Speak to a licensed agent (Monday-Saturday 8am - 8pm, Sunday 9am - 5pm)

(623) 223-8884 | TTY: 711

(623) 223-8884 | TTY: 711

Call Now

Call Now

Call Now

Call Now

Have questions about Medicare in Illinois? Let us help you make the right decision. Discover local tips and answers to frequently asked questions in this ultimate guide.

Speak with a local licensed insurance agent:

(623) 223-8884 (TTY: 711) Monday-Saturday 8am - 8pm, Sunday 9am - 5pmThe Medicare program is a lifeline for millions of Americans, offering access to essential healthcare services that might otherwise be out of reach. Intending to reduce the cost of care, this federal health insurance initiative plays a critical role in the lives of eligible individuals nationwide.

As a system regulated by the federal government and managed by the Centers for Medicare & Medicaid, Medicare guarantees people in every corner of the country have access to high-quality healthcare services. In other words, regardless of where you live, CMS is committed to ensuring you receive the healthcare services you need.

In 2023, a staggering 2.3 million (2,338,936) individuals from Illinois (12,582,032) are enrolled in Medicare, comprising almost 19% of the Illinois population. This means that if you’re one of those who are Medicare-eligible, you’re not alone. Joining this government-funded healthcare program ensures you’ll be in good company with millions of Illinoisans who also benefit from its services.

Continue reading to learn if you’re eligible for Medicare in Illinois.

Are you curious about the requirements for Medicare eligibility in Illinois? If you’re wondering if you qualify, it comes down to either reaching the age threshold or having an approved disability recognized by the Social Security Administration. Let’s explore your options and make sure you understand what you’re eligible for.

Looking for accessible healthcare in Illinois? If you meet any of the following criteria, Medicare could be an option for you:

Medicare is an excellent healthcare solution for seniors, those with disabilities, and individuals with ESRD. If you fit into any of these categories, Medicare could be the perfect option to ensure access to comprehensive healthcare services that meet your unique needs.

Ready to take the next steps in your Medicare plan selection? Now, it’s time to explore your options and find the ideal plan for your health and budget. We’ve got all the information you need to make an informed decision. Don’t wait—let us guide you through finding your ideal Medicare plan in Illinois today.

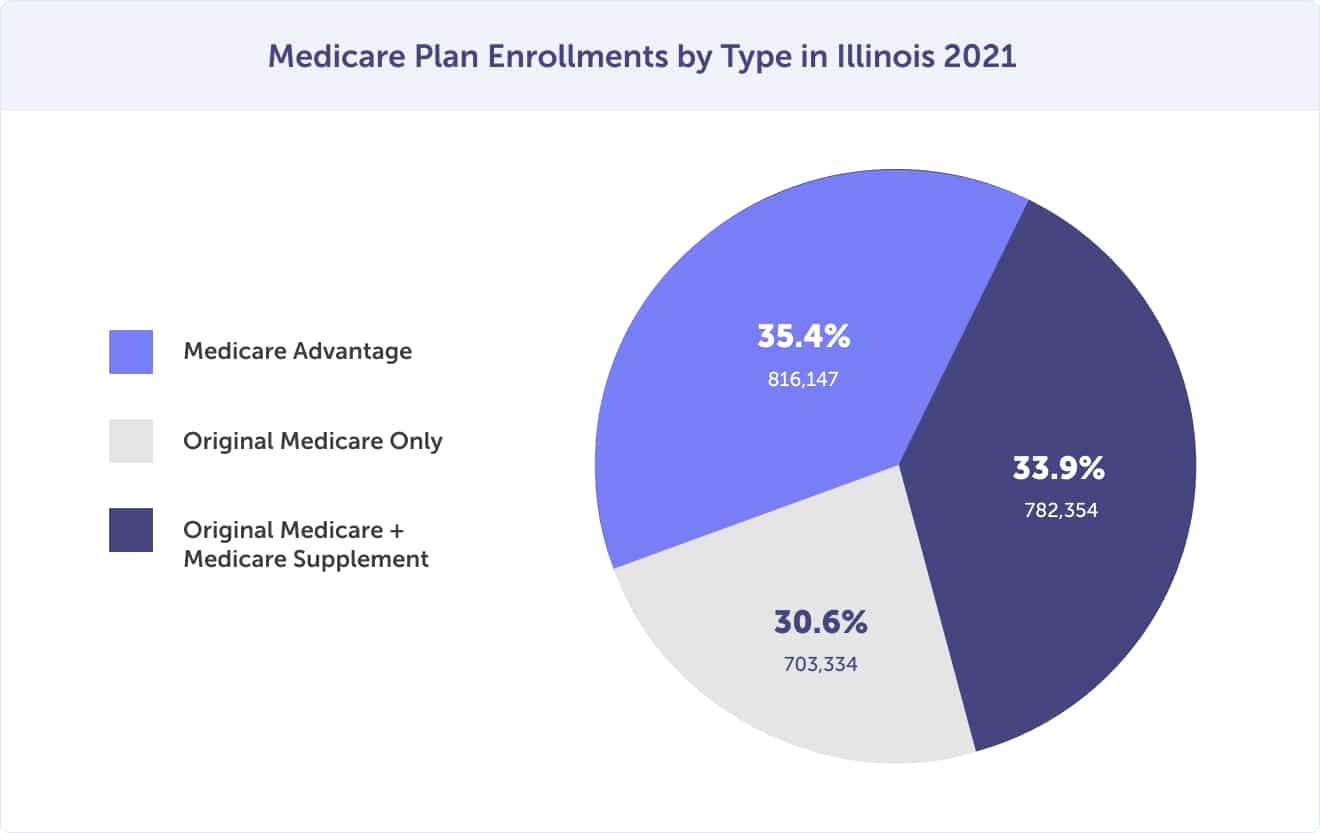

Illinoisans with Medicare coverage number over 2.3 million, and the stats reveal that more than 1.4 million (69%) have either a Medicare Supplement or Medicare Advantage plan.

33.9% (782,354) have opted for a Medicare Supplement plan for more comprehensive coverage with Original Medicare. Interestingly, the remaining 35.4% (816,147) have chosen Medicare Advantage plans, indicating a growing trend towards managed care options.

The majority of beneficiaries (69%) have chosen a plan that offers protection against unexpected and expensive out-of-pocket costs, which go beyond what would be covered by Original Medicare. This means individuals can feel more secure regarding their healthcare expenses and fully focus on getting the necessary treatment.

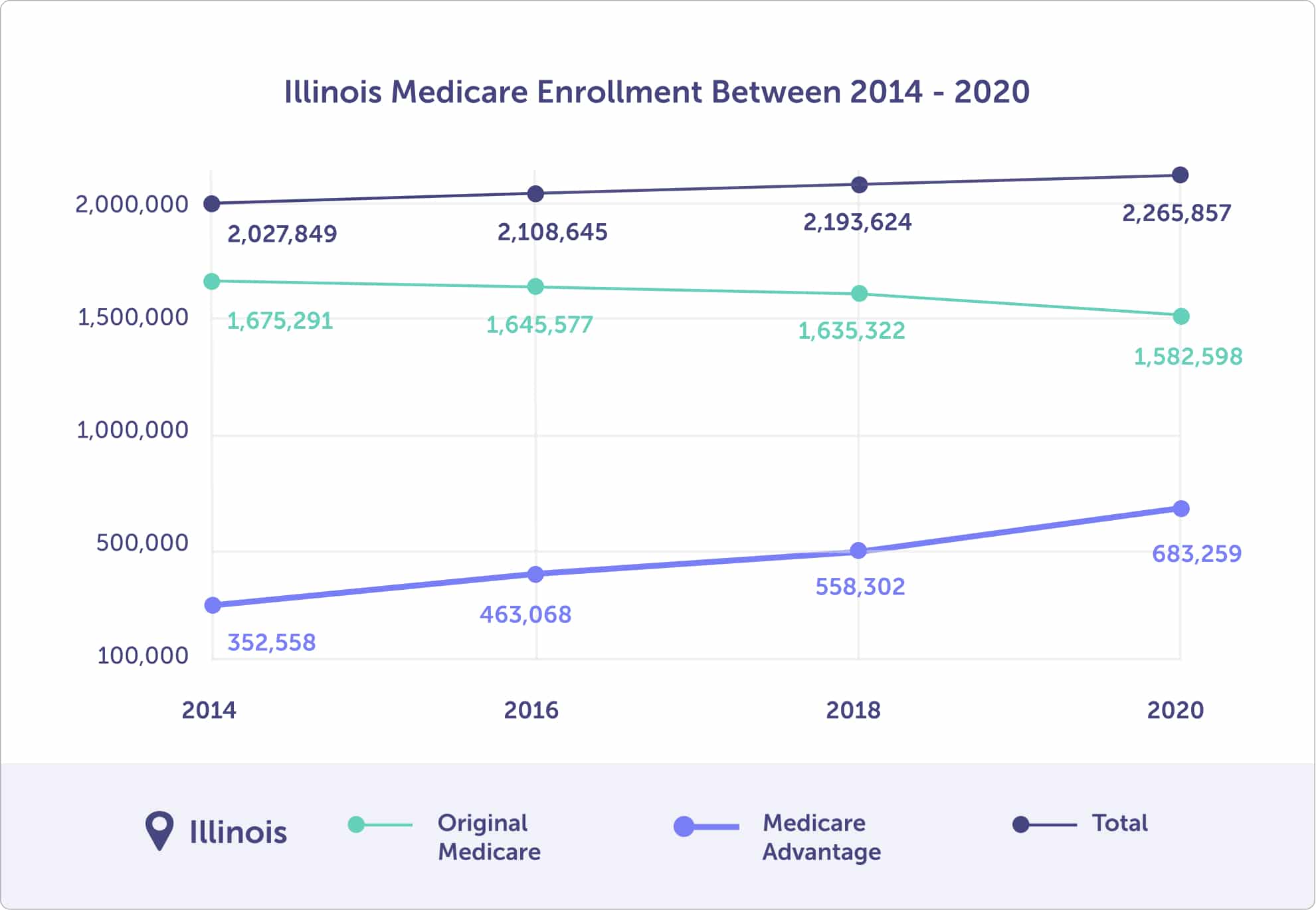

A surge in Illinoisans opting for a Medicare Advantage plan has been witnessed over the past few years, with a staggering 13% increase observed between 2014 and 2020. This means that over 683,000 individuals have switched to enjoy the benefits these plans offer, representing a significant jump from the 352,000 participants in 2014.

More locals are recognizing the value and convenience of Medicare Advantage, making it an increasingly popular choice.

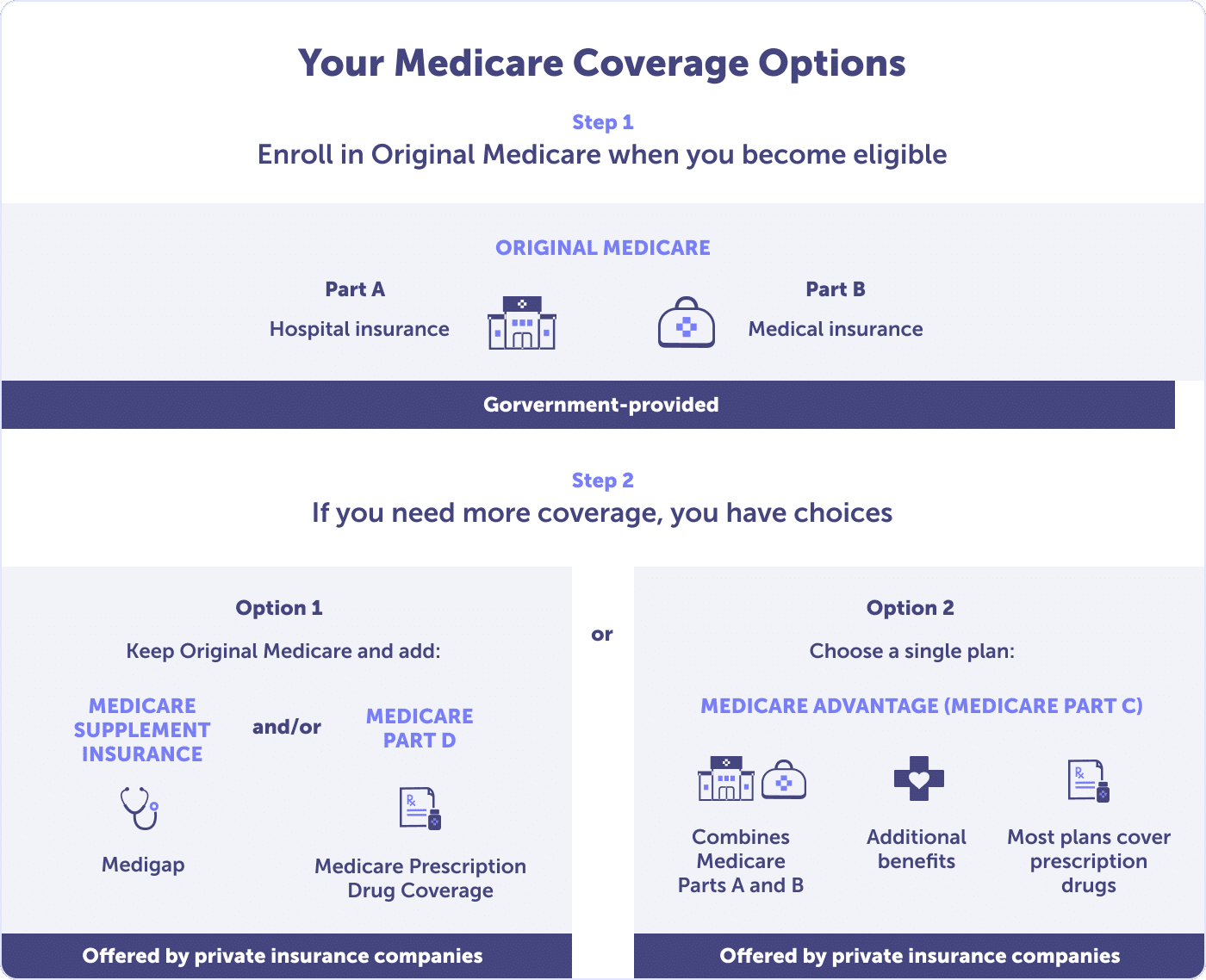

As you embark on your Medicare journey, a pivotal moment will present itself, offering a choice that will significantly impact your future healthcare. This crossroads demands careful consideration and informed decision-making.

Join Original Medicare Parts A and B, along with standalone prescription drug coverage under Medicare Part D, and round out your coverage with a Medigap plan.

OR

Enroll in a Medicare Advantage Plan that covers Medicare Parts A and B, prescription drugs, and extra perks like dental, vision, and hearing coverage. Or, opt for a plan without prescription drug coverage (Medicare Part C) with added benefits to fit your individual healthcare needs.

Enrolling in Original Medicare Parts A & B is crucial for all. But why stop there? You don’t want to get caught with those surprise out-of-pocket expenses. So why not take the smart route and join the 69% of smart Illinoisans already part of Medicare Advantage or Medicare Supplement plans that provide optimum protection from such costs?

Looking for the optimal healthcare options that also fit your budget? Explore Medicare Parts A, B, C, D, and Medicare Supplement plans. Our team of experts is standing by to help you discover the ideal match for your needs.

Looking for hospital insurance? Look no further than Medicare Part A, a key component of Original Medicare provided by the federal government. And the best part? You can typically enjoy this valuable coverage without paying any premiums. With Medicare Part A, you can rest assured you’ll be covered if you ever need to be hospitalized.

Medicare Advantage plan providers contract with the Centers for Medicare & Medicaid Services. As part of this contract, they must provide coverage equal to or greater than Medicare Part A hospital insurance.

Criteria for eligibility to enroll in Original Medicare Part A in Illinois include meeting one of these prerequisites:

Discover peace of mind with your public hospital coverage through Medicare Part A. Benefit from comprehensive insurance that covers all medically-necessary services provided by a Medicare-approved facility with a Medicare-assigned provider.

These services include:

Explore the boundaries of Medicare Part A coverage to ensure you’re safeguarded against unforeseen costs. Avoid surprises by delving into the exclusions explained in this resource on Medicare Part A.

Discover if you qualify for a premium-free Medicare Part A plan.

In Illinois, you must be at least 65 or older and:

Are you under 65 years of age? You may receive premium-free Part A if you:

You may wonder what happens when you and your spouse don’t meet the premium-free Part A healthcare coverage requirements. You still have access to this vital coverage by opting to purchase it. In 2025, the cost could be up to $518 monthly. Let’s explore the available options and ensure you have peace of mind regarding your healthcare needs.

Are you curious about the secret behind your Medicare Part A premium expenses? The answer may surprise you – it all boils down to the quarters.

If you haven’t worked for 30 quarters or more, your monthly premium will be $518. But here’s the good news: if you’ve paid Medicare taxes for 30 to 39 quarters, you’ll pay less. Your premium drops to $285 a month.

When you purchase Medicare Part A, you must also buy Part B medical insurance – and pay both premiums. If you’re not interested in Part A, don’t worry. You can still enroll in Part B and customize your coverage to your unique needs.

Did you know that when it comes to Part A expenses, it’s not just about the premiums? In addition to your monthly payment (if you need to pay one), you may also need to budget for deductibles, coinsurance, and copays. So don’t forget to factor in these costs for a more complete picture of Part A healthcare expenses.

In 2025, the Medicare Part A deductible is $1,676.

When it comes to receiving inpatient care, the length of your stay can impact your coinsurance costs. The longer you stay, the more money you’ll owe – so try your best to get discharged as soon as possible. Don’t hesitate to discuss with your doctor if you think there’s a way to expedite your recovery process.

In 2025, Medicare Part A coinsurance is:

Are you wondering about the potential expenses you might face if you require inpatient care? If you receive care for about five months (150 days), you could owe about $62,850 in coinsurance.

Take a glance at the helpful table below. It outlines the coinsurance costs by days, providing a clear and concise breakdown that makes it easy to see what you would be paying with Original Medicare only. Don’t let unexpected medical expenses catch you off guard – let this information empower you to make informed decisions about your healthcare.

2025 Potential Cost of 1 - 150 Days of Inpatient Care

When it comes to inpatient hospital care, prepare yourself for potential costs. The combination of your coinsurance and deductible could exceed what you anticipated. Brace yourself for possibly paying $62,850 or more.

Remember that Medicare Part A solely covers expenses approved by Medicare. Stay informed and be prepared to tackle any unexpected financial burden that comes your way.

Also, if your hospital stay extends beyond the 150-day mark, the financial responsibility would fall on you. This means you would have to pay out-of-pocket for additional treatment days beyond that point.

This is why 69% of Illinois residents are expanding their Medicare coverage with a Medicare Advantage or Medicare Supplement plan. With Medicare Advantage, you can say goodbye to unlimited expenses thanks to cost capping. If you opt for a Medicare Supplement plan, you may be eligible to cover some or even all of your out-of-pocket expenses.

It’s no secret that healthcare costs can add up quickly, especially when Medicare doesn’t cover services. To avoid unexpected expenses, it’s important to understand what Medicare Part A does and doesn’t cover and to seek pre-approval when necessary. Don’t let a lack of knowledge leave you with out-of-pocket expenses – take control of your healthcare and read up on Medicare Part A.

It’s important to ensure you’re enrolled in Medicare Part A during your Initial Enrollment Period. But don’t worry if you miss this window – you may still be able to sign up during a General or Special Enrollment Period if you qualify.

Medicare Part A takes care of your hospital needs, but Medicare Part B completes the picture by covering your medical expenses.

Looking to enroll in Part B in Illinois? Great news – you’re eligible if you meet the Original Medicare Part A criteria. To qualify, you’ll need to meet one of the following requirements:

Whether you need routine check-ups, immunizations, or specialized procedures, Medicare Part B covers you. Original Medicare Part B is your reliable ally in obtaining medically necessary and preventative services.

Original Medicare Part B covers:

Looking to stay on top of what Medicare Part B covers? Look no further than Medicare’s exhaustive coverage list of What Part B covers. Stay informed and make informed healthcare decisions with ease.

The standard Part B premium is currently $185.00, and while this is the minimum most people are required to pay, it is subject to change depending on your income. So, while Part B is a must-have for anyone needing basic medical coverage, it’s crucial to check how much you’ll need to pay.

Medicare Part B has no one-size-fits-all premium – it’s personalized based on your income. You could pay more than the standard rate if your modified adjusted gross income exceeds a certain threshold. For example, in 2025, you may pay the standard $185.00 premium but also an extra Income Related Monthly Adjustment Amount (IRMAA) based on your income.

Navigating Part B premiums can be complex, but knowing the ins and outs is important. The Centers for Medicare and Medicaid Services (CMS) considers your modified adjusted gross income from two years ago to determine your premium. If you’re currently insured in 2025, your Part B premium will be calculated based on your federal tax return from 2023.

Look for any IRMAA charges by finding your modified adjusted gross income for 2023 below. Knowing what to expect will help you avoid any surprise additional costs for your healthcare. Prefer to brush up on your Part B knowledge? Read about Medicare Part B costs – everything from premiums to deductibles.

2025 Medicare Part B Premium & Income Related Monthly Adjustment Amount (IRMAA)

Illinois’ Medicare Part B deductible is $257.

After meeting the yearly $257 deductible, Medicare beneficiaries typically pay 20% of the cost for Medicare-approved services. This includes services provided by doctors while you’re hospitalized, outpatient therapy, and Durable Medical Equipment (DME), among others. So, while Medicare covers a significant portion of your medical expenses, it’s important to remember the 20% coinsurance that comes with it.

It may come as a surprise to some that Original Medicare doesn’t have a cap for out-of-pocket expenses, and as a result, you’ll have to pay a hefty 20% for each Medicare-approved service unless you’re enrolled in a plan that expands your coverage.

A Medicare Supplement plan can help cover some or all of your Medicare-approved costs, while a Medicare Advantage plan puts a cap on out-of-pocket expenses so you can finally stop worrying about unexpected bills.

With Medicare Part B, in-network healthcare providers offer preventative services at no additional cost to their patients, allowing for easy access to the preventative care that is important for good health.

Looking to find out if your medical needs are covered under Original Medicare? Look no further than Medicare’s intuitive tool that can help determine whether a specific test, item, or service is eligible for coverage.

To make sure you’re not hit with unexpected bills, it’s important to keep a few things in mind. Firstly, don’t forget that some services and tests might require pre-approval. And if you are admitted to the hospital, requesting hospital orders can help you avoid any unexpected charges. Additionally, we suggest you take some time to negotiate the cost of services before they’re provided – this will help ensure that your bills are fair and reasonable.

Enrolling in Medicare Part B during your Initial Enrollment Period is important. But don’t worry if you miss that window – you still have options, although they may come at a price. The General Enrollment Period is another chance to enroll, or you may be eligible for a Special Enrollment Period.

Missing your Initial Enrollment Period and enrolling later during the General or a Special Enrollment Period could result in you facing hefty lifelong late enrollment penalties. Taking action during your initial enrollment window is crucial to avoid any potential financial consequences.

Did you know that delaying your enrollment in Medicare Part B is an option? However, it’s important to note that you’ll need coverage equivalent to Part B from another source, referred to as creditable coverage. This allows you to have flexibility and control over your healthcare choices.

Each year, keep an eye out for a letter of important information. This notice, known as the Notice of Creditable Coverage, lets you know about any Part B equivalent coverage you may receive from:

As you approach the age of eligibility for Medicare Part B, it’s crucial to keep your health coverage intact to avoid costly late enrollment fees. Maintaining credible coverage is the key to unlocking the benefits of Medicare without any barriers. Don’t let gaps in your insurance coverage put you at risk of financial burden in the long run. Stay proactive and stay covered until you’re ready to enroll in Medicare Part B.

Are you looking for comprehensive healthcare coverage? Look no further than Illinois’s dynamic Medicare Advantage plans, also known as Medicare Part C. These plans offer a variety of extra benefits beyond traditional Medicare coverage and are provided by private insurers under the Centers for Medicare & Medicaid Services (CMS) oversight.

Medicare Advantage plans are a great option for limiting out-of-pocket expenses. This way, you can enjoy the plan’s benefits without fearing unexpected costs. If you’re also looking for a plan covering prescription drugs, you’ll want to check out Medicare Advantage Prescription Drug Plans. These plans can give you the creditable prescription coverage you need, making them a smart choice for anyone looking to stay healthy and financially secure.

As you embark on your Medicare journey, enrolling in Medicare Part A and B is the first step. Once that’s completed, the exciting part begins – picking a Medicare Advantage plan tailored to your needs and location. With numerous options available at the county level, you can find a plan that suits all your healthcare needs.

In 2025, Illinois residents have many Medicare Advantage plan options, with different plans available. However, you might not have access to all of them. These plans are selectively available, depending on the county you reside in.

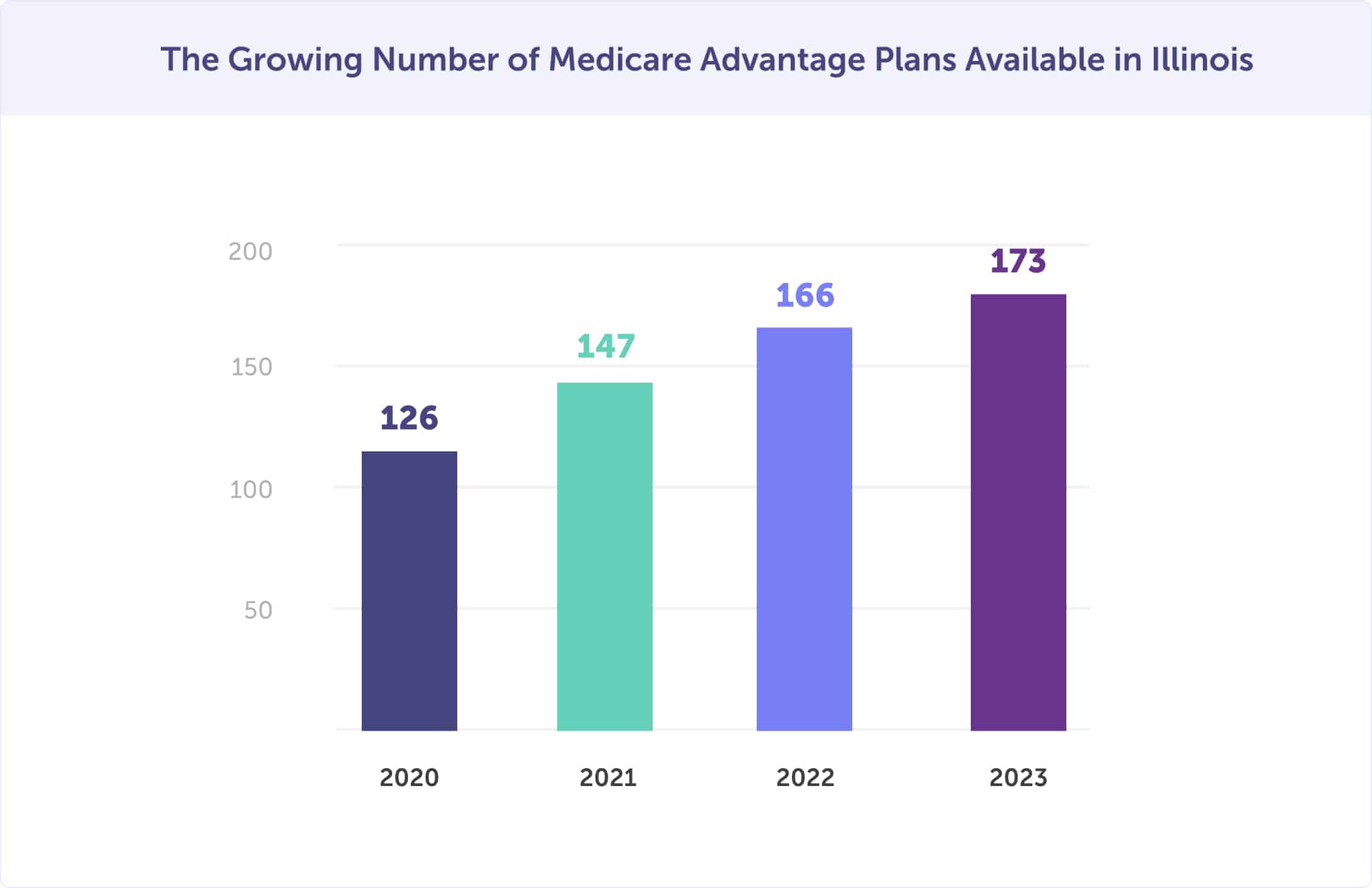

The number of plans available in 2025 is up compared to 2022 when there were 166 plans.

However, between 2021 and 2022, there was an 11% increase in Medicare Advantage plans. Jumping from to 166. In 2023, 40.5% of Illinoisans are enrolled in a Medicare Advantage plan.

As Medicare Advantage plan options continue to grow year after year, the power is in your hands to find the perfect insurance plan for your health and wallet. With more providers offering unique and competitive plans, you can rest assured that you’ll be able to find exactly what you’re looking for. So take advantage of this opportunity and choose the best plan for you.

As the number of Medicare Advantage plans in Illinois steadily increases, a handful of counties stand out for having the highest enrollment rates among Medicare beneficiaries.

In 2025, the five Illinois counties with the highest percentage of Medicare Advantage plan enrollees are Stephenson County (57%), Champaign County (57%), Jo Daviess County (57%), Rock Island County (54%), and Sangamon County (54%).

2023 Top 10 Illinois Counties with the Highest Percentage of Medicare Advantage Enrollment

Medicare Advantage plans boast equal coverage to Parts A and B. These plans also offer a variety of additional benefits that you won’t find with Original Medicare. And with nearly half of all Illinoians already enrolled, it’s a clear choice for many looking for comprehensive, cost-effective Medicare coverage.

Enrolled in Part A & B? You can access a Medicare Advantage plan with a monthly premium of $0. Yes, you read that right, zero dollars. For those who choose a plan with a premium, the average premium for a Medicare Advantage plan in Illinois this year is $11.39.

When you sign up for a Medicare Advantage plan, you’ll still be responsible for paying your Part A and B premiums. However, here’s the good news – most Medicare Advantage plans include prescription drug coverage. This means you can skip the hassle of signing up for a separate Part D plan and paying that premium.

Are you aware that Original Medicare could leave you with endless out-of-pocket expenses? Original Medicare has no cap on copayments or coinsurance, meaning you could be on the hook for a substantial amount without any protection. Even the 20% coinsurance has no limit, leaving you vulnerable to potentially crippling medical bills.

Discover the difference with Medicare Advantage plans. Unlike Original Medicare, these unique options establish deductibles, coinsurance, and copayments within federal regulations, providing peace of mind knowing your financial responsibility is limited. No unexpected surprises, just a straightforward understanding of your potential costs.

Medicare Advantage plans can be the ultimate relief for those worried about their medical expenses. These plans offer a guarantee of coverage once you cross your out-of-pocket maximum limit, including your deductible. After you’ve met that mark, your plan will cover all eligible healthcare expenses for the remainder of the year, leaving you with peace of mind and fewer things to worry about.

If you’re relying solely on Original Medicare for your healthcare needs, it’s important to note that you won’t be covered for dental, vision, or hearing services. This means that if you need to get some dental work done or have your eyesight checked, you’ll need to pay out of pocket.

Looking to maintain your pearly whites, ensure crystal clear vision, or preserve your hearing? You’ll want to enroll in a Medicare Advantage plan. This healthcare option is far from basic, as it covers many services above and beyond what Original Medicare provides.

Medicare Advantage plans go beyond just providing comprehensive health coverage – they offer a world of perks designed to encourage and support your overall well-being.

With a focus on preventative care, these plans feature opportunities to access reduced cost-sharing, free over-the-counter and wellness products, transportation assistance, telemedicine, and even a gym membership. Plus, with added rewards and incentive programs, you’ll feel motivated to take charge of your health and live your best life.

The Centers for Medicare & Medicaid Services (CMS) Innovation Center’s Value-Based Insurance Design (VBID) program in Illinois is a unique initiative worth checking out. It’s designed to add value to insurance policies and promote more effective healthcare, and the benefits are quite impressive. If you’re looking for an innovative way to manage your healthcare costs and get the most out of your insurance, this program is worth considering.

Illinois Medicare beneficiaries can now choose amongst 20 Medicare Advantage plans that come packed with value. Some plans include the elimination of Part D cost-sharing, reward programs for adopting healthy habits, and tailored benefits for underserved and chronically ill individuals. The plans also address critical social issues such as food insecurity and social isolation.

And there’s more; the hospice benefit is included in 2 plans under the VBID Model.

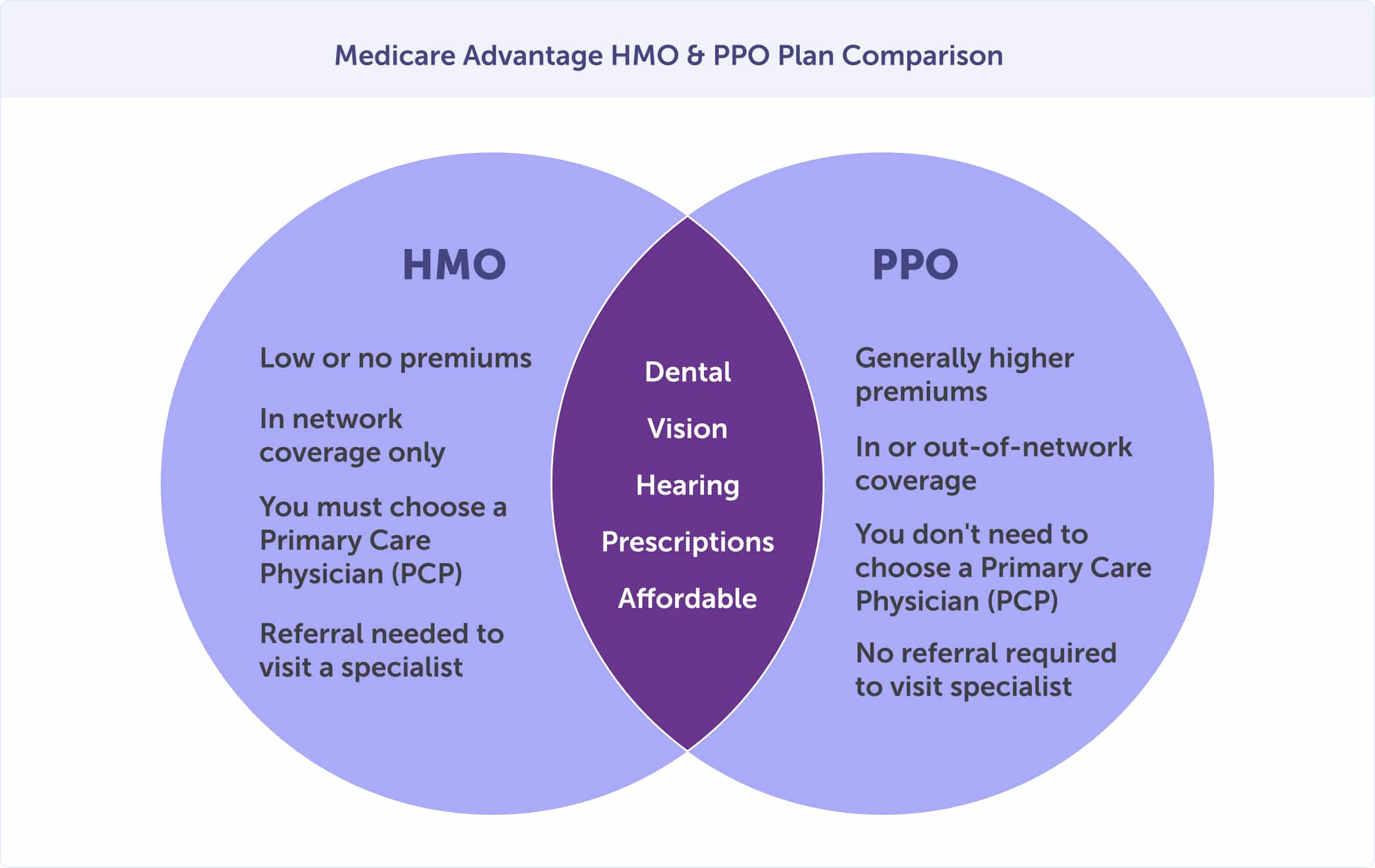

Illinois residents seeking a Medicare Advantage plan have various options, but two plan types tend to stand out above the rest. HMOs and PPOs are the most sought-after options. It’s important to carefully consider your needs when selecting a plan that’s right for you.

While not as popular as other healthcare plans, Special Needs Plans (SNPs) and Private Fee-for-Service (PFFS) options are worth considering if they align with your specific health and financial requirements.

As you navigate the world of Medicare Advantage plans, you’ll be faced with choosing between two popular types – HMO or PPO plans. However, if you live in a predominantly rural area, a lesser-known option is available to you: the PFFS plan. This type of plan offers unique benefits and considerations worth exploring further.

Deciding on the right insurance plan can be a tough decision. But when comparing HMO and PPO plans, two factors will likely be in your mind: network flexibility and cost. Each plan offers its unique balance of these features, so it’s important to carefully consider the best fit for your needs.

Do you know what Medicare Advantage HMO, PPO, SNP, and PFFS plans all have in common?

When it comes to Medicare Advantage, both HMO and PPO plans have a lot in common:

When choosing between HMO and PPO health insurance plans, your decision will come down to a delicate balance. You’ll need to consider the financial cost of each plan and its flexibility level. Each has benefits and drawbacks, so it’s essential to weigh your options carefully before making a final decision.

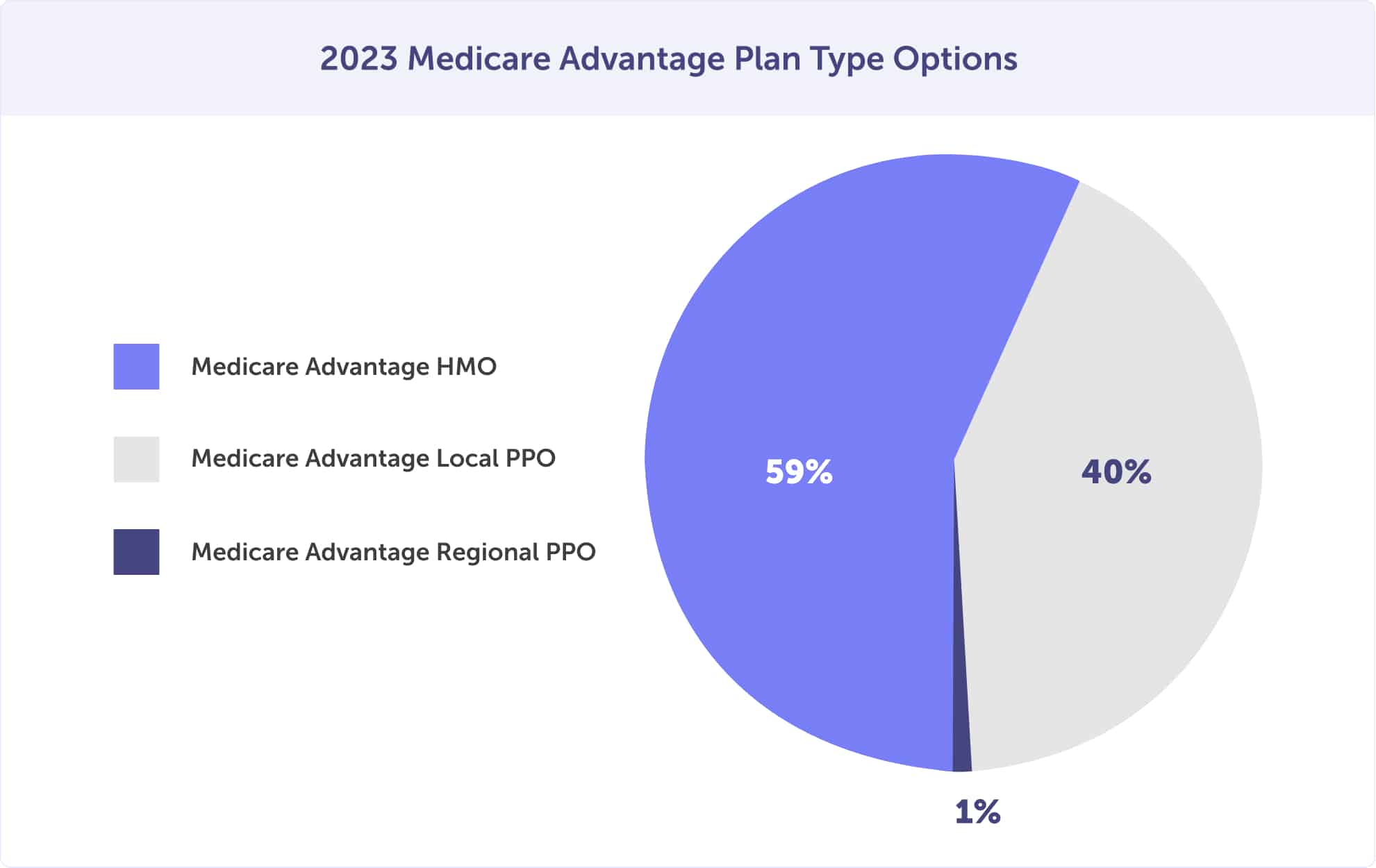

The availability of Medicare Advantage plan options says a lot about the plan types most people want. Of your plan type options, 59% of plans are HMOs. Local PPO plans are trailing behind, with 40% available. It seems as though the popularity of regional PPO plans is on the decline, with enrollment down from 5% in 2020 to 1% in 2023.

Medicare enrollees must have creditable prescription drug coverage, according to the Centers for Medicare & Medicaid Services (CMS). A Medicare Advantage plan is a great option to satisfy this requirement. The combination of traditional Medicare Part C and prescription drug coverage is known as a Medicare Advantage Prescription Drug plan. This plan ensures access to necessary medications while saving you money on out-of-pocket expenses.

Looking for simplicity and ease when it comes to Medicare coverage? Look no further than a Medicare Advantage plan. With all your needs covered under one card and plan, these plans are the ultimate convenience.

Say goodbye to the hassle of multiple plans and premiums – a Medicare Advantage plan covers you for hospital, medical, and prescription drug coverage. Plus, you’ll save money by avoiding an extra Part D prescription drug plan premium.

Experience the convenience and peace of mind that comes with Medicare Advantage Prescription Drug plans, now offered by a vast majority of Medicare Advantage plans. With over 89% of Medicare Advantage enrollees already taking advantage of this coverage, ensure you don’t miss out on the benefits. Get the medications you need when you need them and enjoy the ease of having all of your healthcare needs covered under one plan.

37 Medicare Advantage Plan Providers in Illinois

Good news for those enrolled in Medicare Part A and B in Illinois. You can now get a Medicare Advantage plan with a $0 monthly premium. If you choose a plan with a premium, the average monthly cost is $11.39 in 2025.

When you choose a Medicare Advantage or Medicare Advantage Prescription Drug plan, you’ll pay your premium to the provider. But don’t mix them up with your Medicare A and B premiums – those go straight to Medicare.

As a beneficiary of Original Medicare, you can choose how you pay your premiums. The options include automatic withdrawal from your Social Security benefit, electronic payment, or a good old-fashioned coupon book. So whether you prefer high-tech or old-school, Medicare has you covered.

As you consider enrolling in a Medicare Advantage plan, it’s important to remember that your premium is just the beginning. You may also encounter additional expenses – such as deductibles, copayments, and coinsurance – that can add up over time. Of course, the specific costs will vary depending on the plan you ultimately select. So, before you commit, be sure to thoroughly evaluate all of the potential out-of-pocket expenses, so you can make an informed decision that best fits your healthcare needs and finances.

Discovering the perfect Medicare Advantage plan can be a daunting task. With many coverage and cost options, it’s easy to feel overwhelmed. Narrowing it down to an HMO or PPO plan is a key decision that sets the foundation for making the right choice.

After that, it’s simply asking yourself pertinent questions to uncover the ideal plan that suits your health needs and budget. Take the time to research, and rest assured you’ll make an informed decision that benefits you.

Looking to jump on board with an Illinois Medicare Advantage plan? Your best bet is to take advantage of your Initial Enrollment Period. But, if you’ve missed that window, there’s still hope. You might still qualify for enrollment during the General or Special Enrollment Periods.

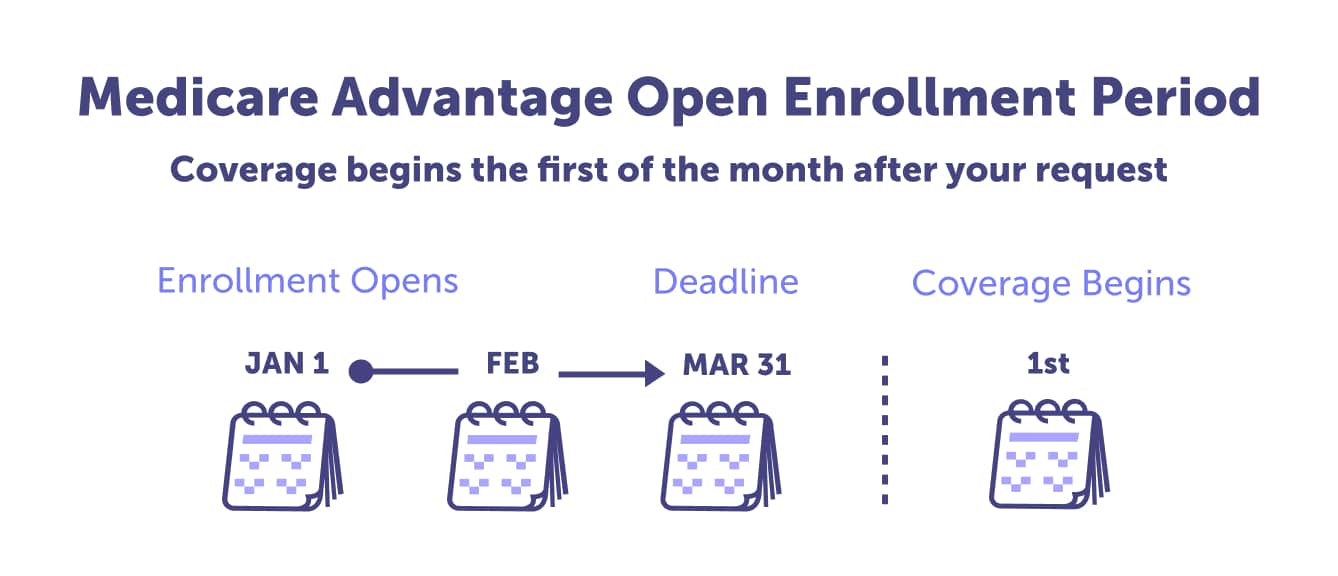

Enrolled in a Medicare Advantage plan and want to make plan changes? The best time to do that is during the Medicare Advantage Open Enrollment Period.

Introducing Medicare Part D: the federal program that ensures eligible individuals have access to vital prescription drugs. With the help of privately-regulated insurance companies and the Centers for Medicare & Medicaid Services (CMS), Part D offers a wide range of coverage options that guarantee consistent access to life-enhancing medications. Whether you’re new to the Medicare system or simply looking to expand your healthcare options, Medicare Part D provides the support and coverage you need.

If you’re enrolled in Original Medicare alone, most enrollees opt for coverage through Medicare Part D. However; it’s important to note that this doesn’t apply if you’re enrolled in Medicare Part C.

You can bundle your plan with prescription drug coverage when enrolled in Medicare Part C. That plan is called a Medicare Advantage Prescription Drug plan. Medicare Part D only works with Original Medicare and cannot be paired with a Medicare Part C plan.

Depending on your county, Medicare Part D is offered at participating pharmacies with varying costs and availability. Depending on the chosen plan, there is typically a monthly premium, annual deductible, copayments, and coinsurance.

Illinoisans can choose from an impressive selection of 24 stand-alone prescription drug plans this year. Interestingly, a significant percentage of those enrolled in Medicare Part D in Illinois – 26% – benefit from the Low-Income Subsidy or “Extra Help.”

What is Medicare Part D Creditable Coverage?

Don’t let unexpected penalties catch you off guard. The Centers for Medicare & Medicaid Services (CMS) requires all beneficiaries to have creditable prescription drug coverage. Don’t leave this requirement to chance – be prepared and avoid surprises.

Stay out of penalty trouble and ensure you’re covered with either a Medicare Advantage Prescription Drug plan or a standalone Medicare Part D prescription drug plan that complements your Original Medicare Parts A and B coverage.

Alternatively, you could obtain creditable coverage through your employer. With this approach, ensure that your employer can provide evidence that their prescription drug coverage is comparable to that of Medicare Part D.

Opportunities for obtaining reliable health insurance abound if you know where to look. Consider options like:

Planning for any changes to your group health insurance or coverage is important. If you lose coverage, you must enroll in Medicare Part D or a Medicare Advantage Prescription Drug plan within 63 days. If you miss this window, be prepared to face lifetime late enrollment penalties.

If you’re a Medicare beneficiary in Illinois with Original Medicare coverage, you can enroll in a Part D prescription drug plan to help cover the cost of your medications.

When selecting a health plan, reviewing the formulary – an individualized list of prescription medications covered is important. The specific drugs included may vary between plans and must be carefully investigated before selection; make sure that any brand-name, generic, or protected-class medications (such as treatments for HIV/AIDS or cancer) that you require are available with your chosen provider.

Concerned about your medication not being covered by your insurance? Fear not. The regulations put in place by the Centers for Medicare & Medicaid Services ensure that every Medicare Part D formulary must include a minimum of two drugs for the most frequently prescribed categories and classes. This means patients with commonly prescribed medications can breathe easily, knowing their necessary medication will not be denied.

While your formulary may not include every brand name medication, similar substitutes are often available. And in the rare case that there isn’t an alternative, you can always request an exception.

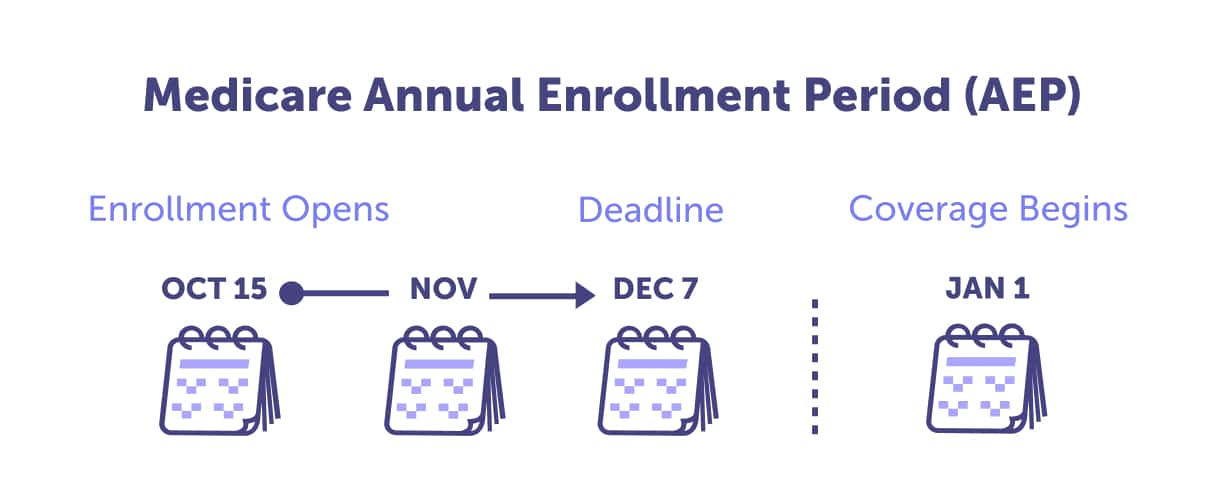

Just like Medicare Advantage and Supplement plans, Medicare Part D plans change annually. To ensure you get the best coverage possible, we suggest reviewing your plan during the Annual Enrollment Period, from October 15 to December 7. Don’t miss out on potentially better coverage options or cost savings – schedule a plan review before the deadline.

Reviewing your plan can help you get the optimal coverage and cost for you:

Don’t let the new year catch you off-guard with unavailable prescriptions or skyrocketing drug costs. A thorough review of your Medicare Part D plan is the key to saving money and staying informed.

Illinois’s lowest monthly premium for a standalone Medicare Part D prescription drug plan is $4.90.

In 2025, the national average monthly premium for standard Medicare Part D prescription drug coverage is $36.78.

In addition to your monthly premium, there are a few other costs to consider when choosing a Medicare Part D plan. These out-of-pocket expenses can include your annual deductible, copayments, and coinsurance.

Understanding your plan’s formulary can give you insight into what you’ll pay for prescription refills. These formularies have different coverage levels, known as tiers, which directly impact medication costs. By selecting a generic option, you may be able to avoid higher tiers and save money.

Rest assured that generic medication meets the same high standards as brand-name drugs. The Food and Drug Administration (FDA) demands that generic drugs be indistinguishable from their pricier counterparts, giving you peace of mind that you’re receiving a product of equal quality.

Generic drugs match their brand-name counterparts, from dosage to performance. If you’re looking to cut costs on your medication, it’s always a good idea to discuss generic options with your doctor or prescriber.

Medicare Part D plans can be flexible regarding deductibles and some plans may not even require one. But for those that do, you’ll be pleased to hear that they can’t exceed $590 this year.

If you’re an Illinois Medicare beneficiary with limited financial resources, there is help to afford your prescription medications. The Extra Help program, also known as the Low Income Subsidy, offers assistance with monthly premiums, annual deductibles, and prescription co-payments. It’s worth looking into if you need help managing your healthcare costs.

For those who are eligible for Extra Help, there’s good news. Signing up for a Medicare drug plan won’t incur a late enrollment penalty.

Each year, the CMS provides a Star Rating for each Medicare plan, helping you assess factors such as customer service, preventative care, and management of chronic conditions. These ratings range from 1 to 5 stars, with 4 and 5-star ratings indicating top-notch quality. By considering these ratings, you can gain insight into a plan’s responsiveness and member satisfaction, ultimately making an informed decision on your healthcare options.

There are no 5-star rated or 4-star rated Medicare Part D plans in Illinois. The highest-rated plans are Aetna Medicare, SilverScript SmartSaver (PDP) and, Blue Cross and Blue Shield, Blue Cross MedicareRx Choice (PDP). Both of these plans have 3.5 stars. When choosing your plan, you may want to consider these two highest-rated plans in Illinois.

Discover the top insurance carriers in Illinois that are offering standalone prescription drug plans for Medicare Part D.

11 Medicare Part D Providers in Illinois

Enrolling in Medicare Part D during your Initial Enrollment Period can make a big difference in your healthcare coverage. Enroll during this period, and you can avoid any late enrollment penalties.

If you accidentally skip your IEP, don’t worry – all is not lost. You can still enroll during the General Enrollment Period, but beware of those pesky late enrollment penalties. Alternatively, you may be eligible for a Special Enrollment Period, so explore all your options before deciding.

As you approach retirement, you want to ensure you have the right coverage to protect your health and finances. And that’s where Medicare Supplement plans–also known as Medigap plans–come in. These plans offer extra benefits on top of your Original Medicare coverage, giving you peace of mind that unexpected medical expenses won’t derail your retirement plans. With a Medigap plan, you can enjoy more stability and predictability in your healthcare costs, allowing you to focus on what matters most.

Medigap plans are like a trusty sidekick to Original Medicare, working together to give you the best possible coverage. And you can breathe a sigh of relief knowing that the Illinois Department of Insurance approves the companies who provide these plans. Plus, with standardization in place, you can rest assured that each insurance company offers the same level of coverage.

When signing up for Original Medicare Parts A & B alongside a Medigap plan, it’s crucial to have prescription drug coverage that is considered “creditable” by Medicare. However, Medicare Supplement plans themselves do not offer this coverage. So, exploring additional options, such as separate Medicare Part D plans or other sources, is essential to ensure you’re getting the comprehensive coverage you need.

The State of Medicare Supplement Coverage by AHIP reported 33.9% (782,354) of Medicare enrollees in Illinois were enrolled in Medicare Supplement coverage in 2021. In 2020, 34.6% (787,968) were enrolled, and in 2019, 35.6% (798,778). Medicare Supplement enrollment is declining – down 0.7% year-over-year.

By relying solely on Original Medicare, you could leave yourself vulnerable to financial strain. The absence of an out-of-pocket cap for Medicare Parts A and B could result in unforeseen expenses. While Part A covers certain inpatient costs and Part B covers most outpatient expenses, you’ll still be responsible for deductibles, copayments, and 20% coinsurance for doctor visits and medical care.

The expenses that fall under the coverage gap or out-of-pocket expenses could leave you paying much more than anticipated. Don’t get caught in a situation where you’re responsible for the costs of extended hospital stays or skilled nursing facilities. The coinsurance fees can add up quickly and hit your wallet hard.

A Medicare Supplement plan has got you covered for expenses such as deductibles, copays, and coinsurance:

In Illinois, there are not one, not two, but 10 different types of Medicare Supplement plans available. These plans, which are A-G and K-N, offer a range of options and benefits for those enrolled in Medicare. Illinois requires that all insurance companies offering Medicare Supplement plans must provide Plan A at the minimum – ensuring you have access to a certain level of coverage.

As you approach Medicare enrollment, you must know the available plans. While there used to be ten options, some have been phased out, leaving fewer choices. Specifically, plans including the Part B deductible, are no longer offered.

However, if you turned 65 in or before 2019, you may still be eligible for Plan C and F. Unfortunately, those who turned 65 in 2020 or later won’t have access to these options. Plan J is also off the table for new enrollments. Be sure to review your options carefully before making a decision.

The top Medicare Supplement plans in Illinois are Plan F (51.4%), Plan G (36%), Plan N (7.1%), Plan C (1.5%), and Plan D (1.5%). Of these five plans, Plan G and Plan N are rising in enrollment due to the phase-out of Plan C and F.

Top Illinois Medicare Supplement Plans

Choosing a health plan that suits your specific needs and budget is important, rather than simply following the crowd. Don’t be swayed by popularity alone when making enrollment decisions, as the most popular plan may not fit you best.

Prioritize your well-being alongside the expenses involved in opting for a health plan. Some plans might have lower monthly premium payments but might entail a higher amount of out-of-pocket expenses. It’s important to discern what matters more to you.

47 Medicare Supplement Plan (Medigap) Providers in Illinois

Although Medicare Plan F used to be the most popular choice among Illinois Medicare eligibles, it’s no longer an option for those who turned 65 after December 31, 1999. While this might seem like a disappointment, fear not. There are still a variety of alternative plans to choose from.

In Illinois, Medigap Plan G boasts impressive popularity, coming in second only to its now-discontinued counterpart, Plan F. Plan G may be the way to go for those seeking a viable alternative.

If you’re looking for a comprehensive Medicare plan in Illinois, then Medicare Plan G might be your option. Plan G covers medical expenses, including hospitalization, outpatient care, preventive services, and more. The plan also covers 100% of the Medicare Part B excess charges, saving you significant money. With Plan G, you won’t have to worry about deductibles or copays, as they are covered under the plan. If you want to learn more about Medicare Plan G in Illinois, talk to a licensed insurance agent who can help you make an informed decision.

You must meet a few prerequisites to qualify for a Medicare Supplement Plan. Firstly, you must be enrolled in Original Medicare’s Part A and B. Secondly, you need to reside in the same county where the plan you’re interested in is offered.

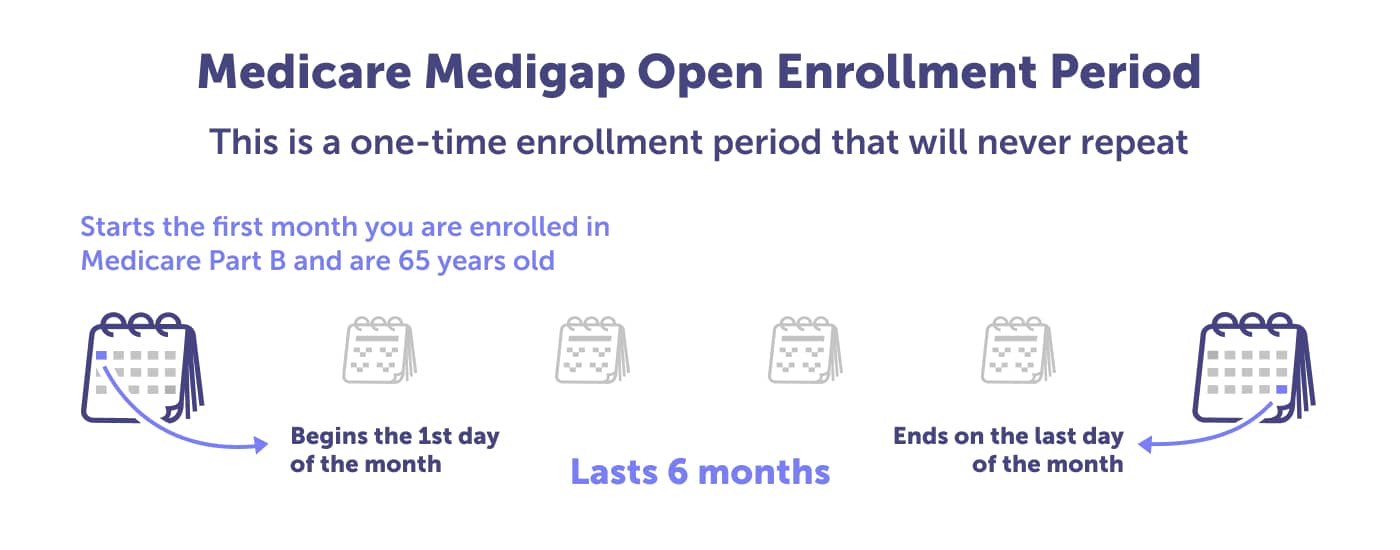

The best time to enroll in a Medicare Supplement plan is during your Medigap Open Enrollment Period. This one-time enrollment opportunity cannot be repeated or altered, so it’s essential to stay informed on when this period rolls around.

Don’t miss your chance to enroll in a Medigap plan. Once your enrollment period has passed, you may undergo medical underwriting and face price hikes. Don’t let preexisting conditions stop you from getting the coverage you need. Take advantage of your Medigap Open Enrollment Period and get peace of mind knowing you’re covered.

Navigating the world of Medicare can be overwhelming, but critical enrollment periods offer key opportunities to secure coverage and benefits. From the Initial Enrollment Period to the Medigap Open Enrollment Period, take advantage of these windows to apply for Medicare. And if you miss your chance, don’t despair – a Special Enrollment period may still be available, provided you meet the eligibility criteria.

Don’t wait until the last minute to enroll. You have a seven-month window known as your Initial Enrollment Period. This includes three months leading up to your birthday month, your birth month, and three months after. Take advantage of this beneficial opportunity; start planning for it today.

By failing to enroll during your Initial Enrollment Period, you could find yourself in a prickly situation with some serious consequences.

You may face hefty late enrollment penalties if you miss your chance and wait until the General Enrollment Period. Don’t let that happen. Taking advantage of the Initial Enrollment Period window is critical to ensure you’re not left with any unpleasant surprises.

Are you unsure when you should enroll in Medicare? Take our easy eligibility quiz today and never miss a beat. We’ll help you identify your Initial Enrollment Period and send you helpful reminders every step of the way.

Don’t let confusion hold you back from getting the benefits you deserve. Take the quiz and get on track with ease.

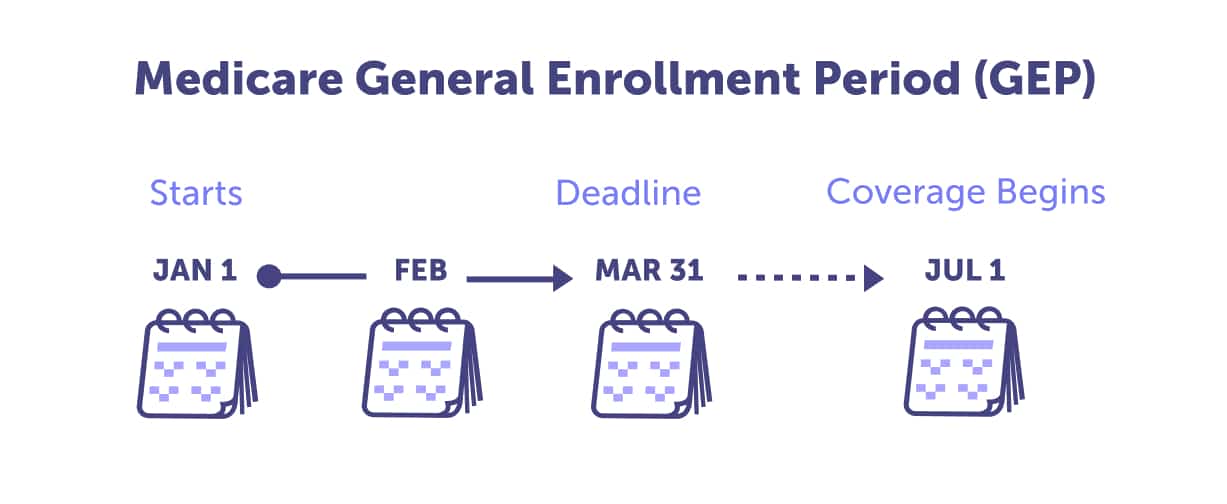

If you happen to miss your Initial Enrollment Period, there’s no need to fret – you still have an opportunity to enroll during the General Enrollment Period. This time window, from January 1 to March 31 every year, is your second chance to gain coverage. Act promptly, as those who take advantage of this period will enjoy benefits as early as July 1. Make sure not to let this chance slip away.

Note: If you enroll in Medicare during the General Enrollment Period, you could face late enrollment penalties that could increase your premiums permanently.

Don’t miss out on the Medigap Open Enrollment Period – a one-time opportunity that lasts six months. When you enroll in Medicare Part B at age 65, mark your calendar for this crucial timeframe. Remember, you won’t have another chance to take advantage of this period, so ensure you’re ready to make the most of it.

Don’t miss your chance to find your perfect Medicare Supplement plan. During your Medigap Open Enrollment Period, the options are aplenty, and the process is hassle-free. Don’t risk being denied coverage or paying higher costs in the future – seize the opportunity to choose the right plan for you.

Great news for Illinois residents seeking Medigap coverage. Effective January 1, 2022, the state has made an exciting exception to the pre-existing condition clause during the ‘one-time’ Open Enrollment Period. Now, carriers cannot deny or discriminate in pricing based on health status, past claims, or any medical condition. This is a fantastic opportunity for anyone needing comprehensive and affordable health coverage. Don’t miss out on this game-changing development.

Not happy with your Medigap plan? During your birthday month, you have a 45-days to assess and adjust your Medigap coverage without penalty. With this second chance, you don’t need to go through underwriting, but there are requirements:

As you look to protect your health and your wallet, it’s important to regularly assess your coverage and make necessary adjustments. By taking advantage of the three pivotal periods throughout the year – the Annual Enrollment, Medicare Advantage Open Enrollment, and Special Enrollment Periods – you can optimize your plans according to your evolving needs. Stay informed, and don’t let any of these opportunities pass you by.

You can maximize savings and enhance overall healthcare benefits by marking important enrollment periods on your calendar. Don’t miss out on the opportunity to obtain optimal healthcare coverage that aligns with your financial and well-being needs. Take the necessary time to evaluate and compare plans to make an informed decision that benefits you in the long run.

The Annual Enrollment Period (AEP) is an important window of opportunity, starting on October 15th and ending on December 7th. This enrollment period allows you to revisit and review your health coverage. If you’re already enrolled in Medicare, it’s the perfect time to make any necessary updates or changes to your current plan for the upcoming year. Don’t miss this chance to ensure you have the best coverage possible to meet your health needs.

The Annual Enrollment Period is when it’s time to examine your coverage closely. Evaluating annually with a local licensed agent helps ensure you get all the health support and savings right for you. Why?

It’s never too early to start planning for Medicare’s Annual Enrollment Period. our comprehensive guide is packed with useful tips to help you maximize your benefits during this crucial time. Don’t wait until the last minute – start preparing today.

After reviewing your plan with a local licensed agent, there are six possible changes to make:

Is your existing Medicare Advantage plan no longer serving your health or budget needs? We’ve got good news for you. You can change your plan during the annual Medicare Advantage Open Enrollment period from January 1 to March 31. Circle it on your calendar and leverage this opportunity to improve your healthcare coverage.

The Medicare Advantage Open Enrollment Period allows you to change your plan to meet your evolving healthcare needs. But if you missed this window of opportunity, don’t fret – there are more avenues for change through the Annual and Special Enrollment Periods.

The Medicare Advantage Open Enrollment Period has never been a better time to make valuable adjustments:

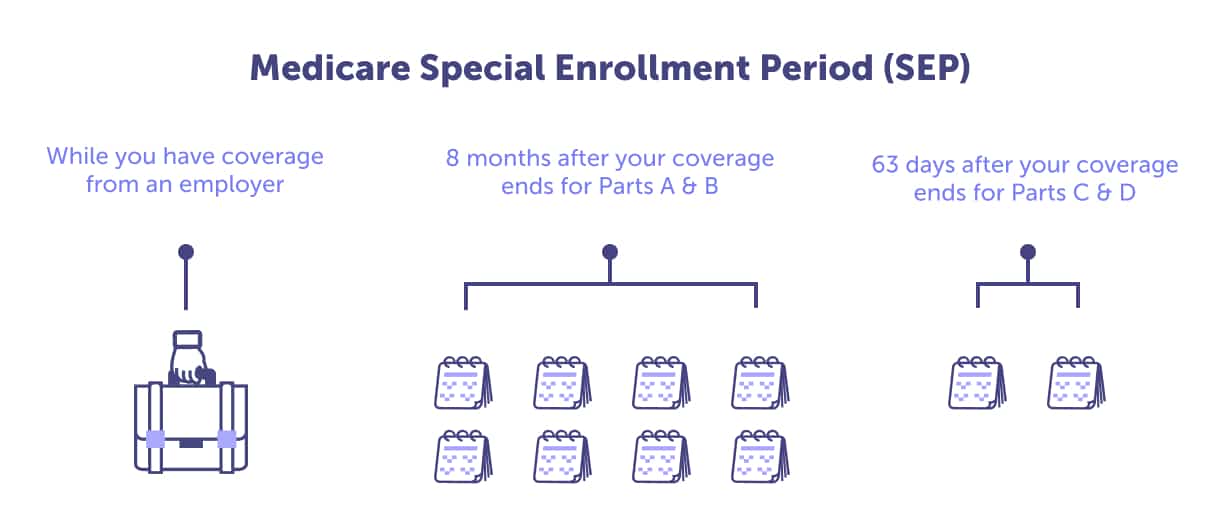

As we journey through life, unexpected events may alter our healthcare needs. Fortunately, Special Enrollment Periods (SEPs) offer us the flexibility to navigate these twists and turns. These exclusive windows of opportunity are designed to provide access to new plan options and allow us to make changes outside of standard enrollment periods. With SEPs, we can confidently adjust our healthcare coverage to match our ever-changing lives.

Explore the key factors that can unlock your access to a Special Enrollment Period:

Did you know that moving, losing your health insurance, or experiencing a significant life change could be a good thing? You could qualify for a Special Enrollment Period.

But navigating your way through the process can be confusing and overwhelming. That’s why it’s a good idea to seek the guidance of a local licensed agent. They’ll help you determine if you qualify for a Special Enrollment Period and develop a personalized timeline that fits your needs. Don’t go it alone – let a licensed agent steer you in the right direction.

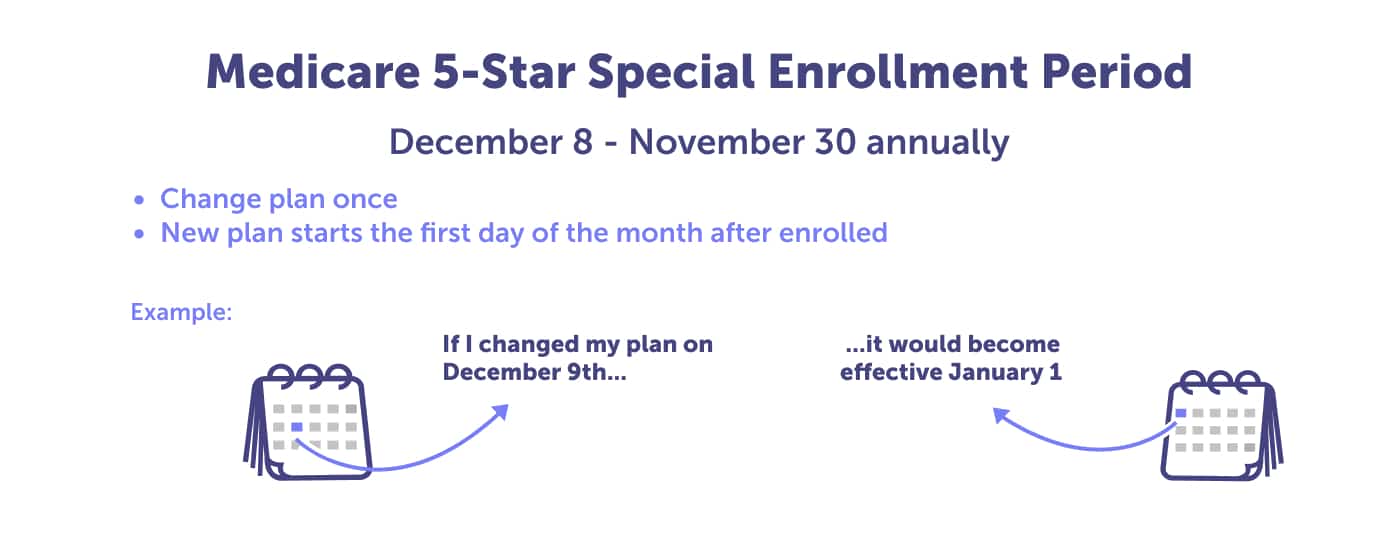

Are you familiar 5-Star Medicare plans? These top-tier plans have been thoroughly evaluated by the Centers for Medicare & Medicaid Services (CMS), utilizing a star rating system. And the results don’t lie – the ultimate achievement is five dazzling stars.

Discover the highest-rated Medicare Advantage, Medicare Advantage Prescription Drug (MAPD), or standalone Medicare Part D prescription drug plans available in your county. The 5-Star Special Enrollment Period is the perfect opportunity to upgrade your healthcare and enjoy the highest-rated care possible.

The 5-Star Special Enrollment Period is available once annually from December 8th to November 30th. Seeking dependable support for navigating health insurance policies? Connect with a licensed agent from your community.

Are you ready to embark on your golden years but still want to work beyond 65? Before you delay your Medicare enrollment, make sure you have creditable coverage. This means the health insurance you and your partner’s employer provide is just as good as Medicare.

Reviewing your Medicare Part B and D coverage regularly through your employer to ensure it safeguards you both adequately is vital. Delaying Medicare could land you in trouble with permanent penalties, so tread carefully.

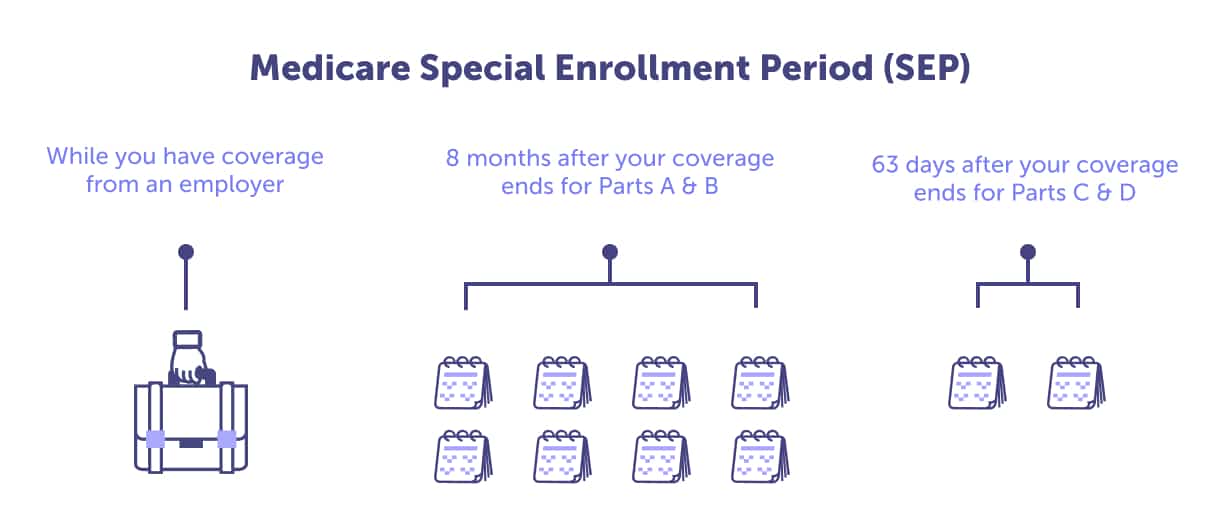

If you’ve recently lost your employer-sponsored healthcare, it’s important to act quickly to enroll in Medicare Part A and B. You’ve got a tight eight-month window to do so after losing employer-sponsored healthcare, or you could face some unpleasant penalties down the line.

And if you’re considering Medicare Advantage or Part D, be prepared to decide within just 63 days. It’s not a lot of time, but it’s critical to avoid additional costs.

Remember, COBRA won’t be of much help in this situation, so it’s important to explore your options and make a smart choice for your health and financial well-being.

The Illinois Association of Area Agencies of Aging comprises thirteen Area Agencies on Aging. They offer services to assist senior adults, their caregivers, grandparents raising grandchildren, people with disabilities, and veterans. You can call or visit their website to connect with your regional agency, which provides comprehensive services designed to maintain health and independence.

Illinois Association of Area Agencies on Aging Phone Number: (217) 787-9234

Ilinois Association of Area Agencies on Aging

The Senior Health Insurance Program (SHIP) provides free health insurance counseling for Medicare beneficiaries and their caregivers.

Illinois Department on Aging SHIP Phone Number: 1-800-252-8966

Senior Health Insurance Program (SHIP)

The Social Security Administration (SSA) administers retirement and disability income programs for the United States. They provide financial support for retirees. You can apply for retirement, disability, and Medicare benefits through the Social Security Administration.

SSA Phone Number: 1-800-772-1213 (TTY 1-800-325-0778)

Social Security Administration FAQ

Social Security Administration local office locator

Email the Social Security Administration

Working with the Social Security Administration, the Railroad Retirement Board administers retirement benefits for railroad workers and their families in the United States.

Illinois RRB Office Phone Number: 1-877-772-5772

RRB National Telephone Service: 1-877-772-5772

General TTY Number: 1-312-751-4701

Headquarters Personnel Directory: 1-312-751-4300

Railroad Retirement Board website

CMS Releases 2023 Projected Medicare Basic Part D Average Premium.

MA State/County Penetration, March 2023.

Medicare Advantage in 2022: Enrollment Update and Key Trends.

Medicare Costs.

Medicare Open Enrollment in Illinois, 2022.

Medicare Open Enrollment in Illinois, 2023.

The State of Medicare Supplement Coverage, 2020.

Total Number of Medicare Beneficiaries by Type of Coverage: Illinois.

U.S Census Bureau Quick Facts: Illinois

What Medicare Part D drug plans cover.

What Part B covers.

Yearly deductible for drug plans.

Last updated: May 1, 2023.

How can you apply for Medicare in Illinois? Our team of licensed agents at Connie Health is here to guide you through the process. Contact us today at 1-888-647-7330, and let Connie Health support you throughout your Medicare journey. Alternatively, you can also apply for Medicare through the Social Security Administration.

Learn more about your Medicare plan options and how to apply for Medicare in Illinois.

While Medicare is a reliable source of coverage for doctor services and hospital care, it usually doesn’t cover the costs of assisted living or long-term care. However, you still have options if your loved one requires these services. Family members can dig into their pockets to foot the bill or invest in long-term care insurance to ensure the cost is covered.

Good news – Medicaid waivers are available to qualifying individuals. These waivers help alleviate the financial burdens by funding long-term care options. Head to Medicaid.gov to explore the various programs offered in your area and start accessing the support you or your loved one deserves.

Learn more about assisted living coverage by reading Does Medicare cover assisted living?

Looking after your teeth is essential to staying healthy, but sadly, Original Medicare coverage doesn’t include dental care. While Medicare Part A can help you with dental procedures while in the hospital, Medicare generally doesn’t offer any coverage for routine dental care.

However, there is a bright side. If dentures are possible for you in the future, then a Medicare Advantage plan in Illinois may be the perfect solution. With a Medicare Advantage plan, you’ll receive all the benefits of Medicare plus additional benefits, which might include dental coverage.

Learn more about how to get denture coverage in Does Medicare cover dentures?

Looking to enhance your hearing health with Medicare coverage in Illinois? It’s important to know that Original Medicare doesn’t include hearing aid coverage. However, you have Medicare Advantage plans (Part C) options.

While Medigap doesn’t cover hearing aids, many Medicare Advantage plans from private insurance companies offer coverage for hearing exams and aids. Plus, Medicare Advantage plans are a great choice if you’re looking for a comprehensive package that includes dental, vision, and prescription drugs.

Learn how to get hearing aid coverage by reading Does Medicare cover hearing aids?

Regarding Medicare in Illinois, you’ll want to ensure you’re covered for all eventualities. To start, most beneficiaries enroll in Original Medicare Parts A and B. However, to avoid getting hit with high out-of-pocket costs, enrolling in a Medicare Advantage or Supplement plan is smart.

But it’s not just medical coverage you need to consider – the Centers for Medicare & Medicaid Services (CMS) requires that you have creditable prescription drug coverage too. Talk to a local licensed agent in Illinois by calling 1-888-647-7330 for guidance on the best Medicare plans for you.

You can also learn more by reading about Medicare plans in Illinois.

Medicare Part A is typically free for most people. Medicare Part A may cost up to $518 a month in 2025. Medicare Part B’s minimum standard premium costs $185.00 a month for 2025, not including IRMAA.

These are the basic premium costs, but you may need to pay more for expanded coverage and prescription drug coverage. You should also consider the out-of-pocket deductibles, copayments, and coinsurance costs.

Because your coverage is tailored to you, there isn’t a set cost. You should explore your coverage options and budget with a local licensed agent. Have support throughout your Medicare journey by calling 1-888-647-7330.

As you reach the landmark age of 65, an important window of opportunity is open to you – the seven-month period where you can enroll in Medicare. This starts three months before your birthday, includes the big day, and extends three months after.

Learn more about Medicare eligibility and the Initial Enrollment Period.

When choosing a Medicare Advantage plan in Illinois, there’s no one right answer. Each plan is tailored to meet different health and financial needs, so it’s crucial to consider your unique circumstances. Don’t be swayed by what your friends or family members are enrolled in or the most popular plan on the market.

Instead, contact our team for guidance on selecting the best Medicare Advantage plan for you. We’re here to help. Call us at 1-888-647-7330 or read more at Medicare Advantage Plans in Illinois.

Ready to sign-up for Medicare in Illinois? Discover your plan options & the essential enrollment deadlines.

Learn how Medicare Advantage plans in Illinois may offer extra benefits like dental, vision & hearing—more affordably.

Original Medicare doesn’t cap expenses. Learn how Medicare Supplement plans in Illinois could bring you peace of mind against surprise bills.