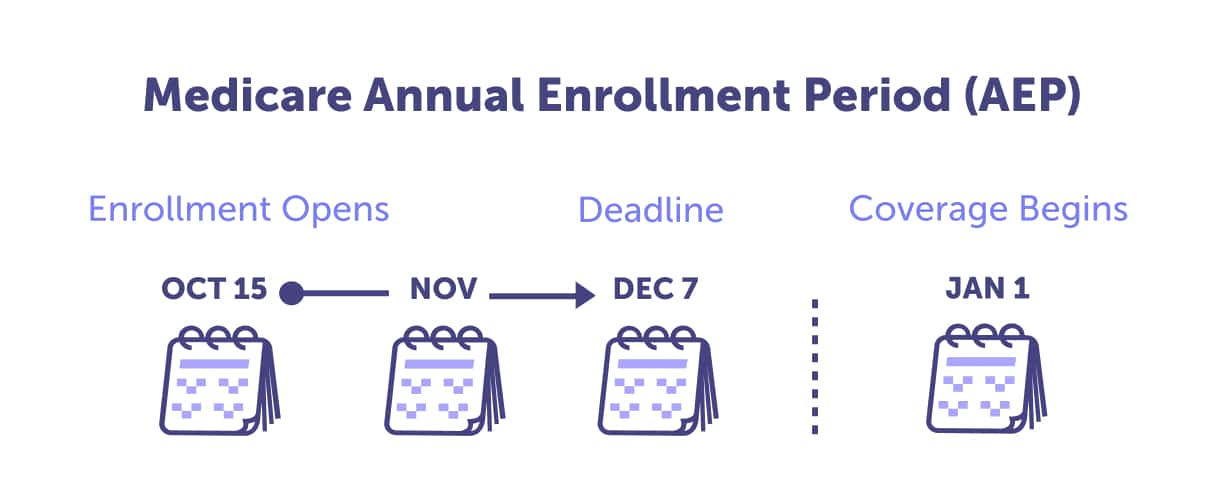

Knowing when to enroll or make plan changes can help you save money.

Are you enrolling in a Medicare Advantage plan for the first time, or are you interested in making a plan change? Skip to the section that applies to you - and mark the dates in your calendar.

If you're new to Medicare, the best time to enroll in a Medicare Advantage plan is during your Initial Enrollment Period. If you miss that, you can still enroll during the General Enrollment Period (January 1 - March 31) or Special Enrollment Period, but likely with penalties.

The best time to change a plan is during the Medicare Annual Enrollment Period (October 15 - December 7). During this time, anyone enrolled in Medicare can review their plan options for the coming year and ensure that their plan choice meets their health and budget needs.

If you need to make a plan change because you moved to a new service area or lost coverage, among other reasons, you could qualify for a Special Enrollment Period.

Whether enrolling for the first time or making a plan change, a Medicare Advantage plan could fit your health and budget needs. Medicare in Illinois can be confusing; you, don't have to sift through your options alone. Call 1-888-813-89111-888-813-8911 to speak with an agent today and review your frequently asked questions below.

You could sign up for a Medicare Advantage plan in several ways. You could choose your plan through Medicare’s website, speak with someone from a local SHIP, enroll directly with an insurance company, or enroll with an insurance broker or agent. We know you have options, and we hope that you’ll contact a local licensed Connie Health agent to speak about your Medicare healthcare needs.

With Connie Health, you can compare Medicare Advantage plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medicare Advantage plan options via phone, in person (a local place of your choosing), or via video chat, whichever you prefer. Call 1-888-813-89111-888-813-8911 to schedule an appointment or review your Medicare Advantage options online.

Free unbaised service

Compare all major plans and carriers

Local licensed insurance agents with 25+ years of experience

Struggling to find a trustworthy doctor who accepts your Medicare plan? It can be a daunting task but don't worry. With Connie Health, you can easily locate Medicare doctors near you.

No more endless phone calls or web searches. Our platform lets you enter your address and plan information (if you have it), and we'll do the rest. Let us help you eliminate the stress of finding a physician who accepts Medicare.

Which doctors near me accept Medicare in Perry?

It’s easy to find a trustworthy doctor that

accepts Medicare in Perry. Don’t spend your

time on endless phone calls and searches. Instead,

the Connie Health tool allows you to enter your

address and plan information if you have it. Then,

our tool will provide Medicare doctors near

you.

Let us help you eliminate the

stress of finding a physician who accepts

Medicare.

Find

your Medicare doctor today.

How many people are enrolled in a Medicare Advantage plan in Perry?

1,144 of 3,774 eligible Medicare beneficiaries are enrolled in Medicare Advantage plan in Perry. That's of the city's Medicare population. These people have chosen to protect themselves from the potentially high out-of-pocket costs of Original Medicare while receiving extra benefits like comprehensive dental, vision, hearing, and more.

Who is eligible for Medicare Advantage plans in Perry?

To be eligible for a Medicare Advantage plan in Perry, you must be enrolled in both Original Medicare Part A and Part B, and live in the service area of the Medicare Advantage plan that you’re considering enrolling.

Can I buy a Medicare Advantage plan in Perry?

Yes, if you meet the Medicare Advantage eligibility criteria you can enroll in an available Medicare Advantage plan in Perry. To be eligible to enroll in a Medicare Advantage plan, you must already be enrolled in Original Medicare Parts A and B.

What is the best time to enroll in a Medicare Advantage plan in Perry?

The best time to enroll in a Medicare Advantage plan in Perry for the first time is during your unique Initial Enrollment Period. This is when you first become eligible for Medicare.

Can I enroll in a Medicare Advantage plan anytime?

No, you cannot enroll in a Medicare Advantage plan in Perry at anytime. There are specific enrollment periods when you can enroll in a Medicare Advantage plan for the first time, or change your plan. You can enroll for the first time during your Initial Enrollment Period, the General Enrollment Period, or a Special Enrollment Period. You can make a Medicare Advantage plan change during the Annual Enrollment Period, Medicare Advantage Open Enrollment Period, or a Special Enrollment Period.

What is the best Medicare Advantage plan in Perry?

The best Medicare Advantage plan in Perry is the plan that best serves your health and budget needs. There is no “best plan” because what serves your neighbor likely won't serve you best. Medicare isn't one-size-fits-all.

How much does a Medicare Advantage plan cost in Perry?

Every Medicare beneficiary in Perry has access to a $0 monthly premium Medicare Advantage plan. That is the lowest-cost premium, and there are 15 plans with a $0 premium in Perry. For those who pay a premium, the average monthly cost is $14.00.

How much does Medicare cost in Perry?

Medicare costs include premiums and deductibles, but also copays and coinsurance. These amounts will depend on the plan or plans that you choose. A Medicare Advantage plan in Perry will cost an average of $14.00 per month for the premium, in addition to the Medicare Part B premium and Medicare Part A, if that applies. Out-of-pocket costs will vary depending on the Medicare-approved services or procedures you need and medications. However, the average Medicare Advantage out-of-pocket maximum is $6,160.34 per year, and the average prescription drug plan deductible is $548.00.

What is the difference between a Medicare Advantage and Medicare Supplement?

A Medicare Advantage plan includes Medicare Part A and B, oftentimes prescription drug coverage, and extra benefits like dental, vision, and hearing. These plans are also called Medicare Part C plans. Medicare Supplement plans, also called Medicare Advantage, supplements your Original Medicare benefits and pays for out-of-pocket medical expenses not covered by Part A and Medicare Part B. A Medicare Supplement plan only works with Original Medicare and doesn’t include extra benefits.

Can I switch Medicare Advantage plans in Perry?

Yes, you can switch Medicare Advantage plans during the Annual Enrollment Period from October 15th to December 7th annually or during the Medicare Advantage Open Enrollment Period between January 1st and March 31st each year.

Can I keep my Medicare Advantage plan if I move to a different city in Illinois?

Maybe. Medicare Advantage plan service areas are by county, so if you stay within the same county you may not need to make a plan change. However, you should inform your Connie Health agent if you move to a different city. Your agent can review your address and determine if it's within your plan's service area and you can keep your plan. If not, you will need to choose a new Medicare Advantage plan that's available in your new location.

Is Humana Gold Plus a Medicare Advantage plan?

Yes, Humana Gold Plus is a type of Medicare Advantage plan, specifically a Health Maintenance Organixation (HMO) plan.

Does Medicare Advantage cover dental in Perry?

Yes, some Medicare Advantage plans cover dental as an additional benefit. Coverage availability and specifics vary by plan and location, so it is best to check with your plan provider for details. If you're looking for a Medicare Advantage plan that offers routine dental, a local licensed Connie Health agent can help review your plan options.

How to choose a Medicare Advantage plan in Perry?

Is Humana Choice PPO a Medicare Advantage plan?

Yes, Humana Choice PPO is a type of Medicare Advantage plan, specifically a Preferred Provider Organization (PPO) plan.

Does Medicare Advantage cover hearing aids in Perry?

Some Medicare Advantage plans offer hearing aid coverage as an additional benefit. Coverage specifics can vary, so it is essential to review the details of each plan.

How to compare Medicare Advantage plans in Perry?

Is Medicare Part C the same as Medicare Advantage?

Yes, Medicare Part C is the same as Medicare Advantage. It is an alternative way to receive your Medicare benefits through private insurance companies approved by Medicare.

What doctors near me accept Medicare in Perry?

It's easy to find a trustworthy doctor who accepts Medicare in Perry. Don't spend your time on endless phone calls and searches. Instead, the Connie Health tool allows you to enter your address and plan information if you have it. Then, our tool will provide Medicare doctors near you. Let us help you eliminate the stress of finding a physician who accepts Medicare. Find your Medicare doctor today.

How do I compare Medicare Advantage plans in Perry, Illinois?

You can compare Medicare Advantage plans online or by speaking with a licensed Connie Health agent in your community. A local licensed agent can discuss your Medicare Advantage options via phone, in person, or video chat, whichever you prefer. Call 1-888-813-89111-888-813-8911 to schedule an appointment or review your Medicare Advantage options online.

Where can I get more information about Medicare Advantage plans in Perry, Illinois?

More information about Medicare Advantage plans in Perry is available by calling 1-888-813-89111-888-813-8911 and speaking with a local licensed agent in your area. You can make an appointment to speak in person, over the phone, or by video chat. Or by reviewing Medicare Advantage plan options online.

Medicare Advantage plans may be available in the following zip codes in the Perry, Illinois. 62362

Renée is the Director of Content at Connie Health. She has a passion for helping people understand their Medicare options and make informed decisions.

David is a licensed Medicare insurance agent with a passion for helping people understand their Medicare options and make informed decisions.

“Explore your Medicare coverage options.” Medicare.gov.

“MA State/County Penetration.” CMS.gov.

“Monthly MA Enrollment by State/County/Contract.” CMS.gov.

“Prescription Drug Coverage - General Information.” CMS.gov.

“VA healthcare and other insurance.” U.S. Department of Veterans Affairs (VA.gov).

Last updated: December 17, 2026